Your pension income is usually paid out as a percentage of your salary during your working years. That percentage depends on the terms set by your employer and your time with the employer. A worker with decades of company or government tenure may get 85% of their salary in retirement.

Full Answer

How much should you really be saving in your pension?

You also receive tax relief on any pension contributions you make, which will boost how much actually goes into your pot. Once auto-enrolment contributions start to rise, people could be saving 10% and 15% of their salary. This means hitting the bottom end of this target suddenly becomes a lot more achievable

How much will my pension be worth when I retire?

If you don't have a retirement savings strategy as part of your overall financial plan by this point, don't delay, one expert said."Every household, regardless of their net worth or stage of life ...

How much should I invest in my pension?

You can invest up to 100pc of your qualifying earnings in your pension. However, the most you can invest and still receive tax relief (the Annual Allowance) is £40,000 per tax year. This is a “per person” allowance – the total you can contribute across all your pensions – and includes all contributions from you and any other sources.

How do we calculate your pension?

linkHow your pension is calculated. Generally, the more wealth you have the less pension you will receive. There are two tests Centrelink applies to assess your wealth - the income test and the assets test. After Centrelink applies both the assets and income tests, it gives you a pension based on the test that calculates the lowest pension amount.

What is the average pension payout?

Average Retirement Income in 2021. According to U.S. Census Bureau data, the median average retirement income for retirees 65 and older is $47,357. The average mean retirement income is $73,228.

What is a typical pension benefit?

The salary figure used to compute pension benefits is typically the average of the two to five consecutive years in which the employee receives the highest compensation. This average amount is multiplied by a percentage called a pension factor. Typical pension factors might be 1.5 percent or 3 percent.

Do you get all the money in your pension?

Your traditional pension plan is designed to provide you with a steady stream of income once you retire. That's why your pension benefits are normally paid in the form of lifetime monthly payments. Increasingly, employers are making available to their employees a one-time payment for all or a portion of their pension.

How do I calculate my pension benefit?

A typical multiplier is 2%. So, if you work 30 years, and your final average salary is $75,000, then your pension would be 30 x 2% x $75,000 = $45,000 a year. That $45,000 becomes your guaranteed lifetime income.

How many years do you have to work to get a full pension?

You will usually need at least 10 qualifying years on your National Insurance record to get any State Pension. You will need 35 qualifying years to get the full new State Pension. You will get a proportion of the new State Pension if you have between 10 and 35 qualifying years.

How much will I lose if I take my pension at 55?

Taking money out of your pension is known as a drawdown. 25% of your pension pot can be withdrawn tax-free, but you'll need to pay income tax on the rest. You can choose whether to withdraw the full tax-free part in one go or over time.

Is it better to take a lump sum or monthly pension?

In most cases, the lump-sum option is clearly the way to go. The main difference between a lump-sum and a monthly payment is that with a lump-sum option, you get to have control over how your money is invested and what happens to it once you're gone. If that's the case, then the lump-sum option is your best bet.

Can I take my pension at 55 and still work?

The short answer is, yes you can. There are lots of reasons you might want to access your pension savings before you stop working and you can do this with most personal pensions from age 55 (rising to 57 in 2028).

What is defined benefit pension?

In this type of pension plan, employers guarantee their employees a defined amount, or benefit, upon retirement, regardless of the performance of the investments involved, and with certain tax-advantages. This can vary from plan to plan, but while employers are the main contributors of DB plans, employees may also be able to contribute. DB plans in the U.S. do not have contribution limits.

What is pension in insurance?

Pensions. Traditionally, employee pensions are funds that employers contribute to as a benefit for their employees. Upon retirement, money can be drawn from a pension pot or sold to an insurance company to be distributed as periodic payments until death (a life annuity).

Why is the cost of living adjustment important?

Due to inflation, prices of goods and services are expected to rise over time, and the cost-of-living adjustment (COLA) helps to maintain the buying power of retirement payouts. While the COLA is mainly used for the U.S. Social Security program, which is technically a pension plan that is public, it also plays an important role in private pension plans. Generally, it is the norm to gradually increase pension payout amounts based on the COLA to keep up with inflation. Unfortunately, most private pensions are not adjusted for inflation. Overfunded pensions, which are pension plans that have more assets than obligations, may be able to afford a COLA if their beneficiaries advocate for it successfully, but the same usually cannot be said for underfunded pensions. Each of the three calculations allows the option to input a custom figure as COLA. If no such adjustment is desired, just use "0" as the input.

