12 States That Do Tax Social Security Benefits

- Colorado: Colorado taxes Social Security benefits at their flat state rate of 4.55%. ...

- Connecticut: Social Security payments in Connecticut are exempt from state taxes as long as your adjusted gross income is less than $75,000. ...

- Kansas: Kansas allows retirees with less than $75,000 in AGI to deduct all Social Security income from their state taxes. ...

What states do not have Social Security taxes?

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- North Dakota

- Rhode Island

- Vermont

What states have no SS tax?

I'd like to retire in a no (or low ... unfortunately isn't that tax-friendly. But before I make any suggestions, let's talk more about taxes. Please look beyond whether a state has an income tax. Far more don't tax Social Security payments, for example.

What states charge tax on social security?

- Colorado: Social Security income received in Colorado will be taxed at the state’s flat rate of 4.55%. ...

- Connecticut: Connecticut’s Social Security income tax rate ranges from 3% to 6.99%. ...

- Kansas: In Kansas, Social Security benefits are taxed at the same rate as all other forms of income, with the tax rate ranging from 3.1% to 5.7%. ...

How much of my Social Security benefits are taxable?

Whether you'll need to pay taxes on your Social Security benefits or not will depend on your provisional income, which is calculated by taking half of your annual benefit and adding it to your adjusted gross income and certain type of non-taxable income, like interest from municipal bonds.

What are the 13 states that tax Social Security?

Of the 50 states, 13 states tax Social Security benefits. Those states are: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia.

Which are the 12 states that tax Social Security benefits?

Twelve states also tax some or all of their residents' Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont and West Virginia.

Which states do not tax Social Security payments?

States That Don't Tax Social SecurityAlaska.Florida.Nevada.New Hampshire.South Dakota.Tennessee.Texas.Washington.More items...•

Do all states tax Social Security benefits?

Most states, however, exempt Social Security from state taxes. The list of 37 states, plus the District of Columbia, that don't tax Social Security includes the nine states with no state income tax, as well as some other states that rank as the most tax-friendly states for retirees, such as Delaware and South Carolina.

What are the 3 states that don't tax retirement income?

Nine of those states that don't tax retirement plan income simply because distributions from retirement plans are considered income, and these nine states have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

What is the most tax friendly state to retire in?

Delaware1. Delaware. Congratulations, Delaware – you're the most tax-friendly state for retirees! With no sales tax, low property taxes, and no death taxes, it's easy to see why Delaware is a tax haven for retirees.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How can I avoid paying taxes on Social Security?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

What state pays the most in Social Security?

These states have the highest average Social Security retirement benefitsNew Jersey: $1,553.63.Connecticut: $1,546.67.Delaware: $1,517.11.New Hampshire: $1,498.01.Michigan: $1,493.77.Maryland: $1,482.87.Washington: $1,472.50.Indiana: $1,464.61.More items...•

Does Social Security change from state to state?

No matter where in the United States you live, your Social Security retirement, disability, family or survivor benefits do not change. Along with the 50 states, that includes the District of Columbia, Puerto Rico, Guam, the U.S. Virgin Islands, American Samoa and the Northern Mariana Islands.

Do I have to pay federal taxes on Social Security?

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000.

Is Social Security taxed after age 70?

Yes, Social Security is taxed federally after the age of 70. If you get a Social Security check, it will always be part of your taxable income, regardless of your age.

How can I avoid paying taxes on Social Security?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Do seniors pay taxes on Social Security income?

Many seniors are surprised to learn Social security (SS) benefits are subject to taxes. For retirees who are still working, a part of their benefit is subject to taxation. The IRS adds these earnings to half of your social security benefits; if the amount exceeds the set income limit, then the benefits are taxed.

Do you have to pay federal taxes on Social Security?

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000.

Colorado

State Taxes on Social Security: For beneficiaries younger than 65, up to $20,000 of Social Security benefits can be excluded, along with other retirement income. Those 65 and older can exclude benefits and other retirement income up to $24,000.

Connecticut

State Taxes on Social Security: Social Security income is fully exempt for single taxpayers with federal adjusted gross income of less than $75,000 and for married taxpayers filing jointly with federal AGI of less than $100,000.

Kansas

State Taxes on Social Security: Social Security benefits are exempt from Kansas income tax for residents with a federal adjusted gross income of $75,000 or less. For taxpayers with a federal AGI above $75,000, Social Security benefits are taxed by Kansas to the same extent they are taxed at the federal level.

