What states pay the highest unemployment?

- Connecticut: $649 max normal a week, up to $749 with dependents

- Illinois: $484 max normal a week, up to $667 with dependents

- Massachusetts: $823 max normal a week, up to $1,234 with dependents

- Ohio: $480 max normal a week, up to $647 with dependents

- Pennsylvania: $572 max normal a week, up to $580 with dependents

What is the average percent an employer pays for unemployment?

Employers pay a certain tax rate (usually between 1% and 8%) on the taxable earnings of employees. In most states, that ranges from the first $10,000 to $15,000 an employee earns in a calendar year. Here’s where it gets tricky.

What is the maximum amount you can receive from unemployment?

- A personal medical illness or injury prevented you from working

- You are caring for a minor child who has a medical illness

- You are caring for a terminally ill spouse

- You have documented cases of sexual assault, family violence or stalking

- You entered Commission-Approved Training and the job is not considered suitable under Section 20

Which state is still paying benefit?

Mendoza joined the chief fiscal officers of Colorado, Connecticut, Massachusetts, Minnesota, New Jersey, New York and Pennsylvania to ask U.S. Treasury Secretary Janet Yellen for the Biden administration’s support for reinstating a pause on interest charges that expired in September.

How much is the highest unemployment benefit?

The majority of U.S. states offer unemployment benefits for up to 26 weeks. Benefits range from $235 a week to $823. Policies and benefits vary by state. Mississippi has the lowest maximum unemployment benefits in the U.S. of $235 per week, while Massachusetts has the highest at $823.

What is the maximum unemployment benefit in California 2021?

$450The maximum unemployment benefit you can get in California is $750 a week through September 6, 2021. After that, the maximum weekly benefit is $450.

What is the maximum time for which I can receive unemployment benefits in New Jersey?

26 weeksA claimant can collect a maximum of 26 weeks of benefits on a regular unemployment claim.

How much is unemployment in Michigan right now 2021?

You can get up to $362 a week for 14 to 20 weeks. The UIA calculates your weekly benefit amount by multiplying the wages paid in your highest base period quarter by 4.1%. You also get an extra $6 per week for each dependent you claim, up to five dependents, but your benefits can't exceed $362.

What state has the highest unemployment pay?

MassachusettsIt's Massachusetts that currently has the highest possible unemployment benefits amount per week, at 823 dollars, while the lowest is Mississippi with just 235 dollars.

How much is EDD paying now 2021?

$167 plus $600 per week for each week you are unemployed due to COVID-19.

Will unemployment be extended 2021?

The American Rescue Plan Act, signed March 11, 2021, extended the Federal Pandemic Unemployment Compensation (FPUC) program, which provides an additional $300 to workers for weeks of unemployment ending on March 11, 2021 through September 4, 2021.

Is New Jersey extending unemployment?

The Department of Labor announced the federal unemployment program known as Extended Benefits will end for about 20,000 New Jerseyans on April 9. The program provided up to 13 weeks of additional jobless benefits for people who exhausted their 26 weeks of regular benefits.

Are unemployment benefits taxable?

Yes, you need to pay taxes on unemployment benefits. Like wages, unemployment benefits are counted as part of your income and must be reported on your federal tax return. Unemployment benefits may or may not be taxed on your state tax return depending on where you live.

How much is Covid unemployment in Michigan?

In Michigan, the standard maximum amount is $362.00. Please note - the amount that you will actually qualify for depends on several factors including how much money you previously earned. But in addition to the state unemployment benefit, under the new federal program, workers will receive an additional $600.00.

What is the highest unemployment pay in Michigan?

$362 per weekMichigan law requires we consider wages you have earned over the last 18 months in calculating your weekly benefit amount. The maximum entitlement is a weekly benefit amount of $362 per week.

What's new with Michigan unemployment?

New PUA claims can now be filed online at michigan.gov/uia. PUA claimants who exhausted their original entitlement of benefits prior to Dec. 26, 2020 can also now reopen their claim to receive an additional 11 weeks of benefits, payable retroactively, beginning with the week ending Jan. 2, 2021.

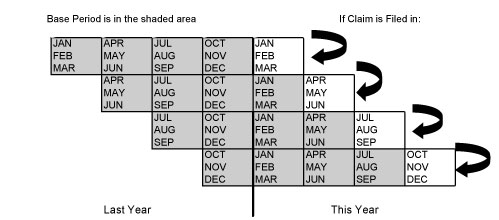

What is the base year for unemployment?

Your base year is the first four of the last five completed calendar quarters before the week in which you file your claim. For example, if you applied for unemployment benefits on January 20, 2020, your base year would include wages earned from October 1, 2018, through September 30, 2019.

