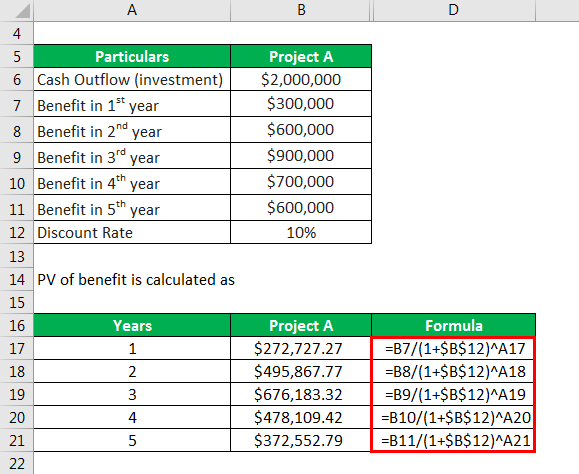

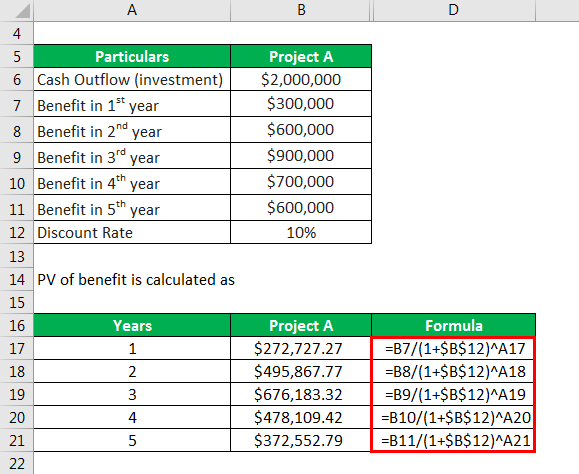

For calculating the cost-benefit ratio, follow the given steps:

- Calculate the future benefits.

- Calculate the present and future costs.

- Calculate the present value of future costs and benefits.

- Calculate the benefit-cost ratio using the formula Benefit-Cost Ratio = ∑ Present Value of Future Benefits / ∑ Present Value of Future Costs.

- If the benefit-cost ratio is greater than 1, go ahead with the project. ...

- The formula for Calculating BCR = PV of Benefit expected from the Project / PV of the cost of the Project.

- Project B.

- Step 2: Insert the relevant formula in cells C10 and C11.

- Step 3: Insert formula =B9*C9 in cell D9.

How to calculate benefit cost?

- Up to 85% of your Social Security may be taxable.

- If your provisional income is above $25,000 as a single filer or $32,000 as a joint filer, you may owe federal income taxes.

- You can pay estimated taxes quarterly, through benefit withholdings, or in full with your federal tax return.

How do you calculate cost benefit?

Benefit-Cost Ratio = ∑PV of all the Expected Benefits / ∑PV of all the Associated Costs Step 6: Now, the formula for net present value can be derived by deducting the sum of the present value of all the associated costs (step 4) from the sum of the present value of all the expected benefits (step 4) as shown below.

How do you calculate cost ratio?

Write your units in the problem.

- Example problem: If you have six boxes, and in every three boxes there are nine marbles, how many marbles do you have?

- Wrong method: 6 b o x e s ∗ 3 b o x e s 9 m a r b l e s = ...

- Right method: 6 b o x e s ∗ 9 m a r b l e s 3 b o x e s = {\displaystyle 6boxes* {\frac {9marbles} {3boxes}}=} 6 ...

What is cost benefit ratio?

The term “Benefit-Cost Ratio” refers to the financial metric that helps in assessing the viability of an upcoming project based on its expected costs and benefits. In other words, the ratio determines the relationship between the expected incremental benefit from a project and the corresponding costs that would be incurred to complete the project.

How do you calculate benefit/cost ratio?

The BCR is calculated by dividing the proposed total cash benefit of a project by the proposed total cash cost of the project.

How do you calculate PVR in Excel?

The PVR can be calculated by dividing the NPV of a project by the net present value of the capital expenditure outflows, discounted at the same rate as used for the NPV valuation.

How do you calculate cost ratio?

To calculate the ratio, divide the cost of revenue by the total revenue. Your answer will be a decimal, usually smaller than one.

How do you use the PV function in Excel?

