Social Security Calculator.

- Take your AIME and round down to the nearest dollar.

- Multiply the first $895 of your AIME by 90%.

- Multiply the amount in step 2 that is over $895, or less than or equal to $5,397, by 32%.

- Multiple the amount in step 3 over $5,397 by 15%.

- Add all totals from step 2-4 and round down to the nearest dollar. This will be your full retirement benefits at age 66.

- Multiply the amount in step 5 by 73.33%. This will be what you receive monthly once you retire at age 62.

How to calculate net benefits?

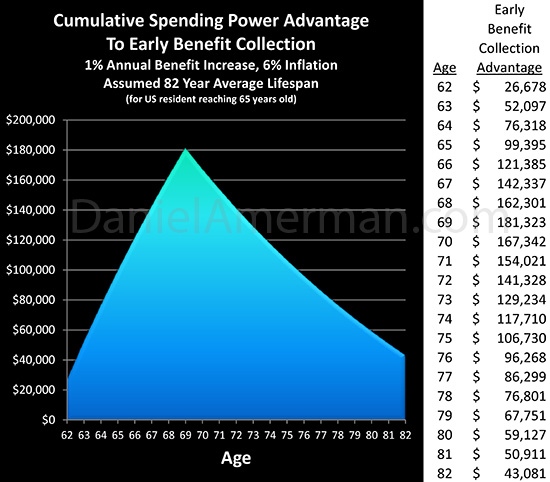

Those eight years of benefits that you would have collected between 62 and 70 amassed to $186,131 according to Schrieber’s calculations. This factors in an assumed 2% COLA on the average inflation rate. If you were to factor in last year’s inflation rate, the number would be even higher.

How are net benefits calculated?

You may be eligible for the dependency allowance if you are the main support for any child who is:

- Under the age of 18

- Under the age of 24 and a full-time student at an educational institution

- Over the age of 18 and incapacitated due to a mental or physical disability

What is net social benefit?

Net Social Benefit. Glossary -> N. The benefit remaining when total social cost is subtracted from total social benefit.

What is the formula for net profit?

The formulas for profit and loss percentage are given below:

- Profit percentage (P%) = (Profit /Cost Price) × 100.

- Loss percentage (L%) = (Loss / Cost price) × 100.

- S.P. = { (100 + P%)/100} × CP (if SP > CP)

- S.P. = { (100 – L%)/100} × CP (if SP < CP)

- C.P. = {100/ (100 + P%)} × SP (if SP > CP)

- C.P.

What is net social benefit?

The Net Social Benefit (NSB) of a particular project is the value at the time of the decision-making of the net addition to consumption that would result from undertaking the project.

What is social benefit formula?

The marginal social benefit, is the total benefit to society, from one extra unit of a good. The MSB = Marginal private benefit (MPB) + marginal external benefit (XMB)

What is net benefit calculate?

Calculate net benefits by subtracting the sum of direct and indirect costs from the sum of direct and indirect benefits. Costs and benefits are expressed in equivalent measures so that investors can see whether the benefits would outweigh the costs enough to make pursuing the project worthwhile.

How do you calculate net benefit loss?

How to calculate net loss. The formula for calculating net loss is revenue minus expenses equals net loss or net profit.

How do you calculate social cost benefit analysis?

Step 1: Calculate the future benefits. Step 2: Calculate the present and future costs. Step 3: Calculate the present value of future costs and benefits. Benefit-Cost Ratio = ∑ Present Value of Future Benefits / ∑ Present Value of Future Costs.

How is MSC calculated?

Marginal Social Cost = MPC + MECMPC is the Marginal Private Cost.MEC is the Marginal External Cost, which can be positive or negative.

How do you calculate benefits?

Calculate the average benefits load for all employees by taking the total annual amount spent by the company on benefits and dividing it by the total annual amount spent on salary.

How do you calculate total benefit?

Hence: Total Benefit = Sum of Marginal Benefits. Consumer surplus is a measurement of the net benefit a consumer gains from consuming a certain amount of a good. It can be thought of as the difference between the amount that the consumer was willing to pay and what he/she actually paid.

What is another word for net benefit?

Net-profit synonyms Income after all exemptions, exclusions, and deductions. Money or profits. Profit is a benefit or gain, usually monetary.

How do u calculate net?

How to calculate net income. To calculate net income, take the gross income — the total amount of money earned — then subtract expenses, such as taxes and interest payments.

How do you calculate net income or net loss?

