A Simple Cost Benefit Analysis Example and Calculation Steps

- Assumptions. Note: In order to simplify the cost benefit analysis example, we will not use a discount rate for each cost and income.

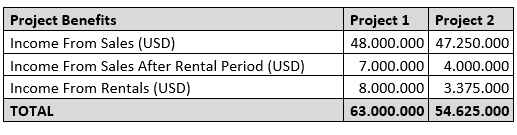

- Project 1. – Rented 100 units will be sold 70,000 USD after 20 years. ...

- Project 2. ...

- Comparing the Project Parameters. ...

- Cost Calculations. ...

- Benefit Calculations. ...

- Costs and Benefits Comparison. ...

What is the last step of the cost benefit analysis?

Steps to Conduct a Coast-benefit analysis

- Compile List In the first step, we have to collect all the list of cost and benefit which associated with the action or decision. ...

- Give cost and benefit a monetary value. After gathering the lists of all costs and benefits then we have to give them the monetary value. ...

- Make the equation and compare.

What is the importance of a cost benefit analysis?

- To evaluate whether a capital investment is worth it.

- To decide whether to hire new employees.

- To determine whether a project or operating change is feasible.

- To develop a benchmark for comparing projects.

- To weigh up one marketing initiative against another.

- To appraise the desirability of a proposed policy.

What are always calculations of cost and benefit?

Cost Benefit Analysis Formula. The following equation can be used to calculate a cost-benefit analysis. Cost-Benefit = Sum of Present Value of Expected Benefits/ Sum of the present value of associated costs. It’s important to make note that this calculator uses the present value of the benefits in costs. This is to take into account their ...

How do you calculate cost benefit?

Benefit-Cost Ratio = ∑PV of all the Expected Benefits / ∑PV of all the Associated Costs Step 6: Now, the formula for net present value can be derived by deducting the sum of the present value of all the associated costs (step 4) from the sum of the present value of all the expected benefits (step 4) as shown below.

What is the formula for cost-benefit analysis?

The formula for benefit-cost ratio is: Benefit-Cost Ratio = ∑ Present Value of Future Benefits / ∑ Present Value of Future Costs.

What are the 5 steps of cost-benefit analysis?

The major steps in a cost-benefit analysisStep 1: Specify the set of options. ... Step 2: Decide whose costs and benefits count. ... Step 3: Identify the impacts and select measurement indicators. ... Step 4: Predict the impacts over the life of the proposed regulation. ... Step 5: Monetise (place dollar values on) impacts.More items...

How do I calculate BCR in Excel?

ExamplesThe formula for Calculating BCR = PV of Benefit expected from the Project / PV of the cost of the Project.Project B.Step 2: Insert the relevant formula in cells C10 and C11.Step 3: Insert formula =B9*C9 in cell D9.Step 4: Drag the formula from cell D9 up to D11.More items...

What is a cost-benefit analysis for dummies?

A cost-benefit analysis involves a systematic approach for evaluating the strengths and weaknesses of any kind of option under consideration.\nThis technique has, in fact, become a cornerstone of cognitive behavioral approaches to anger as well as depression, anxiety, worry, and substance abuse.\nA cost-benefit ...

How do you calculate benefits?

Calculate the average benefits load for all employees by taking the total annual amount spent by the company on benefits and dividing it by the total annual amount spent on salary.

How do you quantify the benefits of a project?

Here's a list of best practice when it comes to measuring benefits.Step one: identify your objectives and outcomes. ... Step two: identify tangible and intangible benefits. ... Step three: document your benefits. ... Step four: capture your baseline measurements. ... Step five: realise your benefits. ... Step six: monitor your benefits.

How do you calculate NPV and BCR?

There are two main criteria used for evaluating projects in Benefit: Cost Analysis (BCA): the Net Present Value (NPV = benefits minus costs) and the Benefit: Cost Ratio (BCR = benefits divided by costs).

What is a good cost-benefit analysis ratio?

Benefit – Cost Ratio (BCR): the BCR is the ratio of the present value of benefits to the present value of costs. The ratio should be greater than 1.0 for a project to be acceptable.

How do you calculate net cost and benefit?

Net Benefit is determined by summing all benefits and subtracting the sum of all costs of a project. This output provides an absolute measure of benefits (total dollars), rather than the relative measures provided by B/C ratio.

How do you do a cost-benefit analysis for a small business?

Luckily, performing a cost-benefit analysis is a straightforward and simple process that you can complete in three steps.Step 1: List out your costs and benefits. ... Step 2: Establish a value framework for your costs and benefits. ... Step 3: Perform cost-benefit analysis.

