What is the maximum amount you can receive from Social Security?

The maximum you can receive from Social Security is $3,790 per month -- more than $45,000 per year. To earn that much, though, there are three steps you'll need to take.

How much can you make while receiving Social Security?

- If you work and earn $6,000 throughout the year, you have not hit the $17,640 annual earnings that would trigger withholding of some of your Social Security benefits. ...

- If you work and earn $35,000, you have exceeded the $17,640 limit by $17,360. ...

- If you work and earn $80,000, you have exceeded the $17,640 limit by $62,360. ...

What is the earliest you can apply for Social Security?

There are three key ages when it comes to Social Security:

- Age 62: This is the earliest age you can begin to receive retirement benefits. Your monthly benefit will be permanently reduced.

- Age 66: This is currently “full retirement age” (FRA). ...

- Age 70: This is the latest age you want to file for benefits. ...

When can you start collecting Social Security?

To claim Social Security spousal benefits, you’ll need to meet certain criteria, including being at least age 62 in most cases. Your spouse or ex-spouse also must be living. Keep in mind that the criteria for spousal benefits varies depending on whether you’re married or divorced.

How Long Will Social Security benefits last?

Introduction. As a result of changes to Social Security enacted in 1983, benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted.

Can you outlive your Social Security benefits?

Social Security provides an inflation-protected benefit that lasts as long as you live. Social Security benefits are based on how long you've worked, how much you've earned, and when you start receiving benefits. You can outlive your savings and investments, but you can never outlive your Social Security benefit.

How much Social Security will I get if I make 60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

Can I lose my Social Security retirement benefits?

If you are already entitled to benefits, you may voluntarily suspend retirement benefit payments up to age 70. Your benefits will be suspended beginning the month after you make the request. We pay Social Security benefits the month after they are due.

Who can receive Social Security benefits?

Social Security can pay what it calls “mother’s or father’s insurance benefits” to surviving spouses and ex-spouses of any age if they are caring for children or dependent grandchildren of a deceased worker who are younger than 16 or disabled.

When do spouses get survivor benefits?

Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

Do Social Security benefits have to be paid for life?

These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit. Beneficiaries entitled to two types of Social Security payments receive the higher of the two amounts.

Who is eligible for survivor benefits in 2021?

Most recipients of survivor benefits — two-thirds of them as of May 2021 — are the surviving spouses or surviving divorced spouses of deceased workers. Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. ...

When do child benefits stop?

Generally, benefits for surviving children stop when a child turns 18. Benefits can continue to as late as age 19 and 2 months if the child is a full-time student in elementary or secondary education or with no age limit if the child became disabled before age 22.

Can a child get survivor benefits if they get married?

In almost all instances, getting married will end a recipient child’s survivor benefits, even if the child still qualifies based on age. Surviving stepchildren, grandchildren, step-grandchildren and adopted children also might qualify for survivor benefits, subject to the rules above.

Can a parent receive survivor benefits?

Parents. Parents of a deceased worker can receive survivor benefits, singularly or as a couple, if they are 62 or older and the worker was providing at least half of their support. As with widows and widowers, these benefits are payable for life unless the parent remarries or starts collecting a retirement benefit that exceeds the survivor benefit.

How are Social Security benefits calculated?

Your Social Security benefits are calculated based on your lifetime earnings. That formula counts your 35 highest-paid years of wages when determining what monthly payout you're entitled to. For each year within that top 35 that you don't have an income on file, you'll have a $0 factored into your benefits calculation.

Is Social Security a complex program?

Know the ins and outs of Social Security. Social Security is a pretty complex program, and the specifics of its rules can change from year to year (for example, the amount of earnings needed for a single work credit can evolve).

Does Social Security count toward work credits?

Keep in mind that as long as you pay Social Security taxes on your income, it can count toward work credits. In other words, if you do freelance work but pay taxes on that income, it counts the same way a salary would. Your Social Security benefits are calculated based on your lifetime earnings.

How long can you keep Social Security disability?

How to Keep Your Social Security Disability Benefits in Effect. If you remain disabled until you reach the age of 65, then you will be able to keep your Social Security Disability benefits until you reach retirement age. At that point your Social Security Disability payments will change from Social Security Disability to Social Security Retirement ...

How long can you earn income before your Social Security benefits are revoked?

If you do decide to return to work your benefits will not stop right away. You can earn income on a “trial” basis for up to nine months before your Social Security Disability benefits are revoked. If you try to return to work and find that you are unable to cope with it, your Social Security Benefits will not end.

How often does Social Security review disability?

Social Security reviews disability benefits on a regular basis. These reviews are called Continuing Disability Reviews and they are given to everyone who receives Social Security Disability benefits. The time between these reviews depends on whether or not your condition is expected to improve. As a general rule, benefits are reviewed every 18 ...

