How Early Retirement Affects Your Social Security Benefits

- Your full retirement age (FRA) is determined by the year in which you were born.

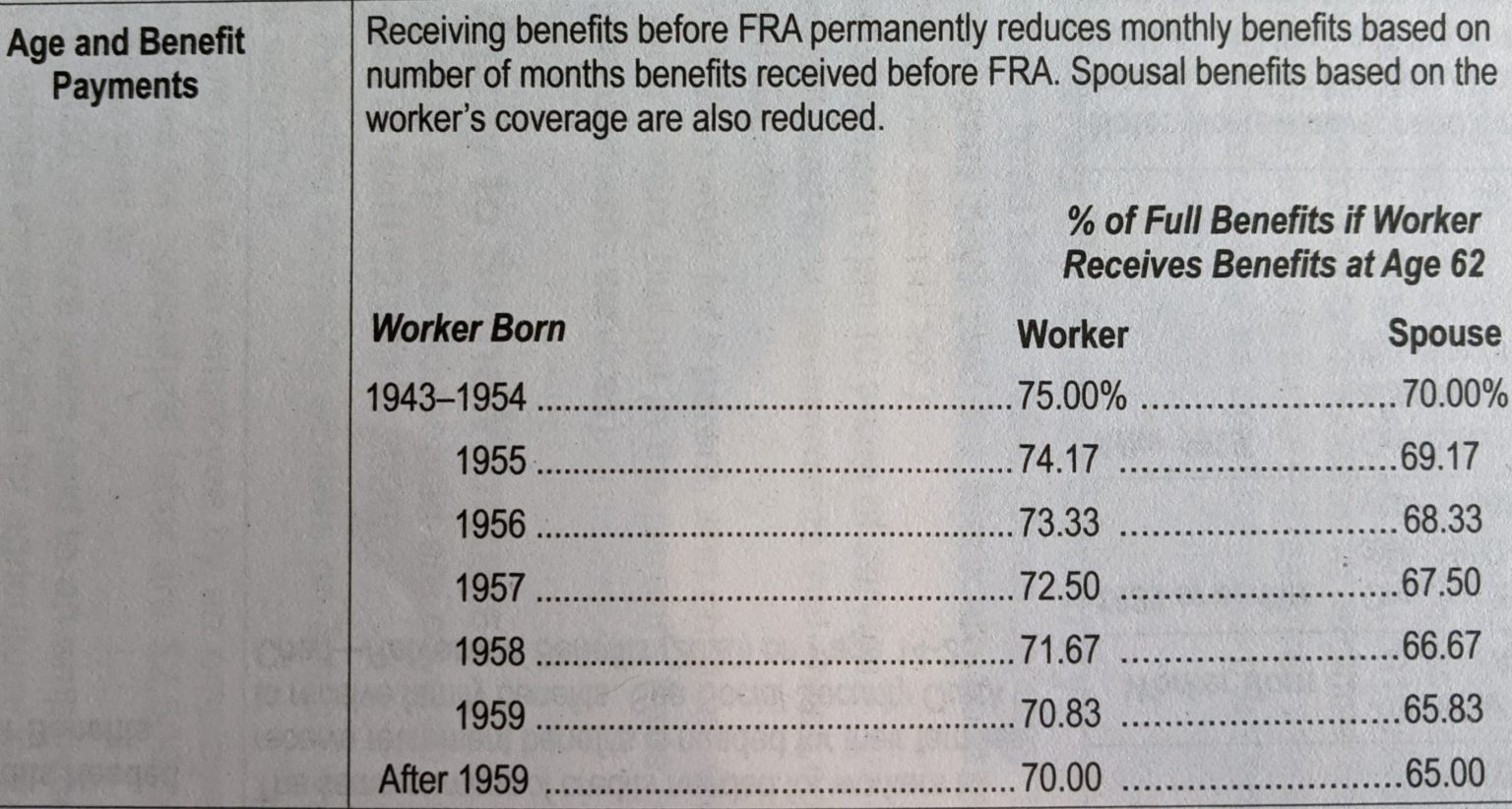

- The earlier you retire, the greater the reduction in your full retirement benefits.

