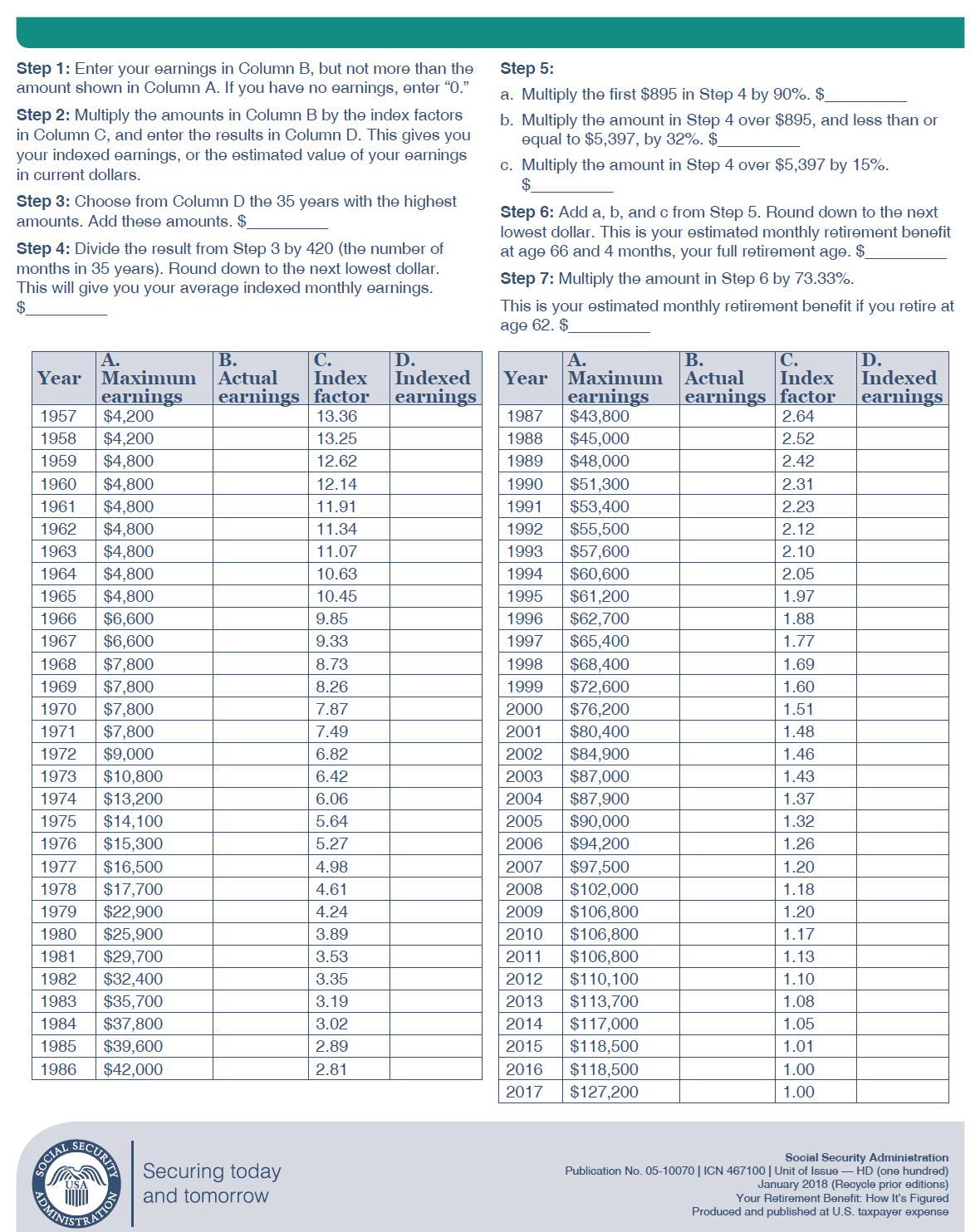

Social Security retirement benefits are calculated using your 35 highest-earning years. If you don’t have 35 years of earnings, you’ll be assigned an income of $0 for each of the missing years. After you turn 62, Social Security recalculates your benefits every year that you don’t claim benefits.

