To be eligible for Unemployment Insurance (UI) benefits, you must:

- Have earned at least: $5,700 during the last 4 completed calendar quarters, and 30 times the weekly benefit amount you would be eligible to collect

- Be legally authorized to work in the U.S.

- Be unemployed, or working significantly reduced hours, through no fault of your own

- Be able and willing to begin suitable work without delay when offered

- Have earned enough wages during the base period.

- Be totally or partially unemployed.

- Be unemployed through no fault of your own.

- Be physically able to work.

- Be available for work.

- Be ready and willing to accept work immediately.

What are the rules for filing for unemployment benefits?

Townsend says nearly 68,000 Iowans are qualified for unemployment benefits today. Townsend plans to hire 18 people to counsel unemployed Iowans and she will seek to redefine what qualifies as work search activities that are required of Iowans receiving jobless benefits.

How do I become eligible for unemployment benefits?

- If you are not available or unable to work

- If you have not actively sought work

- If you quit your job without good cause

- If you were discharged from your job due to misconduct or for other just causes such as unexcused absences or violations of company rules

- If you are in a training program that limits your availability to work

What are the criteria for unemployment benefits?

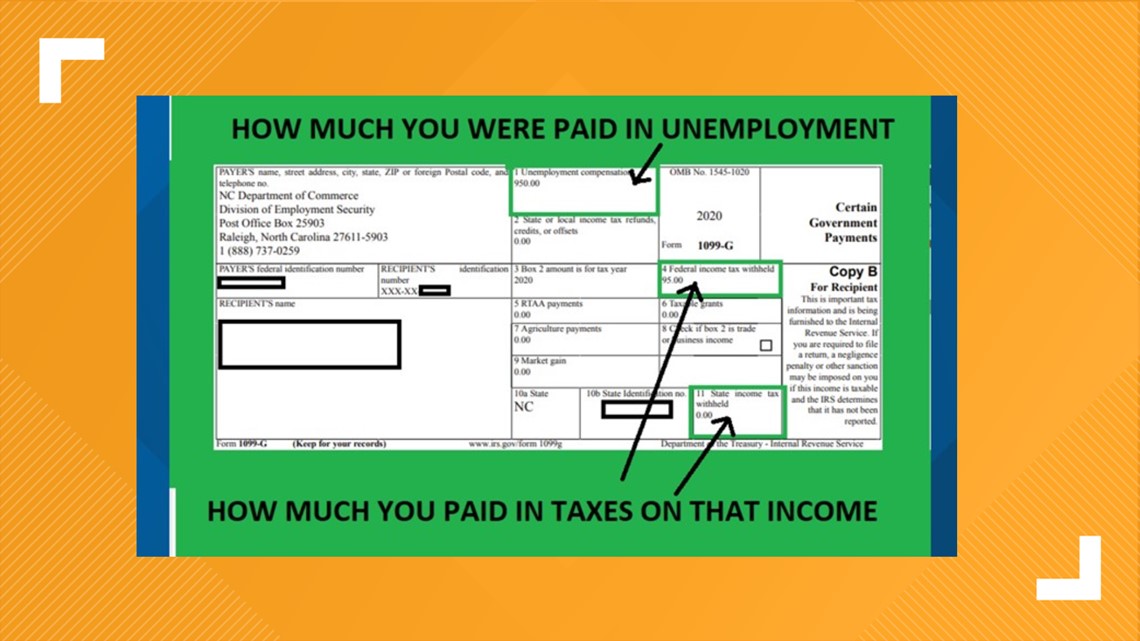

Victims will find out this tax season

- Identity theft linked to unemployment benefits surged during the Covid-19 pandemic.

- Unsuspecting victims may get a 1099-G tax form detailing benefits they didn’t receive.

- The good news: They don’t owe tax on those fraudulent benefits. But there are steps they need to take to protect against financial harm.

How many months must someone work to qualify for unemployment?

To qualify for unemployment benefits, you must have worked long enough at a job to be monetarily eligible for unemployment. To calculate your eligibility, divide the last 15 months into five periods of three months, starting from the day you file for unemployment. Exclude the most recent three months from this calculation.

Who qualifies for NY pandemic unemployment?

Quit a job as a direct result of COVID-19; Place of employment closed as a direct result of COVID-19; Had insufficient work history and affected by COVID-19; Otherwise not qualified for regular or extended UI benefits and affected by COVID-19.

How many months do you need to work to qualify for unemployment in NY?

1. You must have worked for at least two calendar quarters. A calendar quarter is three months of the year. In other words, you cannot claim unemployment benefits unless you have worked for at least six months.

