The death benefit is determined by your basic salary rate rounded to the next highest $1,000, plus an additional $2,000. For example, if Kim has a salary of $77,500, then her FEGLI basic life insurance would cost $12 biweekly and would pay her beneficiary a payment of $80,000 upon her death.

Is FEGLI a good deal for life insurance?

FEGLI life insurance is great for anyone who may be considered high risk life insurance due to a pre-existing condition. However, for everyone who is healthy, keeping FEGLI past age 50 may not make good financial sense. The good news is you can have both FEGLI and Private life insurance, if that option is best for you.

How much FEGLI life insurance coverage do I have?

There are three ways to access your FEGLI coverage information: 1. Log on to Retirement Services Online to view and print a Verification of Life Insurance (VOLI). Your VOLI will show which types of FEGLI coverage you have, your amount of coverage before reduction, your post-65 reductions, and your amount of coverage after reductions complete. 2.

Does FEGLI have cash value?

You can do MUCH BETTER owning an individual policy. FEGLI does not generate any cash value, much like how term life Insurance operates. The upside to having the option to own a life insurance policy that accumulates cash value is that the cash in the plan is available for you to borrow against.

How do I reduce or cancel FEGLI life insurance?

- you retire on an immediate annuity (one which began within a month after you separated); and

- you were insured for the five years of service immediately preceding your annuity commencing date or for the entire period (s) during which the coverages were available to you; and

- you do not convert your life insurance to an individual policy.

How much is FEGLI basic death benefit?

FEGLI Coverage. Unless they waive coverage, most Federal employees have Basic Life Insurance under the Federal Employees' Group Life Insurance Program. Basic Life Insurance is equal to the actual rate of annual basic pay (rounded to the next $1,000) plus $2,000, or $10,000, whichever is greater.

What is the death benefit for FEGLI?

The maximum coverage on your life available through FEGLI is about six times your salary (or about seven times for enrollees age 35 or under), through a combination of Basic, the Extra Benefit, Option A ($10,000), and Option B (maximum of 5 times your salary).

How much is the death benefit from life insurance?

The death benefit amount paid out is the coverage amount you choose when you buy your policy. If you buy a $1 million life insurance policy, your beneficiaries will receive a $1 million lump sum.

How much is OPM survivor benefits?

If you retire under the Civil Service Retirement System (CSRS), the maximum survivor benefit payable is 55 percent of your unreduced annual benefit. If you retire under the Federal Employees Retirement System (FERS), the maximum survivor benefit payable is 50 percent of your unreduced annual benefit.

How long does it take to receive FEGLI death benefits?

within 30 daysHow Long Does It Take for FEGLI to Pay? Federal Employee Group Life Insurance (FEGLI) death benefits should be paid by the insurance company within 30 days from the date a beneficiary filed a notice of claim and submitted all necessary supporting documents.

How does FEGLI pay out?

The Office of Federal Employees' Group Life Insurance (OFEGLI) is an administrative unit of Metropolitan Life Insurance Company that pays claims for the Federal Employees' Group Life Insurance (FEGLI) Program. If OFEGLI is paying the beneficiary less than $5,000, the beneficiary will receive a check.

What is the most common payout of death benefits?

lump-sum payoutThere are two common distributions. A lump-sum payout means that the entirety of the policy will be paid upfront. This is the most common and is used as the default for most policies. You can also choose for the money to be paid in installments, as an annuity.

What is a lump-sum death benefit?

A lump-sum death payment is meant to help defray the costs of the employee's burial expenses. It can only be paid to a widow(er) who was living with the employee when he or she died or to the person who paid all or part of the employee's burial expenses.

Do you get the cash value and the death benefit?

Do beneficiaries get the cash value and the death benefit? Most of the time, no — the cash value can only be used while you, the policyholder, are alive. The cash value remains completely separate from the death benefit, and cannot be accessed by your beneficiaries, even when you die.

How much is monthly survivor benefits?

