Applying for Social Security Death Benefits

- Applications are not accepted online.

- To apply by phone, call 800-772-1213.

- To apply in person, go to a local Social Security office.

Full Answer

How do I apply for SS death benefits?

- Have a parent who is disabled or retired and eligible for Social Security benefits

- Are unmarried

- Are younger than 18 or up to age 19 if they are full-time high school students.

- Are 18 or older and disabled (as long as the disability began before they turned age 22)

How to handle Social Security benefits after someone dies?

cash any checks received for the month the person dies or later. Return the checks to Social Security as soon as possible. However, eligible family members may be able to receive death benefits for the month the beneficiary died. Contacting Social Security The most convenient way to contact us anytime, anywhere is to visit . www.socialsecurity.gov.

How do you file for SS death benefits?

You should give the funeral home the deceased person’s Social Security number if you want them to make the report. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778). You can speak to a Social Security representative between 8:00 a.m. – 7:00 p.m. Monday through Friday.

Who can collect the Social Security death benefit?

More than 60 million Americans receive Social Security benefits, and just under 10 percent, or about 6 million, receive survivor benefits. Until this year, Renn said, LGBTQ people who contributed part of their paycheck to the pot weren’t getting anything back in terms of survivor benefits — simply because of their sexual identity.

How long do you have to work to get full Social Security?

Those who reached full retirement age and worked for at least 10 years while paying Social Security taxes earn their full Social Security benefits, and in doing so they also leave behind the highest potential survivors benefits when they pass away.

When does Social Security death benefit start?

Social Security death benefits can only begin after reporting the loss and after applying; they do not automatically begin when the person passes away. Therefore, it is important to make an application as soon as possible.

Does Medicare cover funeral expenses?

Medicare does not cover funeral costs or burial expenses. However, the insured may set up a Medicare Medical Savings Account (MSA), which allows certain flexibility for non-medical expenses. These are plans which annually add funds to a devoted bank account, truly meant to be used for Medicare-covered medically necessary services.

What Is The Social Security Death Benefit?

The Social Security Death Benefit is a one-time payment of $255 that Social Security pays to the family or other representatives of a deceased Social Security beneficiary. This benefit is also known as the Social Security Widow’s Benefit.

How Long Do You Have To Apply For Social Security Widow’s Benefits?

If you are a surviving spouse or child, you have 2 years from the date of the individual passing away to apply for the Social Security death benefit.

What is death benefit?

Social Security Death Benefit is a payment to surviving family members when the Social Security beneficiary dies.

How to contact Social Security about lump sum death?

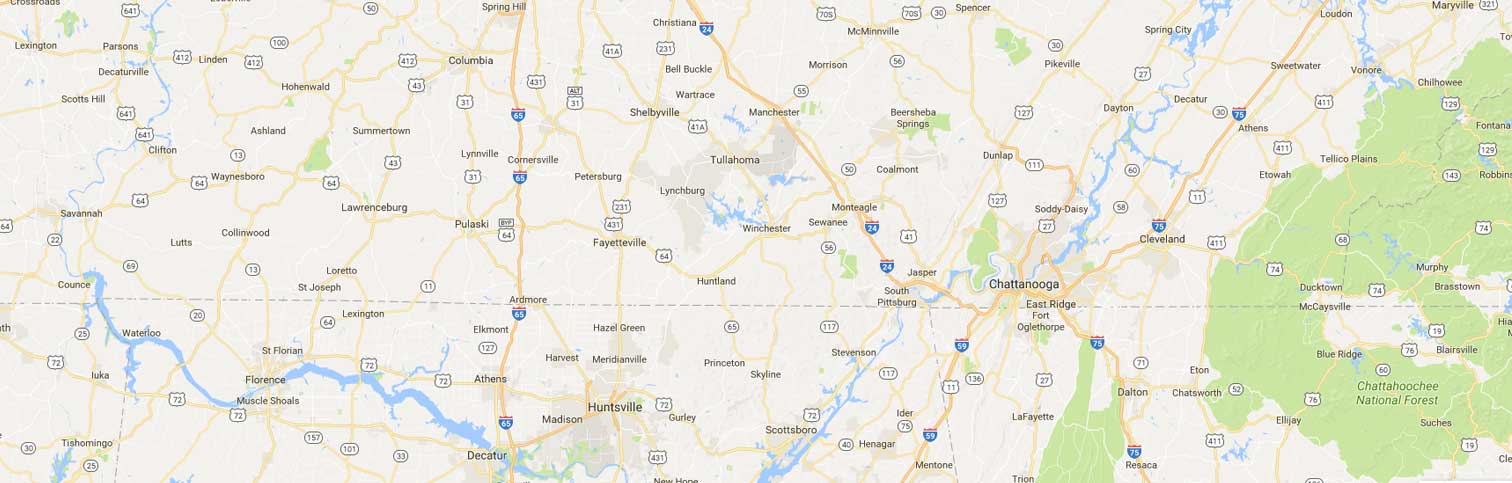

To learn more about the Social Security Lump-Sum Death Benefit you can contact the Social Security Administration at 800.772.1213, visit their website, or visit an office near you.

Can a child receive Social Security if there is no spouse?

The child of a deceased Social Security recipient can receive the payment if there is no eligible surviving spouse. The child would need to meet one of the following requirements:

Who gets the one time payment for a deceased spouse?

In most cases, this one-time payment will go to the surviving spouse that lived with the deceased individual.

Does Social Security pay for funerals?

No, Social Security does not pay for funerals. They can offer a one-time payment of $255 to the surviving spouse or child of the deceased Social Security beneficiary.

Who Cannot Qualify for the Social Security Death Benefit?

The SSA has certain rules about which spouses and children qualify for benefits after an insured worker passes away. If any of the following apply to you, then you’re not eligible for the $255 Social Security death benefit:

How long do you have to notify Social Security of death?

But depending on the circumstances, you may need to notify the SSA yourself. Regardless, someone must notify the SSA within two years of the date on your loved one’s death certificate. Once that deadline passes, survivors cannot apply for the lump-sum $255 Social Security death benefit.

What is a birth certificate?

A signed statement from the doctor or midwife present at your birth

Can a spouse qualify for survivor benefits?

Eligible spouses and children may also qualify for monthly survivor’s benefits. Need help getting benefits after the SSA turned you down or want to apply for disability? Sign up for a free phone call from a local advocate within one business day.

Do you need a discharge paper for the SSA?

Did you serve in the U.S. military before 1968? If yes, the SSA needs your discharge papers. (If you don’t have these, then the SSA can get them from the VA.)

Can a spouse apply for a lump sum death benefit?

Surviving spouses must show the SSA they’re eligible to apply for the lump-sum Social Security death benefit. Make sure you have original versions of most documents listed below:

How old do you have to be to get unemployment benefits?

Unmarried children can receive benefits if they are: Younger than age 18 (or up to age 19 if they are attending elementary or secondary school full time). Any age and were disabled before age 22 and remain disabled.

What age can you take care of a child of a deceased person?

At any age if they take care of a child of the deceased who is younger than age 16 or disabled.

How much is a death benefit for dependent parents?

Parents age 62 or older who received at least one-half support from the deceased can receive benefits. One-time lump sum death payment. A one-time payment of $255 can be made only to a spouse or child if they meet certain requirements.

How to report a death to Social Security?

To report a death or apply for survivors benefits, use one of these methods: Call our toll-free number, 1-800-772-1213 (TTY 1-800-325-0778 ). Visit or call your local Social Security office. More Information. If You Are The Survivor. Survivors Benefits.

Can you get Social Security if you die?

When you die, members of your family could be eligible for benefits based on your earnings. You and your children also may be able to get benefits if your deceased spouse or former spouse worked long enough under Social Security.

What is zoom in icon?

Arrows pointing outwards. There are a couple of things to keep in mind. For starters, a person is due no Social Security benefits for the month of their death. “Any benefit that’s paid after the month of the person’s death needs to be refunded,” Sherman said. With Social Security, each payment received represents ...

How much is the Social Security death benefit?

Finally, upon the death of a Social Security recipient, survivors are generally given a lump sum payment of $255.

What happens to the checks if someone dies in January?

So if a person dies in January, the check for that month — which would be paid in February — would need to be returned if received. If the payment is made by direct deposit, the bank holding the account should be notified so it can return benefits sent after the person’s death.

When does a spouse's benefit automatically convert to a survivor's benefit?

As for benefits available to survivors: If a spouse or qualifying dependent already was receiving money based on the deceased’s record, the benefit will auto-convert to survivors benefits when the government gets notice of the death, Sherman said.

When can a widow get a full retirement?

They can apply for reduced benefits as early as age 60 , in contrast to the standard earliest claiming age of 62.

When should Social Security be alerted?

First, though, it’s important for the Social Security Administration to be alerted as soon as possible after the person dies.

Is it a crime to use someone else's benefits after they die?

It may be no surprise that using someone else’s benefits after they die is a federal crime, regardless of whether the death was reported or not. If the SSA receives notice that fraud might be happening, the allegation is reviewed and potentially will warrant a criminal investigation.

What is a widower?

The widow or widower was living with the deceased at the time of death. He or she was living separately but collecting spousal benefits on the deceased’s earnings record. He or she was living separately but is eligible for survivor benefits on the deceased’s record. In the absence of a qualifying widow or widower, ...

How long does it take to get a death benefit?

If that is not the case, the survivor must apply for the death benefit within two years of the death.

What documents do you need to file for a late worker?

You may need to provide the late worker’s birth and death certificates and other documents. You might also need to answer questions about the deceased’s family, financial and Social Security status, as enumerated in Social Security form SSA-8.

Can a deceased person receive survivor benefits?

He or she was living separately but is eligible for survivor benefits on the deceased’s record.

Who can collect the $255 death benefit?

Only the widow, widower or child of a Social Security beneficiary can collect the $255 death benefit, also known as a lump-sum death payment. Priority goes to a surviving spouse if any of the following apply:

Is death benefit one time?

The death benefit is a one-time payment, not to be confused with survivor benefits, which are continuing payments made to the surviving spouse, ex-spouse, children or, in rare instances, the parents of the deceased. Updated October 23, 2020.

Ways to Apply

You can complete an application for Retirement, Spouse's, Medicare or Disability Benefits online.

Retirement or Spouse's Benefits

You can apply online for Retirement or spouse's benefits or continue an application you already started.

Disability Benefits

You can apply online for disability benefits or continue an application you already started.

Appeal a Disability Decision

If your application for disability benefits was denied recently for medical reasons, you can request an appeal online or continue working on an appeal you already started.

Medicare Benefits

You can apply online for Medicare or continue an application you already started.

Extra Help with Medicare Prescription Drug Costs

You can apply online for Extra Help with Medicare prescription drug costs.

Supplemental Security Income (SSI) Benefits

If you want to apply for Supplemental Security Income (SSI), please read:

How are death benefits paid out?

Death benefits are paid out in two different ways: Lump Sum Death Benefit: This is a one-time payment from Social Security given to the next of kin or beneficiary. As of January 2008, that amount was $255, and only one payment per family is allotted. Monthly payments: Besides the lump sum benefit, Social Security may also disperse monthly payments ...

What happens if you don't pay Social Security taxes?

Also, if you receive a pension which you did not pay into with Social Security taxes, your Survivors Benefits will be reduced; you cannot collect both types of benefits at the same time.

What percentage of Social Security does a spouse receive when they die?

For example, if you die after you reach full retirement age, your spouse can receive a death benefit up to 100 percent of your basic Social Security benefit. However, if your spouse has not yet reached full retirement age at the time of your death, he or she will only receive anywhere from 71 percent to 94 percent of your basic benefit.

What happens to Social Security after you die?

Then, upon your death, if you and your dependents are eligible, your family will receive some funds on which to live.

How old do you have to be to receive Social Security?

For a surviving spouse to receive a Social Security death benefit, he or she must be: Over the age of 65 (or 50 if disabled) Any age if he or she is caring for your child under the age of 16 or disabled. An ex-spouse older than 60 (50 or older if disabled) to whom you were married at least 10 years.

How many years of work do you need to be a survivor?

The younger you are, the fewer years you need to work. However, you don't need any more than 10 years of work (which equates to 40 credits) to be fully insured for benefits. Death benefits are paid out in two different ways:

Does Social Security pay monthly payments?

Monthly payments: Besides the lump sum benefit, Social Security may also disperse monthly payments to eligible spouses and children. The death benefit is equal to what your Social Security benefit will be when you retire. For example, if you die after you reach full retirement age, your spouse can receive a death benefit up to 100 percent ...