- Register for a new account here. If you have an existing State of California Employment Development Department (EDD), just login with your account info.

- Once you register you will need to verify your email. So check your email asap.

- Once verified, you will be prompted to return to the Benefit Programs Online and login with your new account. ...

How much does Pua pay?

How much does PUA pay each week? The PUA benefit is based on your income from the 2019 tax year. You must provide proof of income via 1040 tax forms. The minimum weekly benefit amount is $169, while the maximum is $461.

How to fill out Pua application?

- When accessing the ReEmployCT system the for first time, click the "Create PUA Account" button and answer the questions to create your account.

- After submitting your account, you will be navigated back to the ReEmployCT log-in page.

- Log into your PUA account by entering your User ID and Password.

- Verify your email address.

Is Pua taxable income in California?

Yes, you do have to report your PUA benefits as earned income when you file taxes. You will get a 1099-G form in the mail that lists your income from PUA, PUC, and the Lost Wage Assistance program from the end of the summer (the previous extra $300 per week).

How do I appeal Pua?

PUA appeals can only be submitted online through the EmployNV.gov portal. To file an appeal, claimants need to log in to their EmployNV accounts, click on the Unemployment Services link and select “File an Appeal.” How do I appeal a case in Nevada? To appeal a district court case, you must file a Notice of Appeal with the district court ...

How much is Pua benefits California?

The minimum weekly benefit amount is $40. The maximum weekly benefit amount is $450. Under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, discussed below, eligible individuals may qualify for an extra $600 weekly payment.

How do I apply for COVID-19 unemployment benefits $600?

How Do I Apply? To receive unemployment insurance benefits, you need to file a claim with the unemployment insurance program in the state where you worked. Depending on the state, claims may be filed in person, by telephone, or online.

Can I still apply for Pua?

PUA benefits ended September 4, 2021. The last day you could apply for a PUA claim was October 6, 2021, for weeks of unemployment before September 4. For more information about the ending of federal unemployment benefit programs, visit Federal Provisions for Unemployment.

Is pandemic unemployment still available?

The COVID-19 Pandemic Unemployment Payment (PUP) was a social welfare payment for employees and self-employed people who lost all their employment due to the COVID-19 public health emergency. The PUP scheme is closed.

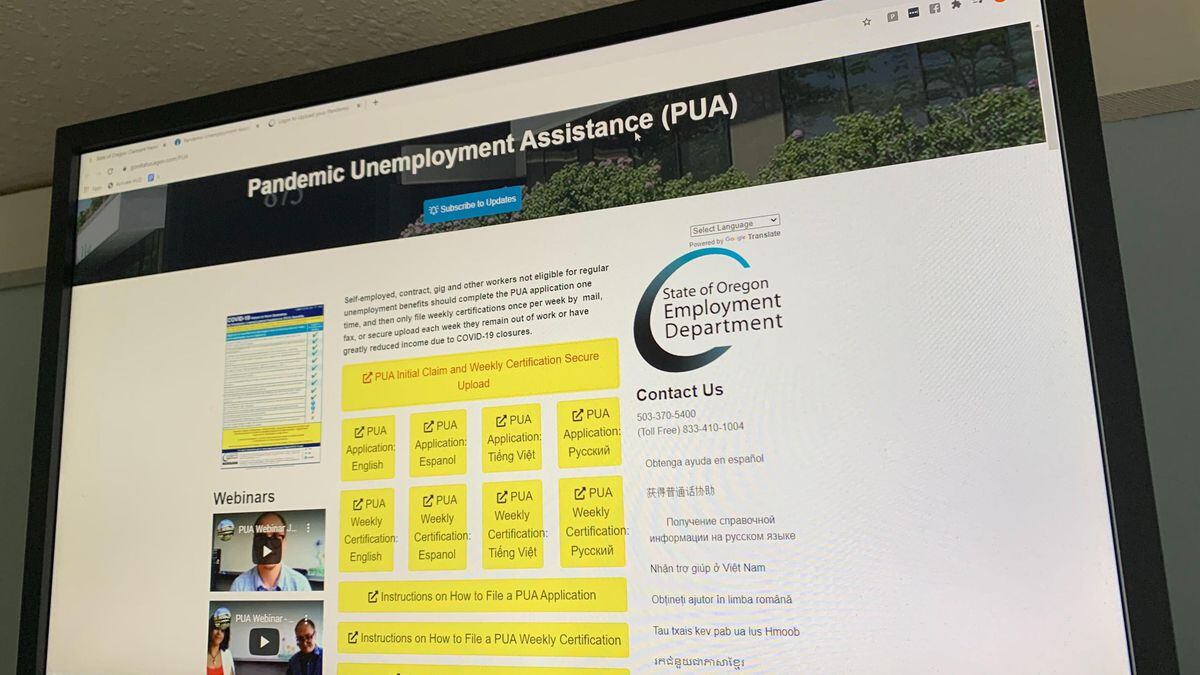

What is PUA in unemployment?

