Does New Jersey have extension on unemployment benefits?

In accordance with New Jersey Unemployment Extended Benefits Law, the Extended Benefit (EB) program has been activated effective May 3, 2020. The first payable week under the Extended Benefits program is July 4, 2020 as the 13 weeks of Pandemic Emergency Unemployment Compensation (PEUC) must be paid prior to Extended Benefits.

How long can I receive extended unemployment benefits in NJ?

Per federal regulations, on April 17, 2021, NJ state extended unemployment benefits were reduced from up to 20 weeks to up to 13 weeks because New Jersey’s unemployment rate went down. The state’s unemployment rates are reviewed regularly to determine if state extended unemployment benefits remain in place.

How long does it take to appeal unemployment New Jersey?

You should receive written notice regarding the outcome of your appeal within a week or so after the initial hearing. New Jersey gives you and your employer another 20 days after the postmark date to appeal a second time, and then it can take an additional two months or so for the Board of Review to arrive at a decision in this state. You can ask the board to expedite the process, however, if you're experiencing severe hardship.

How long can one collect unemployment in New Jersey?

of the eligibility requirements of New Jersey Unemployment Compensation Law. Those who meet the requirements may receive unemployment insurance benefits for up to 26 weeks during a 1-year period. People who are claiming unemployment insurance benefits are sometimes referred to as “claimants.” You

What is the maximum unemployment benefit in NJ for 2020?

$713The New Jersey Department of Labor and Workforce Development determines your unemployment benefit rate based on: Your weekly benefit rate, which is 60% of your average weekly wage, up to the maximum benefit amount, which is $713 in 2020.

How long is Covid unemployment in NJ?

Per federal regulations, on April 17, 2021, NJ state extended unemployment benefits were reduced from up to 20 weeks to up to 13 weeks because New Jersey's unemployment rate went down.

What is the maximum time you can collect unemployment in NJ?

26 weeksThe maximum weekly amount is recalculated annually and is equal to 56 2/3 percent of the statewide average weekly wage. A claimant can collect a maximum of 26 weeks of benefits on a regular unemployment claim.

Is NJ giving extended unemployment benefits?

The Department of Labor announced the federal unemployment program known as Extended Benefits will end for about 20,000 New Jerseyans on April 9. The program provided up to 13 weeks of additional jobless benefits for people who exhausted their 26 weeks of regular benefits.

Will unemployment be extended 2021?

The American Rescue Plan Act, signed March 11, 2021, extended the Federal Pandemic Unemployment Compensation (FPUC) program, which provides an additional $300 to workers for weeks of unemployment ending on March 11, 2021 through September 4, 2021.

Is pandemic unemployment still available?

The COVID-19 Pandemic Unemployment Payment (PUP) was a social welfare payment for employees and self-employed people who lost all their employment due to the COVID-19 public health emergency. The PUP scheme is closed.

Will unemployment be extended again?

But with an ongoing labor shortage in the United States, in part due to ongoing health concerns, experts said it is unlikely the federal government will extend benefits again, leaving low-income Americans scrambling for solutions.

Can I get an extension on my unemployment benefits?

Extended Benefits are available to workers who have exhausted regular unemployment insurance benefits during periods of high unemployment. The basic Extended Benefits program provides up to 13 additional weeks of benefits when a State is experiencing high unemployment.

Will unemployment be extended again after September?

The congresswoman said she will introduce a bill to extend federal unemployment programs established under the March 2020 CARES Act, which expired over Labor Day. If passed, the enhanced jobless aid would be retroactive to Sept. 6 and extended until Feb. 1, 2022.

What is the maximum unemployment benefit in NJ for 2022?

$804For 2022, the maximum weekly benefit rate is $804. We will calculate your weekly benefit rate at 60% of the average weekly wage you earned during the base year, up to that maximum.

How long do you have to work to file unemployment in 2019?

During the base period, your earnings must meet one of the following requirements: • You must have worked at least 20 weeks in the base period and earned at least $200 per week, or.

How much is the weekly unemployment rate?

If you are eligible to receive unemployment, your weekly benefit rate (WBR) will be 60% of your average weekly earnings during the base period, up to a maximum of $713. This number is then multiplied by the number of weeks that you worked during the base period, up to a maximum of 26 weeks. For example, someone with a weekly benefit rate of $300 who worked for 26 weeks will be entitled to a total of $7,800 ($300 x 26 weeks = $7,800).

How many times should you contact different employers for unemployment?

The Department of Labor and Workforce Development (LWD) may ask you to provide contact information for employers you've contacted at any point during your claim. At minimum, you should contact at least three different employers each week.

What happens if you are fired from a job in New Jersey?

If you were fired because you lacked the skills to perform the job or simply weren't a good fit, you won't necessarily be barred from receiving benefits. However, if your actions rise to the level of "misconduct," you will not be eligible for unemployment. New Jersey law distinguishes among three different types of misconduct: 1 Simple misconduct: when an employee's actions go against the employer's best interests, such as being insubordinate or being absent or late without a prior written warning. 2 Severe misconduct: when an employee engages in more serious offenses, such as showing up to work under the influence of drugs or alcohol, stealing or destroying company property, or being absent or late after a written warning. 3 Gross misconduct: when an employee's actions qualify as criminal acts under New Jersey law.

