How unemployment works in Georgia

- As soon as you become unemployed, file a Georgia unemployment application with the state’s Department of Labor.

- After receiving an approval from the Georgia unemployment department, you must enroll with the Georgia DOL Employment Services to receive benefits. This department will help with your job hunt.

- You will begin receiving Georgia unemployment weekly claims, anywhere between $55 and $365, depending on your previous work history and case.

- To continue receiving benefits, you must file a Georgia unemployment weekly claim to prove you are continuing to search for new work. This is mandatory and must be done weekly.

- You are eligible to receive Georgia unemployment weekly claims for between 14 and 20 weeks, depending on the Georgia unemployment rate, and so long as you continue meeting Georgia unemployment ...

- In times of high unemployment, the state may provide additional help. While Georgia unemployment extensions are rare, you may qualify based on a case-by-case basis.

How do you calculate unemployment benefits in Georgia?

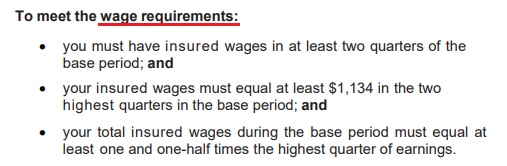

- You must have earned wages in at least two quarters during the base period.

- You must have earned at least $1,134 in wages during the two quarters of your base period in which you earned the highest wages.

- Your total wages during the base period must be at least 1.5 times the wages you earned in the highest quarter of your base period.

How do you file unemployment in Ga?

PHILADELPHIA (KYW Newsradio) — Nine people are accused of stealing close to $1 million of unemployment money in Pennsylvania ... and another from Georgia. Shapiro’s office said three more people are expected to be charged within the next week, and ...

How to tell if you are eligible for unemployment benefits?

You must be:

- Physically able to work.

- Available for work.

- Ready and willing to accept work immediately.

How do you collect unemployment in Georgia?

Of the 480,860 Black workers denied or ruled ineligible for regular unemployment in Georgia, 181,325 applied for PUA ... that 31% of Black applicants nationwide said they had failed to receive the help they sought since the beginning of this year compared ...

Who can apply for unemployment benefits in Georgia?

Georgia law requires that all applicants for UI benefits who are 18 years of age or older attest they are:a United States citizen, ora legal permanent resident, ora non-citizen legally present in the United States.

What is the maximum and minimum number of weeks a regular unemployment claim in Georgia can be established?

Effective July 1, 2012, the maximum number of weeks a claim can be established will range from 14 to 20, depending on the seasonal adjusted statewide unemployment rate in use at the time the regular UI claim is filed. For claims filed from July 1 through December 31, Georgia’s seasonal adjusted UI rate for the previous April will be used. For claims filed from January 1 through June 30, Georgia’s seasonal adjusted UI rate for the previous October will be used. The minimum number of weeks is 6.

What information should I have when I file a claim for unemployment benefits in Georgia?

When filing a claim, you should have:ALL INDIVIDUALS: A copy of your valid government-issued picture identification and Employer Separation Notice, if you were given one.

How long must I have worked to establish a claim for unemployment benefits in Georgia?

See full answerYour claim is based on insured wages earned in the base period, which is the first four of the last five calendar quarters completed at the time you file your claim. You must have earned qualifying wages in at least two of the four quarters in the base period. The total wages in the base period must equal or exceed one and one-half times the wages in the highest quarter. A secondary calculation will be made when the sole reason that a claim cannot be established is the one and one-half times requirement. An alternative base period consisting of the most recently completed four calendar quarters will be used only when a claim cannot be established using the regular base period.

Is everyone eligible for the maximum number of weeks of unemployment benefits in Georgia?

No. The individual’s base period wages are used to determine the maximum benefits payable which may or may not qualify an individual for the maximum number of weeks. The maximum benefits payable to an individual in a benefit year is the least of the maximum number of weeks times the weekly benefit amount or one-fourth of the base period wages.

Why has the maximum number of potential unemployment weeks in Georgia been changed?

The Georgia Legislature passed House Bill 347 which changes the calculation method to determine the maximum number of weeks to be based upon the adjusted statewide unemployment rate in use at the time the regular UI claim is filed. The change became effective July 1, 2012.

Why is an affidavit required for unemployment benefits in Georgia?

Section 50-36-1 of the Official Code of Georgia Annotated (O.C.G.A.) requires every applicant for public benefits, including unemployment insurance (UI), who is 18 years old or older, sign an affidavit attesting that they are (1) a United States citizen or a legal permanent resident or (2) a non-citizen legally present in the United States.

How do I claim unemployment benefits in Georgia each week after I file?

Once you file your claim, you will be required to certify your eligibility for each week you claim benefits and submit your work search for each week of benefits claimed. You may claim benefits using the telephone interactive voice response system, over the Internet, or in person at a GDOL Career Center.

Are there other requirements if I receive unemployment benefits in Georgia?