What can disqualify you from unemployment benefits in Texas?

You may be eligible for benefits if you were fired for reasons other than misconduct. Examples of misconduct that could make you ineligible include violation of company policy, violation of law, neglect or mismanagement of your position, or failure to perform your work adequately if you are capable of doing so.

How long after being laid off can I file for unemployment Texas?

You should apply for benefits as soon as you become unemployed. When you apply for unemployment benefits, the effective date of your initial claim is the Sunday of the week in which you apply. We cannot pay benefits for weeks before your claim effective date.

How much unemployment will I get?

The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount, which can range from $40 to $450 per week. Once you submit your application, we will verify your eligibility and wage information to determine your weekly benefit amount.

Can you file for unemployment if you quit?

Unemployment benefits are provided only to those who are out of work through no fault of their own. That means if you left your job voluntarily, you usually won't qualify for unemployment. A major exception is that you can still collect unemployment if you "good cause" to quit.

Who qualifies for unemployment in Texas Covid?

Pandemic Unemployment Assistance provides up to 39 weeks of unemployment benefits for persons impacted by COVID-19 and covers individuals who are self-employed, who otherwise would not qualify for regular unemployment compensation, or who have exhausted state benefits.

How long do you have to work at a job to get unemployment in Texas?

Who is eligible for Texas Unemployment Benefits? To be eligible for this benefit program, you must a resident of Texas and meet all of the following: Be unemployed or working reduced hours though no fault of your own, and. Worked in Texas during the past 12 months (this period may be longer in some cases), and.

How many hours can you work and still get unemployment in Texas?

If you work part time, you can earn up to 25 percent of your weekly benefit amount (WBA) before TWC reduces your benefit payment. For example, if your WBA is $160, you may earn $40 without a reduction. If you earn $50, we reduce your WBA for the week to $150.

What reasons can you be denied unemployment in Texas?

Common reasons why unemployment claims are denied include:Failing to Meet the Earnings Requirements. To qualify for benefits in Texas (as in most states), you must have earned a minimum amount in wages during a 12-month stretch called the "base period."Getting Fired for Misconduct. ... Quitting Your Last Job.

Do you have to pay back unemployment in Texas?

State law requires that you repay your overpayment before we can pay further unemployment benefits. TWC cannot dismiss or forgive an overpayment, and there is no exception in the law for hardship cases.

What is the maximum unemployment benefit in Texas 2020?

Amount and Duration of Unemployment Benefits in Texas As explained above, the Texas Workforce Commission determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 25, up to a maximum of $535 per week. Benefits are available for up to 26 weeks.

COVID-19 Unemployment Benefits

COVID-19 extended unemployment benefits from the federal government have ended. But you may still qualify for unemployment benefits from your state...

How to Apply for Unemployment Benefits

There are a variety of benefit and aid programs to help you if you lose your job. CareerOneStop.org is a good place to start. It can help with unem...

Continuation of Health Coverage: COBRA

Learn how you can continue your health care coverage through COBRA.What is COBRA?COBRA is the Consolidated Omnibus Budget Reconciliation Act. COBRA...

Short-Term and Long-Term Disability Insurance

If you can't work because you are sick or injured, disability insurance will pay part of your income. You may be able to get insurance through your...

Workers' Compensation for Illness or Injury on the Job

Workers' compensation laws protect employees who get hurt on the job or sick from it. The laws establish workers’ comp, a form of insurance that em...

Wrongful Discharge/Termination of Employment

If you feel that you have been wrongfully fired from a job or let go from an employment situation, you may wish to learn more about your state's wr...

Welfare or Temporary Assistance for Needy Families (TANF)

Temporary Assistance for Needy Families (TANF) is a federally funded, state-run benefits program. Also known as welfare, TANF helps families achiev...

Why Do Unemployment Benefits Have To End

Unemployment benefits provide a safety net for workers who are laid off from their jobs, until they can get work again. They are not meant to be a permanent solution.

The Importance Of Your Unemployment Base Period

Unemployment insurance benefits are calculated for hours you work and income you earn in what is known as a base period. Literally defined, a base period is information used to base the amount of benefits you will receive.

How Do I Qualify For Unemployment Benefits

To qualify for unemployment benefits, we look at the wages you were paid in the first four of the last five calendar quarters the standard base period.

When And How Will I Be Paid My Weekly Unemployment

Florida unemployment benefit recipients can receive benefits electronically through the use of a debit card. These debit cards serve as an alternative method for your Florida unemployment compensation. Payments are conveniently and automatically directly deposited into a personal debit card account.

