The best way is to apply online with the unemployment office in the state where you last worked, ideally late at night or early in the morning when web traffic is lower. If you're a gig worker who works in multiple states — driving a car for Lyft, for instance — you can apply for benefits in any state where you worked.

Full Answer

Can gig workers get unemployment benefits?

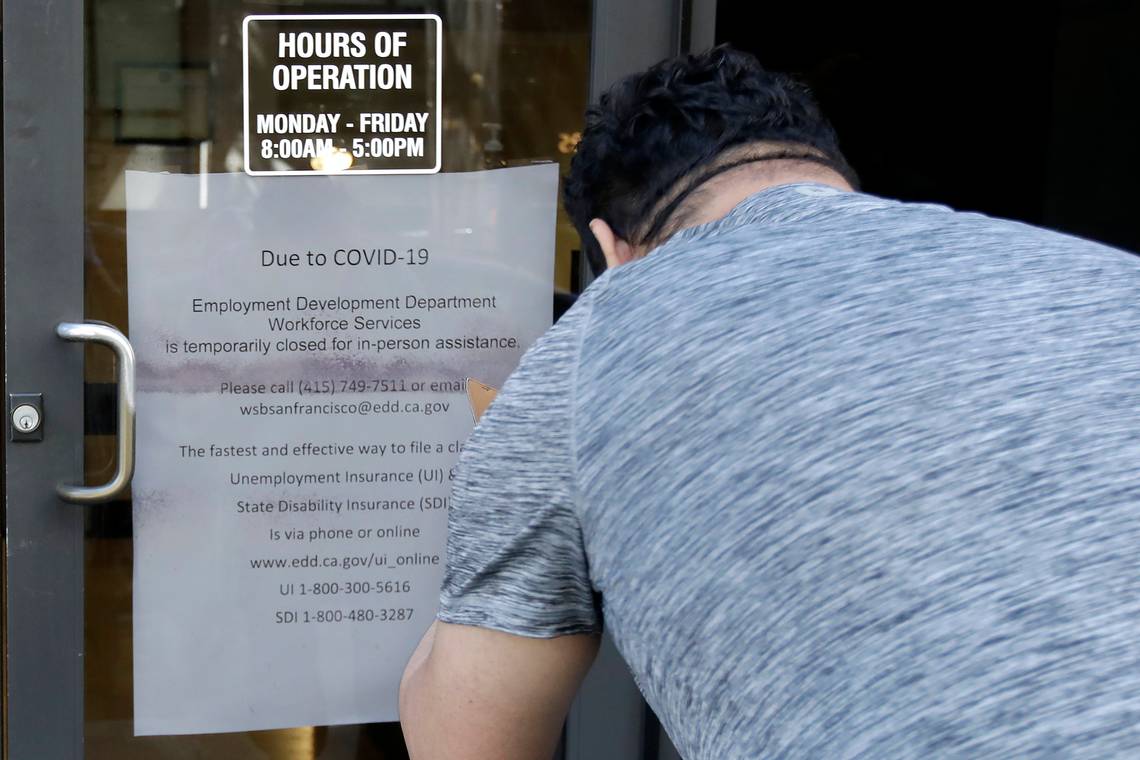

What Gig Workers Need To Know About Collecting Unemployment Here are answers to gig workers' common questions about collecting benefits in Maryland, D.C. and Virginia. Gig workers and self-employed people are facing delays and confusion when applying for unemployment benefits during the pandemic. This story is current as of 9:30 a.m. on April 27.

What if I didn't report income from gig work or unemployment?

If a taxpayer didn't report income from gig work or unemployment compensation on a return, a corrected return can be filed using Form 1040-X, Amended U.S. Individual Income Tax Return. Form 1040-X can be filed electronically.

Do gig workers get benefits in all states?

If you're a gig worker who works in multiple states — driving a car for Lyft, for instance — you can apply for benefits in any state where you worked. The smart move is to apply in the jurisdiction that gives you the most money. (D.C. pays more than Virginia or Maryland. More on that in the next section.)

How do I apply for extended unemployment benefits?

You can apply for extended benefits only once you've run out of regular benefits. Check with your state; not everyone qualifies. You must report unemployment benefits as income on your tax return. Federal agencies offer many unemployment education and training programs. They are generally free or low cost to the unemployed.

How do I apply for unemployment as a gig worker in California?

If you are out of work or had your hours reduced, you may be eligible to receive unemployment benefits from California's Employment Development Department (EDD). First register or log in at Benefit Programs Online, then apply for unemployment benefits on UI Online℠.