See full answerYes. If you are awarded benefits based on your reason for separation from your last employer, you must meet other weekly requirements. You must be able to do some kind of work that is available in your area and that you are qualified to do. You must be available for work without placing undue restrictions on your availability, such as lack of child care, lack of transportation, or other restrictions. You must be actively seeking work each week and you must be looking for full-time employment. As a part of your weekly certification, you must submit three new verifiable job search contacts for each week of benefits claimed. You must not refuse any offer of suitable work or referral to suitable work without good cause.You must be actively registered for employment services to receive UI benefits, unless exempt by law.

What do I have to do to qualify for benefits in Georgia if I have earned enough money to establish a claim?

See full answerJust earning enough money to set up a claim is not enough to receive unemployment benefits. You must also meet other eligibility conditions. You must have a decision made on the reason for separation from your last work. If your most recent job loss was not the result of a lack of work (i.e. layoff, business closure), a decision on the reason for separation is required. A department employee may conduct a telephone interview with you and your former employer to get information about the reason for your separation or any other issues which might affect your claim. A written decision will be mailed to you, and to your employer if the issue is separation. Other requirements include, but are not limited to, being able to work, being available for work, and actively seeking work.

How can I determine what unemployment rate is being used to establish my claim for unemployment benefits in Georgia?

An Unemployment Benefit Determination is mailed to claimants when an initial claim is filed on or after July 1, 2012. The determination will provide the rate for your claim filing period. The current rate for a specified claim filing period may also be obtained by contacting UI Customer Service at 404-232-3001 or 1-877-709-8185.

Can I draw unemployment benefits in Georgia if I quit my job?

If you quit, you may be eligible to draw benefits if you can show that you quit for good work-connected reason(s). Examples of good work-connected reasons are material change in working conditions, material change in working agreement, nonpayment for work, and similar reasons. You will not be able to draw benefits if your reason for quitting was personal even though the personal reason was a good or compelling one. The only way to know for sure whether you are eligible if you quit is to file a claim. The department cannot make a predetermination of eligibility before a claim is filed.

What happens if you don't respond to Georgia unemployment?

Be sure to respond promptly. If you don’t reply by the deadline, your benefits could be delayed or denied.

How often do you have to request unemployment benefits?

After applying, individuals must request payments weekly to be paid unemployment benefits for weeks they are determined to meet eligibility requirements.

What happens if my unemployment claim is denied?

If your claim is denied, you may appeal the decision. It is important that you continue to claim weekly benefits while your appeal is pending review. More information about appeals is available on the Georgia Department of Labor website.

Can I file unemployment online in Georgia?

Georgians filing unemployment insurance (UI) claims with the Georgia Department of Labor must meet certain criteria. Individuals may file a claim for unemployment benefits online with the Georgia Department of Labor and must meet certain criteria. After applying, individuals must request payments weekly to be paid unemployment benefits ...

How long can you be paid for unemployment in Georgia?

If you receive unemployment insurance benefits of any type, you are required to make a good faith effort to find another job as soon as possible. You can only be paid for weeks during which you actively seek work. Unless the Georgia Department of Labor (GDOL) specifically exempts you under our law from this requirement, you are required to keep a detailed record of your work search activities and submit evidence of your efforts by Internet or fax.

Where does unemployment come from?

The funding for unemployment insurance benefits comes from taxes paid by employers. Workers do not pay any costs. Eligibility for benefits is determined based on past wages, reason for job separation, and availability and job search requirements.

What age do you have to be to get UI in Georgia?

Georgia law requires that all applicants for UI benefits who are 18 years of age or older attest they are: a non-citizen legally present in the United States. The GDOL performs electronic verification of your lawful presence in the United States with the Georgia Department of Driver Services (DDS).

Where does unemployment come from?

The funding for unemployment insurance benefits comes from taxes paid by employers. Workers do not pay any costs. Eligibility for benefits is determined based on past wages, reason for job separation, and availability and job search requirements.

Talk to your employer

If you have been furloughed due to the COVID-19 crisis, it’s important that you speak with your employer about your options. Many businesses have received loans or grants that may allow them to offer at least partial paychecks to their employees.

Get your information together

Applying for unemployment is not a particularly grueling process, but you will need to know specific information.

Do your research

Applying for unemployment may be something you have never had to do before, so it’s a good idea to do a little research. If you have colleagues or local friends who have applied, send them a quick email to ask for any tips they have for the process. Again, the actual application will not be too difficult, but it’s always a good idea to be prepared.

Follow up

When a Georgian applies for unemployment insurance, they usually have to enter in weekly work searches to prove that you are actively seeking employment. However, in light of the COVID-19 crisis, that requirement has been waived, as long as the separation of employment is related to the pandemic.

Know what to expect

Once your application is received and approved, you will be contacted by the Georgia Department of Labor. They will begin sending you weekly payments, either by a Georgia UI Way2Go Debit MasterCard®, which will be mailed to your home, or through direct deposit – you can choose which option you prefer.

Other things to know

As stated above, you can choose to have your unemployment wages taxed before you receive them, or wait to pay those taxes until filing for 2020 next spring. If you do choose to have taxes taken out, there will be 10% taken for federal taxes and 6% for state taxes.