How do you calculate unemployment benefits in Ohio?

- You are totally or partially unemployed at the time you file for unemployment. ...

- You must have worked a minimum of 20 weeks during the previous base period to be considered unemployed.

- A base period in Ohio consists of the past 4 quarters of three months each, not including the current one.

What is the maximum unemployment benefits in Ohio?

In Ohio, unemployment benefits typically pay 50 percent of your average weekly wage during the base period. However, the maximum payment is $424 per week and the minimum payment per week is $118. Additionally, depending on if and how many dependents you have, your benefit payment may be higher.

How many weeks do you get unemployment in Ohio?

- Alabama currently provides up to 14 weeks of UI for new enrollees, with an additional five-week extension for those enrolled in a state-approved training program;

- Georgia provides 14 weeks of UI, but in the COVID-19 emergency that has been increased to 26 weeks;

- Florida currently provides up to 19 weeks for claims filed after January 1, 2021;

How is unemployment calculated in Ohio?

Calculate your average weekly wage from the base period. Your unemployment compensation is based on your average wage during past employment. There is a simple process to calculating your average wage. Add up all of your earnings from the base period. If you worked multiple jobs, include all of them in this calculation.

Is Ohio giving extended unemployment benefits?

Under the newly extended benefits program, eligible Ohioans can receive payment for an additional 20 weeks. Those who qualify for the Pandemic Unemployment Assistance program can receive benefits for an additional 7 weeks.

What is the maximum unemployment benefit in Ohio 2020?

If you are eligible to receive unemployment, your weekly benefit rate in Ohio will be 50% of your average weekly wage (see "Past Earnings" section above) during the base period. The most you can receive each week is $480, although if you have dependents, you may be entitled to a higher benefit payment.

Will unemployment be extended 2021?

The American Rescue Plan Act, signed March 11, 2021, extended the Federal Pandemic Unemployment Compensation (FPUC) program, which provides an additional $300 to workers for weeks of unemployment ending on March 11, 2021 through September 4, 2021.

Will unemployment be extended again?

But with an ongoing labor shortage in the United States, in part due to ongoing health concerns, experts said it is unlikely the federal government will extend benefits again, leaving low-income Americans scrambling for solutions.

Will unemployment be extended again after September?

The congresswoman said she will introduce a bill to extend federal unemployment programs established under the March 2020 CARES Act, which expired over Labor Day. If passed, the enhanced jobless aid would be retroactive to Sept. 6 and extended until Feb. 1, 2022.

How long is unemployment on Covid?

Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation (PEUC) program.

Will Edd be extended after September 2021?

Federal-State Extended Duration (FED-ED) benefits are no longer payable after September 11, 2021. The federal government does not allow benefit payments to be made for weeks of unemployment after this program ends, even if you have a balance left on your claim.

What is pandemic unemployment assistance?

PUA was part of the federal assistance that helped unemployed Californians who were not usually eligible for regular unemployment insurance benefits. PUA included up to 86 weeks of benefits, between February 2, 2020 and September 4, 2021.

When will the unemployment benefit end in Ohio?

On March 11, 2021, President Biden signed into law a $1.9 trillion COVID-19 relief bill known as the American Rescue Plan (ARP). The law extended a $300 per week federal unemployment supplement (on top of state-provided benefits) until September 6, 2021. However, in response to apparent labor shortages, the state of Ohio decided to end this supplement early on June 26, 2021. That means the unemployment supplement is no longer available in Ohio.

When is the base period for unemployment in Ohio?

In Ohio, as in most states, the base period is the earliest four of the five complete calendar quarters before you filed your benefits claim. For example, if you filed your claim in August of 2020, the base period would be from April 1, 2019, through March 31, 2020. To qualify for benefits in Ohio, you must meet both of these requirements:

How long is the PUA program?

ARP makes PUA benefits available through Labor Day 2021, and increases the maximum duration of these benefits from 50 to 79 weeks. The PEUC program provides for a federally-funded extension ...

What is the eligibility for unemployment in Ohio?

You must meet these three eligibility requirements to collect unemployment benefits in Ohio: You must have earned at least a minimum amount in wages before you were unemployed. You must be unemployed through no fault of your own, as defined by Ohio law.

How to keep collecting unemployment benefits?

To keep collecting unemployment benefits, you must be able to work, available to work, and looking for employment. (For more information, see Nolo's article, Collecting Unemployment: Are You Able, Available, and Actively Seeking Work?) If you're offered a suitable position, you must accept it.

How to file unemployment in Ohio?

