How Delayed Retirement Affects Your Social Security Benefits

| If you start getting benefits at age * | Multiply your Full Retirement Benefit by |

| 66 | 100% |

| 66 + 1 month | 100.7% |

| 66 + 2 months | 101.3% |

| 66 + 3 months | 102.0% |

...

How Delayed Retirement Affects Your Social Security Benefits.

| If you start getting benefits at age * | Multiply your Full Retirement Benefit by |

|---|---|

| 66 + 10 months | 106.7% |

| 66 + 11 months | 107.3% |

| 67 | 108.0% |

| 67 + 1 month | 108.7% |

Is it always best to delay Social Security?

Yes, delaying Social Security often--even usually--makes sense, especially if you or your partner have reason to believe you'll have an above-average life expectancy.

Should you delay collecting Social Security?

Many people -- including experts from Stanford -- argue for delaying as long as possible because benefits go up the longer you wait. And there are indeed plenty of good reasons to delay. Social Security provides a guaranteed source of income for life, so waiting a little longer to maximize benefits can make sense.

How much does SS increase after 62?

If you claim Social Security at age 62, rather than waiting until your full retirement age (FRA), you can expect up to a 30% reduction in monthly benefits. For every year you delay past your FRA up to age 70, you get an 8% increase in your benefit.

Can you suspend Social Security and restart benefit later?

Prior to the Bipartisan Budget Act of 2015, individuals used to be able to collect Social Security benefits at age 62, suspend benefits, and restart them later. Now, if you collect any time before...

How long can I defer my Social Security benefits?

If you apply for benefits and we have not yet made a determination that you are entitled, you may voluntarily suspend benefits for any month you have not received a payment. If you are already entitled to benefits, you may voluntarily suspend retirement benefit payments up to age 70.

Can I pause my Social Security benefits?

Once you reach your full retirement age, you can suspend your Social Security benefit. Your benefit will grow for each month that it's suspended. You can restart your benefit any month that you choose up to age 70 when it will automatically restart.

Can I stop taking my Social Security and restart later?

If you change your mind about starting your benefits, you can cancel your application for up to 12 months after you became entitled to retirement benefits. This process is called a withdrawal. You can reapply later. You are limited to one withdrawal per lifetime.

What happens when you file and suspend your Social Security?

During a suspension, you earn delayed retirement credits, which boost your eventual benefit by two-thirds of 1 percent for each suspended month (or 8 percent for each suspended year). When you resume collecting Social Security, you'll have locked in a higher monthly payment for life.

How long does it take for delaying Social Security benefits to pay off?

The Social Security Administration uses a formula to calculate your standard benefit amount based on your average wages over 35 years, adjusted for inflation. You'll receive this standard benefit if you retire at full retirement age, which is 67 if you were born in 1960 or later.

How much will Social Security increase if you retire after FRA?

If you retire after FRA, benefits are increased by 2/3 of 1% for each month you delay until age 70. To figure out how long it takes for you to break even by delaying Social Security benefits, calculate how much money you'd receive over the years if you claimed early, then divide this amount by higher monthly benefits you'll receive if you delayed.

What is the retirement age for a person born in 1960?

You'll receive this standard benefit if you retire at full retirement age, which is 67 if you were born in 1960 or later. If you retire before, benefits are reduced by 5/9 of 1% per month for the first 36 months prior to FRA and by an additional 5/12 of 1% for each of the months before that.

Does waiting for Social Security make sense?

Social Security provides a guaranteed source of income for life, so waiting a little longer to maximize benefits can make sense. But while waiting entitles you to earn delayed retirement credits, it also means you miss out on years of money you'd otherwise have received.

Do you need a higher monthly income to make up for missed benefits?

You'll need a higher monthly income for many years to make up for all those missed benefits and reach your breakeven point. To decide whether it makes sense to delay, it's helpful to know how to calculate your breakeven point and get a good idea of how long it might take for delaying benefits to pay off for you. Image source: Getty Images.

How much will Social Security be reduced at 62?

This means that those younger than full retirement age during all of 2021 lose $1 of benefits for each $2 they earn in excess of $18,960. 3 . Those reaching full retirement age during 2021 lose $1 ...

