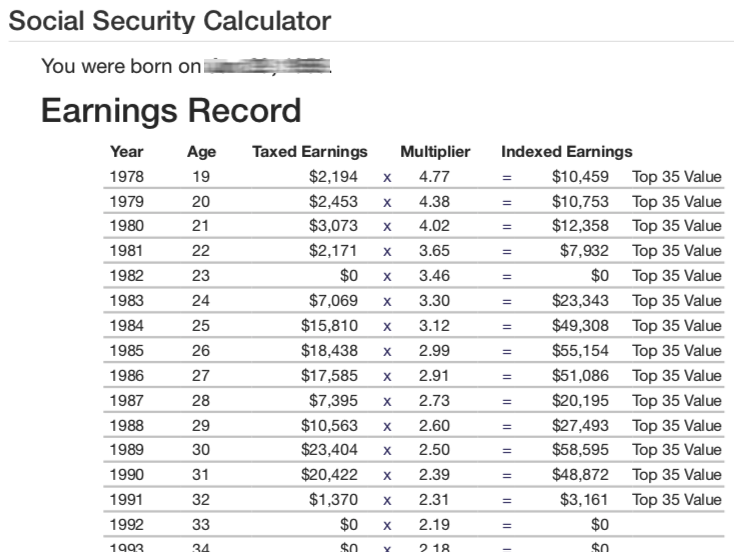

Step 1: Calculate Your Monthly Earnings

- Calculate Your Monthly Earnings Your Social Security benefit calculation starts by looking at how long you worked and how much you made each year. ...

- Calculate Your Primary Insurance Amount (PIA) Once you have calculated your Average Indexed Monthly Earnings (AIME), you'll plug that number into a formula to determine your Primary Insurance ...

- Adjust Your PIA for the Age You Will Begin Benefits

How much can you earn with SSI?

- If you work and earn $6,000 throughout the year, you have not hit the $17,640 annual earnings that would trigger withholding of some of your Social Security benefits. ...

- If you work and earn $35,000, you have exceeded the $17,640 limit by $17,360. ...

- If you work and earn $80,000, you have exceeded the $17,640 limit by $62,360. ...

What is the maximum income to qualify for SSI?

income set aside under a Plan to Achieve Self-Support (PASS). See the SSI Spotlight on Plan to Achieve Self–Support; earnings up to $1,930 per month to a maximum of $7,770 per year (effective January 2021) for a student under age 22. See the SSI Spotlight on Student Earned Income Exclusion;

What counts as income for SSI?

Social security benefits are received by millions in the United States and for many it is their only source of income. Once retirees begin to claim benefits, they will not be able to work at the same levels they had as or they risk jeopardizing their ...

How do you determine your Social Security benefit amount?

- For earnings that fall within the first band, you multiply by 90%. That is the first part of your benefit.

- For earnings that fall within the second band, you multiply by 32%. That is the second part of your benefit.

- For earnings that are greater than the maximum of the second band, you multiply by 15%. This is the third part of your benefit.

How do they determine how much you get for SSI?

In general, monthly amounts for the next year are determined by increasing the unrounded annual amounts for the current year by the COLA effective for January of the next year. The new unrounded amounts are then each divided by 12 and the resulting amounts are rounded down to the next lower multiple of $1.

What amount of SSI will I get?

SSI Payment Amounts by StateCalifornia$729Georgia$603Illinois$614Michigan$615New York$6166 more rows

What is the lowest SSI payment?

The first full special minimum PIA in 1973 was $170 per month. Beginning in 1979, its value has increased with price growth and is $886 per month in 2020. The number of beneficiaries receiving the special minimum PIA has declined from about 200,000 in the early 1990s to about 32,100 in 2019.

What state has the highest SSI payment?

States That Pay out the Most in SSI BenefitsNew Jersey: $1,689 per month.Connecticut: $1,685 per month.Delaware: $1,659 per month.New Hampshire: $1,644 per month.Maryland: $1,624 per month.

How much SSI will I get in 2021?

SSI Monthly Payment Amounts, 1975-2022YearCOLAaEligible individual20192.8%771.0020201.6%783.0020211.3%794.0020225.9%841.0019 more rows

Is SSI getting a $200 raise in 2021?

The Social Security Administration has announced a 1.3% increase in Social Security and Supplemental Security Income (SSI) benefits for 2021, a slightly smaller cost-of-living increase (COLA) than the year before.

How much will the SSI checks be in 2020?

$783 monthlyThe 2020 SSI federal benefit rate ( FBR ) for an individual living in his or her own household and with no other countable income is $783 monthly; for a couple (with both husband and wife eligible), the SSI benefit rate is $1,175 monthly. Payments under SSI began in January 1974.

How much will SSI increase in 2021?