When an employee's actions qualify as criminal acts under New Jersey law?

Gross misconduct: when an employee's actions qualify as criminal acts under New Jersey law.

Can you get unemployment if you are out of work?

You must be out of work through no fault of your own to qualify for unemployment benefits.

Can you be unemployed in New Jersey?

You must be unemployed through no fault of your own , as defined by New Jersey law.

How long does it take to review unemployment?

Federal law requires a review of unemployment claims after one year for benefits to continue. It’s not a glitch, so do not open a new claim.

What happens if you don't earn enough to receive unemployment?

Please note, if a claimant did not earn sufficient wages and is receiving regular unemployment benefits (not federal or state extended benefits) when they reach their benefit year end, those regular benefits would end, and they would be transitioned to federal extended benefits.

What happens if you don't work for unemployment?

IF YOU DID NOT EARN SUFFICIENT WAGES. If you did not work during the base year, or your earnings did not meet the threshold, you will continue collecting benefits on your existing claim (as long as federal or state extended benefits remain available). Please note, if a claimant did not earn sufficient wages and is receiving regular unemployment ...

How long does it take to get unemployment benefits if you refuse to work?

Adjudication currently takes four to six weeks due to unprecedented volume.

How to stop unemployment if you have returned to work?

To stop receiving benefits, simply stop certifying for weekly benefits. If you believe you may be entitled to payment for a partial week, click here for more information.

Can I file a claim before I get unemployed?

Claims filed before you are separated from employment are not valid because you are considered to be employed full-time. You cannot apply for benefits until you become unemployed or your hours are reduced. I collect a pension and/or Social Security benefits.

Can you file a claim after you stop working?

You should file your claim immediately after you stop working full-time, even if you are getting severance pay. Payments that do not extend employment include severance payments based on years of service with an employer. However, salary continuation through termination and payments in Lieu of Notice do extend employment.

How long does unemployment last?

Those who meet the requirements for traditional unemployment insurance may receive benefits for up to 26 weeks during a one-year period.

When will unemployment benefits expire in 2021?

Federal extended unemployment benefits expired on September 4, 2021. Please note that you will still be able to receive benefits for weeks prior to September 4, if you are found eligible for a claim filed before September 4, 2021. Learn more about state extended unemployment benefits here.

What is PUA in unemployment?

Pandemic Unemployment Assistance (PUA) expands unemployment assistance to individuals who are typically not eligible for benefits. To be eligible for Pandemic Unemployment Assistance (PUA), workers must meet all three of the following criteria, which are explained in more detail below.

How long does it take to review unemployment?

Federal law requires a review of unemployment claims after one year for benefits to continue. It’s not a glitch, so do not open a new claim.

When does PUA expire in NJ?

You may have been eligible under Pandemic Unemployment Assistance (PUA), which expires September 4, 2021. New applications for PUA are not accepted after September 4, 2021. Learn more at myunemployment.nj.gov/pua.

When will PUA be available in NJ?

Pandemic Unemployment Assistance (PUA) expanded unemployment assistance to individuals who are typically not eligible for benefits, and expired on September 4, 2021. New applications for PUA are not accepted after September 4, 2021. Learn more at myunemployment.nj.gov/pua.

How many weeks of family leave can you get?

Currently, workers can receive a total of 12 weeks of family leave benefits per year regardless of the reason for leave. For example, if you used 3 weeks of family leave benefits to care for a loved one who had COVID-19, you will have 9 weeks left to bond with your newborn under FLI.

How long do you have to work to get unemployment?

In order to qualify for a new claim, you must have worked for a certain amount of time before you apply again. You need to have worked at least four weeks and earned six times your last claim's weekly benefit rate in covered employment. You must also meet all other eligibility rules. We need all of this information to see if you are once again eligible for benefits.

When do you stop receiving unemployment benefits?

Whether or not you have collected all the benefits in your claim, we stop paying benefits after one year has passed from the initial date of your claim. If after this one-year anniversary you are unemployed, you need to file a new claim because we have to recalculate your weekly benefit rate based on the new base year period.

How much unemployment is $200?

For example, if your weekly benefit rate is $200, your partial weekly benefit rate is $240 (20 percent more than $200.) If you earn $50 (gross) during a week, you would receive $190 in unemployment insurance benefits ($240 – $50 = $190).

What happens if you earn more than 20 percent of your weekly benefit?

If you earn more than 20 percent of your weekly benefit rate from an employer in a given week, your partial weekly benefit payment will be reduced dollar-for-dollar for all gross wages earned that week.

What is the maximum weekly benefit for 2021?

The weekly benefit rate is capped at a maximum amount based on the state minimum wage. For 2021, the maximum weekly benefit rate is $731. We will calculate your weekly benefit rate at 60% of the average weekly wage you earned during the base year, up to that maximum.

Can you increase your dependency benefits if you are not entitled to the weekly maximum?

If you are not entitled to the weekly maximum benefit amount, you may be able to increase your entitlement with dependency benefits.

