Full Answer

What insurance does Cobra cover?

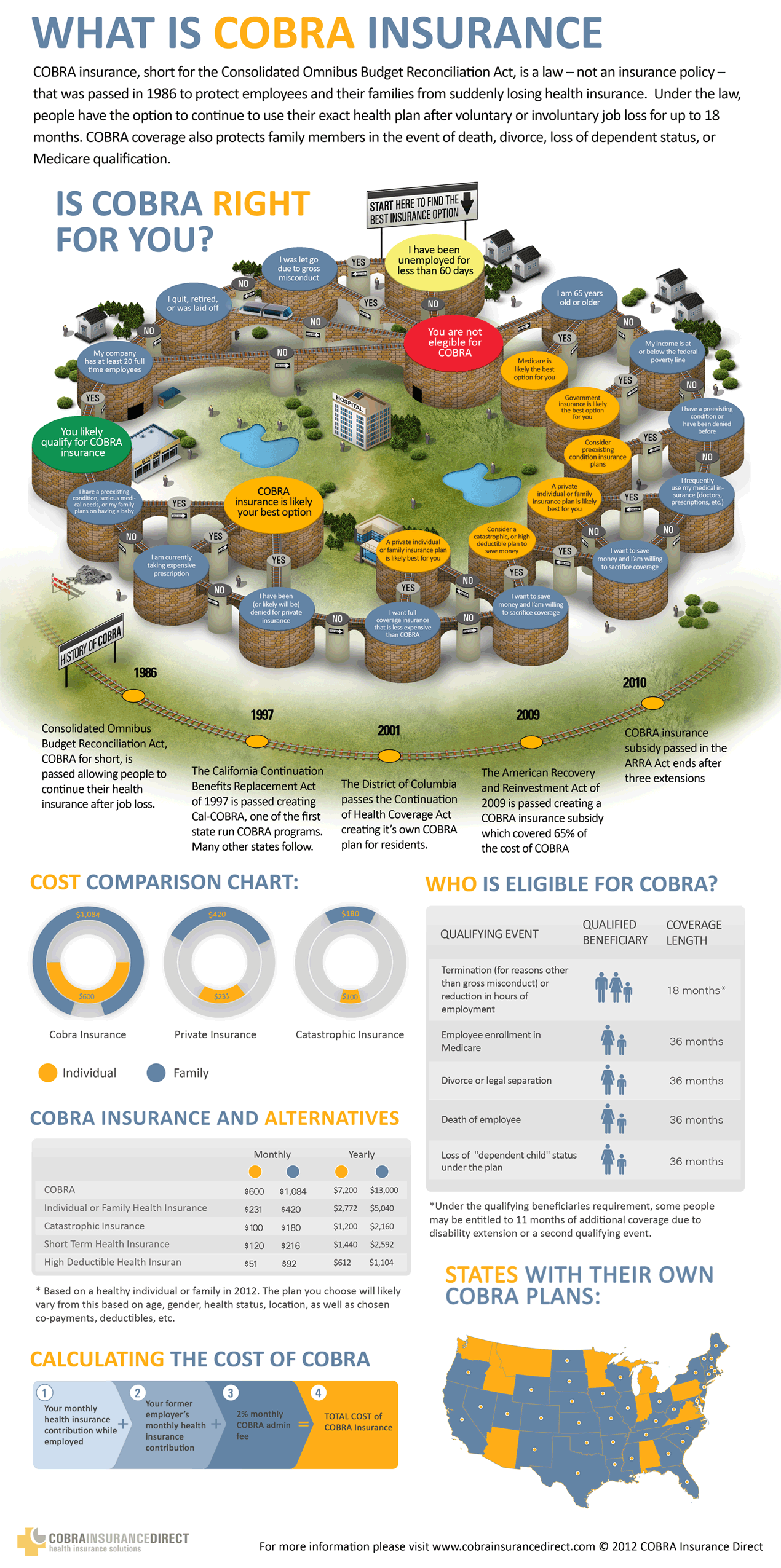

- COBRA lets you extend your former employer's health plan.

- COBRA requires you to pay 100% of the health insurance costs plus up to 2% adminstrative fee.

- You have 60 days to decide whether to sign up for COBRA. Remember, if you sign up on day 59, you will have to pay retroactive premiums.

How much does a COBRA health insurance cost?

