Yes, there is a limit to how much you can receive in Social Security benefits. The maximum Social Security benefit changes each year. For 2019, it’s $2,861/month (up from $2,788/month in 2018). Multiply that by 12 to get $34,332 in maximum annual benefits.

Full Answer

How to calculate your projected Social Security benefit?

- For every dollar of average indexed monthly earnings up to $926, you’ll get 90 cents per month in benefits.

- For every dollar of average indexed monthly earnings between $927 and $5,583 you’ll get $.32 cents per month in benefits.

- For every dollar of average indexed monthly earnings beyond $5,583 you’ll get $.15 cents per month in benefits.

How do you estimate Social Security benefits?

You can use your account to request a replacement Social Security benefits card, check the status of an existing application, estimate how many future benefits you’ll receive or manage the ones you are already getting. One of the most important reasons ...

How do you calculate social security benefit amount?

Social Security benefits are typically computed using "average indexed monthly earnings." This average summarizes up to 35 years of a worker's indexed earnings. We apply a formula to this average to compute the primary insurance amount (PIA). The PIA is the basis for the benefits that are paid to an ...

What is the maximum Social Security benefit amount?

If you filed for benefits now, you’d probably get about $3,345. (You said you’ve paid the maximum amount into Social Security all your life and that is the current maximum full retirement age ...

How much will Social Security pay in 2021?

For reference, the estimated average Social Security retirement benefit in 2021 is $1,543 a month. The maximum benefit — the most an individual retiree can get — is $3,148 a month for someone who files for Social Security in 2021 at full retirement age, or FRA (the age at which you qualify for 100 percent of the benefit calculated from your earnings history).

What is the cap for Social Security in 2021?

In 2021 the cap is $142,800 (it’s adjusted annually to reflect historical wage trends). Any income above that is not counted in your benefit calculation (and is also not subject to Social Security taxes). Updated June 8, 2021.

What is the earliest you can file for Social Security?

Both tools project what you could collect each month if you start Social Security at age 62, the earliest you can file; at full retirement age, currently 66 and 2 months and gradually rising to 67; and at age 70. Between 62 and FRA, Social Security reduces your benefit for filing early; between FRA and 70, it increases your payment as a reward ...

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

How are Social Security payments calculated?

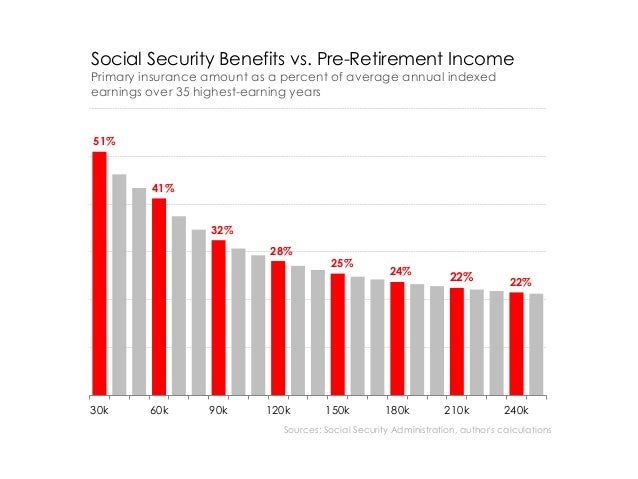

Social Security payments are calculated using the 35 highest-earning years of your career and are adjusted for inflation. If you work for more than 35 years, your lowest-earning years are dropped from the calculation, which results in a higher payment.

What is the maximum Social Security benefit for 2021?

The maximum possible Social Security benefit for someone who retires at full retirement age is $3,148 in 2021. However, a worker would need to earn the maximum taxable amount, currently $142,800 for 2021, over a 35-year career to get this Social Security payment. [. See:

How much is Medicare Part B in 2021?

The standard Medicare Part B premium is $148.50 per month in 2021. Medicare Part B payments are prohibited by law from decreasing Social Security payments for existing beneficiaries, so a Medicare Part B premium hike can't be more than your annual Social Security cost-of-living adjustment.

What age do you have to be to get Social Security?

Your monthly Social Security benefit is reduced if you claim payments before your full retirement age, which is typically age 66 or 67, depending on your birth year.

Can married couples claim Social Security?

Married couples have more claiming options. Married individuals are eligible for Social Security payments equal to 50% of the higher-earning spouse's payment if that's more than the payments based on their own work record. Spousal payments are reduced if you claim them before your full retirement age. You can also claim payments based on an ...

Can a spouse claim survivor benefits?

A spouse can also claim survivor's payments if the higher-earning spouse passes away first. Couples should coordinate when they claim payments to maximize their benefit as a couple and to potentially qualify for higher payments for a surviving spouse. Social Security Changes Coming in 2021.

How to figure out my Social Security benefits?

There are four ways to figure out your Social Security benefits: visit a Social Security office to get an estimate; create an account at the official Social Security website and use its calculators; let the SSA calculate your benefits for you; or calculate your benefits yourself. Doing the calculations for yourself involves understanding what AIME, ...

What is the PIA for Social Security?

PIA determines the monthly Social Security benefit that will be received in the first year of benefits by a worker who starts benefits at their FRA, which is 66 for individuals born between 1943 and 1954, increases by two months each year for those born after 1954, and reaches 67 for those born in 1960 and thereafter. 20 A spouse who qualifies for benefits on a worker’s record will receive half of the worker’s PIA, assuming they start benefits at their FRA. 8

What is the FRA age for a worker who retires at 62?

