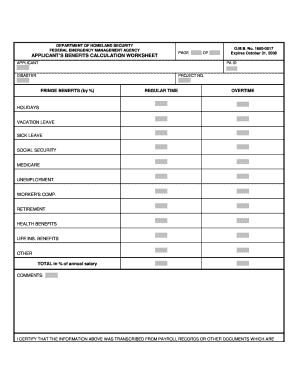

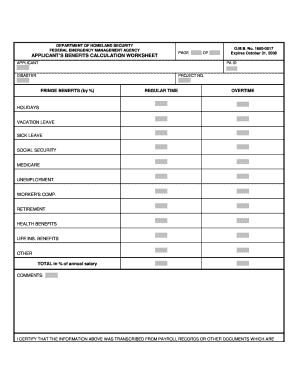

How to Calculate Fringe Benefits

- Method 1 Identifying Fringe Benefits Download Article. Determine what types of wages are required by law. If a wage is...

- Method 2 Calculating Your Own Fringe Benefits as an Employee Download Article. Consider why you would calculate your...

- Method 3 Determining the Cost of Fringe Benefits as an Employer Download Article. Consider the...

What is included in fringe benefit rates?

These benefits include:

- Unused sick leave

- Workers’ compensation

- Tuition remission

- Vacation payout

- ABP pension match

What you should know about fringe benefits?

Some examples of tax-free fringe benefits are:

- Accident insurance

- Disability insurance

- Achievement awards

- Health savings accounts

- Dependent care assistance

- Group-term life insurance up to $50,000

How do fringe benefits count as income?

Section 2 of Publication 15-B provides a list of excludable benefits, including:

- Accident and Health Benefits. These benefits include premiums the employer pays toward health insurance and long-term care insurance. ...

- Achievement Awards. ...

- Adoption Assistance. ...

- Athletic Facilities. ...

- De Minimis Benefits. ...

- Dependent Care Assistance. ...

- Educational Assistance. ...

- Employee Discounts. ...

- Employee Stock Options. ...

- Employer-Provided Cellphones. ...

What are prevailing wage fringe benefits?

These can include:

- Justifiably expected to provide legitimate fringe benefits as described in the Davis-Bacon Act

- The fringe benefit program has been communicated in writing to all employees

- It is carried out under a financially responsible plan or program

- It portrays a fidelity on the contractors part that can be legally enforced

How is Fringe amount calculated?

To calculate an employee's fringe benefit rate, add up the cost of an employee's fringe benefits for the year (including payroll taxes paid) and divide it by the employee's annual wages or salary. Then, multiply the total by 100 to get the fringe benefit rate percentage.

What is an example of a fringe benefit?

Some of the most common examples of fringe benefits are health insurance, workers' compensation, retirement plans, and family and medical leave. Less common fringe benefits might include paid vacation, meal subsidization, commuter benefits, and more.

What is the Fringe percentage of a salary?

The rate is calculated by adding together the annual cost of all benefits and payroll taxes paid, and dividing by the annual wages paid. For example, if the total benefits paid were $25,000 and the wages paid were $100,000, then the fringe benefit rate would be 25%.

What's included in fringe benefits?

Fringe benefits are allowances and services provided by employers to their employees as compensation in addition to regular salaries and wages. Fringe benefits include, but are not limited to, the costs of leave (vacation, family-related, sick or military), employee insurance, pensions, and unemployment benefit plans.

How do you calculate employee benefits?

Calculating the benefit load — the ratio of perks to salary received by an employee — helps a business effectively plan. Find the benefit load by adding the total annual costs of all employees' perks and divide it by all employees' annual salaries to determine a ratio — that ratio is your company's benefits load.

What are the 7 fringe benefits?

These include health insurance, life insurance, tuition assistance, childcare reimbursement, cafeteria subsidies, below-market loans, employee discounts, employee stock options, and personal use of a company-owned vehicle.

How are monthly fringe benefits calculated?

How To Calculate A Fringe Benefit Rate?Add together the cost of an employee's fringe benefits for the year.Divide it by the employee's annual salary.Multiply the total by 100 to determine the percentage of fringe benefit rate.

How are reportable fringe benefits calculated?

Calculating reportable fringe benefits amount The lower gross-up rate for the FBT year ending 31 March 2021 is 1.8868. For example, if the taxable value of your fringe benefits is $2,000.00, your reportable fringe benefit amount is calculated as $2,000.00 × 1.8868 = $3,773.

What is the percentage of benefits to salary?

