For instance, if the plan costs $500 monthly and your employer kicks in $300 toward the cost, you will be responsible for the remaining $200, which typically, will come out of your paycheck. In other words, your paycheck will be $200 less than what it would have been had you not signed up for coverage through your employer.

How much does my employer pay for my health insurance?

Job B employer covers 80 percent of your monthly health insurance premium, with the rest, $200 per month, deducted from your paycheck. The annual deductible is $1,000. Job A: With a $30,000 salary and no annual cost for health insurance, your net salary is $30,000.

How much of your paycheck goes toward Social Security tax?

With the 2019 tax code, 6.2% of your income goes toward social security, and 2.9% goes toward medicare tax — but, if you’re employed by a company full-time, they pay half of your medicare responsibilities, so you should only see 1.45% taken from your pay.

How much does the government take out of your paycheck?

Your employer also feels the pain of payroll taxes, as it must pay an equal amount on your behalf. For example, if your wages are $50,000 for the year, you’ll see $3,825 taken out of your paycheck; but your employer will also pay an additional $3,825 to the government in payroll taxes on your wages.

What benefits are deducted from my pay?

Other benefits like commuter plans, life insurance, and disability insurance, may also be deducted from your pay, depending on whether or not you opt into them and if your employer picks up the bill fully or partially.

Are health benefits taken out of paycheck?

If you sign up for your employer-provided health insurance, the cost will come out of your paycheck.

How much of your paycheck goes to benefits?

Benefits make up 32 percent of an employee's total compensation. However, benefits can vary by the size of the organization, industry group and geographic location. You may want to know how a comparison of higher salary vs. benefits looks in the different types of organizations and industries.

What percentage of paycheck goes to taxes and benefits?

Overview of Federal TaxesGross Paycheck$3,146Federal Income15.22%$479State Income4.99%$157Local Income3.50%$110FICA and State Insurance Taxes7.80%$24623 more rows

What percentage is taken out of paycheck?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Combined, the FICA tax rate is 15.3% of the employee's wages.

How much do employees pay for health insurance?

In 2020, the standard company-provided health insurance policy totaled $7,470 a year for single coverage. On average, employers paid 83% of the premium, or $6,200 a year. Employees paid the remaining 17%, or $1,270 a year.

Do employees pay for benefits?

An employee benefits package typically includes healthcare insurance, retirement plans, vacation and paid time off. Generally, these packages will cover 80%, and in some cases 100%, of healthcare costs. Both the employer and employee pay the monthly premium on benefits.

How much taxes do they take out of a 900 dollar check?

You would be taxed 10 percent or $900, which averages out to $17.31 out of each weekly paycheck. Individuals who make up to $38,700 fall in the 12 percent tax bracket, while those making $82,500 per year have to pay 22 percent.

What taxes come out of my paycheck?

Payroll taxes include federal, state, and local income taxes, federal and state unemployment taxes, and Medicare and Social Security taxes. They are automatically taken out of your paycheck every time you are paid, based on a flat, fixed tax rate for state and local income taxes and Medicare and Social Security taxes.

How much taxes should be taken out?

Your Income Taxes BreakdownTaxMarginal Tax Rate2021 Taxes*Federal22.00%$9,600FICA7.65%$5,777State5.97%$3,795Local3.88%$2,4924 more rows•Jan 1, 2021

How much tax is taken out of a $500 check?

Calculate Take-Home Pay If the gross pay is $500, Social Security and Medicare combined come to $38.25. The employee's federal income tax is $47.50. After these amounts are subtracted, the take-home pay comes to $414.25.

How much taxes do they take out of $1000?

Paycheck Deductions for $1,000 Paycheck The amount withheld per paycheck is $4,150 divided by 26 paychecks, or $159.62. In each paycheck, $62 will be withheld for Social Security taxes (6.2 percent of $1,000) and $14.50 for Medicare (1.45 percent of $1,000).

How much do I pay in taxes if I make 1000 a week?

If you earn $1,000 per week in gross pay, you'll pay $1,000 X . 765, or $76.50 per week toward FICA.

What is deduction in payroll?

Deductions are all of the things that were taken out of your gross pay, leaving you with your net pay, or take-home pay. While there are some deductions you can’t really control, others are part of your employee benefits package, so you can adjust them according to what works for you and your budget.

What does FICA stand for on a paystub?

These taxes are likely labeled FICA (which stands for Federal Insurance Contributions Act) on your paystub. Now, things work a bit differently if you’re employed as an independent contractor or have any other employment status where your employer doesn’t withhold upon your pay, Laviña explains.

Do you have to pay state taxes on your paystub?