Pandemic Unemployment Assistance (PUA) Program. This is a newly available emergency unemployment assistance program under the federal CARES Act. PUA provides assistance for unemployed or partially unemployed individuals who are not eligible for regular unemployment insurance and who are unable or unavailable to work due to COVID-19 related ...

How much is PUA in 2020?

If you qualify for PUA the initial payments you will receive are as follows: $167.00 per week, for each week from February 2, 2020 to March 28, 2020 that you were unemployed due to a COVID-19 related reason . AND.

How often do you have to backdate your PUA?

If you qualify for your claim to be backdated to an earlier PUA effective date based on your last day of work, you could receive payment for prior weeks you were unemployed due to COVID-19. You will be required to provide the EDD eligibility information every two weeks. This is known as certifying for benefits.

When does PUA end?

Similarly, the PUA program has a legislative end date of 12/31/20, but for most Californians the last full week of benefits will end on 12/26/20. 1.

What does it mean when you collect unemployment?

This means that you were qualified for regular UI but have exhausted those benefits, as well as any extended benefits. 2.

How much is unemployment in 2020?

AND. $167.00 per week, for each week from July 26, 2020 to December 26, 2020, that you are unemployed due to a COVID-19 related reason, up to a total of 39 weeks (minus any weeks of regular UI and certain extended UI benefits that you have received).

When does the $600 CARES Act end?

Last week is week ending December 26, 2020.**. ** Under the CARES Act of 2020, the $600 additional benefits are available through 07/31/20. However, the U.S. DOL has issued guidance to clarify that, for most Californians, the last full week of benefits will end on 07/25/20. Similarly, the PUA program has a legislative end date of 12/31/20, ...

Who is eligible for PUA?

Pandemic Unemployment Assistance (PUA) If you are a business owner, independent contractor, self-employed worker, freelancer, or gig worker and only received a 1099 tax form last year , you are most likely eligible for PUA.

What happens if you run out of unemployment benefits?

If you have run out of benefits, you are unemployed, and your benefit year has expired, reapply for benefits through UI Online. If you have run out of benefits but you are still within the one year that your claim is good for, and your benefits: Ran out before February 2, you are probably not eligible for PUA.

Why do you have to quarantine if you are caring for a dependent?

You are caring for a dependent during the work day because their school or another care facility has closed due to COVID-19. Your healthcare provider has told you to self-quarantine because of COVID-19. You have become the main income provider due to a COVID-19 death in your household.

Can I get paid family leave if I am not eligible for UI?

If you’re not eligible for UI, you may be eligible for Disability Insurance or Paid Family Leave. You usually qualify if you paid into the State Disability Insurance program (noted as “CASDI” on paystubs), via taxes.

Can I still get unemployment if I work?

You can still receive unemployment benefits while working, depending on your pay. Your child’s school is closed, and you need to miss work to care for them. Your previous UI claim has expired. If you're already receiving UI, review Receive your benefits to learn how your UI claim may be affected by COVID-19.

Can I get unemployment if I am out of work?

If you are out of work or had your hours reduced, you may be eligible to receive unemployment benefits from California’s Employment Development Department ( EDD). First register or log in at Benefit Programs Online, then apply for unemployment benefits on UI Online℠. Go to Benefit Programs Online.

When will PUA back pay?

We will back pay you for the weeks you are eligible to receive benefits. PUA supports claims between February 2 and December 26, 2020. Claims between March 29 and July 25, 2020 are eligible for an additional, taxable $600 every week.

How to apply for unemployment in the US?

1. Register with Benefit Programs Online. The fastest way to apply for all unemployment benefits is through UI Online. After you have registered for a Benefit Programs Online account, you can get started on UI Online. You can still apply for UI by phone, mail, or fax. Go to Benefit Programs Online. 2.

Can I get unemployment if I am out of work?

If you are out of work or had your hours reduced, you may be eligible to receive unemployment benefits from California’s Employment Development Department (EDD). First register or log in at Benefit Programs Online, then apply for unemployment benefits on UI Online℠.

Eligibility

- PUA benefits were available if you did not qualify for regular unemployment benefits and were out of business or had significantly reduced your services as a direct result of the pandemic. The following were eligible for PUA: 1. Business owners. 2. Self-employed workers. 3. Independent …

Self-Employment and Employment Documentation

- Federal rules require that you provide documentation to prove you were, or planned to be, self-employed or employed at some point during the calendar year before and up to the start of your PUA claim. For example: 1. If your claim started in December 2020, you will need to provide documentation for some time between January 1, 2019, and the start date of your claim in 2020…

Pua Reassessment

- Recent federal guidance added three new reasons and updated the existing reasons unemployed Californians can use to explain why they were out of work during the COVID-19 public health emergency. If you were previously denied benefits for one or more weeks under the PUA program, you will receive a message in your UI Online account with instructions on how to complete the P…

Your Claim Date

- Your claim start date was the Sunday of the week you applied for unemployment. For PUA applications received on or after December 27, 2020, the earliest start date for a claim was December 6, 2020.

Additional Resources

- America’s Job Center of CaliforniaSM– Provides employment assistance.

- COVID-19: Unemployment Claims– Learn what to expect after you file your claim