Full Answer

What is the maximum Social Security retirement benefit payable?

- $2,364 at age 62.

- $3,345 at age 66 and 4 months.

- $4,194 at age 70.

How many years are used to calculate Social Security benefits?

The Social Security benefits calculation uses your highest 35 years of earnings to calculate your average monthly earnings. If you do not have 35 years of earnings, a zero will be used in the calculation, which will lower the average.

How do I estimate my SS Benefits?

You may want to may want to consider using my company's software — Maximize My Social Security or MaxiFi Planner — to ensure your household receives the highest lifetime benefits. Social Security calculators provided by other companies or non-profits may provide proper suggestions if they were built with extreme care. Best, Larry

What exactly are Social Security retirement benefits?

Social Security's benefits formula is always based on a 35-year work history. If you work exactly 35 years, you'll get benefits equaling a percentage of average wages over your entire career.

How is Social Security calculated after retirement?

Social Security benefits are typically computed using "average indexed monthly earnings." This average summarizes up to 35 years of a worker's indexed earnings. We apply a formula to this average to compute the primary insurance amount (PIA).

How do you calculate what your Social Security will be?

Our simplified estimate is based on two main data points: your age and average earnings. Your retirement benefit is based on how much you've earned over your lifetime at jobs for which you paid Social Security taxes. Your monthly retirement benefit is based on your highest 35 years of salary history.

How much Social Security will I get if I make 60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make 70000 a year?

Initial Social Security retirement benefits by age and income levelAnnual Income (Inflation-Adjusted)Age 62Age 65$60,000$1,554$1,931$70,000$1,695$2,106$80,000$1,787$2,220$90,000$1,879$2,3345 more rows•Aug 21, 2018

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

How is Social Security decided?

Your Social Security benefit is decided based on your lifetime earnings and the age you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation. Those earnings are converted to a monthly insurance payment based on your full retirement age.

What is wage indexing?

Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3 .

Is Social Security higher at age 70?

If you have already had most of your 35 years of earnings, and you are near 62 today, the age 70 benefit amount you see on your Social Security statement will likely be higher due to these cost of living adjustments .

Can you calculate inflation rate at 60?

Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward and use those to create an estimate.

How does Social Security affect retirement?

Social Security benefits in retirement are impacted by three main criteria: the year you were born, the age you plan on electing (begin taking) benefits and your annual income in your working years. First we take your annual income and we adjust it by the Average Wage Index (AWI), to get your indexed earnings.

How long do you have to be a Social Security employee to get full benefits?

Anyone who pays into Social Security for at least 40 calendar quarters (10 years) is eligible for retirement benefits based on their earnings record. You are eligible for your full benefits once you reach full retirement age, which is either 66 and 67, depending on when you were born.

What age do you have to be to claim Social Security?

If you claim Social Security benefits early and then continue working, you’ll be subject to what’s called the Retirement Earnings Test. If you’re between age 62 and your full retirement age, and you’re claiming benefits, you need to know about the Earnings Test Exempt Amount, a threshold that changes yearly.

How long do I have to work to get Social Security?

To get your social security benefits we do a couple things. First we assume that you have or will work for 35 years before electing social security benefits (this is needed to calculate your benefits) We then take your income and we adjust it by the Average Wage Index (AWI), to account for the rise in the standard of living during your working ...

How much will Social Security be in 2052?

starting in 2052 at age 66: $48,771. The earliest you can begin receiving benefits is at age 62. Spouse's annual Social Security benefit. The earliest you can begin receiving benefits is at age 62. Social Security Benefits Accounting for Inflation: 1st year of benefits through age 95.

Does Social Security protect against inflation?

That means the retirement income you collect from Social Security has built-in protection against inflation. For many people, Social Security is the only form of retirement income they have that is directly linked to inflation. It’s a big perk that doesn’t get a lot of attention.