State and local taxes. The majority of US states require you to also pay state income tax, which will be listed as another line item on your paystub. Some states may impose additional taxes — for example, California residents have a short-term disability tax deductions from their pay, Cristina Livadary, CFP, says.

Can you opt into a handful of other benefits?

Depending on the company you work for, you may have the opportunity to opt into a handful of other benefits, the costs of which are deducted from your paycheck automatically.

Is 401(k) a pre-tax deduction?

If you’re a full-time employee, your company may give you the opportunity to contribute to a retirement fund, like a 401 (k). This money is a pre-tax payroll deduction, meaning that whatever amount you choose to contribute from each paycheck is deducted from your total taxable income, Livadary explains. “So say your salary is $50,000, and you contribute $5,000 pre-tax over the year to a 401 (k), you’ll only be taxed as if you make $45,000.”

How does your paycheck work?

How Your Paycheck Works: Local Factors. If you live in a state or city with income taxes, those taxes will also affect your take-home pay. Just like with your federal income taxes, your employer will withhold part of each of your paychecks to cover state and local taxes.

What taxes do employers withhold from paychecks?

Overview of Federal Taxes. When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, ...

How much is FICA tax in 2021?

However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2021 is $142,800 (up from $137,700 in 2020).

How does FICA work?

How Your Paycheck Works: FICA Withholding. In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act.

What are pre-tax contributions?

These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 (k) or 403 (b).

What is tax withholding?

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

What is the federal income tax rate for 2019?

Federal Paycheck Quick Facts. Federal income tax rates range from 10% up to a top marginal rate of 37%. The U.S. median household income in 2019 was $65,712. 43 U.S. states impose their own income tax for tax year 2020.

How Much Do Employees Pay for Health Insurance?

There are a couple of factors that will influence how much an employee pays for health insurance. The first is what type of insurance coverage they’re getting. Single insurance policies will obviously cost less, while family plans will represent a larger expense on both the employer and employee.

Are There Alternatives?

You should check to see if your employer offers a health reimbursement arrangement or HRA. HRAs are funds given to you to let you find your own, individual plan. This cuts costs for your employer, while also giving you more choice.

Health Insurance Is Complicated

While the correct answer to “how much do employees pay for health insurance” is “it depends,” understanding the general framework for how employer-sponsored health insurance plans work is important. Knowing the options available to you can help you choose the best one for you and your family.

How much is disability insurance?

Disability Insurance ($2,000 to $5,000 per year) – Premiums for insurance that replaces a portion of your income if you can’t work due to a non-work-related illness or injury can be paid for by the employer, employee or both. Purchasing this insurance as individual policies would be quite expensive.

How much is an HSA?

Health Savings Account (HSA) (typically $500-$1,500 plus current and future tax savings) - More and more employers are also offering high deductible health plans in conjunction with a health savings account (HSA). In many cases, they’re contributing to the employees’ HSAs as well.

What does FICA mean on Social Security?

FICA stands for Federal Insurance Contribution Act, e.g., Social Security and Medicare, and your employer pays just as much as you do towards both programs. The employer contribution adds up to 7.65% of your salary and bonus (up to a max on the Social Security tax).

How much does dental insurance cost?

Dental Insurance ($1,500 - $4,500 annually) The next time you have a cavity filled or need a crown, you’ll be grateful you have coverage to pick up some of the costs. Typically, dental coverage pays for half of certain procedures, as well as for preventative care, up to a certain limit per family member per year.

How much is tuition reimbursement?

Remember that your discount is taxed like income and taxes are withheld on it from your paycheck. Tuition reimbursement (typically $1,500-$5,000 annually for approved coursework) Many large companies offer tuition reimbursement for degree programs, professional certifications and courses related to your job.

How much is financial wellness?

Financial Wellness benefits ($500 - $2,500 annually) If you’re fortunate to have access to employer-paid financial coaching and guidance, that’s like having a financial planner on retainer all year long. That could easily cost hundreds or even thousands of dollars a year.

What happens if you don't have a retirement plan?

The consequence: employees without a work-sponsored retirement plan are far less likely to save for retirement.

What is the deductible for job B?

The annual deductible is $1,000. Do the math: Job A: With a $30,000 salary and no annual cost for health insurance, your net salary is $30,000.

Do you take the time to analyze your health insurance?

You may be so desperate for health insurance that when you finally get an offer, you don't take the time to analyze its attached health plan. But that could cost you.

What are the benefits of total compensation?

Types of benefits companies offer in standard compensation packages include health insurance, performance-based bonuses and retirement plans.

What is base pay and annual pay?