- If you retire at age 62 instead of your FRA, your benefits could be reduced by as much as 30%.

Does early retirement reduce social security benefit payouts?

If you plan on working part-time during early retirement, you may find your Social Security benefits reduced. The reduction is based on something called the "Social Security earnings limit," and it only applies if you have not yet reached full retirement age. If your income is higher than the earnings limit, your benefits will be reduced.

What is the penalty for early Social Security retirement?

- The Saver’s Credit could reduce your tax bill by $2,000

- When does COLA 2022 take effect in Social Security Benefits?

- Dark clouds for stimulus checks in 2022

- Manchin rejects Build Back Better: what does this mean for the Child Tax Credit?

How much does filing early cut my Social Security benefits?

The short answer: as much as $5,000 a year. But you can change that.

What is the penalty for taking social security early?

- Your monthly benefit at 62 would be about $1,023 (a 30% reduction from $1,461).

- You miss 60 months of payouts. ...

- The monthly benefit you get if you delay to 67 is $1,461.

- Subtracting $1,023 from $1,461 gives you $428 -- the difference in monthly benefits that comes from delaying.

- Dividing $61,380 by $438 gives you 140.14. ...

How much will my Social Security be reduced if I retire at 62?

The percentage reduction is 5/9 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. Reduction applied to $500, which is 50% of the primary insurance amount in this example. The percentage reduction is 25/36 of 1% per month for the first 36 months and 5/12 of 1% for each additional month.

What is the amount that Social Security will be reduced if you collect early Social Security and earn more than the maximum amount from working?

If you are younger than full retirement age and earn more than the yearly earnings limit, we may reduce your benefit amount. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2022, that limit is $19,560.

How much does Social Security Reduce at 63?

How Your Social Security Benefit Is ReducedIf you start getting benefits at age*And you are the: Wage Earner, the benefit amount you will receive is reduced toAnd you are the: Spouse, the benefit amount you will receive is reduced to62 + 11 months79.637.36380.037.563 + 1 month80.637.863 + 2 months81.138.246 more rows

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

Will my Social Security benefits be reduced if I retire early?

If you retire more than 36 months early (up to a maximum of 60), your Social Security benefit will be reduced by an additional 5/12 of 1% per extra month. This means that the maximum number of retirement months is 60 for those retiring at age 62 when the full retirement age is 67.

Is it worth taking Social Security at 62?

There is no definitive answer to when you should collect Social Security benefits, and taking them as soon as you hit the early retirement age of 62 might be the best financial move.

Why retiring at 62 is a good idea?

Probably the biggest indicator that it's really ok to retire early is that your debts are paid off, or they're very close to it. Debt-free living, financial freedom, or whichever way you choose to refer it, means you've fulfilled all or most of your obligations, and you'll be under much less strain in the years ahead.

Can I draw Social Security at 62 and still work full time?

Can You Collect Social Security at 62 and Still Work? You can collect Social Security retirement benefits at age 62 and still work. If you earn over a certain amount, however, your benefits will be temporarily reduced until you reach full retirement age.

What happens if you stop working at 62 but don't collect until full retirement age?

What happens if you stop working at 62 but don't collect until full retirement age? You will receive the full retirement age benefit based on your top 35 working years — adjusted for COLA.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

What is the best age to draw Social Security?

When it comes to calculating the best age for starting to collect your Social Security benefits, there's no one-size-fits all answer. As a rule, it's best to delay if you can. If you're in good health and don't need supplemental income, wait until age 70.

What is the best month to start Social Security?

Individuals first become eligible to receive a benefit during the month after the month of their 62nd birthday. So, someone born in May becomes eligible in June. Since Social Security pays individuals a month behind, the person will receive the June benefit in July.