PV, one of the financial functions, calculates the present value of a loan or an investment, based on a constant interest rate. You can use PV with either periodic, constant payments (such as a mortgage or other loan), or a future value that's your investment goal....Remarks.CUMIPMTPPMTFVSCHEDULEXIRRIPMTXNPVPMT2 more rows

How do you calculate NPV in cost benefit analysis?

NPV is calculated by subtracting the discounted costs from the discounted benefits. All projects with a positive NPV provide a net economic benefit. NPV should be used when comparing mutually exclusive project options.

What is a benefit ratio?

The benefit-cost ratio (BCR) is a profitability indicator used in cost-benefit analysis to determine the viability of cash flows generated from an asset or project. The BCR compares the present value of all benefits generated from a project/asset to the present value of all costs.

What does a benefit-cost ratio of 2.1 mean?

This means: A. The costs are 2.1 times the benefits.

What is cost-benefit analysis example?

For example: Build a new product will cost 100,000 with expected sales of 100,000 per unit (unit price = 2). The sales of benefits therefore are 200,000. The simple calculation for CBA for this project is 200,000 monetary benefit minus 100,000 cost equals a net benefit of 100,000.

What is cost benefit analysis?

The term “cost-benefit analysis” refers to the analytical technique that compares the benefits of a project with its associated costs. In other words, all the expected benefits out a project are placed on one side of the balance and the costs that have to be incurred are placed on the other side. The cost-benefit analysis can be executed ...

How to calculate cash inflow from a project?

Step 1: Firstly, Calculate all the cash inflow from the subject project, which is either revenue generation or savings due to operational efficiency. Step 2: Next, Calculate all the cash outflow into the project, which are the costs incurred in order to maintain and keep the project up and running.

What is the benefit cost ratio?

The benefit-cost ratio indicates the relationship between the cost and benefit of project or investment for analysis as it is shown by the present value of benefit expected divided by present value of cost which helps to determine the viability and value that can be derived from investment or project.

What is the benefit of using the benefit cost ratio?

The benefit of using the benefit-cost ratio (BCR) is that it helps to compare various projects in a single term and helps to decide faster which projects should be preferred and which projects should be rejected.

What does BCR mean in investment?

If the Benefit-Cost Ratio (BCR) is equal to one, the ratio will indicate that the NPV of investment inflows will equal investment’s outflows. Lastly, if the investment’s BCR is not more than one, the investment’s outflow shall outweigh the inflows or the benefits, and the project should not be taken into consideration.

How to calculate BCR?

To calculate the BCR formula, use the following steps: Step 1: Calculate the present value of the benefit expected from the project. The procedure to determine the present value is: Aggregate the amounts for all the years. Step 2: Calculate the present value of costs.

What are the limitations of BCR?

The major limitation of the BCR is that since it reduces the project to mere a number when the failure or success of the projector of expansion or investment etc. relies upon various variables and other factors, and those can be weakened by events which are unforeseen.

What is cost benefit analysis?

Cost benefit analysis, as the name suggests is a process of identifying all the costs & benefits of different decision choices and finding which choice offers maximum benefit for minimum cost. It is a generic technique and the implementation varies depending on situation, industry and available data.

What does unit cost formula feel like?

The unit cost formula felt like trying to catch a snitch while riding a broomstick upside down. Thankfully, the bulb replacement cost formula feels like sitting in the crowd, cheering match while eating chocolate frogs.

What is the benefit cost ratio?

What is the benefit-cost ratio formula? The benefit-cost ratio formula, or BCR, is a financial metric that professionals use to assess the costs and benefits of a project to determine its viability. Companies analyze a proposed project with the BCR to see the relationship between the costs to complete the project and the expected benefits over time.

How to find the present value of expected benefits?

You can find the present value (PV) of expected benefits in a period by determining all the cash inflows and monetary benefits you expect from the project, such as incremental revenue, sales, cost savings, increased value of assets or received interest payments. 2.

How to write BCR?

When writing the benefit-cost ratio formula mathematically, it looks like this: BCR = PV of expected benefits / PV of expected costs. Where:

Why is BCR important?

While it's advisable to use multiple indicators and measures when assessing project viability, the BCR is special because of its ability to show absolute amounts of cost and benefits. The BCR formula helps compare project alternatives or difference investments. It can help investors to determine the risk involved in a project by forecasting whether there is a small profit margin with a higher risk or a larger profit margin with a lower risk. Since you can calculate time periods as part of the BCR, you can also use the formula to identify cash flow in relation to time.