With COBRA insurance, the individual becomes responsible for the costs the employer once was responsible for. This may result in paying average monthly premiums of $623 to continue your individual coverage or $1,778 for family coverage. COBRA premiums range depending on if you have an individual or family plan.

Why is Cobra expensive?

Why is COBRA so expensive? COBRA allows you to stay on your employer’s health plan, but your employer stops paying their part of your premium. This means that you must pay the full premium – and your monthly health bill will be slightly more expensive. According to the Department of Labor, COBRA rates should still be less expensive than ...

What are the benefits of a Cobra?

This continuing coverage may also be terminated prematurely should any of the following occur:

- Employer group health plan is terminated

- Negligence toward timely premium payments

- Qualified beneficiary voids coverage by engaging in conduct that would call for such action, such as fraud

- Qualified beneficiary gains Medicare coverage

- Qualified beneficiary gains coverage under a new group health plan

How do I calculate Cobra costs?

Multiply the total monthly cost by the percentage you will pay. For example, assume the total monthly cost of your insurance is $450 and you must pay 102 percent as a monthly premium. Multiply $450 by 1.02 percent to arrive at a monthly premium of $459.

Is it worth it to get Cobra insurance?

Key Takeaways. COBRA provides a good option for keeping your employer-sponsored health plan for a while after you leave your job. Although, the cost can be high. Make an informed choice by looking at all your options during the 60-day enrollment period, and don't focus on the premium alone.

Is Cobra more expensive than regular insurance?

COBRA insurance is often more expensive than marketplace insurance, partly because there isn't any financial assistance from the government available to help you pay those COBRA premiums.

How much does a cobra cost?

On Average, The Monthly COBRA Premium Cost Is $400 – 700/month per individual. Continuing on an employer's major medical health plan with COBRA is expensive. You are now responsible for the entire insurance premium, whereas your previous employer-subsidized a portion of that as a work benefit.

Is COBRA cheaper than Obamacare?

COBRA costs an average of $599 per month. An Obamacare plan of similar quality costs $462 per month—but 94% of people on HealthSherpa qualify for government subsidies, bringing the average cost down to $48 per month.

Can I use COBRA if I quit?

Electing COBRA means you can keep your health insurance after quitting or being fired from a job. You are responsible for paying your premium and the employer's premium, plus a 2% admin fee. Coverage is available for up to 18 months, but an extension may be possible.

Why are COBRA premiums so high?

The cost of COBRA coverage is usually high because the newly unemployed individual pays the entire cost of the insurance (employers usually pay a significant portion of healthcare premiums for employees).

How much is health insurance a month for a single person?

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.

Does health insurance end the day you quit?

When you leave your employer, all of your insurance coverage likely ends. Think carefully about continuing some of the other kinds of coverage you may currently have, like: Disability insurance, Critical illness insurance, and.

Are COBRA payments tax deductible in 2021?

Yes they are tax deductible as a medical expense. There isn't necessarily a “COBRA Tax Deduction”. You can only deduct the amount of COBRA medical expenses on your federal income tax in excess of 7.5% of your Adjusted Gross Income and then only if you itemize deductions.

How long do you have health insurance after leaving a job?

Typically, the Group Insurance Scheme provided by your employer ends on the last working day of the employee. However, some companies in the country provide group insurance coverage for employees and pay the premium in full or partially.

How long can you stay on COBRA?

Employees are eligible for 18 months of continued coverage under COBRA if the qualifying event stems from reduction of hours or termination of employment for reasons other than gross misconduct. Note that termination can be voluntary or involuntary, including retirement.

Where to Get The Information You Need

Your employee benefits or human resources office can tell you how much your COBRA premiums would be, but there may be circumstances under which you...

Another Reason For Sticker Shock

As if the sticker shock associated with paying both the employee’s portion and the employer’s portion of the health plan premium isn’t enough, ther...

Are There Other Alternatives?

The individual health insurance market has always been an alternative to COBRA. Historically, individual market plans were less expensive than COBR...

Where Can I Get More Information About Cobra?

The U.S. Department of Labor oversees COBRA compliance. They have a list of frequently asked questions about COBRA, and you can contact them at 1-8...

Cost of A Cobra Health Insurance

The COBRA health insurance cost significantly depends on the amount taken from your paycheck for your health insurance coverage. Once you have qual...

Cobra Health Insurance Eligibility

Before you become eligible for a COBRA health insurance coverage, you need to look at these factors. 1. Size of the Company– Your employer must be...

