What determines your disability benefit amount?

You can ask for a special base period, if your current base period was negatively affected by:

- Military service

- Industrial disability

- Trade dispute

- Long-term unemployment

What is the maximum disability benefits?

cannot be more than the maximum benefit allowed, currently $170 per week (WCL §204). Is subject to Social Security and Medicare taxes. is paid for a maximum of 26 weeks of disability during any 52 consecutive week period (WCL §205). You cannot collect disability benefits and Paid Family Leave benefits at the same time.

How do you estimate Social Security disability benefits?

You can quickly find this out by contacting the Social Security Administration (SSA) to receive an estimate or you can visit our website for a quicker response and use the disability calculator. The monthly benefit for SSDI is based on a complex formula, while the benefit for SSI is relatively simple.

What is the income limit for disability benefits?

Unearned income includes:

- interest income

- dividends

- rent from property you don't actively manage

- income that your spouse earns

- pensions

- state disability payments

- unemployment benefits, and

- cash or gifts from friends and relatives.

How much will Social Security pay in 2021?

How many years does the SSA use?

How long do you have to wait to get back pay?

How does the SSA determine your AIME?

What is an offset for disability?

Is Social Security disability based on past earnings?

Is SSDI based on past earnings?

See more

About this website

How do you determine how much disability you will receive?

To calculate how much you would receive as your disability benefit, SSA uses the average amount you've earned per month over a period of your adult years, adjusted for inflation. To simplify this formula here, just enter your typical annual income. This income will be adjusted to estimate wage growth over your career.

How is the amount of Social Security disability benefits calculated?

Social Security benefits are typically computed using "average indexed monthly earnings." This average summarizes up to 35 years of a worker's indexed earnings. We apply a formula to this average to compute the primary insurance amount (PIA).

What is the most approved disability?

1. Arthritis. Arthritis and other musculoskeletal disabilities are the most commonly approved conditions for disability benefits. If you are unable to walk due to arthritis, or unable to perform dexterous movements like typing or writing, you will qualify.

What is the monthly amount for Social Security disability?

At the beginning of 2019, Social Security paid an average monthly disability benefit of about $1,234 to all disabled workers. That is barely enough to keep a beneficiary above the 2018 poverty level ($12,140 annually). For many beneficiaries, their monthly disability payment represents most of their income.

Social Security Disability Benefits Pay Chart

Medicare is a federally-sponsored health insurance program for people age 65 and older; people younger than 65 with a disability;…

How are Social Security disability benefits calculated?

Mathematically speaking, Social Security Disability Insurance (SSDI) is calculated in the same way as Social Security retirement benefits. Both are based on your record of “covered earnings” — work income on which you paid Social Security taxes.. The Social Security Administration (SSA) starts by figuring your average monthly income across your working life, adjusted for historical wage ...

Social Security Quick Calculator

Benefit Calculators. Frequently Asked Questions. Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough.

Income Limits for SSDI Disabillity Benefits | DisabilitySecrets

Social Security disability insurance (SSDI) is available to people who can no longer work due to a disability (physical or mental). But only those who've paid taxes into the Social Security system for at least several years are eligible for SSDI (see our article on SSDI eligibility to see how many work credits are required).Those who are approved for benefits receive monthly SSDI payments that ...

How much will Social Security pay in 2021?

To give you an idea of what you might receive, for 2021, the average SSDI benefit amount is $1,277 per month, ...

How many years does the SSA use?

The SSA will use up to 35 of your working years in the calculation. The SSA takes the years with the highest indexed earnings, adds them together, and divides them by the total number of months for those years. The average is then rounded down to reach your AIME. You can see an example of how the SSA calculates an AIME on its website.

How long do you have to wait to get back pay?

Once you are approved for benefits, there is a five-month waiting period, starting at your disability onset date, before you can be paid benefits. This means that, to receive the maximum amount of backpay (going back for the 12 months before your application date), you must have an EOD of at least 17 months prior to your application date (or your protective filing date).

How does the SSA determine your AIME?

To do this, the SSA will adjust, or index, your lifetime earnings to account for the increase in general wages that happened during the years you worked. This is done to make sure that the payments you get in the future mirror this rise.

What is an offset for disability?

Offsets for Other Disability Income. Some disability payments, such as workers' compensation settlements, can reduce your benefit amount. These are called "offsets.". Most other disability benefits, however, such as veterans benefits or payments made by private insurance, do not affect your benefit amounts.

Is Social Security disability based on past earnings?

To be eligible, you must be insured under the program and meet the Social Security Administration's (SSA's) definition of disabled. SSI payments, on the other hand, aren't based on past earnings.)

Is SSDI based on past earnings?

SSI payments, on the other hand, aren't based on past earnings.) Your SSDI benefit payment may be reduced if you get disability payments from other sources, such as workers' comp, but regular income doesn't affect your payment amount.

How much is the average SSDI benefit?

The average amount for those receiving SSDI benefits in June 2020 was $1,427.67 per month, according to the Office of the Chief Actuary. The maximum disability benefits amount as of 2020 is $3,011 per month.

How much is SSDI in 2020?

