How to Calculate the Value of Your Salary & Benefits

- Total Compensation Calculator. The obvious place to start with calculating your total compensation is the items that...

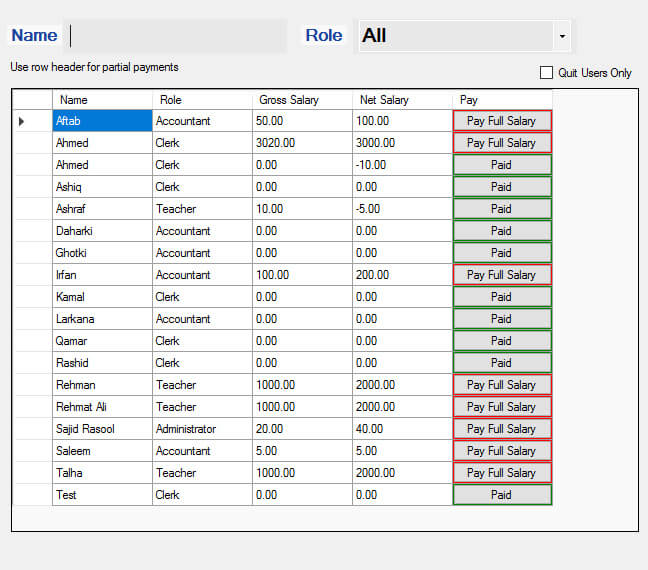

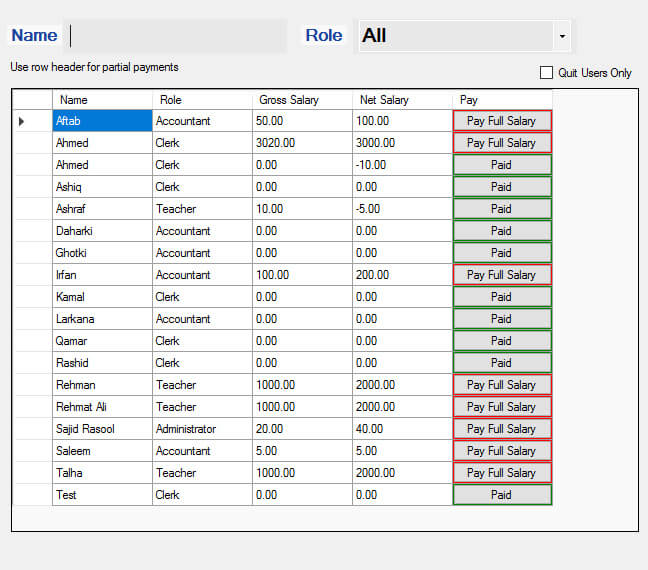

- Salary. This one should be pretty straightforward. Plug in your total gross salary (before any deductions are taken).

- Paid Vacation Time (PTO). To calculate the value of your time off, divide your...

Full Answer

How much are your benefits really worth?

Total employer paid benefits based on a $100,000 income: $28,420. That represents more than 28% of your annual income. If your annual income is $100,000 then, in reality your total compensation is $128,420! That’s just a rough estimate based on common benefits paid by a large number of employers.

How to compute salaries, wages, and benefits?

How to calculate net income

- Determine taxable income by deducting any pre-tax contributions to benefits

- Withhold all applicable taxes (federal, state and local)

- Deduct any post-tax contributions to benefits

- Garnish wages, if necessary

- The result is net income

What percentage of salary is benefits?

you have to pay 3 percent. If you meet the age requirement of 65 and file federal taxes during the tax year, then a nonrefundable tax credit may be claimed for you. Net income less than $89,422 is required for the benefit, and the amount may vary depending ...

Are benefits included in salary?

When calculating salary costs for your employer pays, it is critical to include the costs of benefits in addition to the base pay rate for accurate costing in the employee benefits calculator. The Base salary is just one part of employees' compensation.