What is the maximum WBA benefit in Washington?

In Washington state, the maximum weekly benefit amount is $929. The minimum is $295. No one eligible for benefits will receive less than this, regardless of their earnings. The actual amount you are eligible to receive depends on the earnings in your base year. We calculate your weekly benefit amount (WBA) and maximum benefits payable (MBP) ...

How many hours do you need to work in an alternate base year?

The base year for an alternate base year claim is the last four completed calendar quarters before the week in which you file your claim. You must have 680 hours of work in the alternate base year and still meet all of the other eligibility requirements.

How long can you collect unemployment?

State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits for a lower number of weeks, and maximum benefits also vary based on where you live. In times of high unemployment, additional weeks of unemployment compensation may be available. Regardless of how much you make, you never can collect more than ...

What percentage of unemployment is taxed?

Some states withhold a percentage of your unemployment benefits to cover taxes—typically 10%. If the option to have taxes withheld is available, you will be notified when you sign up for unemployment.

How long do you get unemployment if you are laid off?

The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker. In many states, you will be compensated for half of your earnings, up to a certain maximum. State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits ...

What does it mean to be ineligible for unemployment?

It typically means you are ineligible if you quit—although there are exceptions, like if you quit because of impossible work conditions. If you are fired for cause, you also are likely ineligible. You also have to have been employed for a minimum amount of time or have earned a minimum amount in compensation.

Is unemployment taxable income?

Taxes on Unemployment. Unemployment benefits are considered taxable income, and the unemployment compensation you receive must be reported when you file your federal and state tax returns. 2 . Both state unemployment benefits and federally funded extended benefits are considered income and must be reported when you file your federal ...

How much is the maximum UI benefit?

As of October 4, 2020, the maximum weekly benefit amount is $855 per week. Follow the steps below to calculate the amount ...

How long can you get unemployment?

The maximum number of weeks you can receive full unemployment benefits is 30 weeks (capped at 26 weeks during periods of extended benefits and low unemployment). However, many individuals qualify for less than 30 weeks of coverage. The following examples show how to determine your duration of benefits.

How much unemployment is there in 2020?

As of October 4, 2020, the maximum weekly benefit amount is $855 per week.

How to calculate duration of benefits?

Your duration of benefits is calculated by dividing your maximum benefit credit by your weekly benefit amount.

How long is the benefit year?

Your benefit year. Once your claim is established, it will remain open for 1 year (52 weeks). This period of time is called your benefit year. Your maximum benefit credit (the total amount of benefits you are eligible to receive) is available to you for the duration of your benefit year or until you have exhausted your maximum benefit credit.

How much is dependent allowance?

Dependency allowance. If you are the whole or main support of a child, you may be eligible for a weekly dependency allowance of $25 per dependent child. Spouses are not included. The total dependency allowance you receive cannot be more than 50% of your weekly benefit amount.

How much can you get on unemployment in Oregon?

In order to get this maximum, you must have earned as a minimum $$39,680 in covered wages during your base period.

What is weekly unemployment?

The unemployment weekly benefit amount is the sum you are entitled to collect per week. State law restricts the WBA is limited to stop you from obtaining large unemployment payments. It also preserves the spirit of program by keeping claimants with prior high earnings from draining the fund. The maximum WBA may vary by year.

What is covered wages in Oregon?

Covered wages are those that you get from employment covered under Oregon’s unemployment compensation laws. The state leaves out self-employment, independent contract work or work that that you paid only through commission under these laws.

How long can you extend your EBP?

Extended Base Periods (EBP) Base period can be extended up to 4 quarters if the worker is disabled for the majority of a quarter. If the worker collected worker’s compensation, base year can be extended up to 4 quarters prior to the illness or injury.

Can you get unemployment benefits extended in Oregon?

Due to changing conditions unemployment benefits may be extended. During times of high unemployment in Oregon, individuals may become qualified for unemployment benefit extensions.

Do you have to work to collect UI?

All states need a worker to have earned a definite amount of wages or to have worked for a definite period of time (or both) within the base period to be financially eligible to collect any UI benefits. Most workers are entitled for benefits based on employment and wages in a single state.

Can you get WBA if you work in more than one state?

Most workers are entitled for benefits based on employment and wages in a single state. On the other hand, some workers who work in more than one state will not have sufficient employment and wages in any single state to set up monetary eligibility, or would be qualified for a smaller WBA.