Other Options in The Health Insurance Marketplace

There’s no use denying that a COBRA health insurance coverage is really expensive, especially when you no longer have a job. However, HealthCare.go...

What is Cobra coverage?

COBRA eligibility. COBRA continuation coverage is available to people who quit their job or are: Laid off. Fired and it wasn’t for “gross misconduct.". Without insurance because an employer reduces hours. Without health coverage because of a divorce, a spouse’s death or other qualifying events.

How long is a COBRA plan good for?

Short-term plans are available for one year with the chance for two renewals. Some states forbid short-term plans or imit how long you can have one. Whether COBRA is the right choice for you depends on what you want from your health plan and how much you’re willing to pay for it.

How does Cobra work?

The COBRA plan works exactly like your employer plan. It’s the same health coverage and provider network. The one difference is that COBRA can cost four times more than what you pay in premiums under an employer-based plan.

What is the HCTC for people who lose their jobs?

Something else that might help is federal income tax credits. The U.S. Department of Labor offers a Health Coverage Tax Credit (HCTC) for people who lose their jobs because of the “negative effects of global trade.”. The U.S. Department of Labor's HCTC pays 72.5% of premiums.

How long do you have to notify your employer of Cobra?

You should notify your employer within 60 days if you or a dependent become eligible for COBRA coverage because of a divorce. The same is true if a child turns 26 and is no longer covered by a parent’s insurance. You and your dependents have 60 days to sign up for COBRA. You don’t have to enroll immediately.

Why can't I get Cobra insurance?

Without health coverage because of a divorce, a spouse’s death or other qualifying events. A qualifying event can also effect dependents, even if the former employee doesn't sign up for COBRA coverage. Reasons for why family members might get coverage include if: You die.

How long do you have to sign up for Cobra?

You and your dependents have 60 days to sign up for COBRA. You don’t have to enroll immediately. Coverage is retroactive for when you become eligible, which is usually your last day of work. You can cancel COBRA at any time. For instance, if you start a new job or get new health insurance coverage.

The Cost of COBRA Insurance

In 2020, the average annual premium cost for employer-sponsored health insurance was $7,470 for individual coverage and $21,342 for family coverage. However, employers covered 83% of the costs for individuals and 74% for families on average.

How To Calculate Your COBRA Premium

If you’re leaving your current job and decide to continue coverage with COBRA, the human resources (HR) department can help you determine your premiums.

Alternatives to Using COBRA

If you prefer another option aside from COBRA, there are alternative healthcare alternatives you can utilize.

COBRA Frequently Asked Questions (FAQs)

Below we outline frequently asked questions when it comes to COBRA insurance.

How long do I have to decide if I want to use COBRA?

When you leave your job or suffer certain qualifying events, your employer must notify the health plan administrator within 30 days. The plan administrator must then inform you about your rights and the process for making a COBRA election within 14 days of getting the notice.

Bottom Line

COBRA is an option to extend health insurance benefits when you're no longer employed by your employer. While COBRA may induce extra costs for health insurance, it can be a good option to get health insurance during a qualifying event.

What is Cobra insurance?

Are you wondering what a COBRA health insurance is? For the reference of everybody, COBRA stands for Consolidated Omnibus Budget Reconciliation Act, so basically, it’s a law. Although a COBRA health insurance is not exactly a type of health insurance, it protects and secures you and your family, if it applies, in the event when you lose ...

What was the average COBRA rate in 2015?

HealthInsurance.org says the average COBRA insurance rate for a single employee on a group plan in 2015 was $530.4 per month. The average total contribution for the same year was $520 per month, the employee paid $88 per month, while the employer covered the $432 per month.

What are the requirements for Cobra?

These are the following: – your employer is obligated to give you a COBRA coverage; – you are a qualified beneficiary; – and the qualifying event has already happened.

How long does Cobra last?

In cases when you lose your insurance coverage because you are terminated from the job or your hours are reduced, the COBRA coverage will last up to 18 months. There are other cases when people up to 36 months before the coverage expires. This only means you have time to look for a new job before your COBRA comes to an end.

How many employees are required to be eligible for Cobra?

– Your employer must be a local government organization, a state agency, or a private company has more than 20 full-time employees or a part-timer with an equivalent number of hours to a full-time worker.

Does Cobra cover health insurance?