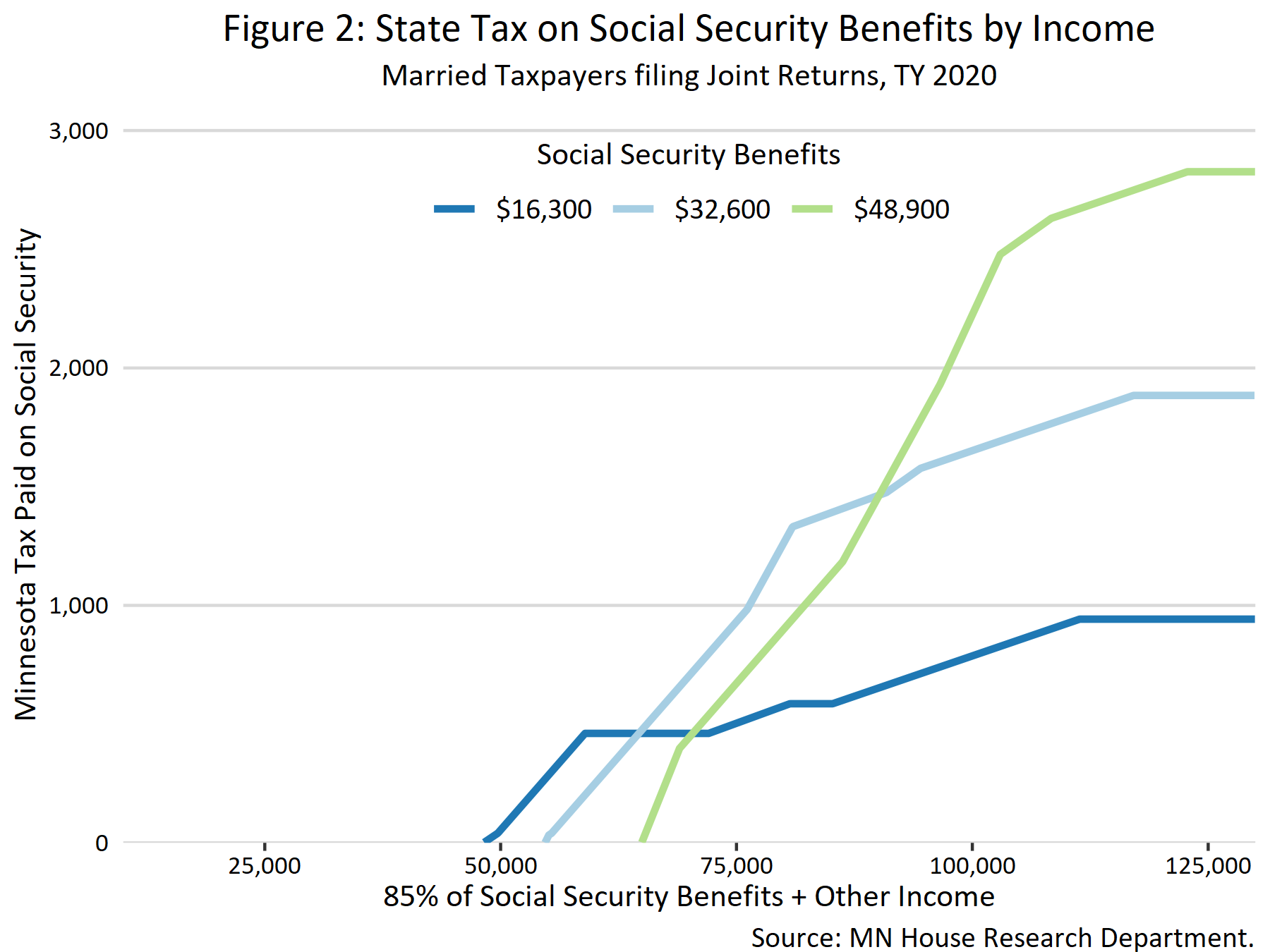

Minnesota

State Taxes on Social Security: Social Security benefits are taxable in Minnesota, but for 2021 a married couple filing a joint return can deduct up to $5,290 of their federally taxable Social Security benefits from their state income.

Missouri

State Taxes on Social Security: Social Security benefits are not taxed for married couples with a federal adjusted gross income less than $100,000 and single taxpayers with an AGI of less than $85,000. Taxpayers who exceed those income limits may qualify for a partial exemption on their benefits.

Montana

State Taxes on Social Security: Social Security benefits are taxable. The method used to calculate the taxable amount for Montana income tax purposes is similar to the method used for federal returns. However, there are important differences. As a result, the Montana taxable amount may be different than the federal taxable amount.

Nebraska

State Taxes on Social Security: For 2021, Social Security benefits are not taxed for joint filers with a federal adjusted gross income of $59,960 or less and other taxpayers with a federal AGI of $44,460 or less.

Which states have a Social Security exemption?

Kansas provides an exemption for such benefits for any taxpayer whose AGI is $75,000, regardless of filing status. Minnesota provides a graduated system of Social Security subtractions which kick in if someone’s provisional income is below $81,180 (single filer) or $103,930 (filing jointly). Missouri allows a 100 percent Social Security exemption ...

What is the taxable portion of Social Security?

Under the federal tax code, the taxable portion of Social Security income depends on two factors: a taxpayer’s filing status and the size of his “combined income” (adjusted gross income + nontaxable interest + half of Social Security benefits). In general, if a taxpayer has other sources of income and a combined income of at least $25,000 ...