But what about a worker who elects to receive benefits before reaching their FRA? Let’s take the case of someone born in 1957 who retires in 2019 at age 62 (their FRA is 66 years and six months.) Retiring at 62, they would receive 72.5% of their normal benefit. Retiring at 63 would give them 77.5% of their benefit, while retiring at 64 would give them 83.3% of their benefit. 21

What to do if you create a model of your future benefits in a spreadsheet?

If you create a model of your future benefits in a spreadsheet, hire a financial advisor to check your math and help you decide when you should retire.

When do you start receiving unemployment benefits?

Starting benefits early— Benefits may begin as soon as age 62, but they are permanently reduced for every month between the onset of benefits and FRA. 20

Is Social Security open by appointment?

Due to the COVID-19 pandemic, Social Security offices are only open by appointment, and to get an appointment you need to be in a “dire need situation.” 6 Most people will have to transact their business online, by phone, or through the mail.

Does PIA increase with age 62?

Keep in mind that when your benefits start, the COLA will increase them annually. If you start benefits at age 66, your PIA (determined at age 62) automatically increases with the applicable COLAs from the years in which you turn 63 through 66.

How Does the Social Security Administration Calculate Benefits?

The Social Security Administration takes your highest-earning 35 years of covered wages and averages them, indexing for inflation. They give you a big fat “zero” for each year you don’t have earnings, so people who worked for fewer than 35 years may see lower benefits.

How long do you have to be a Social Security employee to get full benefits?

Anyone who pays into Social Security for at least 40 calendar quarters (10 years) is eligible for retirement benefits based on their earnings record. You are eligible for your full benefits once you reach full retirement age, which is either 66 and 67, depending on when you were born.

Who Is Eligible for Social Security Benefits?

Anyone who pays into Social Security for at least 40 calendar quarters (10 years) is eligible for retirement benefits based on their earnings record. You are eligible for your full benefits once you reach full retirement age, which is either 66 and 67, depending on when you were born. But if you claim later than that - you can put it off as late as age 70 - you’ll get a credit for doing so, with larger monthly benefits. Conversely, you can claim as early as age 62, but taking benefits before your full retirement age will result in the Social Security Administration docking your monthly benefits.

What is the Social Security income test for 2021?

For 2021, the Retirement Earnings Test Exempt Amount is $18,960/year ($1,580/month). If you’re in this age group and claiming benefits, then every $2 you make above the Exempt Amount will reduce by $1 the Social Security benefits you'll receive. (Note that only income from work counts for the Earnings Test, so income from capital gains and pensions won’t count against you.)

How does Social Security affect retirement?

Social Security benefits in retirement are impacted by three main criteria: the year you were born, the age you plan on electing (begin taking) benefits and your annual income in your working years. First we take your annual income and we adjust it by the Average Wage Index (AWI), to get your indexed earnings.

What age do you have to be to claim Social Security?

If you claim Social Security benefits early and then continue working, you’ll be subject to what’s called the Retirement Earnings Test. If you’re between age 62 and your full retirement age, and you’re claiming benefits, you need to know about the Earnings Test Exempt Amount, a threshold that changes yearly.

How many states tax Social Security?

That covers federal income taxes. What about state income taxes? That depends. In 13 states, your Social Security benefits will be taxed as income, either in whole or in part; the remaining states do not tax Social Security income.

How Is Social Security Calculated?

There is a three-step process used to calculate the amount of Social Security benefits you will receive.

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

How to calculate Social Security if you are not 62?

Because of how the wage indexing formula works, if you are not yet age 62, your calculation to determine how much Social Security you will get is only an estimate. Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward, and use those to create an estimate.

How to calculate indexing year?

Your wages are indexed to the average wages for the year you turn 60. 4 For each year, you take the average wages of your indexing year (which is the year you turn 60) divided by average wages for the years you are indexing, and multiply your included earnings by this number. 5

How to find average indexed monthly earnings?

Total the highest 35 years of indexed earnings, and divide this total by 420, which is the number of months in a 35-year work history, to find the Average Indexed Monthly Earnings.

When is PIA calculated?

Your PIA is calculated at age 62. If you wait beyond age 62, cost-of-living adjustments (COLAs) will be applied to your PIA for each year afterward. 16 17

Do you have to pay taxes on Social Security?

When you're receiving Social Security benefits, you'll still have to pay income taxes, but you won't owe taxes on all of your benefits. Those whose total annual income tops $34,000 ($44,000 for those filing joint returns) will pay income tax on 85% of their Social Security benefits. Otherwise, they will pay income tax on 50% of their Social Security benefits.

How long do you have to work to get Social Security?

Most people become eligible for Social Security retirement benefits once they've earned income for 10 years, but you'll need to work for at least 35 years to receive the maximum benefit amount.

How much do you get if you claim FRA at 62?

If you were to claim early at 62, your benefits would be reduced by 30%, leaving you with $1,120 per month. But if you delay benefits until age 70, you'd receive your full benefit amount plus an extra 24%, or $1,984 per month.

What happens if you exceed the maximum taxable earnings limit?

Once you surpass the maximum taxable earnings limit (which is the highest income that's subject to Social Security taxes), a higher income won't result in additional benefits. To earn this maximum benefit amount, then, you'll need to reach the maximum taxable earnings limit.

What if your earnings are falling short?

If you're earning enough to reach the maximum benefit amount, that's fantastic. But the average worker will struggle to reach the income limits, and not everyone can afford to work 35 years before claiming.