Who Is Eligible For Unemployment Insurance

Unemployment eligibility requirements vary from state to state. They can also change due to unexpected economic circumstances, as seen during the height of the COVID-19 pandemic, or during other periods of high unemployment. This means youll want to check out your states current requirements when youre ready to file your claim.

New York Unemployment Benefits And Eligibility

COVID-19 UPDATE: Because the coronavirus pandemic has left so many Americans jobless, the federal government has given states more flexibility in granting unemployment benefits.

How Much Money Will I Receive

According to the Bureau of Labor Statistics, the typical US worker earned about $1,000 a week at the end of 2019. Weekly unemployment benefit payouts typically replace about 40 to 45% of that median paycheck amount — but vary by state California residents, for example, get about $450 a week.

How Long Does It Take To Receive Unemployment Benefits

Once you submit your claim, you should expect to wait at least three weeks before hearing whether you were approved. However, since unemployment claims have skyrocketed because of the coronavirus pandemic, it may now take even longer to receive a verdict on your application, said David Bakke, human resource specialist at DollarSanity.

Do All The Unemployed Get Ui

No. In ordinary times, most unemployed workers dont receive UI benefits. UI does not cover people who leave their jobs voluntarily, people looking for their first jobs, and people reentering the labor force after leaving voluntarily.

How Do I Become Eligible For Unemployment Benefits

When a person becomes unemployed, it can become a financial hardship if the individual is not eligible for unemployment benefits. In the United States, the US Department of Labor determines eligibility for unemployment compensation. Most countries with large labor forces have the same basic guidelines as the US for unemployment benefits.

Do I Qualify For Unemployment Insurance

There are things you need to know before you apply, and steps you must take after filing your claim for unemployment insurance benefits.

Did Not Work In Washington State

You;cannot;apply for unemployment benefits in Washington or file weekly claims here if you did not work in this state during the past 18 months. The;only;exceptions are if you were in the military or worked for the federal government.

You Have Paid Ei Premiums

If you are employed in insurable employment, your employer will deduct EI premiums from your wages or salary. These premiums go into the EI Fund. There is no minimum or maximum age for paying EI premiums.

How Do I Become Eligible For Unemployment

The only requirement for unemployment is to be out of work, but in order to be eligible for unemployment compensation, a worker must meet certain criteria mandated by the state in which he or she resides.

How long does unemployment last?

Extended unemployment insurance benefits last for 13 weeks. You can apply for extended benefits only once you've run out of regular benefits. Check with your state; not everyone qualifies. You must report unemployment benefits as income on your tax return.

What is the extension for unemployment in 2021?

The American Rescue Plan Act of 2021 temporarily authorized: An extension for people already receiving unemployment benefits. Automatic, additional payments of $300 per week to everyone qualified for unemployment benefits. Extension of the Pandemic Unemployment Assistance (PUA) program for self-employed or gig workers.

What to do if you are terminated by an employer?

If you are an employer seeking information about legal termination of employees, you may wish to contact both the Equal Employment Opportunity Commission (EEOC) and your State Labor Office to ensure you do not violate any federal or state labor laws. You may wish to consult with a licensed attorney.

What to do if you lose your job?

Apply for Unemployment Benefits. There are a variety of benefit and aid programs to help you if you lose your job. CareerOneStop.org is a good place to start. It can help with unemployment insurance benefits, job training, and finding a job. Open All +.

What is workers comp?

Workers' compensation laws protect employees who get hurt on the job or sick from it. The laws establish workers’ comp, a form of insurance that employers pay for. These laws vary from state to state and for federal employees.

How long does a disability policy last?

Types of Disability Policies. There are two types of disability policies. Short-term policies may pay for up to two years. Most last for a few months to a year. Long-term policies may pay benefits for a few years or until the disability ends.

Can an employer let an employee go without notice?

Some states are "employment-at-will" states, which means that if there is no employment contract (or collective bargaining agreement), an employer can let an employee go for any reason, or no reason, with or without notice, as long as the discharge does not violate a law.

How to find out your state's unemployment rules?

To find out your state's rules, visit its website; for links to each state's agency, see State Unemployment Agencies .

What is unemployment insurance?

Unemployment insurance is a joint program of the federal and state governments. State law determines who is eligible for benefits, how much they will receive, and for how long. Generally speaking, applicants must meet these three requirements to qualify for benefits: They must be out of work through no fault of their own.

What is the definition of "able, available, and actively seeking work"?

Able, Available, and Actively Seeking Work. To get benefits, applicants must show that they are able to work and looking for a new job. If, for example, you are temporarily disabled or injured and unable to work, some states will not allow you to collect benefits for that period of time.

How long is the base period for unemployment?