How much can I deduct from my Social Security in North Dakota?

North Dakota allows taxpayers to deduct taxable Social Security benefits if their AGI is less than $50,000 (single filer) or $100,000 (filing jointly).

When will West Virginia start phasing out Social Security?

West Virginia passed a law in 2019 to begin phasing out taxes on Social Security for those with incomes not exceeding $50,000 (single filers) or $100,000 (married filing jointly). Beginning in tax year 2020, the state exempts 35 percent of benefits for qualifying taxpayers.

Does New Mexico have a Social Security tax credit?

It should be noted that the state also provides a nonrefundable retirement tax credit (this does not apply to survivor or disability Social Security benefits). New Mexico includes social security benefits in its definition of income. Several states reduce the level of taxation applied to Social Security benefits depending on things like age ...

How many states are taxing Social Security?

The 13 states currently imposing Social Security taxes include: Now keep in mind that not all of these 13 states tax Social Security in exactly the same way. Some charge tax only on the income on which federal tax rules impose income tax, which means that many residents get away without paying anything.

How many states take Social Security monthly checks?

Currently, 13 states take their share from monthly checks, but fortunately for taxpayers in one of those states, Social Security taxation is about to become a thing of the past. Image source: Getty Images.

How much of Social Security benefits are taxable in West Virginia?

That'll still be the case on 2019 tax returns. But when they file their 2020 state tax returns, West Virginia taxpayers will be able to exclude 35% of their Social Security benefits from their taxable income for state purposes. For the 2021 tax year, that amount goes up to 65% of the benefits they receive from Social Security.

How much of Social Security will be taxed in 2021?

For the 2021 tax year, that amount goes up to 65% of the benefits they receive from Social Security. By 2022, 100% of Social Security benefits will be free of tax.

Do low income areas have higher taxes?

For one thing, many locations that have low income taxes have higher property or sales taxes. You have to look closely at your own financial situation to decide which place would be the best to live from a financial perspective. Even then, plenty of non-financial issues can take precedence.

Is Social Security tax free in West Virginia?

Jim Justice signed a bill that began to phase in tax-free treatment for Social Security benefits in calculating how much personal income tax a West Virginia resident owes. Prior to the bill becoming law, residents paid tax on the same income that was included under federal law. That'll still be the case on 2019 tax returns.

Only 12 states actually levy a tax on Social Security benefits

Ward Williams is an Associate Editor with over four years of professional editing, proofreading, and writing experience. Ward is also an expert on government and policy as well as company profiles. He received his B.A. in English from North Carolina State University and his M.S. in publishing from New York University.

Understanding Taxes on Social Security Benefits

Since 1983, Social Security payments have been subject to taxation by the federal government. 5 How much of a person’s benefits are taxed will vary, depending on their combined income (defined as the total of their adjusted gross income (AGI), nontaxable interest, and half of their Social Security benefits) and filing status.

Social Security Benefit Taxation by State

Out of all 50 states in the U.S., 38 states and the District of Columbia do not levy a tax on Social Security benefits. 2 Of this number, nine states—Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming—do not collect state income tax, including on Social Security income. 8

Are States That Tax Social Security Benefits Worse for Retirees?

Including Social Security benefits in taxable income doesn’t make a state a more expensive place to retire.

Which state is the most tax-friendly for retirees?

Although there’s no official measure of tax friendliness, Delaware is a strong contender for the best state for retirees when it comes to taxes. The First State levies neither state or local sales tax, nor estate or inheritance tax. 40 41 Delaware’s median property tax rate is also one of the lowest in the U.S.

At what age is Social Security no longer taxable?

Whether or not a person’s Social Security benefits are taxable is determined not by their age but by their income—the amount that’s subject to taxation is referred to as “combined income” by the Social Security Administration. 1

The Bottom Line

Although low taxes shouldn’t be the sole motivating factor when deciding on a long-term residence, you still should be aware of which taxes the local government levies so as not to be caught unprepared when your next tax bill rolls in. State taxes on Social Security income can take a significant bite out of your retirement income.

How much of your Social Security benefits are taxable?

more than $34,000, up to 85 percent of your benefits may be taxable. between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. more than $44,000, up to 85 percent of your benefits may be taxable. are married and file a separate tax return, you probably will pay taxes on your benefits.

Can I get a replacement for my Social Security 1099?

If you currently live in the United States and you misplaced or didn't receive a Form SSA-1099 or SSA-1042S for the previous tax year, you can get an instant replacement form by using your online my Social Security ...

Do I pay taxes on my Social Security benefits if I am married?

are married and file a separate tax return, you probably will pay taxes on your benefits. Each January, you will receive a Social Security Benefit Statement (Form SSA-1099) showing the amount of benefits you received in the previous year. You can use this Benefit Statement when you complete your federal income tax return to find out ...