According to the latest data from the U.S. Bureau of Labor Statistics (BLS), the average total compensation for all civilian employees in 2020 is $37.73 per hour. Benefits make up 32 percent of an employee's total compensation.

Are fringe benefits included in gross income?

Fringe benefits are generally included in an employee's gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes.

What are the 4 major types of employee benefits?

Traditionally, most benefits used to fall under one of the four major types of employee benefits, namely: medical insurance, life insurance, retirement plans, and disability insurance.

What fringe benefits are not taxable?

Nontaxable fringe benefits can include adoption assistance, on-premises meals and athletic facilities, disability insurance, health insurance, and educational assistance.

What are fringe benefits?

Fringe benefits are benefits employees receive in addition to their wages. Independent contractors and business partners can also receive fringe benefits (not taxed). Examples of fringe benefits include: Company car. Health insurance. Life insurance coverage.

What is fringe rate?

The fringe rate shows you how much an employee actually costs your business beyond their base wages. Fringe benefit rates vary from business to business. The rate depends on how much you pay employees and how much an employee receives in benefits. Although rates vary, according to the Bureau of Labor Statistics, ...

Is fringe benefit taxable?

Although fringe benefits are typically taxable, some are nontaxable. Taxable fringe benefits can include personal use of a company car, bonus pay, and paid time off. Some nontaxable fringe benefits include group-term life insurance up to $50,000 and employee discounts.

Fringe Benefit Definition

Have you ever wondered what the real value of your work is? You work hard for your money and your fringe benefits, but have you ever wondered exactly how much that work is worth to the company that you’re devoting hours of your life to? Use this calculator to be sure of the exact amount, every time.

Why Use Our Calculator?

Sure, you could do it yourself but why? When a boss tells you to get back to work or you’re pushing towards that all important deadline, do you really want to sit there with an old jeweled calculator or one of those stupid promotional calculators that has a curved middle and never seems to work right? What if you’re rushing to meet that deadline but that quiet nagging voice in the back of your head is wondering about your fringe benefits? Satisfy that random curiosity with this calculator!.

Can I Share This Calculator?

We highly encourage the use of the Fringe Benefit Calculator as much as possible. Download it and put it as a widget on your web site or just share it with your friends on Facebook, Twitter, StumbleUpon or other social media website.

How to Calculate Fringe Benefit

Let's be honest - sometimes the best fringe benefit calculator is the one that is easy to use and doesn't require us to even know what the fringe benefit formula is in the first place! But if you want to know the exact formula for calculating fringe benefit then please check out the "Formula" box above.

Add a Free Fringe Benefit Calculator Widget to Your Site!

You can get a free online fringe benefit calculator for your website and you don't even have to download the fringe benefit calculator - you can just copy and paste! The fringe benefit calculator exactly as you see it above is 100% free for you to use.

How to calculate fringe benefits?

The first step is to figure out what amount of fringe benefits should be credited to each employee annually, this is the benefit rate on the prevailing wage rate for each employee. The second step is to analyze the benefit-cost and divide it by the total cost of the benefit given by 40 hours per week in 52 weeks.

What is fringe benefit?

Those employees who do not incur any cash benefits or are not given any contributions are eligible for fringe benefits that equal the amount in cash they should have been given. If an employee is being given a contribution, it should be properly defined. The contribution could be a pension plan, medical help or anything along these lines. In regards to pension plans if there is an immediate need for it then the employee has a 100% vesting. If there is no immediate vesting then the employee is afforded credit according to an annual rate based on work hours of the previous year.

Can an employer take credit for fringe benefits?

According to law, an employer must make sure that he does not receive any credit for a benefit given to an employee which is required by law. Things like social security, compensations, etc. are a part of the job package and should not be considered or taken credit as a fringe benefit. The only way an employer can take credit is via converting ...

What is the fringe benefit rate for VSU?

VSU has established 7.65% as the fringe benefit rate for part-time employees, student workers, and summer salary. This includes social security and worker’s compensation. Personnel working less than 75% effort are considered part-time. Fringe benefits for all students should be calculated at 7.65% .

How to calculate hourly rate of pay for 12 months?

To determine hourly rate of pay, divide the base salary by 1,792 (duty hours for 12-month employees calculated with allowances for annual leave, official holidays, and administrative closings).

How to budget for faculty effort?

To budget for an hourly rate, divide the faculty member’s base salary by 1,344 (the number of duty hours in an academic year), then multiply that figure by the number of hours of effort for which the faculty member will be compensated.