The coverage of COBRA is similar with the health coverages provided by the employers to its employees. In simplest terms, you still have the same type of insurance before losing the benefits of your health insurance. But if for instance, your employer changes the coverage of your health insurance, then the COBRA coverage will change as well.

Does health insurance cover life insurance?

According to Investopedia, a health insurance coverage includes dental care, vision care, and prescription drugs. However, it does not cover life and disability policies. You need to look for a separate coverage for them. In cases when you lose your insurance coverage because you are terminated from the job or your hours are reduced, ...

What is the Cobra program?

Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) is a program that enables an employee to continue the coverage in case of being unemployed. The COBRA health insurance cost will be shouldered by the policyholder at his or her own expense to retain the coverage of the policy plan provided by the previous employer.

How many employees are required to have Cobra?

Employers with at least 20 employees and operating at least 50% of the fiscal year are required to comply to provide COBRA coverage. Group health plans are mandatory as benefits of full time and part-time employees as health maintenance including family members.

What is continued coverage?

The continued coverage only refers to health insurance plans which mean that life insurance and disability insurance are not included in the program. Even though, policyholders can upgrade the plan for further coverage but at a higher cost.

What is the average premium rate for medicaid?

In comparison to low-income class with private insurance, the average premium rate is about 6% of the total household budget while under Medicaid, the average premium rate is 0.4% only of the total household budget.

What are the qualifying events for Cobra?

Qualifying events to avail COBRA: Termination for any reason except for cases like gross misconduct. Family-related events such as divorce or legal separation. Employers with at least 20 employees and operating at least 50% of the fiscal year are required to comply to provide COBRA coverage.

Which has the lowest deductible?

Bronze has the lowest coverage but with highest deductibles and co-pays while the platinum offers at least 90% coverage of the cost. Monthly and Annual Health Insurance Rates by Metal Tier. Type. Monthly Premium.

Is Cobra insurance expensive?

Therefore, the COBRA insurance can be expensive to continue but there are a lot of available options in the insurance market to choose from. Under a private insurance company, the average employer-sponsored coverage is ...

What is cobra insurance?

COBRA is a federal law passed three decades ago to give families an insurance safety net between jobs. It’s available if you’re already enrolled in an employer-sponsored medical, dental or vision plan, and your company has 20 or more employees. Your spouse/partner and dependents can also be included on your COBRA coverage.

How long does Cobra last?

Federal coverage lasts 18 months, starting when your previous benefits end. Some states extend medical coverage (but may not include dental or vision) to 36 months. Check with your benefits manager to find out whether your state extends COBRA benefits.

What questions to ask before signing up for Cobra?

Here are 5 questions to ask before signing up for COBRA benefits: 1. What is my deadline to enroll in COBRA? Your employer has 44 days from your last day of work or last day of insurance coverage (whichever is later) to send out COBRA information.

How long did Dale wait to join his new employer's health insurance?

When Dale, 45, quit his job to take another position, he knew there was a three-month waiting period before he was eligible to join his new employer’s health plan. Around the same time, his friend Debra, 62, was laid off from her job and would soon lose coverage for herself and her spouse. Luckily, Dale and Debra can both remain on their ...

Can you change your Cobra plan?

COBRA allows you to keep the exact same benefits as before. No changes can be made to your plan at this time. However, if you’re still on COBRA during the next open enrollment period, you can choose another plan from those your former company offers to employees. The new plan will take effect on January 1. 2.

Is Cobra retroactive?

COBRA is always retroactive to the day after your previous coverage ends, and you’ll need to pay your premiums for that period too. One advantage of enrolling right away is that you can keep seeing doctors and filling prescriptions without a break in coverage. COBRA allows you to keep the exact same benefits as before.

What is COBRA health insurance?

Your COBRA health insurance is identical to your employer insurance. “Having COBRA insurance” simply means that you and your covered family members are sticking with your employer’s group coverage after a qualifying life event .

How does COBRA work?

You can apply for COBRA if your former employer had more than 20 employees and provided your group medical insurance. COBRA coverage is not available to people who get their employer-based insurance through:

What is mini-COBRA insurance?

Some states have "mini-COBRA" laws that extend insurance benefits beyond the federal program’s guidelines. For example, some states’ mini-COBRA rules (such as those in Texas and New York) allow coverage to run longer than 18 months. Or, state mini-COBRA laws may apply to companies with fewer than 20 employees.