What is the maximum Social Security income for 2022?

For 2022, the annual earnings limit is $19,560 (up from $18,960 in 2021).

How much higher is a pension at 62?

Waiting until normal retirement age (66 years old for many, 67 for those born in 1960 or later) results in a benefit some 30% higher than taking benefits at age 62. 1 Waiting until age 70 results in a benefit about another 32% higher than the amount at full retirement age. 2 .

Is there a permanent increase in benefits at 70?

As mentioned earlier, waiting until age 70 results in a permanent benefit some 32% higher than if benefits start at full retirement age. This increase is also proportional, increased every year between full retirement age and age 70. 2

When do you get your delayed retirement?

If you retire before age 70, some of your delayed retirement credits will not be applied until the January after you start receiving benefits. For example, if you reach your full retirement age (67) in June, you may plan to wait until your 69th birthday to start your retirement benefits. Your initial benefit amount will reflect delayed retirement ...

When does the benefit increase stop?

The benefit increase stops when you reach age 70.

What happens if you don't sign up for Medicare at age 65?

If you do not sign up at age 65, in some circumstances your Medicare coverage may be delayed and cost more. If you retire before age 70, some of your delayed retirement credits will not be applied until the January after you start receiving benefits.

Can you get retroactive unemployment benefits if you are already retired?

However, we cannot pay retroactive benefits for any month before you reached full retirement age or more than six months in the past.

How much do you get when you retire at 67?

If you start receiving retirement benefits at age: 67, you'll get 108 percent of the monthly benefit because you delayed getting benefits for 12 months. 70, you'll get 132 percent of the monthly benefit because you delayed getting benefits for 48 months. When you reach age 70, your monthly benefit stops increasing even if you continue ...

What is the retirement age for a person born in 1943?

If you were born between 1943 and 1954 your full retirement age is 66. If you start receiving benefits at age 66 you get 100 percent of your monthly benefit. If you delay receiving retirement benefits until after your full retirement age, your monthly benefit continues to increase. The chart below explains how delayed retirement affects your ...

When do Social Security benefits start?

Key Takeaways. Social Security retirement benefits start as early as age 62, but the benefits are permanently reduced unless you wait until your full retirement age. Payments are for life. Social Security spousal benefits pay about half of what your spouse gets if that's more than you'd get on your own. Payments are for life.

When do dependent child benefits end?

Family income limits may also apply. Dependent child benefits begin when a retired worker's benefits start. They end when the child turns 18 (or 19, if a high school student).

How long does spousal benefit last?

The spousal benefit continues until one spouse dies. The survivor then may be eligible for survivor benefits.

What is Social Security retirement?

Social Security Survivor Benefits. Social Security Disability Benefits. Most people think of Social Security benefits as a monthly payment you start getting in retirement and receive for the rest of your life. In fact, Social Security is an umbrella term for several federal benefits programs.

What is the final category of Social Security benefits?

The final category of Social Security benefits applies if you suffer an injury or illness that leaves you unable to work. These benefits are paid from the Disability Insurance Trust Fund. 12

What age can a dependent on Social Security receive benefits?

A surviving parent who was dependent on a Social Security recipient who has died may be eligible to receive benefits at age 62 or older. This benefit is for life. 10

How many people will receive Social Security in 2020?

One of the largest government programs anywhere in the world, Social Security is expected to have paid out more than one trillion dollars to about 65 million Americans in 2020. 1 .

How long does it take to get Social Security at 70?