The latest COLA is 5.9 percent for Social Security benefits and SSI payments. Social Security benefits will increase by 5.9 percent beginning with the December 2021 benefits, which are payable in January 2022. Federal SSI payment levels will also increase by 5.9 percent effective for payments made for January 2022.

Why Is Income Important in The SSI Program?

Generally, the more countable income you have, the less your SSI benefit will be. If your countable income is over the allowable limit, you cannot...

What Income Does Not Count For Ssi?

Examples of payments or services we do not count as income for the SSI program include but are not limited to:the first $20 of most income received...

How Does Your Income Affect Your SSI Benefit?

Step 1: We subtract any income that we do not count from your total gross income. The remaining amount is your "countable income".Step 2: We subtra...

Example A – SSI Federal Benefit With only Unearned Income

Total monthly income = $300 (Social Security benefit)1) $300 (Social Security benefit) -20 (Not counted) =$280 (Countable income)2) $750 (SSI Feder...

Example B – SSI Federal Benefit With only Earned Income

Total monthly income = $317 (Gross wages)1) $317 (Gross wages) -20 (Not counted) $297 -65 (Not counted) =$232 divided by 1/2 =$116 (Countable income)

Example C – SSI Federal Benefit and State Supplement With only Unearned Income

The facts are the same as example A, but with federally administered State supplementation.1) $300 (Social Security benefit) -20 (Not counted) =$28...

Example D – SSI Federal Benefit and State Supplement With only Earned Income

Total monthly income = $317 (Gross wages)1) $317 (Gross wages) -20 (Not counted) $297 -65 (Not counted) $232 divided by 1/2 =$116 (Countable income...

How Will Windfall Offset Affect My Benefit?

Windfall offset occurs when we reduce your retroactive Social Security benefits if you are eligible for Social Security and SSI benefits for the sa...

When Does Deemed Income Apply?

When a person who is eligible for SSI benefits lives with a spouse who is not eligible for SSI benefits, we may count some of the spouse's income i...

When Does Deemed Income Not Apply?

When you no longer live with a spouse or parent.When a disabled or blind child attains age 18. When an alien's sponsorship ends.

What is the benefit estimate?

Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough. Although the "Quick Calculator" makes an initial assumption ...

How many retirement estimates does Quick Calculator give?

If you do not give a retirement date and if you have not reached your normal (or full) retirement age, the Quick Calculator will give benefit estimates for three different retirement ages.

What does "0" mean in retirement?

If you entered 0, we assume you are now retired. Enter the last year in which you had covered earnings and the amount of such earnings.

How old do you have to be to use Quick Calculator?

You must be at least age 22 to use the form at right.

Why are retirement benefits unreliable?

Lack of a substantial earnings history will cause retirement benefit estimates to be unreliable.

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

How Is Social Security Calculated?

There is a three-step process used to calculate the amount of Social Security benefits you will receive.

How to calculate Social Security if you are not 62?

Because of how the wage indexing formula works, if you are not yet age 62, your calculation to determine how much Social Security you will get is only an estimate. Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward, and use those to create an estimate.

How to calculate indexing year?

Your wages are indexed to the average wages for the year you turn 60. 4 For each year, you take the average wages of your indexing year (which is the year you turn 60) divided by average wages for the years you are indexing, and multiply your included earnings by this number. 5

What is wage indexing?

Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3 .

What is the process used to determine how to adjust your earnings history for inflation?

Social Security uses a process called "wage indexing" to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3

How to find average indexed monthly earnings?

Total the highest 35 years of indexed earnings, and divide this total by 420, which is the number of months in a 35-year work history, to find the Average Indexed Monthly Earnings.

What is income in SSI?

Income is any item an individual receives in cash or in-kind that can be used to meet his or her need for food or shelter. Income includes, for the purposes of SSI, the receipt of any item which can be applied, either directly or by sale or conversion, to meet basic needs of food or shelter. Earned Income is wages, net earnings from ...

What are some examples of payments or services that do not count as income for the SSI program?

Examples of payments or services we do not count as income for the SSI program include but are not limited to: the first $20 of most income received in a month; the first $65 of earnings and one–half of earnings over $65 received in a month; the value of Supplemental Nutrition Assistance Program (food stamps) received;

What is considered in-kind income?

In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value. Deemed Income is the part of the income of your spouse with whom you live, your parent (s) with whom you live, or your sponsor (if you are an alien), which we use to compute your SSI benefit amount.

What is impairment related work expenses?

the cost of impairment–related work expenses for items or services that a disabled person needs in order to work. See the SSI Spotlight on Impairment–Related Work Expenses;

What is unearned income?

Unearned Income is all income that is not earned such as Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, dividends and cash from friends and relatives. In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value.

What is Supplemental Nutrition Assistance Program?

the value of Supplemental Nutrition Assistance Program (food stamps) received; income tax refunds; home energy assistance; assistance based on need funded by a State or local government, or an Indian tribe; small amounts of income received irregularly or infrequently;

Can I count my spouse's income for SSI?