Why did Social Security end?

Why Social Security Disability Benefits End. There are a number of reasons why Social Security Disability benefits would be revoked after being instated. The most common reasons for a stop in Social Security Disability benefits are improvement of one's disabling condition, incarceration, or a return to work. How long you receive Social Security ...

How often do you have to review your Social Security benefits?

As a general rule, benefits are reviewed every 18 months, every 3 years, or every 7 years depending on your condition and your chances of improvement. Improvement of one's condition is not the only reason Social Security Benefits can be revoked.

When do people stop receiving Social Security?

While many people will receive Social Security Disability benefits until they reach the retirement age of 65, not everyone will. For those who do receive Social Security Disability benefits until age 65, Social Security benefits will not just stop altogether.

When will Social Security retirement benefits stop?

There are, however, some instances in which a Social Security Disability beneficiary will have their disability benefits stopped prior to reaching the age of 65. There are a number of reasons why Social Security Disability benefits would be ...

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

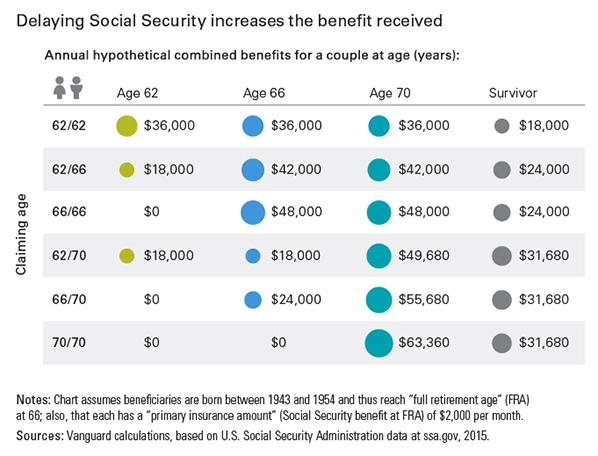

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you claim Social Security benefits before reaching FRA?

If you claim benefits before reaching FRA, they'll be reduced in the process. But if you hold off on claiming benefits beyond FRA, you'll accrue delayed retirement credits that boost them by 8% a year. As such, it often pays to delay your Social Security filing -- but only to a point. IMAGE SOURCE: GETTY IMAGES.

What is the maximum boost for Social Security if you are 66?

This means that if your FRA is 66, the highest boost you can snag for your benefits is 32%. If your FRA is 67, you're looking at a maximum 24% boost.

Does Social Security provide income?

Social Security will likely provide a substantial amount of income for you during retirement, and as such, it's crucial to get as much money from it as possible.

Is it a good idea to wait until 70 to file for Social Security?

Though waiting until 70 to file is a good way to get more money from Social Security, there's no sense in holding off past that point. Furthermore, while it often pays to claim Social Security at 70 for that maximum benefit boost, in some cases, waiting even that long is a bad idea.

How much Social Security do I need to retire?

To qualify for retirement benefits, you need 40 Social Security credits. You earn credits by paying Social Security tax on your income, and you can earn up to four per year. In 2021, $1,470 in earnings equals one credit; you earn four credits after making $5,880 for the year.

How many credits do I need to get Social Security Disability?

Qualification for Social Security Disability Insurance (SSDI) — benefits for people unable to work due to a significant health issue — can require as few as six credits (if you are under 24 years old) and as many as 40 (if you are 62 or over). The specific number depends on the age at which you became disabled.

How much can I earn on Social Security in 2021?

You earn credits by paying Social Security tax on your income, and you can earn up to four per year. In 2021, $1,470 in earnings equals one credit; you earn four credits after making $5,880 for the year. For eligibility purposes, it doesn’t matter how long it takes you to earn your 40 credits, but practically speaking most people qualify ...

Do you have to work to get SSI?

There is no work requirement for Supplemental Security Income (SSI), a safety-net program administered by Social Security that provides cash assistance for people who are over 65, blind or disabled and have very limited income and financial assets.

Do you get Social Security if you don't earn enough credits?

People who did not earn sufficient credits to qualify for Social Security on their own may receive benefits on the work record of a spouse, former spouse or parent.

What age do you have to be to get SSI?

The SSI program provides monthly payments to people who: Are at least age 65 or blind or disabled. Have limited income (wages, pensions, etc.). Have limited resources (the things you own). Are U.S. citizens, nationals of the U.S., or some noncitizens.

Can I get less SSI?

You may get less if you have other income such as wages, pensions, or Social Security benefits. You may also get less if someone pays your household expenses or if you live with a spouse and he or she has income. You may be able to get SSI if your resources are worth $2,000 or less.