Can you get dependent benefits if your weekly benefit rate is less than maxium?

If your weekly benefit rate is less than the maxium weekly benefit rate and you have dependents, you may qualify for Dependency Benefits .

How many credits do you need to be a student to get unemployment?

A. A claimant is disqualified for benefits for any week in which the individual is a student in full time (at least 12 credits) attendance at, or on vacation from, any public or other nonprofit educational institution, except in cases in which the claimant establishes 20 or more base weeks of employment or meets the alternative earnings test during academic term (s) in the base-year.

What is the burden of proof for a claimant to quit a job?

The burden of proof is on the claimant to prove that he/she quit for good cause.

What is a lag period employer?

A. A lag-period employer is an employer who paid wages to an individual between the last day of the base-year period and the filing of an unemployment claim. Since wages earned in the lag period are not in the base-year, employers with only lag-period employment are not normally charged. However, if the claim is determined invalid under the regular base year, an Alternative Base Period may be used to determine monetary eligibility. If the lag-period employment is in the Alternative Base Year, the lag-period employer will then be charged.

How is each base year employer charged?

Each base-year employer is charged a percentage of each benefit payment in proportion to the amount of wages that the employer paid the claimant during the base-year and the total wages received by the claimant during that period.

Do full time students apply to school?

The full-time student criteria do not apply to any individual attending a school or training program approved by the Division to enhance the individual’s employment opportunity.

Do you have to requalify for unemployment?

Once the re-qualifying threshold is met, the disqualification must end and the individual is potentially eligible to receive benefits.

How Many Weeks of Regular State Unemployment Benefits Are Available?

"The period for collecting unemployment benefits varies by state but the maximum period for getting such benefits is 26 weeks," says David Clark, a lawyer and partner at the Clark Law Office, which has offices in Lansing and Okemos, Michigan.

What Federal Unemployment Benefits Are Available?

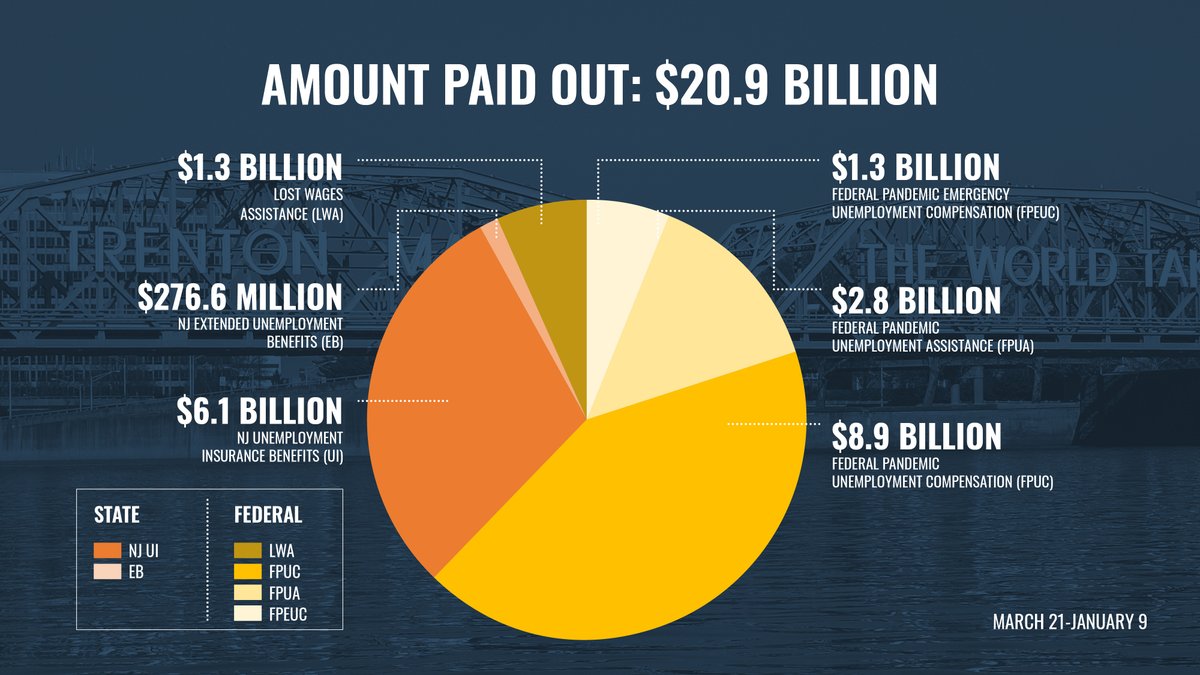

There are three federal unemployment benefit programs available – but not for long. They're set to end on Sept. 6. It has been estimated that approximately 7.5 million Americans are at risk for losing federal unemployment benefits.

What if I Need Unemployment Benefits After 26 Weeks? Do I Have Options?

After Sept. 6, your options may be pretty limited, other than finding employment. Of course, regular unemployment benefits will continue, and so if you became unemployed, for instance, on Aug. 20, you'd have a couple weeks of receiving extended benefits – and then you would continue receiving your regular state's unemployment benefits.