How do you prove income for a gig worker?

How to Provide Proof of IncomeAnnual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. ... 1099 Forms. ... Bank Statements. ... Profit/Loss Statements. ... Self-Employed Pay Stubs.

Who qualifies for pandemic unemployment in California?

You must also have been unemployed, partially unemployed, or unable or unavailable to work due to at least one of the following reasons to be eligible for PUA: My place of employment was closed as a direct result of the COVID-19 public health emergency.

Who can apply for pandemic unemployment in NY?

Quit a job as a direct result of COVID-19; Place of employment closed as a direct result of COVID-19; Had insufficient work history and affected by COVID-19; Otherwise not qualified for regular or extended UI benefits and affected by COVID-19.

Are gig economy workers self-employed?

Gig economy workers have traditionally been classified as self-employed for employment law purposes. A 'genuinely' self-employed person is their own boss and so needs no protection under employment law.

How do I prove my income if unemployed?

Proof of Income Sources for PUAFederal tax return (Internal Revenue Service (IRS) Form 1040, Schedule C or F).State tax return.W-2 form if they worked as an independent contractor and employee.Pay stubs or statements.Payroll history.Bank statements.Business records.Contracts for work.More items...•

Is pandemic unemployment still available?

The COVID-19 Pandemic Unemployment Payment (PUP) was a social welfare payment for employees and self-employed people who lost all their employment due to the COVID-19 public health emergency. The PUP scheme is closed.

Can self-employed get unemployment benefits in California?

If you are self-employed, you may have benefits available from EDD unemployment insurance programs that you or your employer may have paid into over the past 5 to 18 months. You may have contributions from a prior job, or you could have been misclassified as an independent contractor instead of an employee.

Is Pua extended in California?

Pandemic Unemployment Assistance PUA benefits ended September 4, 2021. The last day to apply for PUA was October 6, 2021, for weeks of unemployment before September 4. Federal law does not allow PUA benefits to be paid for weeks of unemployment after September 4, even if there is a balance remaining on your claim.

How do I file for unemployment if I am self-employed in NY?

Call our Telephone Claim Center, toll-free during business hours to file a claim.1-888-209-8124.Telephone filing hours are as follows: Monday through Friday, 8 am to 5 pm.

Can self-employed get unemployment?

Self-employed people can become unemployed if their business has to close down. It may also be the case, though you continue to be self-employed the amount of work you are getting has reduced so much that it no longer provides you with a sufficient income.

Is Nys still giving pandemic unemployment?

Regular Unemployment Insurance The Pandemic Emergency Unemployment Compensation Program (PEUC) provided 53 weeks of additional benefits. It went into effect April 5, 2020 and expired the benefit week ending September 5, 2021.

What do gig workers need to know about unemployment?

Gig workers and self-employed people are facing delays and confusion when applying for unemployment benefits during the pandemic.

How long can you collect unemployment in Virginia?

The maximum weekly benefit in Virginia is $378, Maryland's is $430 and D.C.'s is $444. Claimants can collect benefits for up to 39 weeks, or about nine months.

When will the extra 600 be paid?

Gig workers can collect this money for work lost after March 27, and it will be paid until July 31, 2020.

Which states are accepting self employed claims?

More on that in the next section.) D.C., Maryland and Virginia are all accepting claims from self-employed people as of April 27. Virginia and D.C. require self-employed applicants (and anyone else eligible for PUA benefits) to be rejected for regular unemployment insurance before they apply for CARES Act benefits.

Can gig workers get PUA?

Yes. The latest guidance from the Department of Labor clarifies that gig workers who have lost most of their income due to the pandemic are eligible for PUA benefits. You don't have to wait for Uber or Lyft to shut down in order to qualify.

Who is considered self employed?

Self-employed individuals; People seeking part-time work; Existing claimants who have maxed out their unemployment benefits (technically called "exhaustees"); Clergy and employees of religious organizations; People without sufficient work history normally required to qualify for benefits. Article continues below.

When will the 600 supplement be distributed?

says it will distribute the first federal payments April 21. But this only applies to people who have approved applications by those dates.

How do I apply for PUA?

If you were already filing biweekly for PUA before the program ended, you can begin filing using that same dashboard anytime between Friday, Jan. 22 to Friday, Jan. 29. Missing the Jan. 29 deadline means you’ll have to email [email protected] to request backdating.

When will PUA benefits be distributed?

Tuesday, Jan, 26, is the earliest possible date Pennsylvanians who apply and qualify for the benefits will receive them, according to the state.