The average amount for those receiving SSDI benefits in June 2020 was $1,427.67 per month, according to the Office of the Chief Actuary. ...

Who can help you with disability?

Alternatively, a social security disability lawyer can assist you in gathering all the necessary documentation and ultimately estimating your monthly disability benefits amount.

Is Social Security Disability dependent on your earnings?

Social Security Disability Insurance (SSDI) monthly payments are dependent upon your lifetime average earnings for which you paid into Social Security. As such, having access to your full work history becomes extremely important when estimating what your benefit amount may be.

How much is the SSI payment for 2021?

The full monthly federal benefit for an SSI recipient is fixed, subject to annual increases. In 2021, the federal base payment is $794 (up from $783 in 2020). For a couple where both spouses receive SSI, the monthly payment is $1,191 in 2021 (up from $1,175 in 2020). You will receive more than this amount if your state pays an extra state ...

What is the average monthly payment for Social Security in 2021?

The average monthly payment in 2021 is $1,277, and the most you can receive is $3,148. Unlike with SSI payments, Social Security won't count any income against you to lower your SSDI benefit. The only reduction that may be taken from your SSDI benefit is for an offset for workers' comp benefits or an offset for temporary state disability benefits. ...

Does SSDI go up or down?

Because of these factors, SSDI is a fixed monthly payment; it won't go up or down except for once per year, if there is a cost-of-living adjustment in December. For more information, see our article on how much SSDI pays.

Do you get back pay on SSDI?

Most disability applicants who are approved for benefits also receive some type of back payments or retroactive disability benefits. The amount of backpay you'll get depends on whether you get SSDI or SSI, when you applied for dis ability, and when your disability began.

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

How much will SSDI pay in 2021?

Most SSDI recipients receive between $800 and $1,800 per month (the average for 2021 is $1,277) . However, if you are receiving disability payments from other sources, as discussed below, your payment may be reduced.

How does SSDI payment work?

Your SSDI payment depends on your average lifetime earnings. If you are eligible for Social Security Disability Insurance (SSDI) benefits, the amount you receive each month will be based on your average lifetime earnings before your disability began. It is not based on how severe your disability is or how much income you have.

What is the AIME for Social Security?

Your average covered earnings over a period of years is known as your average indexed monthly earnings (AIME).

Does disability affect SSDI?

If you receive disability benefits from private a long-term disability insurance policy, these benefits will not affect your SSDI benefits. However, if you receive government-regulated disability benefits, such as workers' comp benefits or temporary state disability benefits, they can affect your SSDI benefits in the following way: You cannot receive more than 80% of the average amount you earned before you became disabled in SSDI and other disability benefits. If you do, your SSDI or other benefits will be reduced. However, SSI and VA benefits will not reduce your SSDI benefit.

Can I get SSDI if I have long term disability?

If you receive disability benefits from private a long-term disability insurance policy, these benefits will not affect your SSDI benefits. However, if you receive government-regulated disability benefits, such as workers' comp benefits or temporary state disability benefits, they can affect your SSDI benefits in the following way: You cannot ...

What is the work incentive for Social Security?

There are also a number of special rules, called "work incentives," that provide continued benefits and health care coverage to help you make the transition back to work. If you are receiving Social Security disability benefits when you reach full retirement age, your disability benefits automatically convert to retirement benefits, ...

When do child benefits stop?

The child's benefits normally stop at age 18 unless he or she is a full-time student in an elementary or high school (benefits can continue until age 19) or is disabled.

Does Social Security pay for partial disability?

Social Security pays only for total disability. No benefits are payable for partial disability or for short-term disability. We consider you disabled under Social Security rules if all of the following are true: You cannot do work that you did before because of your medical condition.

How much does SSDI pay?

Most SSDI recipients receive between $800 and $1,800 per month (the average for 2020 is $1,258). Benefit estimates depend on your date of birth and on your earnings history.

Is SSDI based on income?

If you are eligible for Social Security Disability Insurance (SSDI) benefits, the amount you receive each month will be based on your average lifetime earnings before your disability began. It is not based on how severe your disability is or how much income you have.

What is the maximum disability for a disabled family?

The maximum social security disability benefit for a disabled worker’s family is 85% of the workers’ AIME and cannot be more than 150% of the PIA. However, the minimum social security disability benefit cannot be less than the workers’ PIA. On December 4, 2020, the SSA released a Fact Sheet describing the Social Security Disability Thresholds in ...