How are benefits calculated based on salary?

Calculate the average benefits load for all employees by taking the total annual amount spent by the company on benefits and dividing it by the total annual amount spent on salary.

Do you count benefits in your salary?

The company includes benefits as part of overall compensation. According to Truitt, "Your base salary is the combination of your benefits plus your base salary. In rare cases, a company will pay you what you were hoping in base salary, in addition to offering a terrific benefits package.

How much more would benefits add to your salary?

Private vs. The BLS shows that average compensation for private industry workers is $35.34. Total benefits make up $10.53 of this total or 29.8 percent. On the other hand, government workers earn an average total compensation of $52.45 per hour with benefits costing $19.82 or 37.8 percent of total compensation.

How do you calculate benefit value?

Find the benefit load by adding the total annual costs of all employees' perks and divide it by all employees' annual salaries to determine a ratio — that ratio is your company's benefits load.

Are benefits more important than salary?

According to the Glassdoor survey, 80% of employees prefer additional benefits over a pay increase. Employees are starting to prioritize the benefits they would receive from a company over salary because employee benefits provide better experience and helps increase their job satisfaction.

Can I decline benefits for higher salary?

You can say that you'll agree not to ever take benefits, but the company can't sign off on that. And as for agreeing to take a pay cut if you decide to take benefits, that doesn't go over well either. No one likes to get their pay cut, even if they volunteered to do so 3 years previous.

Is it better to work or be on benefits?

New analysis shows that you're still better off in low paid work than on benefits, but the financial advantages have shrunk for some. Three years ago I wrote a blog about this, and new analysis shows that you're still better off in low paid work than on benefits, but the financial advantages have shrunk for some.

How much should I budget for employee benefits?

Experts suggest that you should expect to pay a range of 1.25 to 1.4 times each employee's base salary. That extra $10,000 might include things like $120 for life insurance—an average cost for your younger and older workers—$5,760 for family health coverage, $520 for dental insurance, and $200 for long-term disability.

How is total salary calculated?

While gross salary is the employee's amount without any deductions, net salary is the amount received by the employee after all deductions have been accounted for. Gross salary includes basic salary, HRA, and other allowances, whereas net salary is gross salary minus income tax, professional tax, and provident fund.

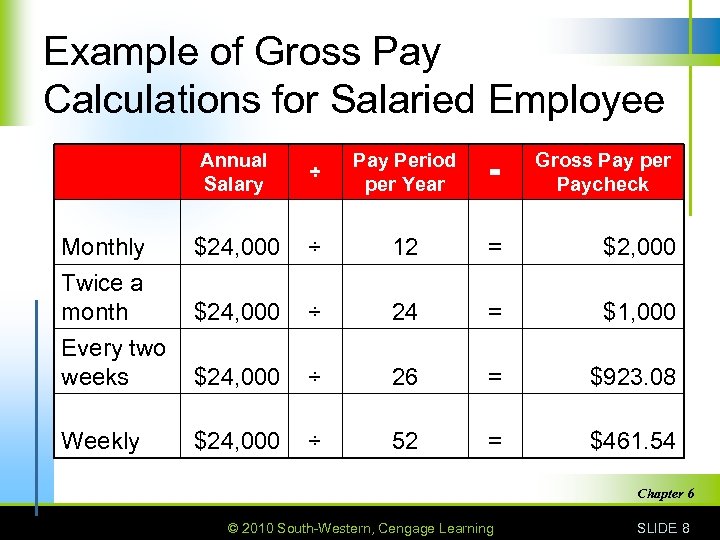

How do we compute salary?

To calculate annual salary, start by figuring out how many hours you work in a week. If you work different hours every week, use the average number of hours you work. Next, multiply your hourly salary by the number of hours you work in a week. Finally, multiply that number by 52 to find your annual salary.

Self-Employed Contractors

Self-employed contractors (freelancers who sell their goods and services as sole proprietorships) tend to use their advertised hourly rates as a wa...