Total Revenues – Total Expenses = Net Income If your total expenses are more than your revenues, you have a negative net income, also known as a net loss. Using the formula above, you can find your company's net income for any given period: annual, quarterly, or monthly—whichever timeframe works for your business.

How do I calculate my net income?

Formula for Calculating Net Income Net Income = Total Income – Total Expenses.

How Social Security Works

Social Security works by collecting mandatory financial contributions from workers across the U.S.A. and distributes those contributions for people who are eligible for Social Security. A portion of your paycheck is taken out and given to Social Security each month.

When Can I Collect Social Security?

Once you have reached the age of 62 and are able to retire, you can begin collecting Social Security benefits. If you are disabled before the age of 62 you may be able to begin collecting Social Security benefits as well.

Social Security Calculator

Let’s look at just how much you can collect from Social Security when you become eligible for retirement benefits. Your base earnings are factored by your lifetime earnings. Depending on what year you began working, your maximum benefits are determined by an index factor that fluctuates depending on what year it is.

What is social benefit?

Social benefit is the total benefit to society from producing or consuming a good/service. Social benefit includes all the private benefits plus any external benefits of production/consumption. If a good has significant external benefits, then the social benefit will be greater than the private benefit.

What are some examples of social benefits?

Examples of social benefit. Ability to avoid congestion, and quicker journey to the worker. But, the social benefit of cycling may also include external benefits, such as: Lower pollution levels from a decision to cycle rather than drive. Better health may lead to lower health care costs.

Is cycling a social benefit?

But, the social benefit of cycling may also include external benefits, such as: Lower congestion for other road users . Lower pollution levels from a decision to cycle rather than drive. Better health may lead to lower health care costs. Therefore, in this case, the social benefit of cycling may be greater than private benefit.

How much will Social Security be in 2052?

starting in 2052 at age 66: $48,771. The earliest you can begin receiving benefits is at age 62. Spouse's annual Social Security benefit. The earliest you can begin receiving benefits is at age 62. Social Security Benefits Accounting for Inflation: 1st year of benefits through age 95.

How long do you have to be a Social Security employee to get full benefits?

Anyone who pays into Social Security for at least 40 calendar quarters (10 years) is eligible for retirement benefits based on their earnings record. You are eligible for your full benefits once you reach full retirement age, which is either 66 and 67, depending on when you were born.

How does Social Security affect retirement?

Social Security benefits in retirement are impacted by three main criteria: the year you were born, the age you plan on electing (begin taking) benefits and your annual income in your working years. First we take your annual income and we adjust it by the Average Wage Index (AWI), to get your indexed earnings.

What age do you have to be to claim Social Security?

If you claim Social Security benefits early and then continue working, you’ll be subject to what’s called the Retirement Earnings Test. If you’re between age 62 and your full retirement age, and you’re claiming benefits, you need to know about the Earnings Test Exempt Amount, a threshold that changes yearly.

How long do I have to work to get Social Security?

To get your social security benefits we do a couple things. First we assume that you have or will work for 35 years before electing social security benefits (this is needed to calculate your benefits) We then take your income and we adjust it by the Average Wage Index (AWI), to account for the rise in the standard of living during your working ...

Does Social Security protect against inflation?

That means the retirement income you collect from Social Security has built-in protection against inflation. For many people, Social Security is the only form of retirement income they have that is directly linked to inflation. It’s a big perk that doesn’t get a lot of attention.

Is Social Security a tax?

You may hear people grumbling about the Social Security “Earnings Tax”, but it’s not really a tax. It’s a deferment of your benefits designed to keep you from spending too much too soon. And after you hit your full retirement age, you can work to your heart’s content without any reduction in your benefits.

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

How to calculate net benefits?

Calculate net benefits by subtracting the sum of direct and indirect costs from the sum of direct and indirect benefits.

What are indirect and direct benefits?

This includes direct and indirect benefits. Direct benefits can be attributed directly to a project, such as the specific items that a new piece of equipment would produce. Indirect benefits are derived from a project, like the overtime dollars that a company would not have to pay because it could produce more items in less time.

Can benefits and costs be measured differently?

Benefits and costs may be measured differently, as units of time, input, output or money. But a common measure must be used in a cost-benefit analysis. For example, time must be converted to money. If a worker will spend eight hours operating a machine, then the amount of wages that worker earned based on his or her hourly rate may be compared to the dollar value of the items that the machine would produce in the same time.