Is there a difference between the CARES Act and the PUA Program Extension?

At the beginning of the pandemic, many workers lost their jobs. Former US President Donald Trump approved a law concerning Unemployment Insurance (UI) benefits. That law provided a stimulus to the unemployed during the pandemic. That bill (the CARES Act) was a response to the COVID-19 situation.

The extension of PUA provides benefits for gig workers

The extension provides a safety net for workers who had lost their income because of COVID-19. If workers meet the PUA rules, they will receive additional 11 weeks of UI benefits.

Gig workers ought to give precise documentation

Gig workers and others who are eligible for PUA benefits need to provide specific documents. And they should have these documents before filing for benefits. The simplest way of fulfilling the requirements is to provide tax documents from previous years.

How many steps are there to get unemployment?

While applying for unemployment benefits is generally a one-step process for traditional salaried workers receiving a W-2, it’s become a two -step process for the self-employed, gig and other workers in most states, according to experts.

What is the law on weekly pay for jobless workers?

The law raised weekly pay for jobless workers, increased the duration of those payments and extended benefits to previously ineligible workers. The latter group includes self-employed individuals, gig workers like Lyft and Uber drivers, independent contractors, people seeking part-time employment and others whose work or ability to work has been ...

Can self employed people file for unemployment?

But the process has been especially fraught for self-employed workers and others, like those in the so-called gig economy, who are newly eligible to collect unemployment benefits .

How much is the weekly unemployment benefit?

Non-traditional applicants who are eligible will qualify for a base weekly benefit amount of $207, plus the additional $600 Federal Pandemic Unemployment Compensation ( FPUC) payment per week. Self-employed, contract and gig workers must submit their 2019 IRS 1040 Schedule C, F or SE prior to December 26, 2020 by fax or mail: Fax: (512) 936-3250.

How to contact TWC?

For details on TWC and the services it offers in coordination with its network of local workforce development boards, call 512-463-8942 or visit www.texasworkforce.org. To receive notifications about TWC programs and services subscribe to our email updates. Return to Top.

Does unemployment affect PUA?

The initial denial for unemployment insurance may cause confusion but does not affect the PUA eligibility. Those who have already submitted claims should not reapply. They should continue to request benefit payment every two weeks while TWC enrolls them in PUA. Applicants do not need to call TWC.

Does TWC denial PUA?

The initial denial for unemployment insurance may cause confusion but does not affect the PUA eligibility.

How long does unemployment last?

Extended unemployment insurance benefits last for 13 weeks. You can apply for extended benefits only once you've run out of regular benefits. Check with your state; not everyone qualifies. You must report unemployment benefits as income on your tax return.

What is the extension for unemployment in 2021?

The American Rescue Plan Act of 2021 temporarily authorized: An extension for people already receiving unemployment benefits. Automatic, additional payments of $300 per week to everyone qualified for unemployment benefits. Extension of the Pandemic Unemployment Assistance (PUA) program for self-employed or gig workers.

What to do if you are terminated by an employer?

If you are an employer seeking information about legal termination of employees, you may wish to contact both the Equal Employment Opportunity Commission (EEOC) and your State Labor Office to ensure you do not violate any federal or state labor laws. You may wish to consult with a licensed attorney.

What to do if you lose your job?

Apply for Unemployment Benefits. There are a variety of benefit and aid programs to help you if you lose your job. CareerOneStop.org is a good place to start. It can help with unemployment insurance benefits, job training, and finding a job. Open All +.

What to do if you get hurt working for a private company?

Private Sector and State or Local Government Employees. If you get hurt working for a private company or state or local government, seek help through your state. Your state workers' compensation program can help you file a claim. If your claim is denied, you can appeal.

What is workers comp?

Workers' compensation laws protect employees who get hurt on the job or sick from it. The laws establish workers’ comp, a form of insurance that employers pay for. These laws vary from state to state and for federal employees.

What happens if you can't work?

If you can't work because you are sick or injured, disability insurance will pay part of your income. You may be able to get insurance through your employer. You can also buy your own policy.

COVID-19 Unemployment Benefits

The federal government allowed states to change their laws to provide COVID-19 unemployment benefits for people whose jobs have been affected by the coronavirus pandemic.

Find COVID-19 Vaccine Locations With Vaccines.gov

Vaccines.gov makes it easy to find COVID-19 vaccination sites. Select which vaccine you want and search by zip code. Depending on your location, you may be able to choose from pharmacies, health department clinics, and other health care providers.

Do you have a question?

Ask a real person any government-related question for free. They'll get you the answer or let you know where to find it.