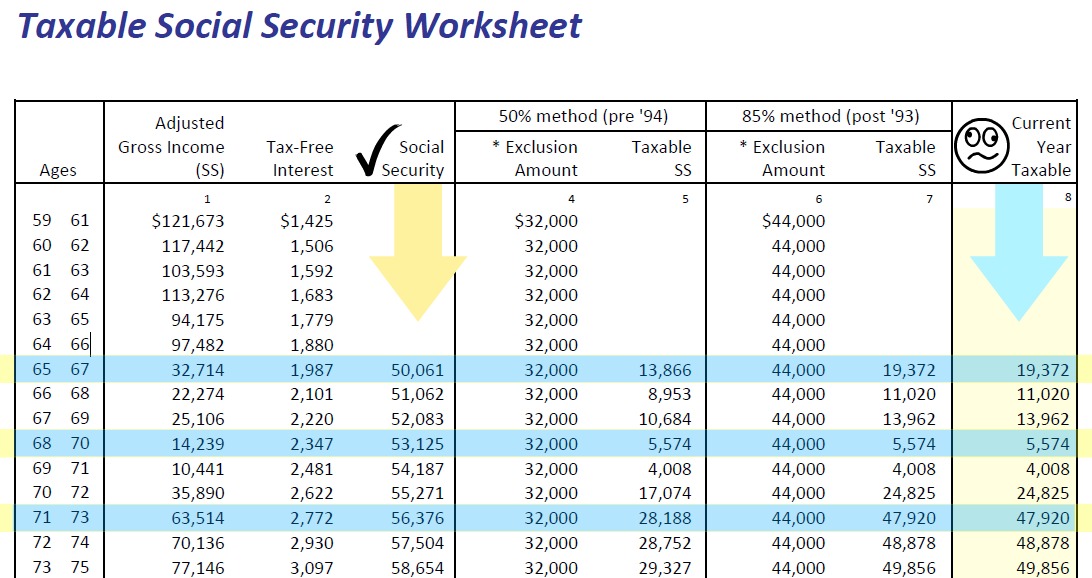

When will the Social Security Disability thresholds be released?

On December 4, 2020, the SSA released a Fact Sheet describing the Social Security Disability Thresholds in 2020 and 2021. We summarize these social security disability benefit payments in the social security disability payment chart below:

Can you get disability if you paid taxes?

However, it is always important to note that you and certain family members will only be eligible for social security disability insurance benefits if you paid Social Security taxes. The Benefit Eligibility Screening Tool is also a great resource that you can use to find the right social security benefits for you.

Is SSDI disability included in the calculation?

Therefore, the severity of your disability is not included in the calculation.

What is disability payment?

Your disability payment is based on your average lifetime earnings before you became disabled. The severity of disability does not factor in, although payments from other sources can. Unlike Supplemental Security Income ( SSI ), which also pays benefits to people who are disabled and unable to work but is based on limited income and resources, ...

What is the average SSDI payment for 2021?

The average SSDI payment is currently $1,277. The highest monthly payment you can receive from SSDI in 2021, at full retirement age, is $3,148. This article covers how the monthly benefit is calculated.

How does SSDI work?

If you are eligible for SSDI benefits, the amount you receive each month will be based on your average lifetime earnings before your disability began. This is the only factor that determines your benefit amount, although it may be reduced if you're receiving disability payments from other sources (more on this below).

What is the AIME for SSDI?

Your SSDI payment will be based on your average covered earnings over a period of years, known as your average indexed monthly earnings (AIME). A formula is then applied to your AIME to calculate your primary insurance amount (PIA)—the basic figure the SSA uses in setting your actual benefit amount.

What is a covered earnings on SSDI?

"Covered earnings" are wages you have received from jobs that have paid into Social Security.

What are some examples of 80% disability?

Examples of these include temporary disability benefits paid by the state, military disability benefits, and state or local government retirement benefits that are based on disability. Some public benefits are not counted toward the 80%, including SSI or VA benefits.

Can you get reduced SSDI if you are injured?

For instance, if you were injured on the job and are receiving workers' compensation benefits, the amount of SSDI benefits you receive might be reduced. Other disability benefits that are not job-related and are paid for by the federal, state, or local government may also reduce your SSDI benefit amount. Examples of these include temporary ...

How much will Social Security pay in 2021?

To give you an idea of what you might receive, for 2021, the average SSDI benefit amount is $1,277 per month, ...

How many years does the SSA use?

The SSA will use up to 35 of your working years in the calculation. The SSA takes the years with the highest indexed earnings, adds them together, and divides them by the total number of months for those years. The average is then rounded down to reach your AIME. You can see an example of how the SSA calculates an AIME on its website.

How long do you have to wait to get back pay?

Once you are approved for benefits, there is a five-month waiting period, starting at your disability onset date, before you can be paid benefits. This means that, to receive the maximum amount of backpay (going back for the 12 months before your application date), you must have an EOD of at least 17 months prior to your application date (or your protective filing date).

How does the SSA determine your AIME?

To do this, the SSA will adjust, or index, your lifetime earnings to account for the increase in general wages that happened during the years you worked. This is done to make sure that the payments you get in the future mirror this rise.

What is an offset for disability?

Offsets for Other Disability Income. Some disability payments, such as workers' compensation settlements, can reduce your benefit amount. These are called "offsets.". Most other disability benefits, however, such as veterans benefits or payments made by private insurance, do not affect your benefit amounts.

Is Social Security disability based on past earnings?

To be eligible, you must be insured under the program and meet the Social Security Administration's (SSA's) definition of disabled. SSI payments, on the other hand, aren't based on past earnings.)

Is SSDI based on past earnings?

SSI payments, on the other hand, aren't based on past earnings.) Your SSDI benefit payment may be reduced if you get disability payments from other sources, such as workers' comp, but regular income doesn't affect your payment amount.