How to tell if you are eligible for unemployment benefits?

You must be:

- Physically able to work.

- Available for work.

- Ready and willing to accept work immediately.

What is the maximum amount per week of unemployment benefits?

You may receive the maximum amount of $350 per week. Your weekly benefit amount is based on the last two completed quarters in your base period divided by 52 and rounded down to the next whole dollar. The seasonally adjusted statewide unemployment rate used to determine the maximum number of weeks that you may get benefits is calculated on January 1 and July 1.

How to maximize unemployment benefits?

“And we know that Louisiana has one of the lowest unemployment benefits in the country so this increase will do a little to help folks put food on the table and keep a roof over their heads for their families,” said Fiore. Fiore said the increase is only applicable to claims filed on or after January 2nd.

What is the average percent an employer pays for unemployment?

Employers pay a certain tax rate (usually between 1% and 8%) on the taxable earnings of employees. In most states, that ranges from the first $10,000 to $15,000 an employee earns in a calendar year. Here’s where it gets tricky.

How are unemployment rates calculated?

In simple terms, the unemployment rate for any area is the number of area residents without a job and looking for work divided by the total number of area residents in the labor force.

How many hours can you work and still get unemployment in Texas?

If you work part time, you can earn up to 25 percent of your weekly benefit amount (WBA) before TWC reduces your benefit payment. For example, if your WBA is $160, you may earn $40 without a reduction. If you earn $50, we reduce your WBA for the week to $150.

How many hours can you work while on unemployment in Massachusetts?

To be eligible for partial benefits, you cannot work more than 80 percent of the hours normally worked in the job. For example, if you worked a 40-hour week, you won't be able to get benefits if you work more than 32 hours.

Can I work part time and collect unemployment Texas?

Working Part Time If you work part time, you may be eligible to continue receiving unemployment benefits as long you meet all other requirements, including looking for full-time work.

Is 30 hours full time?

Full-time work usually means a person works 40 hours a week, but could mean working between 30 and 40 hours. Full-time employees sometimes work shifts, and may work outside of normal business hours.

Is working 32 hours considered full time?

There is no legally defined number of hours for full time employment, where individual employers can decide how many hours per week are to be considered full time. The hours that workers are expected to work will usually be set out in the company working hours policy and/or within individual contracts of employment.

What disqualifies you from unemployment in Massachusetts?

You may not be eligible for Unemployment Insurance (UI) benefits if your only source of employment is from working as: An employee of a non-profit or religious organization. A worker trainee in a program run by a nonprofit or public institution. A real estate broker or insurance agent who work only on commission.

Can I collect unemployment in MA if my hours are reduced?

If you are not working a “full-time” schedule of hours (see question above), you may be classified as “partially unemployed,” and you may be entitled to receive reduced benefits during any period in which you remain in partially unemployed.

How much can I earn on Ma unemployment?

If you are eligible to receive Unemployment Insurance (UI) benefits, you will receive a weekly benefit amount of approximately 50% of your average weekly wage, up to the maximum set by law. As of October 3, 2021, the maximum weekly benefit amount is $974 per week. This calculator helps you estimate your benefits.

What can disqualify you from unemployment benefits?

Unemployment Benefit DisqualificationsInsufficient earnings or length of employment. ... Self-employed, or a contract or freelance worker. ... Fired for justifiable cause. ... Quit without good cause. ... Providing false information. ... Illness or emergency. ... Abusive or unbearable working conditions. ... A safety concern.More items...•

Will Texas unemployment benefits be extended 2021?

The Texas Workforce Commission ( TWC ) will stop paying Extended Benefits ( EB ) as of the week ending September 11, 2021.

How is unemployment calculated in Texas?

Amount and Duration of Unemployment Benefits in Texas As explained above, the Texas Workforce Commission determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 25, up to a maximum of $535 per week. Benefits are available for up to 26 weeks.

What happens if you don't accept additional hours?

If your employer offers additional hours that you choose not to accept, your benefits may be affected. For any wages earned from any employer: If you earn 20 percent or less of your weekly benefit rate from an employer, you can still receive your full weekly benefit rate (WBR) for that week.

What is the maximum weekly benefit for 2021?