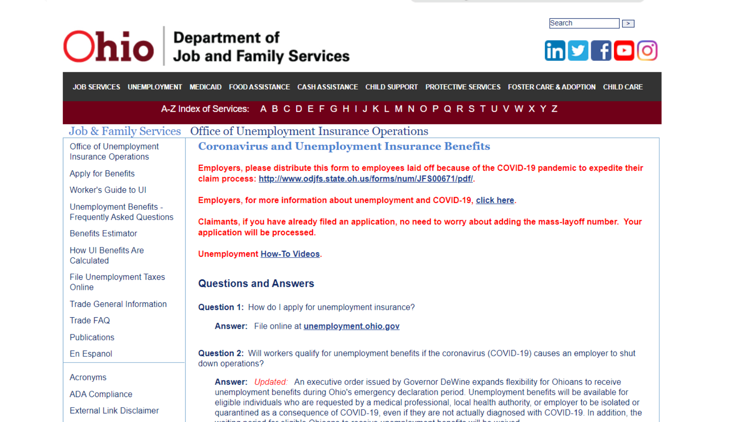

You may file your claim for unemployment benefits electronically or by phone. You can find contact information and online filing information at the website of the Ohio Department of Job and Family Services.

How much do you have to make to qualify for unemployment in 2021?

You must have earned an average of at least $280 per week during the base period. (This amount is for 2021; it changes each year.) To find out whether you meet this requirement, divide your total earnings during the base period by the total number of weeks in which you worked.

How long is the TRA for Ohio unemployment?

For example, TRA is available for a maximum of 26 weeks. I previously received Federal-State Extended Benefits, which are no longer available because Ohio’s unemployment rate declined.

How to apply for unemployment in Ohio?

Applying online is the quickest way to start receiving unemployment benefits. To apply online, go to unemployment.ohio.gov. Click here for a step-by-step guide to applying online. If you don't have access to a computer, you can apply by phone by calling 877-644-6562. Call center hours are Monday through Friday 8 a.m. to 5 p.m. Note that it is not possible to apply for unemployment benefits in person.

What to do if you have an overpayment on unemployment in Ohio?

The first thing that you should do if you believe your overpayment was issued in error is to appeal your decision. All overpayment notices contain instructions for how to do so. Be prepared to submit additional documentation to support your case. Additionally, federal and state law authorize the Ohio Department of Job and Family Services to waive the repayment of unemployment benefit overpayments if it is determined that the overpayment was not the claimant’s fault and that repayment would be “contrary to equity and good conscience.” If you received a notice that you have an overpayment, and if you believe the overpayment was not your fault, you can request a waiver by logging into your account online and following these instructions.

Why is unemployment denied?

Each claim is different, but sometimes traditional unemployment applications are denied because the applicant didn’t earn at least $280 in the “base period” of their claim. Please refer to the Claimant Affidavit portion of your New Claim Instruction Sheet. It should show the information provided by the employer (s) during the base period for the claim. If the weeks and wages that are reported do not meet the minimum monetary requirement, the claim will be disallowed because it is considered to be “monetarily ineligible.” The Affidavit provides an opportunity for you to review the information that is being used to establish your claim. It also provides you with an opportunity to submit corrections. Claims also can be denied for a “non-monetary” reason. Typically, for new claims, this is due to a determination by the agency that you are not unemployed through no fault of your own.

What is the phone number for Ohio unemployment?

Please call (877) OHIO-JOB (1-877-644-6562) or TTY at (888) 642-8203. Breaks in claim can occur if you tried to reopen a claim, but you earned more than your previous weekly benefit amount. If your payment shows as "pay held," this could be for any of several reasons.

What to do if your unemployment application is denied?

If you believe your application was denied in error, you may file an appeal. Please read your determination letter for instructions on how to do so. You will need to provide the number of weeks that you worked, plus supporting documentation of your wages (such as pay stubs).

How long does it take to get a payment from a debit card?

If your payment shows as "paid" and the amount is listed as $0, this means you should receive payment in your account or on your debit card within 24 to 48 hours. Once the payment is finalized, the amount will be updated.

How long does unemployment last in Ohio?

By Jeremy Pelzer, cleveland.com. COLUMBUS, Ohio—Ohio recently announced that if people thrown out of work by the coronavirus exhaust their first 39 weeks of unemployment benefits, they can get up to an additional 20 weeks of federal benefits. A closer look, though, shows that those extra 20 weeks likely won’t pay as much as regular unemployment ...

How long is Ohio unemployment?

Right now, Ohio workers without a job are eligible for up to 26 weeks of unemployment benefits equal to half the average weekly pay they had been making, as well as federal coronavirus benefits for an additional 13 weeks. (Separately, unemployed workers can get an extra $600 per week in federal benefits on top of their regular benefits, though that bonus ends July 25).

How much is extended unemployment?

The total amount that can be paid during the 20-week period is the lesser of the following amounts: either 80% of the total of regular benefits that were payable to the individual in their benefit year, or 20 times the individual’s average weekly benefits payable for a week of total unemployment in the individual’s benefit year.

How long can you work without getting extended unemployment benefits?