In contrast to base pay, which excludes extra compensation, annual pay takes into account additional earnings over the year. This includes overtime, awards, bonuses and benefits. 1.

What happens when you get a job offer?

When you receive a job offer, the employer will present you with a compensation package that includes a base salary and potentially other benefits. You may choose to negotiate for a better compensation package if you believe that the offer is not in line with your skillset, education, career level or other strengths.

What should I include in my salary history?

This should include amounts for bonuses and commissions that you receive regularly. If the sum is uneven, you can provide an average. For example, you might say that “In my current role, I earn a base salary of $65,000, in addition to an average annual bonus of $5,000.”

Why do employers ask about salary history?

First, keep in mind that the reason that employers ask about salary history is to determine your potential market value and to make sure that your salary expectations are in line with the budget for the role.

What is compensation package?

A compensation package is your base pay plus other benefits. When considering a job offer or a raise, it is critical to take into account not just the base salary, but the entire compensation package that is offered. There is a wide variety of potential benefits packages that employers can offer. Benefits can be provided at ...

What to do if you feel uncomfortable sharing your salary history?

If you feel uncomfortable sharing your salary history or would like to avoid the discussion until the negotiation phase, you may politely decline by explaining that you would rather learn more about the role and its responsibilities before moving to a discussion of salary expectations.

How much does an average employee make a year?

For single individuals, the average employee pays around $1,200 a year. To break it down even further, the average American earns around $780 a week and contributes approximately $120 a week to cover the cost of their employer-sponsored family plans, and $25 for individual plans.

What happens if my employer doesn't pay me for my health insurance?

The remaining portion of benefits that your employer does not cover will be your responsibility, and usually, those costs will come out of your paycheck. For instance, if the plan costs $500 monthly and your employer kicks in $300 toward the cost, you will be responsible for the remaining $200, which typically, will come out of your paycheck.

Does health insurance cover all of the cost?

While most companies will cover some of the expense, generally, they do not cover all of the cost of the benefits. The remaining portion of benefits ...

Is it better to get health insurance from employer or marketplace?

While health insurance benefits through an employer are usually more economical than Marketplace plans, the reduction in your paycheck can really take a toll on your financial situation. Though receiving a smaller check is certainly not desirable, it’s actually better to have your premiums taken out of your paycheck.

How much does employer health insurance add up to?

If your employer contributes $400 each month toward your health insurance, it adds up to $4,800 per year. None of that amount is subject to income taxes or payroll taxes. The higher your income tax rate, the greater the savings for you.

How much of your income is taken out of your FICA?

Your employer also withholds Social Security and Medicare taxes, known as FICA payroll taxes. Generally, 6.2% of your income is taken out for Social Security taxes and 1.45% is taken out for Medicare taxes.