When a person who is eligible for SSI benefits lives with a spouse who is not eligible for SSI benefits, we may count some of the spouse's income in determining the SSI benefit.

How Does the Social Security Administration Calculate Benefits?

The Social Security Administration takes your highest-earning 35 years of covered wages and averages them, indexing for inflation. They give you a big fat “zero” for each year you don’t have earnings, so people who worked for fewer than 35 years may see lower benefits.

How long do you have to be a Social Security employee to get full benefits?

Anyone who pays into Social Security for at least 40 calendar quarters (10 years) is eligible for retirement benefits based on their earnings record. You are eligible for your full benefits once you reach full retirement age, which is either 66 and 67, depending on when you were born.

Who Is Eligible for Social Security Benefits?

Anyone who pays into Social Security for at least 40 calendar quarters (10 years) is eligible for retirement benefits based on their earnings record. You are eligible for your full benefits once you reach full retirement age, which is either 66 and 67, depending on when you were born. But if you claim later than that - you can put it off as late as age 70 - you’ll get a credit for doing so, with larger monthly benefits. Conversely, you can claim as early as age 62, but taking benefits before your full retirement age will result in the Social Security Administration docking your monthly benefits.

What is the Social Security income test for 2021?

For 2021, the Retirement Earnings Test Exempt Amount is $18,960/year ($1,580/month). If you’re in this age group and claiming benefits, then every $2 you make above the Exempt Amount will reduce by $1 the Social Security benefits you'll receive. (Note that only income from work counts for the Earnings Test, so income from capital gains and pensions won’t count against you.)

How does Social Security affect retirement?

Social Security benefits in retirement are impacted by three main criteria: the year you were born, the age you plan on electing (begin taking) benefits and your annual income in your working years. First we take your annual income and we adjust it by the Average Wage Index (AWI), to get your indexed earnings.

What age do you have to be to claim Social Security?

If you claim Social Security benefits early and then continue working, you’ll be subject to what’s called the Retirement Earnings Test. If you’re between age 62 and your full retirement age, and you’re claiming benefits, you need to know about the Earnings Test Exempt Amount, a threshold that changes yearly.

How many states tax Social Security?

That covers federal income taxes. What about state income taxes? That depends. In 13 states, your Social Security benefits will be taxed as income, either in whole or in part; the remaining states do not tax Social Security income.

How is SSI payment reduced?

Payment reduction. The monthly amount is reduced by subtracting monthly countable income. In the case of an eligible individual with an eligible spouse, the amount payable is further divided equally between the two spouses. Some States supplement SSI benefits.

What is the maximum federal income tax for 2021?

The latest such increase, 1.3 percent, becomes effective January 2021. The monthly maximum Federal amounts for 2021 are $794 for an eligible individual, $1,191 for an eligible individual with an eligible spouse, and $397 for an essential person.

Is the online calculator more accurate than the Quick Calculator?

To use the Online Calculator, you must have a copy of your earnings record because you will need to enter your covered earnings for each year. This calculator is more accurate than the Quick Calculator. (The Online Calculator requires that your browser be JavaScript-enabled.)

Can you use the retirement calculator if you are receiving a benefit based on your own earnings?

You can not use this calculator if you are receiving a benefit based on your own earnings record. In addition, you must be permanently insured to use the Retirement Estimator. Other calculators, listed below, are less restrictive but require you to enter your earnings.

How is SSDI calculated?

Mathematically speaking, Social Security Disability Insurance (SSDI) is calculated in the same way as Social Security retirement benefits. Both are based on your record of “covered earnings” — work income on which you paid Social Security taxes.

How does Social Security calculate PIA?

The Social Security Administration (SSA) starts by figuring your average monthly income across your working life, adjusted for historical wage growth. It then plugs that figure into a formula to determine your primary insurance amount (PIA ), also known as your full retirement benefit.

How many years does the SSA count up?

The SSA counts up the number of years from the year you turned 22 to the year before you became disabled

Can you get reduced SSDI?

SSDI benefits can be reduced if you are collecting other public disability payments, such as state disability benefits or workers' compensation. There is no reduction for private disability benefits, such as payouts from commercial insurance.

Does SSI apply to earnings based benefits?

The earnings-based benefit calculation does not apply to Supplemental Security Income (SSI), the other SSA-run benefit program serving people with disabilities. SSI eligibility is based on financial need, and benefit amounts are set by the federal government, without regard to a recipient’s work history.

Is SSDI benefit lower than retirement?

Still, that full payment tends to be lower for SSDI recipients than for retirees, in part because your disability can cost you higher-earning years that would boost your calculated benefit. In August 2021, the average monthly retirement and SSDI benefits were about $1,558 and $1,280, respectively, according to SSA data. If you have an online My Social Security account, you can check your projected retirement and disability benefit amounts.