How Much Is the Social Security Spousal Benefit? If you’re eligible and can qualify, the spousal benefit can be as much as 50% of the higher-earning spouse’s full retirement age benefit. If your spouse’s full retirement age benefit amounts to $2,000 per month, your spousal benefit at your full retirement age could amount to $1,000 per month.

Full Answer

How to calculate spouse SSA benefit?

Today's Social Security column addresses questions about how Social Security spousal benefits are calculated, whether it's necessary to file in January to get a given year's COLA and what effects of benefits rates not paying taxes can have. Larry Kotlikoff ...

How do you calculate spouse Social Security benefits?

The requirements for claiming benefits based on your ex-spouse's work record include:

- You must have been married at least 10 years.

- You must have been divorced from the spouse for at least two consecutive years.

- You are unmarried.

- Your ex-spouse must be entitled to Social Security retirement or disability benefits.

- The benefit you would receive from your work record would be less than this spousal benefit.

How couples can maximize social security benefits?

You can expect the following when applying for Social Security spousal benefits: To make the most of your spousal Social Security benefit, it can be helpful to be aware of the amount you might be ...

How to estimate Social Security benefits from a former spouse?

- If you are of full retirement age or older, you would receive 100%.

- If you are age 60 or older but not yet of full retirement age, you would receive 71.5% to 99%.

- If are 50 to 59 years old and disabled, you would receive 71.5%.

How much do you get for spousal benefits from Social Security?

The spousal benefit can be as much as half of the worker's "primary insurance amount," depending on the spouse's age at retirement. If the spouse begins receiving benefits before "normal (or full) retirement age," the spouse will receive a reduced benefit.

Does wife get half of husband's Social Security?

How Much to Expect for Spousal Social Security Benefits. Your spousal benefit will be 50% of your spouse's benefit if you start payments at full retirement age or older. The full retirement age varies by birth year and is usually age 66 or 67.

Do married couples get 2 Social Security checks?

Not when it comes to each spouse's own benefit. Both can receive retirement payments based on their respective earnings records and the age when they claimed benefits. One payment does not offset or affect the other.

Can I collect my husband's Social Security if he is still alive?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

Social Security Spouse's Benefit Estimates

Plan for your future with a my Social Security account. With a my Social Security account, you can view the benefits you could receive based on your spouse’s earnings history, or the benefits your spouse could receive based on your earnings history.

Follow these steps to get started

Ask your spouse to create or open their my Social Security account, go to the ‘Plan for Retirement’ section, and note their retirement benefit estimate at their full retirement age or Primary Insurance Amount (PIA).

How much is spousal benefit?

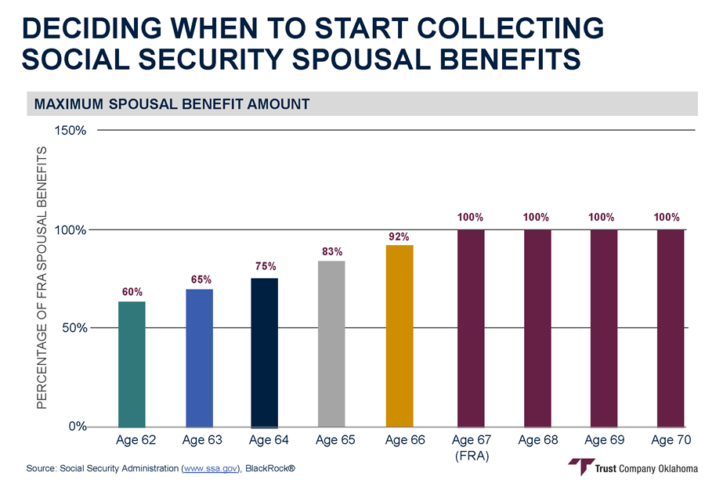

Depending on how old you are when you file, the spousal benefit amount will range between 32.5% and 50% of the higher-earning spouse’s full retirement benefit. Check out the chart below to get an idea of how the benefit works and what your payment might be if you can take advantage ...

How many people receive Social Security benefits as a spouse?

A recent Social Security report found that 2.3 million individuals received at least part of their benefit as a spouse of an entitled worker. Some of these spouses had benefits of their own, but were eligible to receive higher benefit because the spousal benefit amount was greater than their own benefit. Others never worked outside the home ...

What is the 1 year requirement for Social Security?

The 1-year requirement is also waived if you were entitled (or potentially entitled!) to Social Security benefits on someone else’s work record in the month before you were married. An example of these benefits would be spousal benefits, survivor benefits or parent’s benefits.

What is Julie's reduction to her own benefit?

This means that Julie’s reduction to her own benefit would be based on her age when she filed for her benefit. However, her reduction to the spousal benefit would be based on her age when Joe filed for his benefit. So, if Julie filed when she was 62, her own benefit would be reduced.

How long do you have to be married to get spousal benefits?

The Two Exceptions to Know Around the 1 Year Marriage Requirement. Normally, you must be married for at least 12 continuous months to meet the spousal benefit duration-of-marriage requirement. However, there are two exceptions to this rule.

How much of my spouse's Social Security is my full retirement?

Remember, in that case, it’s between 32.5% and 50% of the higher-earning spouse’s full retirement age benefit, depending on your filing age. However, it can seem a little more complicated if you have Social Security benefits from your work history.

How much is Joe's retirement?