What is single life pension?

A single-life pension means the employer will pay their employee's pension until their death. This payment option offers a higher payment per month but will not continue paying benefits to a spouse who outlives the retiree. In contrast, a joint-and-survivor pension payout pays a lower amount per month, but when the retiree dies, ...

How do pensions work after retirement?

Upon retirement, pensions generally provide two methods of distributing benefits. Single-life plans pay a monthly benefit for the remainder of the beneficiary's life , but as soon as they pass away, pension payments halt . A drawback to this is that surviving spouses will be left without a major source of income. Unsurprisingly, this option is most commonly used by retirees without spouses or dependents. However, there are exceptions for single-life pensions that have guarantee periods; if the retiree passes away within the guarantee period (usually five or ten years), dependents are eligible to receive income until it ends. Monthly benefits for plans with guarantee periods tend to be lower than for those without a guarantee period.

Why do people take lump sums?

Also, lump sums tend to make more sense for people with shorter life expectancies. If they are forecasted not to live long enough to realize the financial benefits of a schedule of cash flows, due to serious disease or otherwise, simply taking the lump sum instead can result in more income.

What is the most common DB plan?

Generally speaking, the longer an employee works for a company or the higher their salary, the higher their projected benefits in retirement. Social Security is the most common DB plan in the U.S. Most American workers are qualified for collecting Social Security benefits after retirement.

What is defined benefit pension?

A defined benefit pension plan is a pension plan that promises a certain benefit at retirement, usually calculated through a formula based on a combination of years of service and amount of pay. The following information will help you understand the choices and how they will affect your retirement benefit payments.

What percentage of your pension will you receive if you choose a survivor?

Sometimes you have a choice of whether the surviving spouse will receive 50% or 75% of your benefit. There may be other choices. If so, make sure you understand what they are. If you choose the survivor’s benefit, it means that you will receive lower monthly benefits than the monthly benefits based on the pension-earner’s lifetime alone. ...

What is single life benefit?

This Fact Sheet focuses on two types of benefits: Single Life Benefit: monthly payments based only on the pension-earner’s expected lifetime, which means the benefits stop when that person dies. Joint and Survivor Benefit: monthly payments based on you and your spouse’s lifetime.

What happens if you are married and you retire?

If you are married when you retire, and either you or your spouse has a traditional defined-benefit pension, you will face some choices when you retire and apply for benefits.

How much does a spouse's annuity pay if they die?

It would stop if/when your spouse dies. Under a joint and survivor annuity, the benefit might be $1,300 a month while your spouse is alive. However, if/when your spouse dies, your benefit would be $650 a month for as long as you live.

Does the federal pension waiver cover state pensions?

Unfortunately, the law does not cover state and local government pensions. Be sure to read this form carefully. It can be confusing.

Do spouses receive survivor benefits if they die first?

This means that should the pension-earner die first, the spouse will continue to receive survivor’s benefits from your spouse’s pension. The monthly payments are typically lower than a single life benefit but they are guaranteed to continue for the surviving spouse.

How much do pensions pay out?

Your pension income is usually paid out as a percentage of your salary during your working years. That percentage depends on the terms set by your employer and your time with the employer. A worker with decades of tenure with a company or government may get 85% of their salary in retirement.

What is the difference between a private pension and a public pension?

As you probably guessed, the main difference between a public pension and a private pension is the employer. Public pensions are available from federal, state and local government bodies. Police officers and firefighters likely have pensions, for instance. So do school teachers.

What happens if you leave your employer before your pension benefits vest?

If you leave your employer before your pension benefits vest, you forfeit the money your company put aside for your retirement. Vesting schedules come in two forms: cliff and graded. With cliff vesting, you have no claim to any company contributions until a certain period of time has passed.

Why are pensions frozen?

Many, though, have frozen their pensions so that new employees are not eligible to receive them. Compared to public pension funds, private pensions have more legal protections. By law, private companies must make sure their pension funds have adequate funding.

What happens if a pension fund manager makes bad investment decisions?

If the manager of the fund makes bad investment decisions, that could potentially result in insufficient funds for the overall pension. This would presumably lead to a reduction of your benefits without warning. Another risk of not being in control is that your company could change the terms of your pension plan.

What does lack of control mean for pensions?

But on the flip side, the lack of control means employees are powerless to ensure that their pension funds have adequate financing. They also must trust their company to continue being a going concern for their lifetime.

