How to Calculate Social Security SSDI Benefits.

- Use SSA’s Online Benefits Calculator.

- Create a myssa.com account.

- Call your local SSA office.

- Or, call the National SSA 1800 number at 1-800-772-1213.

How much in Social Security disability benefits can you get?

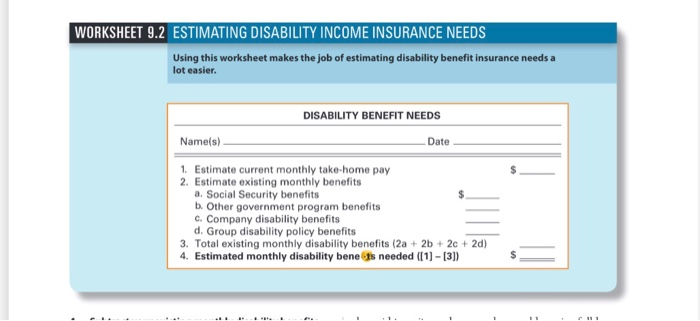

- 90% of the first $1,024 of average indexed monthly earnings

- 32% of the average indexed monthly earnings over $1,024 through $6,172, and

- 15% of the average indexed monthly earnings over $6,172.

How do you calculate Social Security disability?

So failing to file tax returns could adversely affect a person's Social Security retirement or disability benefit rate. Furthermore, if and when a person claims Social Security benefits the IRS can place a levy on the person's benefits in order to collect ...

How are SSDI payments calculated?

Social Security payments are calculated by combining your highest paid 35 years (if you have worked more than 35 years). First, all salaries are indexed to account for inflation. Previous years ...

How are Social Security disability benefits calculated?

Social Security calculators provided by other companies or non-profits ... So failing to file tax returns could adversely affect a person's Social Security retirement or disability benefit rate. Furthermore, if and when a person claims Social Security ...

How is SS disability calculated?

The Social Security Administration (SSA) will determine your payment based on your lifetime average earnings before you became disabled. Your benefit amount will be calculated using your covered earnings. These are your earnings at jobs where your employer took money out of your wages for Social Security or FICA.

How do you determine how much you get on disability?

To calculate how much you would receive as your disability benefit, SSA uses the average amount you've earned per month over a period of your adult years, adjusted for inflation. To simplify this formula here, just enter your typical annual income. This income will be adjusted to estimate wage growth over your career.

What is the most approved disability?

1. Arthritis. Arthritis and other musculoskeletal disabilities are the most commonly approved conditions for disability benefits. If you are unable to walk due to arthritis, or unable to perform dexterous movements like typing or writing, you will qualify.

Does disability pay more than Social Security?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

How much is SSI monthly?

If you meet the qualifications as described below, and your application for SSI is approved, you will receive benefits of $733 per month (for individuals) or $1,100 per month (for couples), minus a portion of your current income.

What is SSI disability?

SSI is called a “means-tested program,” meaning it has nothing to do with work history, but strictly with financial need. SSI disability benefits are available to low-income individuals who haven’t earned enough work credits to qualify for SSDI.

What is back payment on SSDI?

Back payments are any disability benefits that are past due, or the benefits that you would have been paid if your initial application was approved right away. Retroactive payments are for the months that you were disabled and could not work. You are eligible for retroactive payments only with SSDI and not SSI.

How long does a person have to be on SSDI to receive SSI?

In order to receive SSDI, the prospective recipient must be able to demonstrate they have a disability that is medically determinable, that will continue to last no less than twelve months, and that prevents the individual from engaging in substantial gainful activity.

What is the AIME on SSDI?

This income is called your “covered earnings”. The average of your covered earnings over several years is called your average indexed monthly earnings (AIME).

What is SGA in Social Security?

Substantial Gainful Activity – SGA. is an important concept to understand when pursuing Social Security Disability Insurance or Supplemental Security Income. The Social Security Administration defines it as “the performance of significant mental and/or physical duties for profit”. SGA maximum amounts are set by the Social Security Administration ...

How much income do I need to qualify for SSI?

The amount is set by your particular state, and it is usually between $700 and $1400 per month, and some states allow individuals with higher incomes to still qualify for SSI. You must own less than $2,000 in property (minus your home and car) for individuals, or $3,000 for a couple.

What is SSDI benefits?

SSDI is a benefit for disabled workers who have sufficiently paid into the Social Security system over the course of their employment. You must have earned a certain number of work credits to qualify for benefits if you become disabled before retirement age. The exact number of credits you need depends on your age.

What is the maximum amount of SSI you can collect in 2017?

In 2017, the FBR is $735. This is maximum amount of SSI you can collect each month. Then, the SSA simply deducts your countable unearned income and your countable earned income from the $735 to determine your monthly SSI benefit amount. The SSA counts various types of income against your benefit amount, including:

What is a PIA in SSA?

PIAs are complex to calculate and even harder to explain. “The PIA is the sum of three separate percentages of portions of average indexed monthly earnings, ” states the SSA. Essentially, the SSA separates your AIME into three portions that it calls “bend points”:

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

How is Social Security decided?

Your Social Security benefit is decided based on your lifetime earnings and the age you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation. Those earnings are converted to a monthly insurance payment based on your full retirement age.

What is wage indexing?

Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3 .

Is Social Security higher at age 70?

If you have already had most of your 35 years of earnings, and you are near 62 today, the age 70 benefit amount you see on your Social Security statement will likely be higher due to these cost of living adjustments .

Can you calculate inflation rate at 60?

Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward and use those to create an estimate.

How long can you work on disability?

Once you start receiving disability, you may not be able to make enough income to support yourself, but the SSA may allow you to work on the side. However, any month where you make over a certain amount will count as a “trial work period” (TWP). You are permitted to use up to 9 months towards a TWP. These months do not have to be consecutive so long as they are within any 60-month period. Once you use up your 9 months, you may jeopardize your benefits by continuing to work.

How much disability is there in 2020?

Individuals receiving disability in 2020 have a maximum benefit or $3,011 per month. These benefits reflect the 1.6% COLA for 2020. This is a significant decrease from the 2019 adjustment of 2.8% and the 2018 adjustment of 2%.

Do you have to be a SGA to qualify for disability?

To qualify for disability benefits in the first place, you must not be engaging in “ substantial gainful activity” (SGA). If you earn more than the prescribed income limit, you are engaging in SGA and therefore do not meet the SSA’s strict definition of being disabled.

Can you continue to work after 9 months of disability?

Once you use up your 9 months, you may jeopardize your benefits by continuing to work. You must report any income received while on disability to the SSA, and any income over the following thresholds triggers a trial work period:

Can I receive SSDI if I retired?

Most SSDI applicants can receive benefits as though they retired at the maximum retirement age; however, this calculation may be different for SSI applicants. This calculator is therefore most helpful for SSDI applicants.

What is the benefit estimate?

Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough. Although the "Quick Calculator" makes an initial assumption ...

How old do you have to be to file for Social Security?

You must be at least age 22 to use the form at right. Lack of a substantial earnings history will cause retirement benefit estimates to be unreliable. Enter your date of birth ( month / day / year format) / /. Enter earnings in the current year: $. Your annual earnings must be earnings covered by Social Security.

How old do you have to be to use Quick Calculator?

You must be at least age 22 to use the form at right.