How does a cost-benefit analysis work?

A CBA is a business management technique that allows you to weigh the costs associated with an investment against the benefits the investment is likely to generate. Whenever you're unsure whether to make a change in your business, a CBA can help guide you through the decision-making process.

What is cost benefit analysis?

The term “cost-benefit analysis” refers to the analytical technique that compares the benefits of a project with its associated costs. In other words, all the expected benefits out a project are placed on one side of the balance and the costs that have to be incurred are placed on the other side. The cost-benefit analysis can be executed ...

How to calculate benefit cost ratio?

The formula for a benefit-cost ratio can be derived by dividing the aggregate of the present value of all the expected benefits by an aggregate of the present value of all the associated costs, which is represented as,

How to calculate cash inflow from a project?

Step 1: Firstly, Calculate all the cash inflow from the subject project, which is either revenue generation or savings due to operational efficiency. Step 2: Next, Calculate all the cash outflow into the project, which are the costs incurred in order to maintain and keep the project up and running.

What is the benefit cost ratio?

Benefit-Cost Ratio = ∑PV of all the Expected Benefits / ∑PV of all the Associated Costs

Why is cost benefit analysis important?

The importance of cost-benefit analysis lies in the fact that it is used for assessing the feasibility of an opportunity, comparing projects, appraising opportunity cost and building real-life scenario-based sensitivity testing. In this way, this technique helps in ascertaining the accuracy of an investment decision and provides a platform for its comparison with similar proposals.

What is Net Present Value?

Net Present Value = ∑PV of all the Expected Benefits – ∑PV of all the Associated Costs

What is the benefit to cost ratio of option 1 and option 2?

We can see that the Benefit-cost ratio of option 1 is 1.02, and option 2 is 1.04. When we compare both options, option 2 has a higher benefit to cost ratio, and therefore the company should choose it over option 1.

How much is the total value of the costs from project 1?

The total value of the Costs from project 1 = $ 60 million.

What is the total benefit of a project?

Total benefit from the project = Increase in revenue from expansion

Is project 2 a positive outcome?

Analysis: Being both the projects have positive outcomes; both of the projects are beneficial for the company, i.e., the company will be in profit if it undertakes any of the projects. However, as the company has to choose one out of two, the project with a higher benefit-cost ratio will be selected. In the present case, project 2 has a higher benefit-cost ratio, so as per Cost-benefit analysis, project two will be selected by financial analysis International Ltd

Cost benefit analysis: What is it?

A cost benefit analysis (also known as a benefit cost analysis) is a process by which organizations can analyze decisions, systems or projects, or determine a value for intangibles. The model is built by identifying the benefits of an action as well as the associated costs, and subtracting the costs from benefits.

See how Smartsheet can help you be more effective

Watch the demo to see how you can more effectively manage your team, projects, and processes with real-time work management in Smartsheet.

Scenarios Utilizing Cost Benefit Analysis

As mentioned previously, cost benefit analysis is the foundation of the decision-making process across a wide variety of disciplines. In business, government, finance, and even the nonprofit world, cost benefit analysis offers unique and valuable insight when:

How to Do a Cost Benefit Analysis

While there is no “standard” format for performing a cost benefit analysis, there are certain core elements that will be present across almost all analyses. Use the structure that works best for your situation or industry, or try one of the resources and tools listed at the end of this article.

How to Establish a Framework

In establishing the framework of your cost benefit analysis, first outline the proposed program or policy change in detail. Look carefully at how you position what exactly is being evaluated in relationship to the problem being solved.

Identify and Categorize Costs and Benefits

Now that your framework is in place, it’s time to sort your costs and benefits into buckets by type. The primary categories that costs and benefits fall into are direct/indirect, tangible/intangible, and real:

How to Calculate Costs and Benefits

With the framework and categories in place, you can start outlining overall costs and benefits. As mentioned earlier, it’s important to take both the short and long term into consideration, so ensure that you make your projections based on the life of the program or initiative, and look at how both costs and benefits will evolve over time.

What is cost benefit analysis?

Cost benefit analysis is a process used primarily by businesses that weighs the sum of the benefits, such as financial gain, of an action against the negatives, or costs, of that action. The technique is often used when trying to decide a course of action, and often incorporates dollar amounts for intangible benefits as well as opportunity cost ...

What is the first thing to do when running a cost benefit analysis?