How to prepare for retirement?

Tips for Preparing for Retirement 1 Don’t be afraid to get professional help with your retirement plans. A financial advisor can help you make sure you’re on pace for a comfortable retirement. Luckily, finding the right financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. Get started now. 2 Try to max out on your company’s 401 (k) match. The match is free money. It’s an easy way to increase your nest egg. To figure out how big that nest egg needs to be, use our retirement calculator, which takes even local taxes into account.

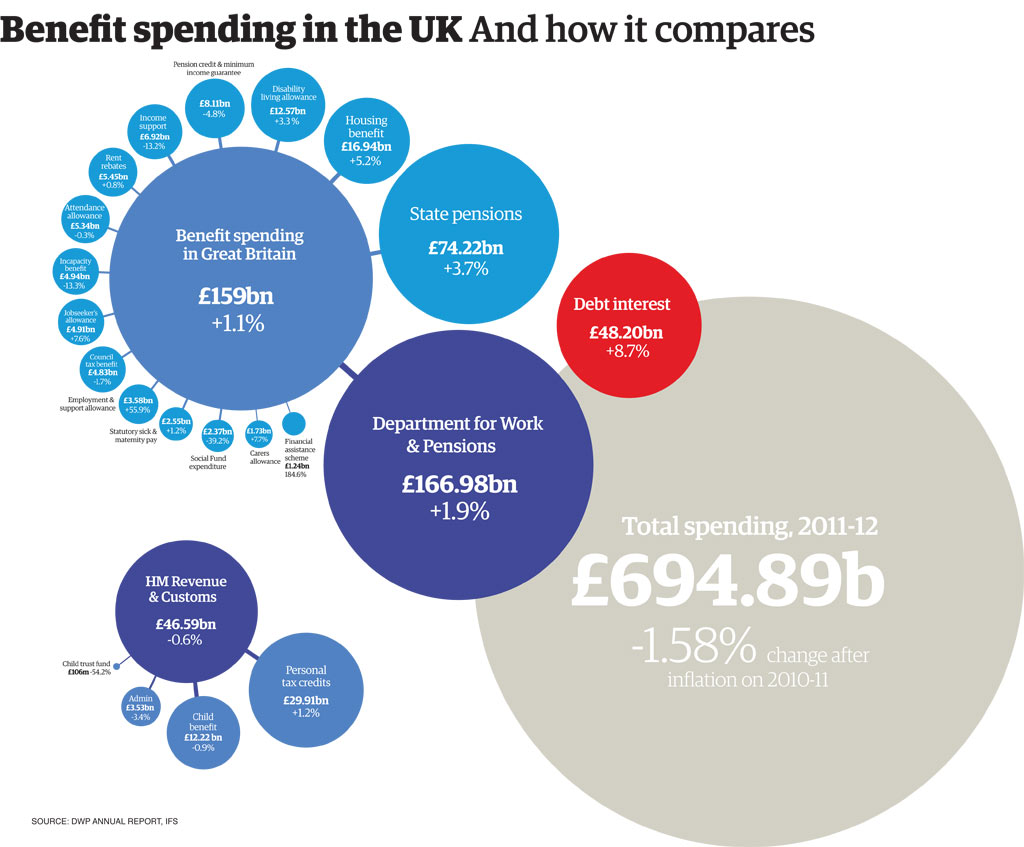

What is the average pension income in the UK?

The difference between expectation and reality In reality, the average UK adult has a pension of £ 355,000, which equates to an estimated annual income of £ 13,000, some £ 20,000 below his desired income. Currently, the average net income of a retired person in the UK is just £ 15,080 per year [2].

Can you retire on 6000 a month?

He worked hard, invested well, and planned a comfortable retirement. … At $ 6,000 a month, you have more money than the average retiree (Americans 65 and older generally spend about $ 4,000 a month) and therefore more options for where to live.

How much money does the average 40 year old have in the bank?

The average 40-year-old has a net worth of approximately $ 80,000. But for people 40 and above average, their net worth is closer to $ 660,000. Hopefully your goal is to be 40 years above average when it comes to building wealth. With above-average wealth, you can live an above-average life!

What is defined benefit pension?

Pensions, also known as Defined Benefit plans, have become rarer as companies force their employees to save for themselves mainly through a 401k, 457, 403b, Roth 401k or IRA. These savings vehicles are also known as Defined Contribution plans.