Joe’s benefit at his full retirement age is $2,000. Assuming they are both full retirement age when they file, Joe will be entitled to a benefit of $2,000 and Julie will be entitled to the greater of her own benefit or half of Joe’s benefit.

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

How much can I collect as a spouse?

If you wait until full retirement age to claim benefits, you'll receive the maximum amount you can collect as a spouse. That is equal to 50% of your spouse's benefit amount. 3 . The benefits claiming strategy known as "file and suspend" has been totally eliminated.

What is the full retirement age for Social Security?

Full retirement age, for Social Security purposes, is between 66 and 67, depending on your year of birth. 2 . One exception: If you are caring for your spouse's child who is under age 16 or who receives Social Security disability benefits, you can collect spousal benefits at any age without a reduction. 3 . ...

Can you collect spousal benefits on your own?

However, only one person per couple may collect spousal benefits while earning delayed retirement credits on his or her own account. And, to repeat, this option is no longer available to anyone who wasn't born on or before Jan. 1, 1954.

Can I apply for Social Security if my spouse is not eligible?

Key Takeaways. Spouses who aren't eligible for Social Security on their own work record can apply for benefits based on the other spouse's record. The maximum spousal benefit is equal to 50% of the other spouse's benefit. People can apply for spousal benefits as early as age 62, but they'll get more money if they wait until their full retirement ...

Can I file a restricted application for Social Security?

To file a restricted application, both you and your spouse must be of full retirement age, and you both must have filed for Social Security benefits. 5 . Filing a restricted application can result in a higher benefit amount when you later file for Social Security under your own account.

Can I claim my spouse's Social Security if I never worked?

If you have never worked or paid Social Security taxes (or didn't pay them for long enough), you won't be eligible to claim Social Security retirement benefits on your own account. However, you may be able to receive spousal benefits through your spouse's account.

Can a spouse file for Social Security at full retirement age?

Using this strategy, the higher-earning spouse could file for Social Security at full retirement age (thus making it possible for their spouse to get spousal benefits), but then "suspend" his or her claim and not take benefits until later, while racking up delayed retirement credits in the meantime. 5 .

How much of my spouse's retirement is my full benefit?

Your full spouse’s benefit could be up to 50 percent of your spouse’s full retirement age amount if you are full retirement age when you take it. If you qualify for your own retirement benefit and a spouse’s benefit, we always pay your own benefit first. You cannot receive spouse’s benefits unless your spouse is receiving his or her retirement ...

What is the maximum survivor benefit?

The retirement insurance benefit limit is the maximum survivor benefit you may receive. Generally, the limit is the higher of: The reduced monthly retirement benefit to which the deceased spouse would have been entitled if they had lived, or.

What happens if you take your reduced retirement first?

If you took your reduced retirement first while waiting for your spouse to reach retirement age, when you add spouse’s benefits later, your own retirement portion remains reduced which causes the total retirement and spouses benefit together to total less than 50 percent of the worker’s amount. You can find out more on our website.

What does it mean to have a partner?

Having a partner means sharing many things including a home and other property. Understanding how your future retirement might affect your spouse is important. When you’re planning for your fun and vibrant golden years, here are a few things to remember:

Can my spouse's survivor benefit be reduced?

On the other hand, if your spouse’s retirement benefit is higher than your retirement benefit, and he or she chooses to take reduced benefits and dies first, your survivor benefit will be reduced, but may be higher than what your spouse received.

What is the percentage of Social Security for spouse?

The percentage of your spouse's Social Security that you receive starts at 32.5% at age 62 and steps up gradually to 50% at your full retirement age, 66 or 67 depending on your year of birth. The amount is based on your spouse's benefit at full retirement age. 15 . The important point is this: Don't bother delaying past your full retirement age.

How much can I get from my spouse?

The maximum amount you can receive is 50% of your spouse's full benefit. 1 That's straightforward enough, but the precise amount you'll get and when you'll get it depends on several circumstances, including your spouse's age and work history, your own age and work history, and more. That leaves some room for you to maximize ...

What is the maximum amount of spousal benefits at 62?

For example, if your full retirement age is 67 and you choose to claim spousal benefits at 62, you'd receive a benefit that's equal to 32.5% of your spouse's full benefit amount. The amount increases with each year you delay. At your full retirement age (67 in this example) you'd be eligible for the maximum, which is 50% ...

What happens if your spouse retires at 70?

If your spouse delays retiring until 70, the spouse gets more but you don't. Survivors may receive up to 100% of the deceased person's Social Security amount. 10 There's a complicated formula for families in which more than one dependant is eligible for benefits. It caps the maximum. 16 .

How much can a widow receive?

A widow or widower can receive up to 100% of a spouse's benefit amount. That's if the survivor has reached full retirement age at the time of the application. The payment is reduced to somewhere between 71% and 99% of the deceased's entitlement if the widowed person is at least 60 but under full retirement age. 8 .

How old do you have to be to collect Social Security?

If your spouse has filed for Social Security benefits, you can also collect benefits based on the spouse's work record, if: You are at least 62 years old. Regardless of your age, if you care for a child who is entitled to receive benefits on your spouse’s record, and who is under age 16 or disabled. 2 .

When can I claim my spousal benefits?

But the amount you receive will depend upon when you begin to claim it. You can claim spousal benefits as early as age 62 , but you won't receive as much as if you wait until your own full retirement age.