The first thing to do when running a cost benefit analysis is to compile a comprehensive list of all the costs and benefits associated with the potential action or decision.

What is the benefit cost ratio?

While there are slightly more complex formulas, the benefit-cost ratio is essentially just taking into account all of the direct or indirect costs and benefits and seeing if one outweighs the other. Additionally, running a CBA often takes into account opportunity cost and is frequently used to compare different options by calculating their benefit-cost ratios.

What is CBA in accounting?

Still, CBA is similar to net present value (or NPV), which is often used by investors.

When performing a cost benefit analysis, what is the purpose of the CBA?

When performing a cost benefit analysis, or CBA, it is generally helpful to weigh the total benefits and total costs of a future project at their present value - which is where net present value comes in. Given that CBAs are often done with a long-term view in mind, the value of money often changes due to inflation and other factors, making it helpful to factor in the net present value of the figures you are analyzing when conducting a CBA.

Why do we need a CBA?

Running a CBA for a potential decision can help visualize the implications and impact of that course of action, and is often very helpful for smaller or medium-sized decisions that are more immediate in scope of time. However, there are some disadvantages to practicing a CBA in certain circumstances.

How much does it cost to build a house in Option 1?

Construction costs for option 1 would be $80,000 per house, which would sell for $100,000 each. The cost of a sales office would be $1,000,000 and the salaries of sales staff would be $200,000 each year. The project would last 2 years, with a financing cost of $2,000,000 per year.

What is the benefit cost ratio?

What is the benefit-cost ratio formula? The benefit-cost ratio formula, or BCR, is a financial metric that professionals use to assess the costs and benefits of a project to determine its viability. Companies analyze a proposed project with the BCR to see the relationship between the costs to complete the project and the expected benefits over time.

How to find the present value of expected benefits?

You can find the present value (PV) of expected benefits in a period by determining all the cash inflows and monetary benefits you expect from the project, such as incremental revenue, sales, cost savings, increased value of assets or received interest payments. 2.

How to write BCR?

When writing the benefit-cost ratio formula mathematically, it looks like this: BCR = PV of expected benefits / PV of expected costs. Where:

What is the discounting rate?

Based on the opportunity cost or the available market information, determine the discounting rate or interest rate. This can represent the target return rate, the capital cost rate or the risk adjusted market interest rate. When there are multiple periods, each period will use the discount rate to the power of the period.

Is a project a good financial consideration?

This means that the cash flow from the project is more than the cost of the project, so the project is a good financial consideration. When a project has a BCR value lower than one, the cash flow benefits are less than the cost, meaning the project costs more than it will return financially. You can write the BCR formula as the present value ...

Can BCR be qualitative?

You can express BCR values either as monetary or qualitativ e. When a project has a BCR value higher than one, a firm and its investors can expect the project to deliver a positive net present value and an internal rate of return above the discount rate.

What are the benefits of cost benefit analysis?

Advantages of Cost-Benefit Analysis 1 It is data-driven: Cost-benefit analysis allows an individual or organization to evaluate a decision or potential project free of opinions or personal biases. As such, it offers an agnostic and evidence-based evaluation of your options, which can help your business become more data-driven and logical in how it operates. 2 It makes decisions simpler: Business decisions are often complex by nature. By reducing a decision to costs versus benefits, the cost-benefit analysis can make them less complex. 3 It can uncover hidden costs and benefits: Cost-benefit analysis forces you to sit down and outline every potential cost and benefit associated with a project, which can help you uncover less-than-obvious factors, such as indirect or intangible costs.

Why is cost benefit analysis important?

It makes decisions simpler: Business decisions are often complex by nature. By reducing a decision to costs versus benefits, the cost-benefit analysis can make them less complex.

What to do if costs outweigh benefits?

If the costs outweigh the benefits, ask yourself if there are alternatives to the proposal you haven’t considered. Additionally, you may be able to identify cost reductions that will allow you to reach your goals more affordably while still being effective.

What happens if you don't give all the costs and benefits a value?

If you don’t give all the costs and benefits a value, then it will be difficult to compare them accurately. Direct costs and benefits will be the easiest to assign a dollar amount to. Indirect and intangible costs and benefits, on the other hand, can be challenging to quantify.

What happens if the projected benefits outweigh the costs?

If, on the other hand, the costs outweigh the benefits, then a company may want to rethink the decision or project.

What happens if total benefits outnumber total costs?

If total benefits outnumber total costs, then there is a business case for you to proceed with the project or decision. If total costs outnumber total benefits, then you may want to reconsider the proposal.