The weekly benefit rate is capped at a maximum amount based on the state minimum wage. For 2021, the maximum weekly benefit rate is $731. We will calculate your weekly benefit rate at 60% of the average weekly wage you earned during the base year, up to that maximum.

Can I collect unemployment if my hours were reduced?

If your work hours were reduced, but not completely cut, you may still be able to collect Unemployment Insurance benefits. NOTE: When claiming benefits, you must report your part-time wages when earned, even if you have not yet been paid. How we calculate partial Unemployment Insurance benefits.

What was the Cares Act?

First, the CARES Act expanded unemployment eligibility to more categories of workers.

How long can you collect unemployment in the US?

Before the coronavirus, most states offered unemployment benefits for a maximum of 26 weeks. The CARES Act allowed states to add an additional 13 weeks of eligibility. And later coronavirus relief bills gave further extensions, with a current end date of September 6, 2021.

How much does Jane make on unemployment?

Specifically, they can earn the equivalent of 50% of their weekly unemployment benefits without penalty. Because Jane receives $470 each week, she can earn up to $235 per week without it having any effect on her $470 per week benefit. Unfortunately for Jane, she makes $400 per week.

When will the supplemental unemployment benefits end?

Second, about half of states intend to end these supplemental benefits before the September 6, 2021 deadline. Third, the length of time a person could get unemployment got extended.

What does it mean when you get fired for cause?

Getting fired for cause means an employee’s misconduct led them to get fired. Quitting may also prevent someone from getting unemployment compensation. One exception is if the person had no reasonable choice but to quit. For instance, an employee who quits because they’re being sexually harassed.

How much does John make in 2020?

They’ll then divide that number by 26 to calculate his weekly benefit amount (WBA). Because John earned a steady $45,000 per year, he made $11,250 per quarter.

Does unemployment go up or down?

Your unemployment benefits can go up or down based on other factors that don’t relate to your total wages. These variables will mainly affect how much money you receive, but they can also affect how long you can receive weekly unemployment payments. Some of these variables include:

How much is dependent allowance?

Dependency allowance. If you are the whole or main support of a child, you may be eligible for a weekly dependency allowance of $25 per dependent child. Spouses are not included. The total dependency allowance you receive cannot be more than 50% of your weekly benefit amount.

What is the primary base period?

Primary base period. The primary base period is the last 4 completed calendar quarters prior to the effective date of your claim (typically the Sunday of the week that you filed your claim). For most claimants, the primary base period is used to calculate your maximum benefit credit, which is the total amount of benefits you are eligible to receive.

How much unemployment is there in 2020?

As of October 4, 2020, the maximum weekly benefit amount is $855 per week.

How to calculate duration of benefits?

Your duration of benefits is calculated by dividing your maximum benefit credit by your weekly benefit amount.

How long is the benefit year?

Your benefit year. Once your claim is established, it will remain open for 1 year (52 weeks). This period of time is called your benefit year. Your maximum benefit credit (the total amount of benefits you are eligible to receive) is available to you for the duration of your benefit year or until you have exhausted your maximum benefit credit.

What to do if you disagree with your wage?

If you disagree with the wages reported on your Monetary Determination notice, you can provide proof of the wage amounts you are disputing by completing and returning the Wage and Employer Correction sheet that was mailed to you with your notice.

How long can you get unemployment?

The maximum number of weeks you can receive full unemployment benefits is 30 weeks (capped at 26 weeks during periods of extended benefits and low unemployment). However, many individuals qualify for less than 30 weeks of coverage. The following examples show how to determine your duration of benefits.

What is WBA 26 x WBA?

WBA is the Weekly Benefit Amount, so 26 x WBA would be the regular weekly program. 1/3 BPW refers to the Base Period Wages, so if a person did not succeed to earn more than 3 times the standard benefit amount, they will be suitable for fewer weeks of coverage.

How to calculate unemployment weekly?

To calculate your weekly benefits amount, you should: Work out your base period for calculating unemployment. Take a look at the base period where you received the highest pay. Calculate the highest quarter earnings with a calculator. Calculate what your weekly benefits would be if you have another job. Calculate your unemployment benefits ...

What happens if you work while receiving unemployment?