How Unadjusted and Adjusted Salaries Are Calculated

Using a $10 hourly rate with inputs resulting in an average of eight hours worked each day and 260 working days a year (52 weeks multiplied by 5 wo...

Different Pay Frequencies

The calculator contains options to select from several periods normally used to express salary amounts, but actual pay frequencies as mandated by v...

The 10 Federal Holidays in The U.S.

1. January—New Year's Day, Birthday of Martin Luther King Jr. 2. February—Washington's Birthday 3. May—Memorial Day 4. July—Independence Day 5. Sep...

How to put dollar value on benefits?

The best way to put a dollar value on benefits as part of a job offer is to ask the prospective employer to do it for you, says management expert Lonnie Pacelli, author of The Project Management Advisor.

What is the deductible for job B?

The annual deductible is $1,000. Do the math: Job A: With a $30,000 salary and no annual cost for health insurance, your net salary is $30,000.

What are the benefits of being a college graduate?

Consider the two most common benefits offered to new college grads: health insurance and retirement plans.

How much can you put in for 403b?

Job B offers a 403b plan that allows you to put in up to $1,000 a year toward retirement. The organization will match 50 percent after a year.

Do you take the time to analyze your health insurance?

You may be so desperate for health insurance that when you finally get an offer, you don't take the time to analyze its attached health plan. But that could cost you.

Is insurance important to a recent college graduate who hasn't been sick a day in his or her?

These insurance concepts "may not seem important to a recent college graduate who hasn't been sick a day in his or her life," says Roberta Chinsky Matuson, principal of Human Resource Solutions in Northampton, Massachusetts. "But ask anyone who has been stricken by illness how quickly medical expenses add up, even with health insurance."

What is base salary?

The Base salary is just one part of employees' compensation. The Total Compensation Calculator is used to estimate the pay and benefits which make up the total compensation package for a given position. Additional monetary rewards, like salary bonuses and commissions are also part of it.

How much does an employer match for retirement?

Employer matching is usually between 25 cents and a dollar for each dollar the employee contributes to the retirement account, up to a preset limit.

What are the benefits of total compensation?

To use the benefits calculator to get your total compensation package results, types of benefits could include bonus, Social Security, 401k/403b, Disability, Healthcare, Pension, paid Time off . The base salary is only one component of total compensation. Total compensation will include the dollar value of any or all benefits that you pay for your employees. ( 2021-09-27 salary.com )

Why is pension important?

Because your employer probably pays the full cost of your pension plan (if you have one), pension plan benefits are an important component of the total compensation package. Your Summary Plan Descriptions (SPDs) or the plan document will tell you how much pension you accrue for your service.

Why add disability insurance to total compensation?

Because the company often pays the entire premium or pays the premium up to a certain amount of coverage, it is important to add disability insurance when calculating the value of your total compensation package.

How many vacation days are paid off?

Typically, employees receive two to four weeks of vacation plus 10 to 12 holidays yearly. Companies also grant between one and four personal days, while sick days can vary from five to 15 days a year. Some companies have written policies that include paid time off for election, bereavement leave, military service, and jury duty.

What is the FICA on a paycheck?

Often noted as FICA (Federal Insurance Contribution Act ) on your paystub, Social Security covers three benefits: disability, retirement, and Medicare. The FICA taxes you pay out of your paycheck and your employer's matching payment help fund these three programs.

What is salary calculator?

The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Examples of payment frequencies include biweekly, semi-monthly, or monthly payments. Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year.

What is salary in employment?

An employee's salary is commonly defined as an annual figure in an employment contract that is signed upon hiring.

How many hours does a $30 hourly salary work?

Using a $30 hourly rate, an average of eight hours worked each day, and 260 working days a year (52 weeks multiplied by 5 working days a week), the annual unadjusted salary can be calculated as:

What is an exempt employee?