What are intangible costs?

Intangible Costs: These are any costs that are difficult to measure and quantify. Examples may include decreases in productivity levels while a new business process is rolled out, or reduced customer satisfaction after a change in customer service processes that leads to fewer repeat buys.

What is cost benefit analysis?

A cost-benefit analysis (CBA) is a process that is used to estimate the costs and benefits of decisions in order to find the most cost-effective alternative. A CBA is a versatile method that is often used for the business, project and public policy decisions. An effective CBA evaluates the following costs and benefits:

How to calculate net present value?

The net present value of a project is a measurement of profit that is calculated by subtracting the present values of cash outflows from the present values of cash inflows over a period of time.

What is the purpose of CBA?

There are two main purposes in using CBA: To determine if the project business case is sound, justifiable and feasible by figuring out if its benefits outweigh costs. To offer a baseline for comparing projects by determining which project’s benefits are greater than its costs.

What is a RACI matrix?

RACI is an acronym for responsible, accountable, consulted and informed. By filling out this template, you’ll organize your team and stakeholders and keep everyone on the same page.

What is a CBA project?

Project managers strive to control costs while getting the highest return on investment and other benefits for their business or organization. A cost-benefit analysis (CBA) is just what they need to help them do that. In a project, there is always something that needs executing, and every task has a cost and expected benefits.

How accurate is CBA?

How accurate is CBA? The short answer is it’s as accurate as the data you put into the process. The more accurate your estimates, the more accurate your results.

Can you compare current monetary value with future rate?

As mentioned on the last step, you can’t compare the current monetary value of costs and benefits with future rates. That’s why you’ll have to calculate the time value of money, discount rate, and net present value of cash flows.

Step One: Calculate All-Inclusive Cost

It is critical for managers to calculate an all-inclusive cost for project analysis. These costs include, but should not be limited to:

Step Two: Calculate Benefits

Similar to the cost calculation, it is critical to be all inclusive in your approach to project benefits. A solid cost benefit analysis with a positive material return provides a Return on Investment (ROI) period. Some types of benefits are harder to quantify than others.

Step Three: Incorporate Time to the Equation

Cash flow is king in today’s business world. The key is collecting the discrete cost and benefit numbers, then place it in a template, generally in a spreadsheet such as Microsoft Excel, and determine the net result on cash flow over time.

What is cost benefit analysis?

According to the official definition, cost-benefit analysis (CBA) is a business process that adds up all the benefits of an initiative (i.e. a project) and then subtracts the associated costs. So, for example, the benefits of your project could be $1 million in terms of revenue, and your costs could be $500k.

When was cost benefit analysis invented?

Cost Benefit Analysis dates back to the 18th century , when a French engineer and economist by the name of Jules Dupuit decided to evaluate the feasibility of a construction project by taking a look at how much people were willing to pay for it.

What happens if you don't run a CBA?

Easily evaluate and control your project’s progress. Conversely, if you don’t run a CBA, you’ll have to talk your stakeholders into working on the project. After all, they have no proof that the project is going to be successful in the long term.

What is sensitivity analysis?

Sensitivity analysis (also called the “What-If Analysis”) considers risks and uncertainties in your projections.

What is the most popular method for estimating project time and cost?

One of the most popular techniques for estimating project time and cost is certainly the Work Breakdown Structure (WBS).

Should you consider long term costs?

You should consider long-term costs, as well, not just immediate costs. For example, if you’re evaluating the feasibility of migrating the entire company to new software, you have to factor in the software’s costs in the long-term, too. Perhaps even training, if necessary.

Do you have to be fiscal to get your benefits?

Again, your benefits don’t have to be fiscal.

Explanation of Cost-Benefit Analysis Formula

Examples of Cost-Benefit Analysis Formula

- Let’s see some simple to advanced practical examples of the cost-benefit analysis equation to understand it better.

Relevance and Uses

- Cost-benefit analysis is useful in making decisions on whether to carry out a project or not. Decisions like whether to shift to a new office, which sales strategy to implement are taken by carrying out a cost-benefit analysis. Generally, it is used for carrying out long term decisions that have an impact over several years. This method can be used by organizations, government as w…

Recommended Articles

- This article has been a guide to the Cost-Benefit Analysis Formula. Here we provide a calculation of cost-benefit analysis along with practical examples and a downloadable excel template. You can learn more about accounting and budgeting from the following articles – 1. Cost-Benefit Principle Examples 2. Standard Error Formula 3. Formula to Calculate Gain 4. Examples of Cost-…