Calculate net benefits by subtracting the sum of direct and indirect costs from the sum of direct and indirect benefits. Costs and benefits are expressed in equivalent measures so that investors can see whether the benefits would outweigh the costs enough to make pursuing the project worthwhile.

- Calculate gross wages. ...

- Subtract pretax deductions and nontaxable arrangements from gross wages to arrive at taxable wages. ...

- Withhold taxes from taxable wages. ...

- Subtract after-tax deductions to arrive at net pay.

How do you calculate net benefits?

Calculate net benefits by subtracting the sum of direct and indirect costs from the sum of direct and indirect benefits. Costs and benefits are expressed in equivalent measures so that investors can see whether the benefits would outweigh the costs enough to make pursuing the project worthwhile. Identify all benefits that the project would produce.

How do you calculate a company's benefits load?

Find the benefit load by adding the total annual costs of all employees’ perks and divide it by all employees’ annual salaries to determine a ratio — that ratio is your company’s benefits load. For example, if your company pays $3,000/year total in benefits and $10,000/year total in salaries, your benefit load is 30% (3000/10,000).

What is the NETnet salary for job B?

Net salary for Job B falls to $29,100 ($29,600 net salary minus $500 of your $1,000 deductible) and will drop up to $500 more if you have additional health problems.

What is the purpose of the employee benefits calculator?

Benefits calculator help employee combine salary and benefits to calculate total compensation cost. When calculating salary costs for your employer pays, it is critical to include the costs of benefits in addition to the base pay rate for accurate costing in the employee benefits calculator.

How do I calculate net to gross?

Net vs gross You are a shop owner and you sell a huge chocolate bar for $40 . The sales tax or VAT (doesn't really matter in this case) is 25% . The gross price would be $40 + 25% = $40 + $10 = $50 . Net price is $40 , gross price is $50 and the tax is 25% .

How do I calculate my salary benefit?

The simplest method is to total the actual employer contributions to benefits and retirement and divide by the actual salary.

How are job benefits calculated?

Find the benefit load by adding the total annual costs of all employees' perks and divide it by all employees' annual salaries to determine a ratio — that ratio is your company's benefits load.

What is the percentage of benefits to salary?

32 percentAccording to the latest data from the U.S. Bureau of Labor Statistics (BLS), the average total compensation for all civilian employees in 2020 is $37.73 per hour. Benefits make up 32 percent of an employee's total compensation.

How to calculate time off?

To calculate the value of your time off, divide your salary by 260 to calculate your average pay per day. Then, multiply this value by the number of days off you receive per year.

What insurances do employers offer?

Insurances - health, life, disability. Many employers offer one or multiple types of insurances. For health insurance - add in the amount paid by your employer towards the cost of coverage. If your employer contributes to a Flexible Savings Account (FSA) or Health Savings Account (HSA), add this amount in as well.

Do you include the value of your benefits?

If you are not likely to utilize a benefit, do not include the value. Because some of your benefits may vary from year to year (like bonuses), it can be helpful to calculate your benefits twice - once with best case and once with worst case.

Is it easy to quantify benefits?

While the majority of benefits are easy to put a value on, there are others which do bring value to your life, but are not as easy to quantify. They tend to result in a time savings or added flexibility.

Is there more to total compensation than salary?

There is a lot more to your total compensation than just your salary. When calculating the total value of your compensation, you should also incorporate all the benefits you use or are likely to use. Your benefits may be clearly financial (bonuses, retirement contributions, etc.) or they may offer time savings or flexibility.

What is the deductible for job B?

The annual deductible is $1,000. Do the math: Job A: With a $30,000 salary and no annual cost for health insurance, your net salary is $30,000.

What is the difference between 401(k) and 403b?

What's the difference between them? A 401k lets you invest in any publicly traded securities, mutual funds and options. The 403b limits you to annuity contracts, mutual funds and money-market funds. Take the same two hypothetical jobs, Job A and its $30,000 salary and Job B with its $32,000 salary.

Do you take the time to analyze your health insurance?

You may be so desperate for health insurance that when you finally get an offer, you don't take the time to analyze its attached health plan. But that could cost you.

Why is it important to offer employee benefits?

You either have to do it because the law requires it, or you are highly encouraged to do so because 97% of workers say their benefits are important to how they feel about their job and workplace.

How much overtime do you have to pay for 40 hours a week?

Throwing a wrench in overtime pay budgeting is a new law passed in September of this year which raised the threshold under which salaried employees must be paid overtime for hours worked beyond 40/week from $23,660 to $35,568.

What is paid leave?

Paid leave comprises any time you’re paying an employee to not work. That includes allotted days for vacation or if someone gets sick, but also holidays. Check out this guide to find out if you live in a state that requires paid leave.

What is Supplemental Pay?

Supplemental pay. Supplemental pay includes any compensation awarded to workers outside of their normal wages, and is defined as a benefit by the BLS. This includes overtime pay, shift differential pay (compensation offered to employees that work outside of normal business hours), and any bonuses.

Do you have to factor in Social Security if you don't have a 401(k)?

But even if you don’t offer retirement savings plans, you still have to factor in required wage withholdings for Social Security and Medicare.

Do companies with 50 employees have to offer health insurance?

The employer mandate of the Affordable Care Act (ACA) says that companies with 50 or more FTE (full-time equivalent) employees must offer health insurance, but about one-third of businesses smaller than this offered health insurance last year anyway to attract job seekers and retain employees.

Is offering employee benefits expensive?