How Do I Apply For Peuc

Sign into your online account at des.nc.gov and click on the Apply for Pandemic Emergency Unemployment Compensation link to apply. Federal guidelines require you to file a separate claim for PEUC to receive these benefits. You will not automatically receive PEUC when you exhaust regular state unemployment insurance benefits.

Is There A Supplemental Payment

The $600 weekly supplement was in effect for weeks ending April 4 through July 25. This program was reinstated at a lower $300 weekly rate beginning December 27, 2020, and has been extended until September 6, 2021.

Whats The Unemployment Situation In Nc

As of last week, about 240,000 people were getting unemployment benefits in North Carolina, the Associated Press reports. But itâs not clear how many of those were getting extra money each week through the federal program.

As An Employer What If The Claimant Is Not Claiming Benefits Against My Account

You should respond to all requests for information regarding a claim from DES. Neither claimants nor employers get to choose which employer is charged for a claim. This is determined by the Employment Security Law. All employment within a claimants base period and a claimants last employment before filing a claim are considered.

If Youve Recently Become Unemployed In North Carolina You May Have Options To File For Unemployment

If you need to apply for unemployment benefits in the Tarheel State, here are some things to know.

Unemployment Benefits Imposter Fraud

DES has detected a recent increase in suspected imposter fraud in the unemployment benefits system. Fraud safeguards put in place by DES flagged suspicious claims to prevent payments from being released.

What Are The Accepted Covid

You have been diagnosed with COVID-19 or are experiencing symptoms of COVID-19 and are seeking medical diagnosis member of your household has been diagnosed with COVID-19

What is the maximum weekly benefit for 2021?

The weekly benefit rate is capped at a maximum amount based on the state minimum wage. For 2021, the maximum weekly benefit rate is $731. We will calculate your weekly benefit rate at 60% of the average weekly wage you earned during the base year, up to that maximum.

Can I collect unemployment if my hours were reduced?

If your work hours were reduced, but not completely cut, you may still be able to collect Unemployment Insurance benefits. NOTE: When claiming benefits, you must report your part-time wages when earned, even if you have not yet been paid. How we calculate partial Unemployment Insurance benefits.

What is weekly benefit rate?

Your Weekly Benefit Rate is the amount you can receive if you are eligible for benefits for a week and your benefits are not reduced for any reason. Your Weekly Benefit Rate is calculated based on the wages you were paid in your base year. You must determine the total gross wages received during your base-year period and how much you received ...

How many weeks can you get UC benefits?

However, you can receive an allowance for dependents only for the number of weeks corresponding to your maximum benefit amount (i.e., between 18 and 26 weeks).

What is the high quarter of your paycheck?

The quarter in which you were paid the most money is known as your High Quarter. The High Quarter determines your Weekly Benefit Rate. However, it is not the only determining factor.

How much of your wages must have been paid in one or more quarters other than your high quarter?

To be eligible, at least 37 percent of the total qualifying wage (as in Part C of the Rate and Amount of Benefits Chart ) must have been paid in one or more quarters other than in your High Quarter.

How much qualifying wages are needed for a high quarter?

For instance, if your High Quarter was $1688, you must have at least $2,718 total qualifying wages in the base year.

How much is the dependent allowance?

If you are eligible for benefits, you may receive an additional $5 weekly for a dependent spouse plus $3 weekly for one dependent child. If you have no dependent spouse, you can receive $5 weekly for one dependent child, plus $3 weekly for a second dependent child.

What is the maximum amount you can receive in unemployment?

Your maximum benefit amount ( MBA) is the total amount you can receive during your benefit year. Your MBA is 26 times your weekly benefit amount or 27 percent of all your wages in the base period, whichever is less. To receive benefits, you must be totally or partially unemployed and meet the eligibility requirements.

How long can you be out of work for APB?

You may be able to use an alternate base period ( APB) if you were out of work for at least seven weeks in one base-period quarter because of a medically verifiable illness, injury, disability, or pregnancy. The ABP uses wages paid before the illness or injury. To be eligible, you must have filed your initial claim no later than 24 months after the date that the illness, injury, disability, or pregnancy began. Call a TWC Tele-Center at 800-939-6631 to ask if you qualify for an ABP.

How much is WBA in Texas?

Your WBA will be between $70 and $535 (minimum and maximum weekly benefit amounts in Texas) depending on your past wages. To calculate your WBA, we divide your base period quarter with the highest wages by 25 and round to the nearest dollar.

Can you use the TWC unemployment estimate?

You may use the TWC Benefits Estimator to estimate your potential benefit amounts. The estimator cannot tell you whether you qualify for unemployment benefits. Your benefit amounts are based on your past wages. How we calculate benefits is explained below.