Even if people can receive the full 20 weeks of extended benefits, having no job for more than a year is economically devastating. “In a best-case scenario, people are probably drawling less than 40% of what their regular income would have been during employment,” said Lisa Hamler-Fugitt, executive director of the Ohio Association of Foodbanks.

Will unemployment pay out after 20 weeks?

A closer look, though, shows that those extra 20 weeks likely won’t pay as much as regular unemployment benefits. And there’s no guarantee that any of that money will be paid out after the end of the year. Here are some questions – and answers – about the details of the extended benefits, and the impact they’ll have on Ohio workers.

Does Ohio have to pay back unemployment?

While Ohio is currently borrowing money from the federal government to continue paying regular unemployment benefits, the extended benefits are covered entirely by the feds, meaning the state won’t have to pay the money back.

Unemployment Benefits During A Pandemic

How Long Does Unemployment Last (And Extra $600) in 2020 with the CARES Act?

Can An Employer Contest An Unemployment Claim

As an employer, you have the right to contest an unemployment claim that you think is invalid or misleading. When a former employee makes a claim, youll receive a notice from the state or federal unemployment agency along with details surrounding the termination.

How Long Do Unemployment Benefits Last In California

An unemployment benefits claim is effective for one year. During the year, claimants can receive from 12-26 weeks of full benefits. The number of weeks varies, based on total earnings during the base period .

What Are The Unemployment Qualifications In Indiana

To qualify for unemployment benefits in Indiana, you must meet several qualifications before being granted unemployment payments. There are three specific requirements mandated by the Indiana unemployment department that impact whether or not you qualify for unemployment:

I Still Have More Questions About How To Apply For Unemployment Benefits Where Can I Find More Answers

You can find more answers on the Texas Workforce Commissions website, Unemployment Benefits Handbook, or virtual assistant. The virtual assistant is available on any Texas Workforce Commission webpage at the bottom of the page under the CHAT WITH US tab. You can also contact Texas RioGrande Legal Aid at 888-988-9996.

What You Need To File For Unemployment Benefits

To expedite your claim, its best to have all the relevant information and documents at hand before you file. While requirements vary by state, you may need some or all of the following in order to apply:

I Applied And Was Denied Because I Didnt Have Enough Past Earnings I Thought The Federal Stimulus Bill Didnt Require Past Earnings So Why Didnt I Qualify

The federal stimulus bill does not require you to have a minimum amount of past earnings. However, to receive these federal benefits, you must first be denied regular unemployment benefits under Texas state law.

Can you get benefits if you quit after being disciplined?

However, if you quit after you were disciplined or put on a performance improvement plan, it will be harder to qualify for benefits. If, for example, you were able to improve your performance, you might have been able to keep your job.

Can an employee be compensated if they did not terminate?

If the employer did, then the employee will not qualify for compensation. However, if the employer did not have just cause to terminate, then the employee may well qualify for compensation despite the resignation. However, it must really be inevitable that the employee was going to lose the job.

Benefits

- Ohio residents who have recently lost their jobs might be eligible for unemployment benefits: payments available to employees who are out of work temporarily, through no fault of their own. Although the basic rules for unemployment are similar across the board, the benefit amounts, eligibility rules, and other details vary from state to state. Here...

Results

- Once the ODJFS receives your application, it will send you a New Claim Instruction Sheet explaining how to file weekly claims for benefits. You will also receive notice if the ODJFS needs more information or makes a determination on your claim. Quitting. If you quit your job, you won't be eligible for unemployment benefits unless you had just cause to leave your job. In general, jus…

Purpose

- The ODJFS determines eligibility for workers claiming unemployment benefits in the state. You must meet these three eligibility requirements to collect unemployment benefits in Ohio:

Example

- Firing. If you were fired because you simply weren't a good fit, you wont necessarily be barred from receiving benefits. If, however, you were fired for good cause, you may be disqualified from receiving benefits. For example, if you were fired for failing to perform your job duties or willfully violating company policies of which you were aware, you might not be eligible for benefits.

Causes

- To keep collecting unemployment benefits, you must be able to work, available to work, and looking for employment. (For more information, see Nolo's article, Collecting Unemployment: Are You Able, Available, and Actively Seeking Work?) If youre offered a suitable position, you must accept it.

Definition

- Whether a position is suitable depends on a number of factors, including how similar the job is to your previous employment, how much you will be paid, the working conditions, and the skills, experience, and training required for the position. The longer you are unemployed, the more likely you will have to consider jobs that are different from, pay less than, or require a significantly lon…

Preparation

- You must engage in a good faith search for work, including contacting at least two potential employers each week. The ODJFS may ask you to provide contact information for employers youve reached out to at any point during your claim. In addition, you will be required to create a resume and participate in other reemployment efforts at the ODJFSs online portal, OhioMeansJ…

Resources

- For more information on the unemployment process, including current eligibility requirements and benefits amounts, visit the website of the Ohio Office of Unemployment Compensation.