This means that they are exempt from minimum wage, overtime regulations, and certain rights and protections that are normally only granted to nonexempt employees. To be considered exempt in the U.S., employees must make at least $684 per week (or $35,568 annually), receive a salary, and perform job responsibilities as defined by the FLSA. Certain jobs are specifically excluded from FLSA regulations, including many agricultural workers and truck drivers, but the majority of workers will be classified as either exempt or nonexempt.

How much does a full time employee make in 2020?

Factors that Influence Salary (and Wage) in the U.S. (Most Statistics are from the U.S. Bureau of Labor in 2020) In the first quarter of 2020, the average salary of a full-time employee in the U.S. is $49,764 per year, which comes out to $957 per week.

What is salary in business?

A salary or wage is the payment from an employer to a worker for the time and works contributed. To protect workers, many countries enforce minimum wages set by either central or local governments. Also, unions may be formed in order to set standards in certain companies or industries.

Why do companies pay higher salaries?

Misc. —To a lesser extent, salary is also influenced by the overall performance of companies; during years of high profits, a company may choose to pay a higher than average salary for a job applicant with excellent credentials. Also, in certain jobs, workers are expected to perform job responsibilities in dangerous working conditions, such as handling dangerous chemicals in a research facility, working in an underground mine with the presence of potential toxins, or patrolling a notoriously dangerous part of town as a police officer. Such jobs can be compensated with a higher salary in the form of hazard pay. Similarly, people who work less favorable shift hours, such as the "graveyard shift," which runs through the early hours of the morning, can sometimes earn a premium for doing so, due to the higher social and physical costs of working outside normal hours.

What are the factors that affect the average salary?

Other factors of variation in base salary include education, skillset, cost of living, level of experience and seasonality.

What is base pay?

Base pay is expressed in terms of an hourly rate, or a monthly or yearly salary. In other words, a job ad that promises a base pay of $20 per hour means that the employee would earn a salary of $20 per hour worked, or $160 for an 8 hour day. Base salary does not include any extra lump sum compensation, including overtime pay or bonuses, ...

What happens when you get a job offer?

When you receive a job offer, the employer will present you with a compensation package that includes a base salary and potentially other benefits. You may choose to negotiate for a better compensation package if you believe that the offer is not in line with your skillset, education, career level or other strengths.

What to ask for when negotiating a salary?

For example, you might ask for more vacation days, stock options or a higher range of performance-based bonuses.

Why do employers ask about salary history?

First, keep in mind that the reason that employers ask about salary history is to determine your potential market value and to make sure that your salary expectations are in line with the budget for the role.

What is compensation package?

A compensation package is your base pay plus other benefits. When considering a job offer or a raise, it is critical to take into account not just the base salary, but the entire compensation package that is offered. There is a wide variety of potential benefits packages that employers can offer. Benefits can be provided at ...

What to do if you feel uncomfortable sharing your salary history?

If you feel uncomfortable sharing your salary history or would like to avoid the discussion until the negotiation phase, you may politely decline by explaining that you would rather learn more about the role and its responsibilities before moving to a discussion of salary expectations.

What happens if you receive a benefit in excess of the limit?

Consider the limits of tax exclusions. Some exclusions have limits, and if you receive a benefit in excess of that limit, you will be taxed on the excess. These special rules are laid out on the IRS's website. For example:

Why do you calculate fringe benefits?

Consider why you would calculate your fringe benefits. If you are an employee, or potential employee, you may want to calculate fringe benefits to get an idea of the full value of your services. Also, if you are looking at a particular job, you may want to calculate the value of fringe benefits to get an idea of the full compensation package.

How much is fringe benefits for employee one?

The value of their fringe benefits package is $3,200.

How much is the annual value of a fringe benefit?

Assume your employer pays your health insurance premiums, which equal $250 per month. If you multiply $250 by the 12 months in a year, you get $3,000, which is the annual value of that fringe benefit.