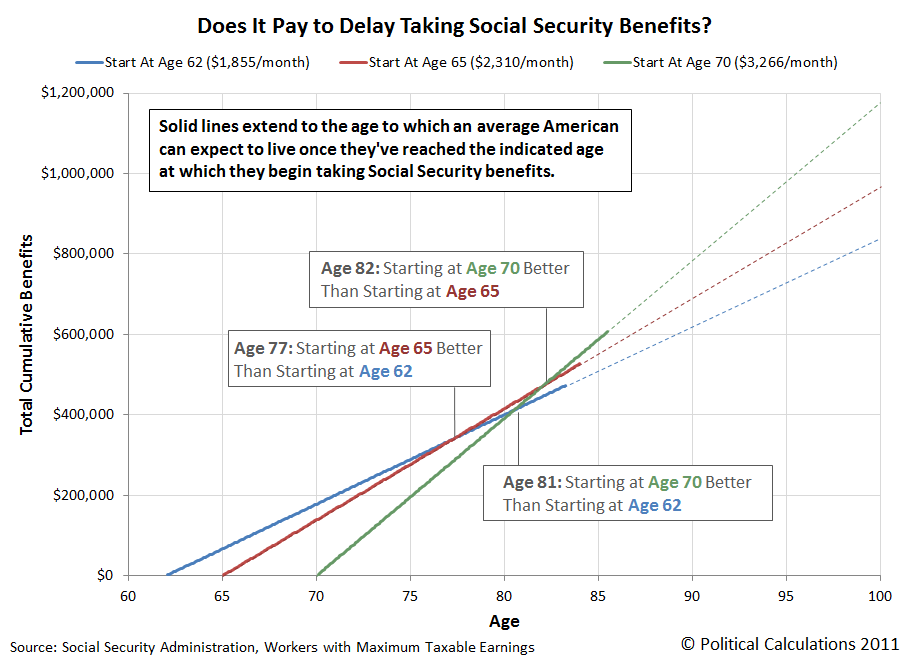

Q. When discussing Social Security, nobody seems to mention that if you wait until age 70, it takes another seven years to make up the difference between the money you would have collected from age 62 to 70. This means you will be 77 before you’re ahead. Isn't this true?

What is the Social Security increase for 2012?

The Social Security cost-of-living increase for 2012 is 2.8 percent, and is credited in the January payment each year. D’Agostini said you will get delayed credits for each year that you defer claiming from age 62, which is the soonest you can claim, until age 70. After age 70, there are no more credits and so you should claim at that age.

How much higher is Social Security if you delay your retirement?

Delaying your Social Security start date until age 70 entitles you to a monthly payout that’s more than 75 percent higher than your age-62 benefit. That’s a whole lot more money to support a much older you.

How much Social Security will I get if I wait until 70?

A better plan is if you wait until 70. Every year you wait between your normal retirement age and 70, Social Security will add a guaranteed 8 percent to your eventual monthly payout. I want to make sure you didn’t glide by what I just said: 8 percent. Guaranteed.

What happens if you take Social Security at 62?

If you start taking it at 62, your monthly payout will be 25 to 30 percent less than what you would get by waiting until your full retirement age (66 or 67, depending on the year you were born). Plus, if you take Social Security early and you die before your spouse, his or her survivors benefit will be lower, too.

What happens to Social Security if you are suspended?

When you resume collecting Social Security, you’ll have locked in a higher monthly payment for life.

How to request a suspension of Social Security?

When you resume collecting Social Security, you’ll have locked in a higher monthly payment for life. You can request a suspension by phone, in person at your local Social Security office or in writing.

Can I suspend my Social Security benefits?

Can I suspend Social Security benefits and restart them at a higher value? En español | Yes. If you have reached your full retirement age (the age at which you are entitled to 100 percent of the benefit calculated from your lifetime earnings) but are not yet 70, you can request a suspension of retirement benefits.

Is voluntary suspension for retirement only?

A voluntary suspension is for retirement benefits only. There is no such provision for family and survivor benefits.

Do You Have An Immediate Need For The Money?

Are You Still working?

- A part- or full-time job can be a plus in early retirement, but working and taking Social Security benefits before full retirement age can also push you over the annual earnings limit, which trims benefits. For 2022, the annual earnings limit is $19,560 (up from $18,960 in 2021). This means that those younger than full retirement age during all of 2022 lose $1 of benefits for each $2 the…

Take Cash Now Or A Larger Benefit Later?

- Those who take Social Security at age 62 face a significant and permanent reduction in benefits compared with those who wait. This reduction drops proportionately for each year a recipient waits between 62 and their full retirement age.6 As mentioned earlier, waiting until age 70 results in a permanent benefit some 32% higher than if benefits start...

The Bottom Line

- When to take Social Security benefits is an important decision—and a complex one. Take ample time and seek advice before deciding which way to go. And keep an eye on changing benefit levels and other shifts in Social Security; these are reviewed every year.