In almost every state, the base period is a one-year period , consisting of the earlier four of the last five complete calendar quarters before you applied for unemployment.

Can you get unemployment if you refuse a drug test?

In many states, an employee who fails or refuses to take a drug test is not eligible for unemployment. Even if you are not eligible for unemployment because you were fired for misconduct, this might be only a temporary disqualification. Some states consider an employee who was fired for serious misconduct to be ineligible for benefits, period.

Do you have to be a temporary worker to collect unemployment?

Benefits aren't available to those who have been out of work for a long time or have only held very limited jobs (occasional or seasonal work, for example). In other words, your unemployment must be temporary.

Do you have to be looking for work to collect benefits?

In every state, you must be looking for work to collect benefits. What qualifies as an adequate job search depends on how things work in your field . For retail positions, you might go to stores, ask about openings, and complete job applications.

What is the eligibility for unemployment?

When you apply for Unemployment Insurance (UI), your initial eligibility for benefits is based on a number of factors, including your earnings and your reason for leaving your job. Ongoing eligibility requirements include being able to work, available for work, and actively searching for work.

How do I get unemployment benefits?

To be eligible (UI) benefits, you must: 1 Have earned at least:#N#$5,400 during the last 4 completed calendar quarters, and#N#26 times the weekly benefit amount you would be eligible to collect 2 Be legally authorized to work in the U.S. 3 Be unemployed, or working significantly reduced hours, through no fault of your own 4 Be able and willing to begin suitable work without delay when offered

What is unemployment insurance?

Unemployment Insurance (UI) eligibility and benefit amounts. Unemployment Insurance (UI) offers benefits to workers who have lost their jobs through no fault of their own. Learn more about eligibility, and how your benefits are determined. Skip table of contents.

What happens if there is an issue on your claim?

If there is an issue on your claim, a determination will be sent, which indicates whether or not you are eligible for benefits.

How much is the maximum UI benefit in 2021?

As of Oct. 3, 2021, the maximum weekly benefit amount is $974 per week, which does not include any additional dependency allowance.

How much do you have to earn to collect unemployment?

To be eligible (UI) benefits, you must: Have earned at least: $5,400 during the last 4 completed calendar quarters, and. 26 times the weekly benefit amount you would be eligible to collect. Be legally authorized to work in the U.S.

What affects your weekly benefits?

Several factors can affect your weekly benefit amount including part-time work, self-employment, going to school full-time, and travel.

How is unemployment calculated?

Unemployment benefits are calculated as a percentage of your average pay over a recent 52-week period. Here’s how you can calculate your weekly benefit rate.

How often do you have to file a claim for unemployment?

After you have filed your initial application for UC benefits or reopened an existing application, you must file a claim for each week in which you are totally or partially unemployed.

How long does it take to get a biweekly unemployment claim in Pennsylvania?

It can take up to four to six weeks to receive the approval of your first biweekly claim.

How long does it take to get a weekly UC certification?

It can take several weeks to receive the approval of your first weekly certification if there is a UC eligibility issue with your employment. You should continue to file weekly certifications during this time.

How long does unemployment last?

Your initial claim will remain active for one year and between 18 and 26 full weeks of benefit payments will be available if you are eligible for benefits ( see the calculation of weekly benefit rate explanation ).

Did Pennsylvania have low unemployment?

Before the pandemic, Pennsylvania had low unemployment with a near-record number of people working and the UC office was appropriately staffed for those conditions.

What are the requirements to file for unemployment?

These requirements include being able, available, and actively searching for work; that you lost your job through no fault of your own; and that you earned enough wages during your base period to qualify for payments. Submit a claim for unemployment insurance if you meet all the requirements .

What are the requirements for unemployment in Indiana?

Requirement #1: You are able to work. Indiana unemployment laws require you to be able to find new work before you can receive benefits. You must be able to work. You must be available to work. You must be actively searching for a full-time job.

How to contact Indiana unemployment?

The DWD has FAQs and tutorials on its website. If you need additional assistance, you can reach the department’s benefit call center at 800-891-6499. TDD service is available at 317-232-7560. The call center is open on weekdays from 8 a.m. to 4:30 p.m.

How long can you collect unemployment in Indiana?

Indiana’s maximum time for collecting unemployment benefits is capped at 26 weeks plus any time allowed under federal guidelines. Know how and when you will be paid.

Does Indiana pay unemployment tax?

It’s important to know that only employers pay this tax, and it doesn’t come from your paycheck. For that reason, you meet certain Indiana unemployment requirements to qualify for unemployment benefits. The Indiana Department of Workforce Development (DWD) manages the state’s unemployment benefits program.