When to use BCR?

The most common use for the BCR is when analyzing the overall fiscal value of a new project in capital budgeting. Since capital budgeting often includes projects where you assumptions and where quantitative data may be uncertain, there is often a large variety of potential BCR outcomes.

Is a project a good financial consideration?

This means that the cash flow from the project is more than the cost of the project, so the project is a good financial consideration. When a project has a BCR value lower than one, the cash flow benefits are less than the cost, meaning the project costs more than it will return financially. You can write the BCR formula as the present value ...

How to calculate cost-benefit ratio?

For calculating the cost-benefit ratio, follow the given steps: Step 1: Calculate the future benefits. Step 2: Calculate the present and future costs. Step 3: Calculate the present value of future costs and benefits. Step 4: Calculate the benefit-cost ratio using the formula.

How is cost benefit analysis used?

Cost-benefit analysis is useful in making decisions on whether to carry out a project or not. Decisions like whether to shift to a new office, which sales strategy to implement are taken by carrying out a cost-benefit analysis. Generally, it is used for carrying out long term decisions that have an impact over several years. This method can be used by organizations, government as well as individuals. Labor costs, other direct and indirect costs, social benefits, etc. are considered while carrying out a cost-benefit analysis. The costs and benefits need to be objectively defined to the extent possible.

Why is cost benefit analysis important?

Cost-benefit analysis is useful in making decisions on whether to carry out a project or not. Decisions like whether to shift to a new office, which sales strategy to implement are taken by carrying out a cost-benefit analysis.

What is labor cost?

Labor costs. Labor Costs Cost of labor is the remuneration paid in the form of wages and salaries to the employees.

What are allowances in manufacturing?

The allowances are sub-divided broadly into two categories- direct labor involved in the manufacturing process and indirect labor pertaining to all other processes. read more. , other direct and indirect costs, social benefits, etc. are considered while carrying out a cost-benefit analysis.

What are the advantages of benefit cost ratio?

Key advantages of the benefit-cost ratio include: It is a useful starting point in determining a project’s feasibility and whether it can generate incremental value. If the inputs are known (cash flows, discount rate), the ratio is relatively easy to calculate. The ratio considers the time value of money. Time Value of Money The time value of money ...

What is discount rate?

The discount rate used refers to the cost of capital, which can be the company’s required rate of return. Required Rate of Return The required rate of return (hurdle rate) is the minimum return that an investor is expecting to receive for their investment. Essentially, the required rate of return is the minimum acceptable compensation for ...

Is benefit cost ratio a determinant of feasibility?

Although the benefit-cost ratio is a simple tool to gauge the attractiveness of a project or asset, it should not be the sole determinant of a project’s feasibility. Other ratios and further analysis are recommended.

Formula

Steps to Calculate Benefit-Cost Ratio

Examples

Advantages

Disadvantages

- To calculate the BCR formula, use the following steps: 1. Step 1: Calculate the present value of the benefit expected from the project. The procedure to determine the present value is: 1. The amount for each year = Cash Inflows*PV factor 2. Aggregate the amounts for all the years. 1. Step 2: Calculate the present value of costs. If the costs are in...

Conclusion

- Example #1

EFG ltd is working upon the renovation of its factory in the upcoming year, and for they expect an outflow of $50,000 immediately, and they expect the benefits out of the same for $25,000 for the next three years. The inflation rate that is currently prevailing is 3%. You are required to assess … - Example #2

Sunshine private limited has recently received an order where they will sell 50 tv sets of 32 inches for $200 each in the first year of the contract, 100 air condition of 1 tonne each for $320 each in the second year of the contract, and the third year they will sell 1,000 smartphones valuing at $5…

Recommended Articles

- The benefit of using the benefit-cost ratio (BCR) is that it helps to compare various projects in a single term and helps to decide faster which projects should be preferred and which projects shou...

- It compares benefit and cost at the same level that is it considers the time value of money before giving any outcome based on absolute figures as there could be a scenario that the pr…

- The benefit of using the benefit-cost ratio (BCR) is that it helps to compare various projects in a single term and helps to decide faster which projects should be preferred and which projects shou...

- It compares benefit and cost at the same level that is it considers the time value of money before giving any outcome based on absolute figures as there could be a scenario that the project appears...