In case you earn an income while receiving benefits, they would reduce the amount of benefits that you receive. If you work temporarily then you must report those earnings to the state unemployment agency and they will determine how much of the unemployment benefits would be reduced.

How long does unemployment last?

This is beneficial for those that are out of work for a long period. The maximum benefits duration has increased from 26 to 99 weeks in some states.

How long does it take to get unemployment?

If eligible for unemployment benefits, you can expect to receive your first payment within 3-4 weeks if there are no issues with your claim. In general, it takes approximately 3 weeks to process a claim; however, you will still need to claim benefits every week. The information you need before filing a claim:

How to file a weekly claim?

You can file your weekly claim: Through the Internet – You can file your weekly claim online. You must have a User ID and PIN in order to file your weekly claim online. By phone – You must call the number given to you during the registration process.

Is it hard to file for unemployment?

When it comes to filing for unemployment, it can be quite difficult. Make sure that you have complete information about unemployment benefits which includes how to apply, eligibility requirements, weekly benefit amount, important phone numbers and much more.

How to calculate unemployment rate?

The following are the steps to take when calculating the unemployment rate in the United States: 1. Determine the percentage of people in the labor force. The first step in calculating the unemployment rate is to calculate the total percentage of individuals in the labor force, ...

What are the different types of unemployment?

The BLS incorporates three different categories of unemployed people into its calculations of the "real" unemployment rate: 1 Marginally attached labor force workers: These are individuals who have not sought work in the past four weeks but have looked for a job at least once in the last year. 2 Long-term unemployed individuals: This group of people includes those who have been looking for work in the past four weeks and have been unemployed for 27 or more weeks. 3 Discouraged workers: This population describes a group of workers who have searched for work over the past year, but not in the last four weeks. Because they haven't sought work in the last four weeks, the government does not consider them unemployed. However, these workers still wish to have full-time jobs.

What is the lagging indicator of unemployment?

The unemployment rate is a lagging indicator, or an indicator of how an economic event affected employment during a certain time period. For example, a recession is an economic event, and high unemployment rates are the lagging indicator of the effects of the recession. This also indicates that unemployment will steadily rise for a period of time even after the recession is over.

What is the primary unemployment rate?

The primary, or official, unemployment rate is the rate that the government uses to make decisions, such as the monetary policy. This is the traditional rate that only includes the unemployment of persons who have no job but are actively seeking employment. Another type of unemployment rate calculated by the BLS is the "real" unemployment rate, ...

Why is unemployment important?

The unemployment rate is important because unemployment can affect the economy and individual people. Here are the ways that the unemployment rate affects both the economy and individuals:

Why does the Federal Reserve use unemployment?

Additionally, the Federal Reserve uses the unemployment rate to gauge the overall health of the economy when it establishes a monetary policy. This policy is used to manage economic growth, inflation and unemployment.

How does unemployment affect people?

Unemployment also affects individuals by increasing or decreasing the competition when looking for a job. The more people that are looking for work, the more competition you will have when searching for and applying for a position.

When will I know my weekly benefit amount?

After you apply for benefits, we will mail you an Unemployment Claim Determination letter that tells you how much you are potentially eligible to receive.

How much can I get each week?

In Washington state, the maximum weekly benefit amount is $929. The minimum is $295. No one eligible for benefits will receive less than $295, regardless of their earnings.

How can I estimate my weekly benefit amount?

You can estimate your own weekly benefit amount to see how much you are potentially eligible to receive. To do this, you need to know which calendar quarters will make up your base year.

Alternate base year (ABY) claims

You could be eligible for an alternate base year claim if you do not have the required 680 hours of work in your regular base year.

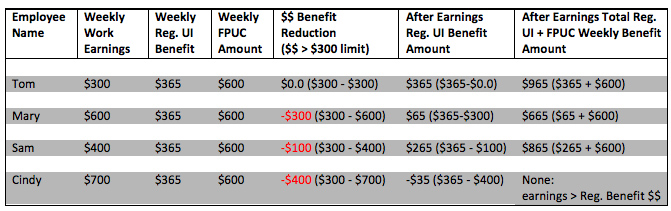

Earning deductions chart

This chart helps determine how much you may get if you report partial earnings during a week.