Why are pensions so valuable?

Therefore, the value of a pension has gone WAY UP because the value of cash flow has gone way up.

How does pension work?

Most pensions start paying out at a certain age and continue paying out until death. The amount of pension you receive is determined by years of service, age in which you elect to start collecting, and usually the average annual income over your last several years of service.

Can a pension be paid out to a spouse?

Although, in some cases, a pension can keep paying out to a surviving spouse. The reality is one’s pension value fades as the owner inches closer towards the end. Therefore, it behooves every pension owner to live as long and healthy of a life as possible to maintain the value of his/her pension.

Do pensions have inflation adjusters?

Most pensions also have an inflation adjuster built in order to keep up with inflation. Although sometimes, the inflation adjustments don’t keep up. Here’s a chart I put together highlighting the values of a $35,000 and $50,000 pension (in the range of the most common pension amounts).

Why do people get pensions monthly?

First, receiving a regular payout each month helps you stick to your budget in retirement. This is because they work similar to traditional checks that you earn from a job.

What happens to pension when you die?

That means you could wind up leaving a lot less cash to your children, grandchildren and other beneficiaries.

What is lump sum payout?

On the upside, receiving a lump sum payout gives you the freedom to spend what you need in retirement, when you need it. This includes both expected and unexpected costs, like housing and healthcare. For example, if you have a serious health condition and need around-the-clock care, your lump sum would come in handy.

Can pensions be adjusted for inflation?

Some pension plans will adjust their monthly payouts for inflation. This obviously isn’t a benefit that single, lump sum payouts can match. Pension plans with a monthly payout are a great source of security in retirement, as they typically continue until death. In some cases, they are even transferable to a spouse.

How to live frugally in retirement?

Regardless of how much cash you have in retirement, it’s always wise to set up and stick to a workable monthly budget. Living frugally in retirement could entail any of the following: 1 Planning for healthcare costs 2 Moving to an area with a lower cost of living 3 Cutting excess costs like going out to dinner or cable 4 Rethinking a life insurance policy

Can you lose your pension if your company goes bankrupt?

However, most pensions are insured by the federal government, so don’t harp on this too much. Pros and Cons of Lump Sum Pension Payouts. A lump sum payout is the more exciting option of the two.

Is a lump sum payment finite?

There are a few drawbacks of the lump sum payout option. A lump sum is finite, while monthly pension payments continue at least until your death. This means that you’ll have to be significantly more diligent about how you manage your lump sum payment.

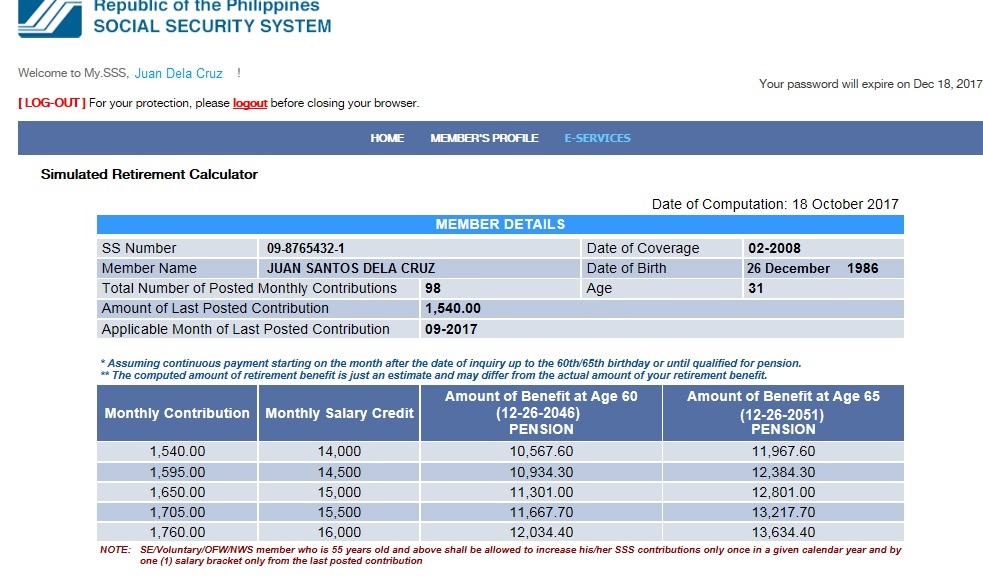

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.