Why are COBRA insurance premiums so high?

COBRA premiums cost more even though you’re getting the same level of insurance coverage. That’s because you have to pay the entire health insurance premium yourself (rather than your former employer paying a share). In addition, a small administrative fee of up to 2% may apply.

COBRA insurance and Medicare: What to know

If you're eligible for Medicare and you lose your group health plan coverage, you can enroll in Medicare after your group coverage ends.

COBRA insurance vs. ACA insurance

If you do become eligible for COBRA, you don't have to go that route for health insurance. You should look into whether an Affordable Care Act (ACA) plan from the health insurance marketplace is a more affordable option.

The bottom line

COBRA continuation coverage can help you hold on to your job-based health insurance after a change in job status or family circumstances. But it can be very expensive, as you pay the full premium yourself plus an administrative surcharge. So, before signing up for COBRA, examine other insurance options.

What is Cobra insurance?

COBRA health insurance eligibility. COBRA applies to private-sector companies with 20 or more employees as well as state and local governments. Some states also have "mini-COBRA" laws that apply to employers with fewer than 20 workers. See the section below for more information about mini-COBRA plans.

How much does an employer pick up on Cobra?

Employers usually pick up well more than half of premium costs. However, with a COBRA plan, the former employee has to pay all the costs -- oftentimes, that means paying four times what the former employee was paying in premiums for coverage when you were employed.

How long does Cobra coverage last in Illinois?

Massachusetts extends coverage to 30 months if the former employee is disabled and expands eligibility for 36 months for dependents if the employee dies.

What is a mini cobra?

Most states have mini-COBRA laws for people who were employed by small businesses . Mini-COBRA laws pertain to former employees of companies with 20 or fewer employees. These state laws provide COBRA health insurance for former employees just like the federal COBRA law.

Why did Congress pass the Consolidated Omnibus Reconciliation Act?

Congress passed the Consolidated Omnibus Reconciliation Act two decades ago to give families an insurance safety net. Before then, people who lost health insurance had to try to find affordable individual insurance on their own, which wasn't easy.

How many times can you renew Cobra?

These plans are good for a year and you can renew two more times. A handful of states forbid the sale of short-term plans and more states restrict how long you can keep a short-term plan. If you decide on a COBRA alternative, make sure to check the provider networks and what's covered.

How long can you keep Cobra?

You can keep COBRA for at least 18 months. In some cases, you can have a COBRA plan for even longer -- up to 36 months -- depending on the qualifying event. At the end of your eligibility period, you need to find another health plan if you want insurance.

How much premium is required for Cobra?

Generally, you’ll have a $0 premium on your COBRA coverage for the months COBRA premium assistance is available to you. You’ll get a written notice of your eligibility for COBRA premium assistance from your former employer. If you had a chance to elect COBRA coverage before but declined it, or if you previously elected COBRA coverage and ended it, ...

When will Cobra premium assistance be available?

COBRA premium assistance is available April 1, 2021 through September 30, 2021 under the American Rescue Plan Act ...

What happens if you lose your job based insurance?

When you lose job-based insurance, you may be offered COBRA continuation coverage by your former employer. If you’re losing job-based coverage and haven’t signed up for COBRA, learn about your rights and options under COBRA from the U.S. Department of Labor. If you decide not to take COBRA coverage, you can enroll in a Marketplace plan instead.

How long do you have to enroll in a Cobra plan?

Losing job-based coverage qualifies you for a Special Enrollment Period. This means you have 60 days to enroll in a health plan, even if it’s outside the annual Open Enrollment Period.

What happens if you end Cobra early?

If you’re ending COBRA early. If your COBRA costs change because your former employer stops contributing or you lose a government subsidy (like COBRA premium assistance) and you must pay full cost. If your COBRA costs change because you lose a government subsidy, (like COBRA premium assistance) and you must pay full cost.

When does Cobra end?

If you know your COBRA premium assistance is ending September 30, 2021, you can report a "loss of coverage" to qualify for a Special Enrollment Period starting August 1, 2021.

When will Cobra be available?

COBRA premium assistance is available April 1, 2021 through September 30, 2021 under the American Rescue Plan Act of 2021, based on when your COBRA coverage starts and how long it can last. If you qualify: Generally, you’ll have a $0 premium on your COBRA coverage for the months COBRA premium assistance is available to you.