In general, these are the steps in determining how social security disability is calculated and the monthly amount of SSDI benefits:

- Determining Your AIME In SSA terminology, AIME is your Average Indexed Monthly Earnings. This refers to the average amount of income from which you’ve paid Social Security taxes. ...

- Determining Your PIA Your Primary Insurance Amount (PIA) is the amount of your monthly benefits before it is rounded off. ...

- Rounding Off

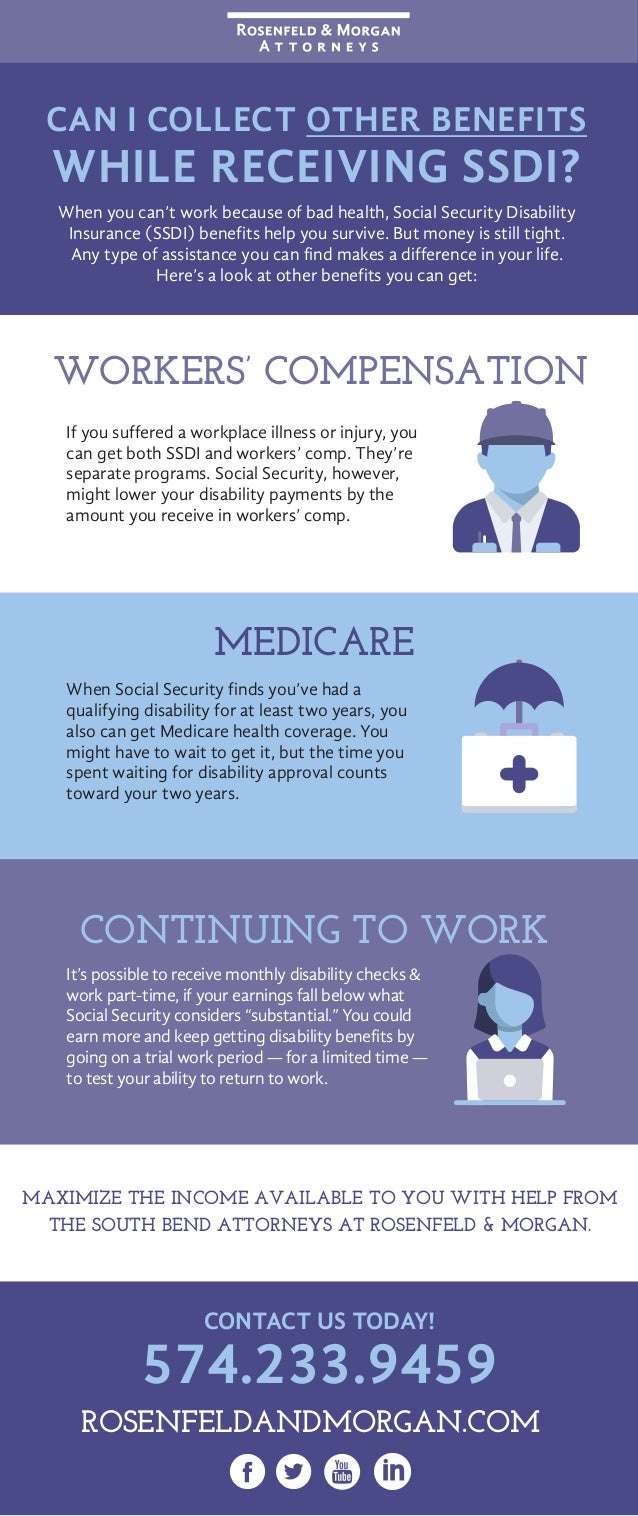

What other benefits can I collect while on SSDI?

What Other Benefits Can I Collect While on SSDI? If you have a disability that prevents you from working, then you are probably receiving SSDI benefits (Social Security Disability Insurance). Alas, if you’re like many people who get money from government in this way, you probably struggle to live off the amount you receive.

How much money does SSDI pay per month?

- 90% of the first $996 of average indexed monthly earnings

- 32% of the average indexed monthly earnings over $996 through $6,002, and

- 15% of the average indexed monthly earnings over $6,002.

Can you collect retirement benefits and SSDI?

The reduction percentage calculation is 5/9 of 1% for each month prior to her full retirement age, up to 36 months. If she files more than 36 months prior to her full retirement age, the benefit is further reduced 5/12 of 1% for each additional month.

How does SSI compare to SSDI?

