If You Have Other Income

| Filing status | Base amount | Additional amount |

| Single | $25,000 | $34,000 |

| Head of Household | $25,000 | $34,000 |

| Qualifying Widow (er) | $25,000 | $34,000 |

| Married Filing Jointly | $32,000 | $44,000 |

Full Answer

What to do if Social Security pays too much?

- Someone recommended that she rethink her situation and suspend her benefits until her full retirement age

- Another quoted the Social Security Administration

- People shared links to confusing articles

What is the tax rate for Social Security withholding?

Key Takeaways

- Social Security tax is paid as a percentage of net earnings and has an annual limit.

- In 2022, the Social Security tax limit increased significantly, to $147,000. ...

- The amount of the benefits received by individuals and couples rose to 5.9%.

- The largest social security tax increase was in 2021 but 2022 is high as well.

How much can I earn without losing Social Security benefits?

- If you work and earn $6,000 throughout the year, you have not hit the $17,640 annual earnings that would trigger withholding of some of your Social Security benefits. ...

- If you work and earn $35,000, you have exceeded the $17,640 limit by $17,360. ...

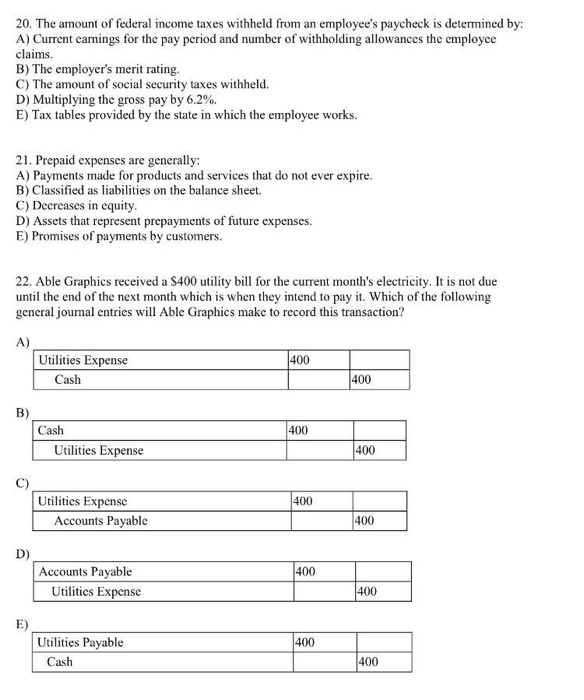

- If you work and earn $80,000, you have exceeded the $17,640 limit by $62,360. ...

How do you calculate Social Security withholding?

To calculate Federal Income Tax withholding you will need:

- The employee's adjusted gross pay for the pay period

- The employee's W-4 form, and

- A copy of the tax tables from the IRS in Publication 15: Employer's Tax Guide ). Make sure you have the table for the correct year.

News about How Much To Withhold From Social Security Benefitsbing.com/news

Videos of How much To Withhold From Social Security benefitsbing.com/videos

How much taxes should you withhold from Social Security?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

Should I have taxes taken out of my Social Security check?

Answer: You aren't required to have taxes withheld from your Social Security benefits, but voluntary withholding can be one way to cover any taxes that may be due on your Social Security benefits and any other income.

How much Social Security should be taken out of my check?

6.2 percentSocial Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

How do you determine how much to withhold for Social Security and Medicare tax?

FICA Tax Withholding RatesThe Social Security (OASDI) withholding rate is gross pay times 6.2% up to the maximum pay level for that year. ... The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. ... For a total of 7.65% withheld, based on the employee's gross pay.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Do seniors pay taxes on Social Security income?

Many seniors are surprised to learn Social security (SS) benefits are subject to taxes. For retirees who are still working, a part of their benefit is subject to taxation. The IRS adds these earnings to half of your social security benefits; if the amount exceeds the set income limit, then the benefits are taxed.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

How do I calculate my taxable Social Security benefits 2020?

Calculating Taxable Social Security Benefits – Not as Easy as 0%, 50%, 85%Less than $25,000 single/$32,000 joint: 0% taxable.$25,000 to $34,000 single/$32,000 to $44,000 joint: up to 50% taxable.Greater than $34,000 single/$44,000 joint: up to 85% taxable.

Why is so much Social Security taken out of paycheck?

The Social Security and Medicare programs are in place to help with your income and insurance needs once you reach retirement age. If you're on your employer's insurance plan, this deduction may come out of your paycheck to cover your medical, dental and life insurance premiums.

How do I calculate Social Security tax?

FICA Tax Calculation To calculate FICA tax contribution for an employee, multiply their gross pay by the Social Security and Medicare tax rates. For example, if an employee's taxable wages are $700 for the week, their social security contribution would be: $700.00 x 6.2% = $43.40.

How do I calculate Medicare withholding 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

How do I calculate withholding tax?

Federal income tax withholding was calculated by:Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage.Subtracting the value of allowances allowed (for 2017, this is $4,050 multiplied by withholding allowances claimed).More items...