Is Social Security a tax?

You may hear people grumbling about the Social Security “Earnings Tax”, but it’s not really a tax. It’s a deferment of your benefits designed to keep you from spending too much too soon. And after you hit your full retirement age, you can work to your heart’s content without any reduction in your benefits.

How old do you have to be to file for Social Security?

You must be at least age 22 to use the form at right. Lack of a substantial earnings history will cause retirement benefit estimates to be unreliable. Enter your date of birth ( month / day / year format) / /. Enter earnings in the current year: $. Your annual earnings must be earnings covered by Social Security.

What is the benefit estimate?

Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough. Although the "Quick Calculator" makes an initial assumption ...

What happens if you don't give a retirement date?

If you do not give a retirement date and if you have not reached your normal (or full) retirement age, the Quick Calculator will give benefit estimates for three different retirement ages .

How old do you have to be to use Quick Calculator?

You must be at least age 22 to use the form at right.

How to figure out my Social Security benefits?

There are four ways to figure out your Social Security benefits: visit a Social Security office to get an estimate; create an account at the official Social Security website and use its calculators; let the SSA calculate your benefits for you; or calculate your benefits yourself. Doing the calculations for yourself involves understanding what AIME, ...

What is the NAWI adjustment factor for Social Security?

To be conservative, use a NAWI adjustment factor of 1.0 in column B for all future years.

How to increase PIA?

There are four ways the starting benefit can be permanently increased or reduced from the PIA calculated at age 62: 1 Starting benefits early – Benefits may begin as soon as age 62, but they are permanently reduced for every month between the onset of benefits and FRA. 18 2 Delaying benefits beyond full retirement age – Delayed retirement credits can permanently increase benefits, and they are awarded for every month between FRA and a later onset of benefits. 20 3 Starting early and continuing to work – If you start benefits before your FRA and keep working, the SSA may deduct the part of your benefits that exceeds a threshold. However, any such deductions are not permanent. When you reach your FRA, the SSA recalculates your benefits and credits back any deductions. 21 4 Continuing to work, period – Even if you don’t start benefits early, you can increase your benefits by continuing to work up to any age. Any year in which your indexed earnings are higher than one of your 35 previous highest years will boost your benefits. 22 However, after age 60 you will not receive wage indexing, and after age 62 you will not receive bend point inflation indexing.

When does index factor change to 1.0000?

Notice that the index factor becomes 1.0000 in 2014, the year in which the worker turns 60, and it remains 1.0000 without changing for any future years of taxable earnings. If you plan to continue working after age 60, just project your taxable earnings in column two and use 1.0000 in column three for all future years.

Is Social Security progressive?

Social Security is designed as a “progressive” social insurance system, which means it replaces a greater part of average monthly pay for low-income workers than it does for high-income workers. The bend points implement this skew relative to each worker’s AIME. 13 .

Is Social Security open by appointment?

Due to the COVID-19 pandemic, Social Security offices are only open by appointment, and to get an appointment you need to be in a “dire need situation.” 6 Most people will have to transact their business online, by phone, or through the mail.

Can you wait until you start receiving Social Security benefits?

You can wait until you decide to start receiving benefits and let the SSA calculate the amount for you. However, this doesn’t help you plan ahead, and while the SSA can usually be counted on to determine benefits accurately, mistakes can be made. 5 .

What is the maximum amount you can earn before retirement in 2021?

If you will reach full retirement age in 2021, the limit on your earnings for the months before full retirement age is $50,520. Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings.

What is the maximum amount you can earn in 2021?

For 2021 that limit is $18,960. In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before the month you reach your full retirement age. If you will reach full retirement age in 2021, the limit on your earnings for the months before full retirement age is ...

Can you report a change in earnings after retirement?

If you need to report a change in your earnings after you begin receiving benefits: If you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us, let us know right away. You cannot report a change of earnings online.