Offering employee benefits is an increasingly expensive proposition for businesses (benefits costs to employers have increased 368% over the last 14 years), and a complicated one. You can’t predict with absolute certainty who’s going to opt in and pay for voluntary benefits, or how much allotted PTO workers will actually use.

How to calculate net benefits?

Calculate net benefits by subtracting the sum of direct and indirect costs from the sum of direct and indirect benefits.

What are indirect and direct benefits?

This includes direct and indirect benefits. Direct benefits can be attributed directly to a project, such as the specific items that a new piece of equipment would produce. Indirect benefits are derived from a project, like the overtime dollars that a company would not have to pay because it could produce more items in less time.

Can benefits and costs be measured differently?

Benefits and costs may be measured differently, as units of time, input, output or money. But a common measure must be used in a cost-benefit analysis. For example, time must be converted to money. If a worker will spend eight hours operating a machine, then the amount of wages that worker earned based on his or her hourly rate may be compared to the dollar value of the items that the machine would produce in the same time.

How much does an employer match for retirement?

Employer matching is usually between 25 cents and a dollar for each dollar the employee contributes to the retirement account, up to a preset limit.

What is base salary?

The Base salary is just one part of employees' compensation. The Total Compensation Calculator is used to estimate the pay and benefits which make up the total compensation package for a given position. Additional monetary rewards, like salary bonuses and commissions are also part of it.

Why is pension important?

Because your employer probably pays the full cost of your pension plan (if you have one), pension plan benefits are an important component of the total compensation package. Your Summary Plan Descriptions (SPDs) or the plan document will tell you how much pension you accrue for your service.

What is total compensation?

Total compensation is the combination of salaries, wages, and benefits that employees receive in exchange for them doing a particular job. When the benefits calculator uses to evaluate job salary, there may get pay different based on the company industry divided.

What is 401(k) 403b?

The 401K/403b benefits in benefits calculator of the Internal Revenue Code allow employees to contribute to retirement plans. This code section has now become the de facto common name of a specific type of retirement plan. These tax-deferred saving plans allow employees to contribute by deferring compensation; these contributions may accumulate interest until disbursements are made. The interest and often the contributions are tax-deferred.

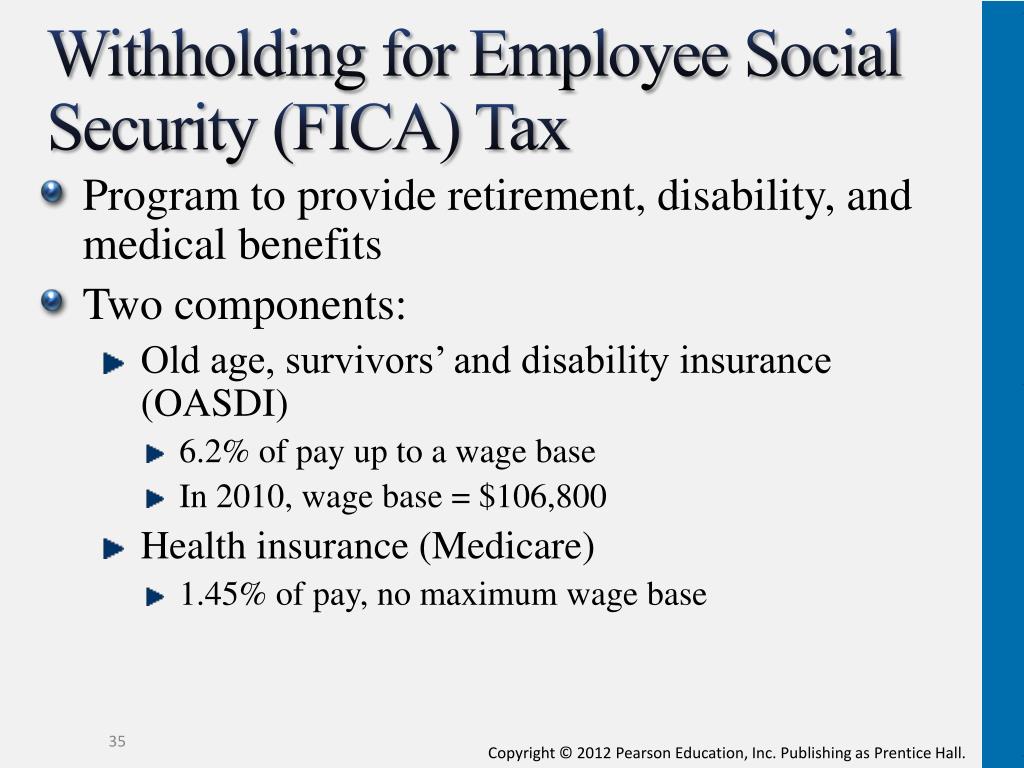

What is the FICA on a paycheck?

Often noted as FICA (Federal Insurance Contribution Act ) on your paystub, Social Security covers three benefits: disability, retirement, and Medicare. The FICA taxes you pay out of your paycheck and your employer's matching payment help fund these three programs.

How long does it take to get disability if you are out of work?

Short-term disability coverage usually does not begin until an eligible employee has been out of work for five to ten consecutive days.

Why is it important to calculate the value of perks?

Calculating the value of perks is important for one big reason: To manage effectively, you need to know exactly the total value of compensation (cost to the business) each of your employees receives, not just their salaries.

Does vacation prior to pay increase cost your company?

For example, an employee’s vacation prior to a pay increase will cost your company less than the employees’ vacation taken following that raise. In such a case, you would have to adjust the total compensation calculation accordingly.