Why do employers provide fringe benefits?

As an employer, if you provide fringe benefits, you may entice quality talent to work for you and you may keep your workforce happy and healthy. In addition, employees might prefer fringe benefits for the reduced tax liability when fringe benefits aren't taxed (while your salary will be).

How much is 20 per hour paid annually?

For example, if you make $20 per hour and work 40 hours per week, your annual salary equals $41,600 (40 hours per week x 52 weeks in a year x hourly wage). If you add your annual salary to your annual fringe benefit value, you can see you are compensated annually in the amount of $50,160 ($41,600 + $8,560).

How to determine if a wage is fringe?

1. Determine what types of wages are required by law . If a wage is required by law, it will not be considered a fringe benefit. One easy way to identify fringe benefits is to eliminate the benefits you know are not fringe. Examples of non-fringe benefits include: Base wages and salaries; Payments to fund social security;

How to calculate summer pay for VSU?

To budget for summer effort, divide the 9-month base salary by 9 to calculate the monthly rate of pay, then multiply that figure by the number of summer months (up to 3) that the faculty member will work on the grant project. VSU allows 9-month faculty to earn up to 33% of their salary during the summer. When all summer pay – including teaching and grant pay – is combined, the total cannot exceed 33% of the faculty member’s academic-year salary. Take a faculty member’s summer teaching plans into account when determining how much time to budget for grant activity, to ensure the budget doesn't exceed the 33% summer pay maximum. Also keep in mind that some funding agencies (including the National Science Foundation) limit summer compensation to 2 months – be sure to check the program guidelines carefully for these restrictions.

How to pay a faculty member to teach a summer course?

To budget for a summer course, multiply the faculty member’s base salary x 3/32 (one summer course = 3/32 x academic year salary).

How to budget for faculty effort?

To budget for an hourly rate, divide the faculty member’s base salary by 1,344 (the number of duty hours in an academic year), then multiply that figure by the number of hours of effort for which the faculty member will be compensated.

What is the fringe benefit rate for VSU?

VSU has established 7.65% as the fringe benefit rate for part-time employees, student workers, and summer salary. This includes social security and worker’s compensation. Personnel working less than 75% effort are considered part-time. Fringe benefits for all students should be calculated at 7.65% .

How does a faculty grant work?

With the approval of the Department Head and Dean, faculty can be released from academic year teaching duties to work on grant-funded activities. In these instances, the grant will pay for that portion of the faculty member’s time, creating “salary savings” to the institution. For faculty members teaching four courses per semester (8 courses per year), each course equals 12.5% of their total academic year effort. To budget for academic year course release, multiply 12.5% x the number of courses from which the faculty member will be released during the academic year x the faculty member’s base salary.

What is considered full time?

Personnel working 75% effort or greater are considered full-time.

Can fringe benefits be calculated for consultants?

Note: Fringe benefits should not be calculated for consultants and others providing services on a contractual basis.

What do millennials consider when considering a job offer?

Millennials are more likely to consider factors such as salary and bonuses when evaluating a job offer—while only 4% consider other financial components such as stock options and profit sharing. According to Fidelity’s Evaluate a Job Offer Study, other overlooked benefits include retirement benefits (39%), health and medical insurance (28%), and paid time off (27%). Thinking about a benefit such as a workplace retirement savings plan, a company that offers a lower salary but a greater 401K match may give you a better start on reaching your retirement savings goals. So, it’s important to carefully weigh the different factors when deciding which job to choose.

Does Fidelity have a changing jobs calculator?

Lucky for you, we’ve found a (free!) calculator that does all the hard work for you. Fidelity Investment’s changing jobs calculator looks at all things money-related when you’re considering a new role— such as your current and new salary, bonuses, commission, retirement plan matching, as well as if you’re relocating or shifting to be self-employed or part-time—to show you just how much more (or less) you’ll make compared to where you’re at now.