The OIG key finds are as follows:

- Overall participation rate remains low (i.e, disability recipients continued to decline to participate in the Ticket to Work program)

- The percentage of beneficiaries who ceased benefits as a result of employment had remained unchanged from before Ticket to Work

- Less than 1 percent of all ticket holders assigned their tickets to ENs

How much can you deduct from your Social Security if you are disabled?

If you are receiving either workers’ compensation or public disability and Social Security Disability benefits, the total amount of these benefits can not exceed 80% of your average earnings before you become disabled. If the total amount of these benefits exceeds 80% , the excess amount will be deducted from your Social Security benefit.

What is the bend point for SSA?

Bend Point #2: The SSA will take 32% of these earnings. Bend Point #3: The SSA will take 15% of these earnings. The bend points help ensure that lower earners receive a higher amount of benefits. You can find the bend points of each year from 1979 to 2020 on the SSA website.

How much is the AIME for SSDI 2020?

You can use a formula to help calculate your potential SSDI benefits if approved in 2020. In the following example, an applicant’s AIME is $3,500/month. For the year 2020, the dollar amounts in PIA consist of the first bend point being $960 and the second bend point being $5,785.

How long can you keep your SSA benefits?

In the extended period, the SSA gives you a 36-month extended period of eligibility to keep your benefits as long as you do not make more than $1,260 a month. Receiving additional income from other sources such as disability payments from workers’ compensation and public disability benefits may reduce your benefits.

What is the total of Bend Point 3?

Bend Point #3: No Bend Point #3 because earnings did not exceed $5,785. The sum of $864 and $812.80 will be equal to a total of $1,676.80. The final PIA amount is an estimated amount of SSDI benefits that you are entitled to.

What is covered earnings?

Covered earnings are work-related earnings subject to Social Security taxation and include most types of wages and self-employment income. Over a period of years, the average covered earnings become your average indexed monthly earnings ( AIME ).

What happens if your Social Security benefits exceed 80%?

If the total amount of these benefits exceeds 80%, the excess amount will be deducted from your Social Security benefit. Therefore, it is important to keep the SSA informed of any monthly payment increase or decrease or if you receive a lump-sum payment.

How much is SSI monthly?

If you meet the qualifications as described below, and your application for SSI is approved, you will receive benefits of $733 per month (for individuals) or $1,100 per month (for couples), minus a portion of your current income.

What is SSI disability?

SSI is called a “means-tested program,” meaning it has nothing to do with work history, but strictly with financial need. SSI disability benefits are available to low-income individuals who haven’t earned enough work credits to qualify for SSDI.

What is back payment on SSDI?

Back payments are any disability benefits that are past due, or the benefits that you would have been paid if your initial application was approved right away. Retroactive payments are for the months that you were disabled and could not work. You are eligible for retroactive payments only with SSDI and not SSI.

How long does a person have to be on SSDI to receive SSI?

In order to receive SSDI, the prospective recipient must be able to demonstrate they have a disability that is medically determinable, that will continue to last no less than twelve months, and that prevents the individual from engaging in substantial gainful activity.

What is the AIME on SSDI?

This income is called your “covered earnings”. The average of your covered earnings over several years is called your average indexed monthly earnings (AIME).

What is SGA in Social Security?

Substantial Gainful Activity – SGA. is an important concept to understand when pursuing Social Security Disability Insurance or Supplemental Security Income. The Social Security Administration defines it as “the performance of significant mental and/or physical duties for profit”. SGA maximum amounts are set by the Social Security Administration ...

How much income do I need to qualify for SSI?

The amount is set by your particular state, and it is usually between $700 and $1400 per month, and some states allow individuals with higher incomes to still qualify for SSI. You must own less than $2,000 in property (minus your home and car) for individuals, or $3,000 for a couple.

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

What is SSDI benefits?

SSDI is a benefit for disabled workers who have sufficiently paid into the Social Security system over the course of their employment. You must have earned a certain number of work credits to qualify for benefits if you become disabled before retirement age. The exact number of credits you need depends on your age.

What is the maximum amount of SSI you can collect in 2017?

In 2017, the FBR is $735. This is maximum amount of SSI you can collect each month. Then, the SSA simply deducts your countable unearned income and your countable earned income from the $735 to determine your monthly SSI benefit amount. The SSA counts various types of income against your benefit amount, including:

What is a PIA in SSA?

PIAs are complex to calculate and even harder to explain. “The PIA is the sum of three separate percentages of portions of average indexed monthly earnings, ” states the SSA. Essentially, the SSA separates your AIME into three portions that it calls “bend points”: