- Make Sure You Can Answer ‘Yes’ to These Questions. To qualify for an ex’s Social Security benefits, you need to be able to answer “yes” to these four questions.

- Gather Your Ex’s Information. You’re going to need some information to prove to Social Security that you’re eligible for your ex’s benefits.

- Resist the Urge to Tell Them. Remember: Your decision to seek more Social Security on your ex’s record does not affect them in any way.

- Ask Social Security Whose Record Gets You the Best Benefit. ...

- Delay as Long as Possible (but Not Too Long) The earlier you take benefits, the lower your monthly checks will be, no matter whose record you claim on.

Full Answer

How to estimate Social Security benefits from a former spouse?

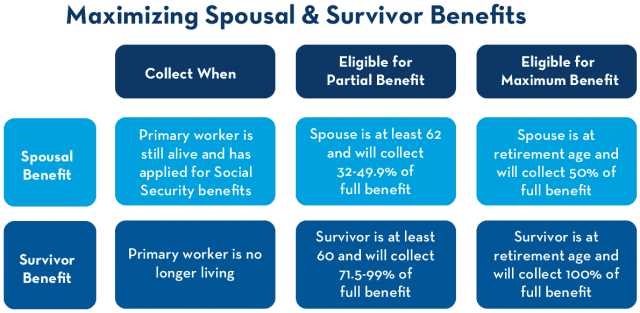

- If you are of full retirement age or older, you would receive 100%.

- If you are age 60 or older but not yet of full retirement age, you would receive 71.5% to 99%.

- If are 50 to 59 years old and disabled, you would receive 71.5%.

How do you apply for spousal Social Security benefits?

Applying for benefits online is perhaps the easiest way to apply for Social Security benefits. You can begin your online application through the SSA portal’s website. Before you apply, however, there are some important things to take into consideration.

What benefits does social security offer spouses?

What benefits does social security offer spouses? As a spouse, you can claim a Social Security benefit based off your own earnings, as well as you collect the spousal benefit, which can provide up to 50% of the full retirement age (FRA) of your spouse’s Social Security benefit. The Social Security website can help you determine what your FRA ...

Can I Collect my Ex spouses Social Security?

Your ex-spouse qualifies for Social Security benefits. You can even begin drawing benefits before your ex has retired, as long as they qualify and you’ve been divorced at least two years. How Much Can I Receive?

Can a divorced woman claim her ex husband's Social Security?

Benefits For Your Divorced Spouse If you are divorced, your ex-spouse can receive benefits based on your record (even if you have remarried) if: Your marriage lasted 10 years or longer. Your ex-spouse is unmarried. Your ex-spouse is age 62 or older.

How do I collect my ex spouses Social Security?

Form SSA-2 | Information You Need to Apply for Spouse's or Divorced Spouse's Benefits. You can apply: Online, if you are within 3 months of age 62 or older, or. By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office.

How much Social Security does a divorced spouse get?

The most you can collect in divorced-spouse benefits is 50 percent of your former mate's primary insurance amount — the monthly payment he or she is entitled to at full retirement age, which is 66 and 4 months for people born in 1956 and is rising incrementally to 67 over the next several years.

How much of my ex spouses Social Security Am I entitled to?

50%You can receive up to 50% of the amount your former spouse would receive in benefits at their full retirement age (this equation applies to all spouses, not just exes). This amount is not in addition to your own benefit — and again, your benefit has to be lower than half of your ex's benefit in order for you to apply.

How does a divorced woman collect her husband's Social Security?

Depending on their circumstances, divorced Social Security beneficiaries can receive either retired-worker benefits, which are based on the individual's own covered earnings history; auxiliary benefits, which are determined by a living or deceased former spouse's covered earnings history; or a combination of both.

Can you collect 1/2 of spouse's Social Security and then your full amount?

Your full spouse's benefit could be up to one-half the amount your spouse is entitled to receive at their full retirement age. If you choose to begin receiving spouse's benefits before you reach full retirement age, your benefit amount will be permanently reduced.

Is my ex wife entitled to my Social Security if she remarries?

Can I collect Social Security as a divorced spouse if my ex-spouse remarries? Yes. When it comes to ex-spouse benefits, Social Security doesn't care about the marital status of your former spouse; it only cares about your marital status.

Can I collect ex spousal benefits and wait until I am 70 to collect my own Social Security?

You can only collect spousal benefits and wait until 70 to claim your retirement benefit if both of the following are true: You were born before Jan. 2, 1954. Your spouse is collecting his or her own Social Security retirement benefit.

How Do Social Security spousal benefits work?

The spousal benefit can be as much as half of the worker's "primary insurance amount," depending on the spouse's age at retirement. If the spouse begins receiving benefits before "normal (or full) retirement age," the spouse will receive a reduced benefit.

How old do you have to be to get a disability?

If you are disabled, and your ex-spouse has died, you can begin receiving survivors benefits if you're between the ages of 50 and 59. Your disability also must have started before or within seven years of your ex's death. The rules vary slightly when it comes to children. If you are caring for a child who is under age 16 or disabled, ...

How much do you get if you are 60?

If you are age 60 or older but not yet of full retirement age, you would receive 71.5% to 99%. If are 50 to 59 years old and disabled, you would receive 71.5%. If you are caring for your ex-spouse's child who is disabled or under the age of 16, you would receive 75%, no matter your age. 6 7.

Can you receive your own retirement at age 70?

That way, you receive only the ex-spousal benefit. You can let your own benefit amount continue racking up delayed retirement credits until you reach age 70. When you reach age 70, you can switch to your own benefit amount if that's larger than the ex-spousal amount.

How old do you have to be to claim your ex-spouse?

However, if this is the case, the divorce must be at least two years old. (There is no such requirement if your ex is already receiving benefits.)

How long do you have to be married to collect spousal benefits?

You are eligible to collect spousal benefits on a living former wife’s or husband’s earnings record as long as: The marriage lasted at least 10 years. You have not remarried. You are at least 62 years of age. Your ex-spouse is entitled to collect Social Security retirement or disability benefits . Your former spouse doesn't have to be collecting ...

How long do you have to be married to get Social Security?

There are other rules, of course. You must have been married to your ex-spouse for 10 years or more .

How long do you have to be married to collect unemployment benefits?

You must have been married to your ex-spouse for 10 years or more. If you’ve remarried, you can’t collect benefits on your former spouse’s record unless your later marriage ended by annulment, divorce, or death.

Can thinking about an ex-spouse be emotional?

No doubt about it — thinking of an ex-spouse can be emotional. And, if your finances have changed for the worse since the breakup, even more emotions can surface.

What does the SSA look for in spousal benefits?

The SSA looks at the amount of retirement benefits you're eligible for, then the amount of spousal benefits you're eligible for. If the spousal benefits are greater than your retirement benefits, you would be paid your retirement benefits first, then spousal benefits would be used to make up the difference. You always get the larger of the two ...

How much is my spouse's spousal benefit?

Decide when you want to start receiving benefits. Your full spousal benefit is 50% of your spouse's primary insurance amount. However, if you decide to start receiving those benefits before you reach your normal retirement age, your benefit amount will be permanently reduced.

What is the lowest percentage of your spouse's insurance?

The lowest percentage you could possibly get is 32.5% of your spouse's primary insurance amount. In some situations, it might make sense for you to claim your spousal benefits early. However, if you can afford to do so, you'll get more money if you wait until you reach your normal retirement age.

What is the phone number to call for Social Security?

If you can't apply online or don't want to use the online form, you can also call 1-800-772-1213 (TTY 1-800-325-0778).

How to check status of Social Security application?

1. Set up an online account if you haven't already. From your "My Social Security" account at https://www.ssa.gov/myaccount/ , you can check the status of your application and manage your benefits. If you didn't apply for your benefits online, you can still set up a free account to manage your benefits.

Is my spouse's retirement benefit based on my primary insurance?

The amount of your spousal benefit isn't affected by the age at which your spouse started receiving their retirement benefits. It is always based on your spouse's primary insurance amount, which is the amount they would receive if they started claiming benefits at their normal retirement age (NRA).

Can my ex-spouse get Social Security?

Your ex-spouse is entitled to Social Security benefits (either retirement or disability) Your retirement benefits are less than your spousal benefits based on their work would be. You've been divorced for at least 2 years (if your ex-spouse has not yet claimed their benefits)

Social Security Spouse's Benefit Estimates

Plan for your future with a my Social Security account. With a my Social Security account, you can view the benefits you could receive based on your spouse’s earnings history, or the benefits your spouse could receive based on your earnings history.

Follow these steps to get started

Ask your spouse to create or open their my Social Security account, go to the ‘Plan for Retirement’ section, and note their retirement benefit estimate at their full retirement age or Primary Insurance Amount (PIA).

What age can an ex spouse receive Social Security?

Your ex-spouse is age 62 or older. The benefit that your ex-spouse is entitled to receive based on their own work is less than the benefit they would receive based on your work. You are entitled to Social Security retirement or disability benefits.

How much can a divorced spouse receive?

Generally, the total amount you and your family can receive is about 150 to 180 percent of your full retirement benefit. If you have a divorced spouse who qualifies for benefits, it will not affect the amount of benefits you or your family may receive.

Does divorce affect Social Security?

If your ex-spouse will also receive a pension based on work not covered by Social Security, such as government work, their Social Security benefit on your record may be affected. The amount of benefits your divorced spouse gets has no effect on the amount of benefits you or your current spouse may receive.

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

Who Is Eligible?

Social Security Benefits

- The maximum amount of Social Security benefits you can receive based on an ex-spouse's record is 50% of what your ex-spouse would get at their full retirement age. This varies based on their year of birth. The spousal benefit amount is further decreased if you file before you reach your own full retirement age.3 If you have an idea of what your ex-...

Survivors Benefits Explained

- If your ex-spouse has died, you may collect survivor's benefits. These follow different rules than those for a living ex-spouse. You can apply for benefits as early as age 60. If you remarry after you reach age 60, or age 50 if you are disabled, you will still be able to claim these benefits. If you are disabled, and your ex-spouse has died, you can begin receiving survivors benefits if you're betwe…

What About Unmarried Children?

- An unmarried child of the deceased may be able to receive benefits if one of the following applies: 1. They are younger than 18 years of age; or, they are up to age 19, if they are a full-time student in an elementary or secondary school. 2. They are age 18 or older with a disability that began before the age of 22.8