Children in New Jersey have an average monthly Social Security survivors benefit of $1,004StateYoung widow(er)sChildrenAlaska$976$870Arizona$1,036$884Arkansas$919$814California$999$9308 more rows•Jul 7, 2020

What happens when a federal retiree dies?

If an employee dies and no survivor annuity is payable based on his/her death, the retirement contributions remaining to the deceased person's credit in the Civil Service Retirement and Disability Fund, plus applicable interest, are payable. the laws in the deceased person's state of domicile.

What happens to my husband's Government pension when he dies?

You may be entitled to extra payments from your deceased spouse's or civil partner's State Pension. However, this depends on their National Insurance contributions, and the date they reached the State Pension age. If you haven't reached State Pension age, you might also be eligible for Bereavement benefits.

What happens if you die on a FEGLI life insurance?

FEGLI Claim for Death Benefits. If you die while still covered by your FEGLI life insurance, your designated beneficiary or beneficiaries need to file a FEGLI claim for death benefits. They will need to file the claim with your employing office, which will forward the claims to FEGLI for death benefits ...

Does OFEGLI pay death benefits?

OFEGLI will only pay the death benefits if it has received all the required forms and supporting documentation. Each claimant has to file separate claim forms and supporting documentation. This includes: Form FE-6, which is the Claim for Death Benefits form;

How to report death of employee receiving compensation?

You can report the death in one of three ways: Phone: Call 1-888-767-6738 (1-88USOPMRET).

Where to send FE-6?

You will have to print out the FE-6 and send it, with a certified copy of the death certificate, to the Office of Federal Employees' Group Life Insurance, P.O. Box 6080, Scranton, PA 18505-6080 . This report of death will also stop the monthly annuity payments.

What is the number to call for a deceased overseas beneficiary?

Overseas beneficiaries should call 212-578-2975. Be sure you have the following information ready when you make the call: the name of the insured employee/retiree/compensationer. the insured's social security number. the name of the deceased (if different), and. the date of death of the deceased.

Where do you report a death to the employee?

Employee (Or Employee's Family Member) You must report the death to the human resources office of the employee's employing agency. Be sure to have the employee's full name and social security number. You'll also need the deceased's date of death.

What is the FEGLI program?

The FEGLI life insurance program provides different levels of life insurance: Basic – The FEGLI Basic Insurance Program is provided to every federal employee automatically upon being hired unless he or she has specifically opts-out of the program. The government pays for a third of the premium and the employee pays the remaining two thirds.

What is dependent on FEGLI?

If you are a federal employee and/or in the Federal Employees Retirement System, you are likely dependent on FEGLI Life Insurance and FERS Survivor Benefits for making certain your spouse or partner receives a sufficient financial benefit in the event of your death. Many federal employees who are enrolled in these programs are likely unfamiliar ...

What is FERS retirement?

Under the FERS program, eligible employees are entitled to retirement benefits derived from the Basic Benefit Plan, Social Security, and the Thrift Savings Plan.

How much life insurance does Grace want?

Grace wants life insurance in the amount of at least 5 times her salary but wants to reduce the rising cost. We recommend Grace pick up a 30 year, fully underwritten term life insurance policy with an $800,000 face amount, keep FEGLI basic and drop FEGLI option B.

What is the maximum amount of FERS benefits for surviving spouse?

Under FERS, if an employee dies while he or she is still working, the surviving spouse will receive a lump-sum death benefit of 50% of your salary or High-3, whichever is greater plus $32,326 provided you had a minimum of 18 months of service.