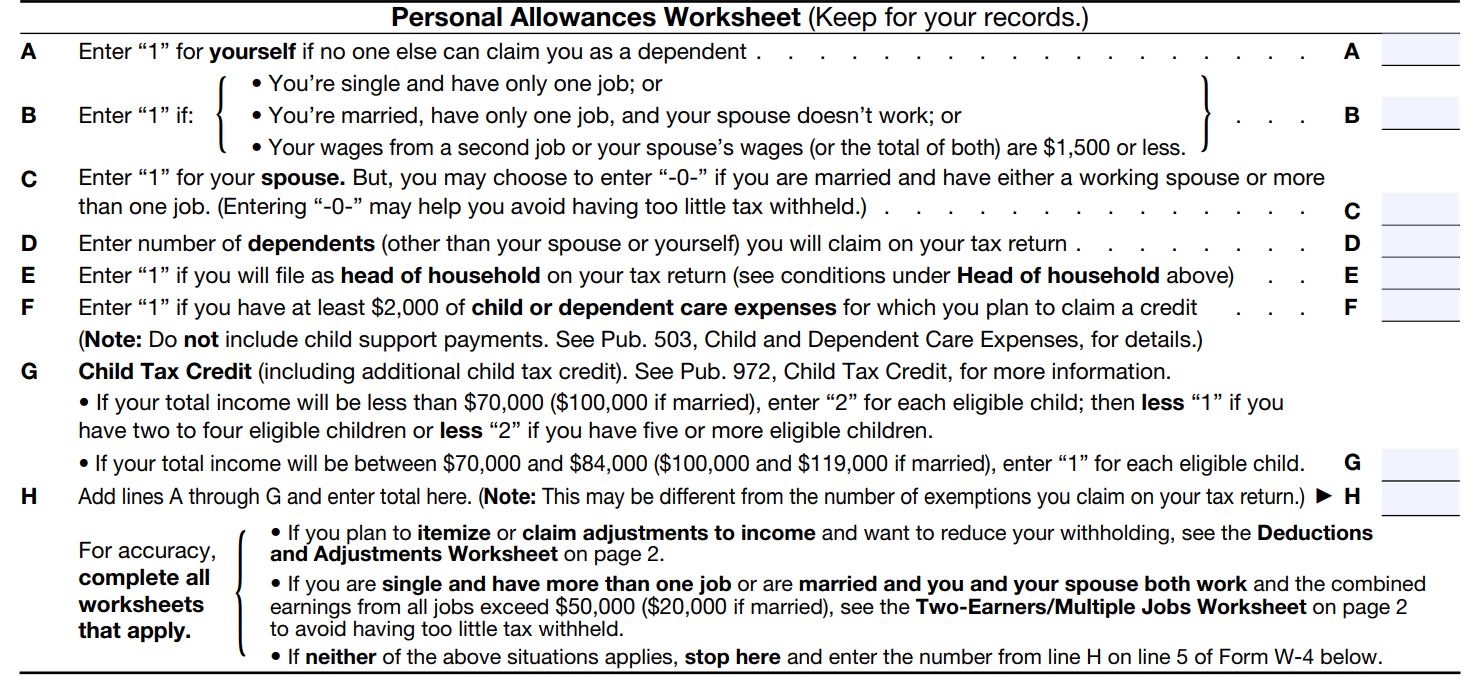

What is the amount withheld from a W-4?

The amount withheld includes not only federal income taxes, but also state and local income taxes, if they are applicable. The information you supply when filling out Form W-4 determines how much your employer will withhold from each paycheck for taxes. The form tells your employer your filing status and how many allowances you are claiming.

How much is the penalty for claiming too many allowances?

Worse, you might owe an extra $500 penalty for claiming too many allowances. If you are an independent contractor, your employer won’t withhold money from your paycheck for taxes. Instead, you’re responsible to make estimated tax payments to the IRS at least quarterly to cover what you will owe at tax time.

How much will Social Security taxes be in 2021?

Each year, the Social Security wage base adjusts, and in 2021 it’s $142,800. So, if you bring home $145,000, you won’t have to pay Social Security taxes on your last $2,200 of income. Your employer also feels the pain ...

What is bonus withholding?

Bonus Withholding. Usually, getting a bonus brings great joy to an employee’s face — until she sees how much of the bonus she actually takes home. Bonuses are subject to different withholding rules than a normal paycheck, and this often results in a lot more money being withheld.

Can you deduct health insurance from your paycheck?

Health Insurance Deductions. You might get health insurance through an employer, but that doesn’t mean you don’t have to contribute to the cost . However, you reap some tax benefits from having your contribution deducted from your paycheck rather than paying it out of pocket.

Payment Options

What's on Your Pay stub?

- Every paycheck you receive should come with an accompanying pay stub. This is a record of how much you earned from a certain pay period, as well as the amount of money that was removed for deductions. It has quite a bit of information on it, so let's take a look and see what it all means. Your pay stub may look different from the example below, but it should contain most of the sam…

Earnings vs. Net Pay

- When you view your pay stub, you'll find two notable figures: your earnings (or gross pay) and your net pay. Your earnings is the amount of money you make based on your pay rate. After a number of taxes and deductions are applied, you're left with your net pay, or the money that's available to you on your paycheck. Upon your initial payment, you might be surprised at the difference betwe…

Taxes

- As mentioned above, there are several deductions that may be applied to your earnings. Some of these vary depending on location and your employer, but there's one deduction everyone must deal with: income tax. No matter where you live in the country, federal income tax will be deducted from your earnings. The amount of money that's withheld will depend on several factors, includi…

Federal Taxes

State and Local Taxes

- The majority of US states require you to also pay state income tax, which will be listed as another line item on your paystub. Some states may impose additional taxes — for example, California residents have a short-term disability tax deductions from their pay, Cristina Livadary, CFP, says. Similar to your W-4, you will fill out your state income tax forms once hired. On top of that, certai…

Investment Account Contributions

- If you’re a full-time employee, your company may give you the opportunity to contribute to a retirement fund, like a 401(k). This money is a pre-tax payroll deduction, meaning that whatever amount you choose to contribute from each paycheck is deducted from your total taxable income, Livadary explains. “So say your salary is $50,000, and you contri...

Other Employee Benefits

- Depending on the company you work for, you may have the opportunity to opt into a handful of other benefits, the costs of which are deducted from your paycheck automatically. If you sign up for your employer-provided health insurance, the cost will come out of your paycheck.Livadary notes that any company with over 50 employees is required to offer these benefits, and the HR d…