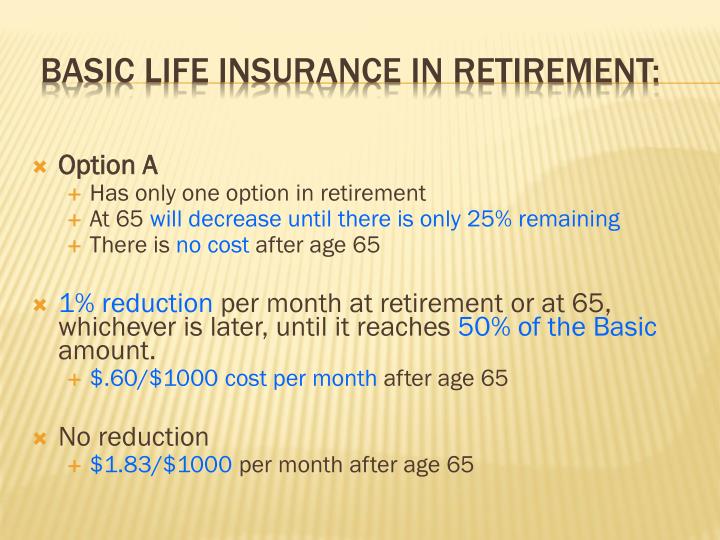

When does optional life insurance become unaffordable?

The cost of the optional life insurance coverage when the employee reaches age 50 becomes almost unaffordable when compared to what can be purchased in the private insurance marketplace.

What is Gabrielle's life insurance?

Gabrielle wants life insurance in the amount of $1,000,000 to age 80. Even though this doesn’t show cost savings, he intends on using this policy as a substitute for the survivor benefit plan over retirement.

What percentage of annuity is payable to surviving spouse of federal employee?

The annuity payable to the surviving spouse of an employee whose death occurs while employed with the Federal Government is 55 percent of the annuity computed as if the employee had retired on disability as of the date of his or her death.

When do student benefits stop?

Benefits for student children, stop at the end of the month before the one in which the student child: turns 22; marries; dies; stops attending school; transfers to a school that is not recognized; changes to less than full-time attendance; enters military service or a Government service academy; or.

When do survivors annuities end?

Survivor annuities payable to widows, widowers, and former spouses end if the survivor remarries before age 55 and was not married for at least 30 years to the deceased employee or annuitant. Widows, widowers, and former spouses who remarry after they reach age 55 continue to be eligible for survivor annuity benefits.

When do annuities end?

Annuity benefits for children end when the child reaches age 18, marries , or dies. Survivor annuities are payable through the end of the month prior to the date of the event which caused the loss of eligibility. For example, if the child turns 18 on June 29, benefits would end on May 31. Benefits for student children, ...

Your Guide to Federal Employee Survivor Benefits

Federal employees have a whole raft of benefits that touch on everything from retirement savings and pensions to health, life and long term care insurance. But what happens to those benefits when you die? No one likes to think about death, but it’s crucial that you know how your benefits will be distributed to your surviving spouse or children.

Thrift Savings Plan

The Thrift Savings Plan (TSP) is a defined contribution retirement account for federal employees.

FERS Survivor Benefits

The Federal Employee Retirement System (FERS) is a defined benefit plan that pays out a pension upon retirement. This is an annuity that provides an annual payment of a certain percentage of your most recent salary, depending on your age and years of service in a federal job.

FEGLI Benefits

Federal Employee Group Life Insurance is an additional benefit that provides life insurance to federal employees. These benefits are designed to be paid out when you die, so the survivor benefits are much more straightforward. All funds are distributed to your designated beneficiary upon your death.

FEHB Benefits

The Federal Employees Health Benefits program is the health insurance plan for federal employees and their families. When a federal employee dies, surviving family members covered under the Self and Family plan can continue their coverage as long as they are eligible for a FERS Survivor Annuity.

Social Security

The Social Security Administration also provides benefits to survivors. It can be easy to lose sight of your Social Security eligibility in the midst of all the other benefits, but it’s also important. To be eligible for survivor benefits, you will have to have earned a certain number of work credits based on your age at the time of your death.

How to Get Help

Thinking about death is difficult, but it’s crucial to plan for your family’s wellbeing. If you’re a federal employee with questions about your benefits, please reach out.