Step 1: Calculate Your Monthly Earnings

- Calculate Your Monthly Earnings Your Social Security benefit calculation starts by looking at how long you worked and how much you made each year. ...

- Calculate Your Primary Insurance Amount (PIA) Once you have calculated your Average Indexed Monthly Earnings (AIME), you'll plug that number into a formula to determine your Primary Insurance ...

- Adjust Your PIA for the Age You Will Begin Benefits

What is the formula for Social Security retirement benefits?

To sum it all up:

- Calculate Average Indexed Monthly Earnings (AIME). ...

- Apply the Social Security benefits formula to your AIME to calculate your primary insurance amount. ...

- Adjust your primary insurance amount based on cost-of-living increases for each year after you turn 62 but before retirement. ...

How do I estimate my SS Benefits?

You may want to may want to consider using my company's software — Maximize My Social Security or MaxiFi Planner — to ensure your household receives the highest lifetime benefits. Social Security calculators provided by other companies or non-profits may provide proper suggestions if they were built with extreme care. Best, Larry

How to estimate Social Security retirement benefits?

- Currently receiving benefits on your own Social Security record.

- Waiting for a decision about your application for benefits or Medicare.

- Age 62 or older and receiving benefits on another Social Security record.

- Eligible for a Pension Based on Work Not Covered By Social Security.

How to calculate your projected Social Security benefit?

- For every dollar of average indexed monthly earnings up to $926, you’ll get 90 cents per month in benefits.

- For every dollar of average indexed monthly earnings between $927 and $5,583 you’ll get $.32 cents per month in benefits.

- For every dollar of average indexed monthly earnings beyond $5,583 you’ll get $.15 cents per month in benefits.

How is SSI calculated for retirement?

We: Base Social Security benefits on your lifetime earnings. Adjust or “index” your actual earnings to account for changes in average wages since the year the earnings were received. Calculate your average indexed monthly earnings during the 35 years in which you earned the most.

What is the average SSI retirement benefit?

$1,496.13 per monthCalifornia. In America's most populous state, some 4.3 million retirees who collect Social Security can expect to receive an average $1,496.13 per month from the program in 2020, or $17,953.56 over the course of the year. California is another state where benefits are below average for the U.S.

How SSI benefits are calculated?

The SSI Payment Formula The Social Security Administration, known as SSA, figures your federal SSI benefit by deducting your countable unearned income and your countable earned income from the maximum Federal Benefit Amount of $783 for individuals and $1,175 for a couple. The remainder is your Federal Amount Payable.

How much Social Security will I get if I make 60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $50000 a year?

For example, the AARP calculator estimates that a person born on Jan. 1, 1960, who has averaged a $50,000 annual income would get a monthly benefit of $1,338 if they file for Social Security at 62, $1,911 at full retirement age (in this case, 67), or $2,370 at 70.

Can I get Social Security retirement and SSI at the same time?

In most cases, you cannot collect Social Security retirement and Social Security Disability Insurance (SSDI) at the same time. You may, however, qualify for Supplemental Security Income (SSI) if you meet the strict financial criteria while drawing either Social Security retirement or SSDI benefits.

How much Social Security will I get if I make $40000 a year?

Those who make $40,000 pay taxes on all of their income into the Social Security system. It takes more than three times that amount to max out your Social Security payroll taxes. The current tax rate is 6.2%, so you can expect to see $2,480 go directly from your paycheck toward Social Security.

How much Social Security will I get if I make $30000 a year?

0:362:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipThe number of months and 35. Years that gives you 2500. Still with me that number gives you yourMoreThe number of months and 35. Years that gives you 2500. Still with me that number gives you your average index monthly earnings or aim. Simply put it's your monthly pay for the last 35.

What is indexing factor for a prior year?

The indexing factor for a prior year Y is the result of dividing the average wage index for the year in which the person attains age 60 by the average wage index for year Y.

What is indexing factor?

Indexing brings nominal earnings up to near-current wage levels. For each case, the table shows columns of earnings before and after indexing. Between these columns is a column showing the indexing factors. A factor will always equal one for the year in which the person attains age 60 and all later years. The indexing factor for a prior year Y is the result of dividing the average wage index for the year in which the person attains age 60 by the average wage index for year Y. For example, the case-A indexing factor for 1982 is the average wage for 2020 ($55,628.60) divided by the average wage for 1982 ($14,531.34).

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

How much can you lose from Social Security at 62?

They take a bite from the full benefit if you are younger than full retirement age — you can lose more than a quarter of your benefits by starting Social Security at 62, the earliest possible age. But they add to your benefit for each month between full retirement age and 70 that you delay claiming benefits. You can gain more than 30 percent extra in benefits this way.

What is the average monthly wage for 2021?

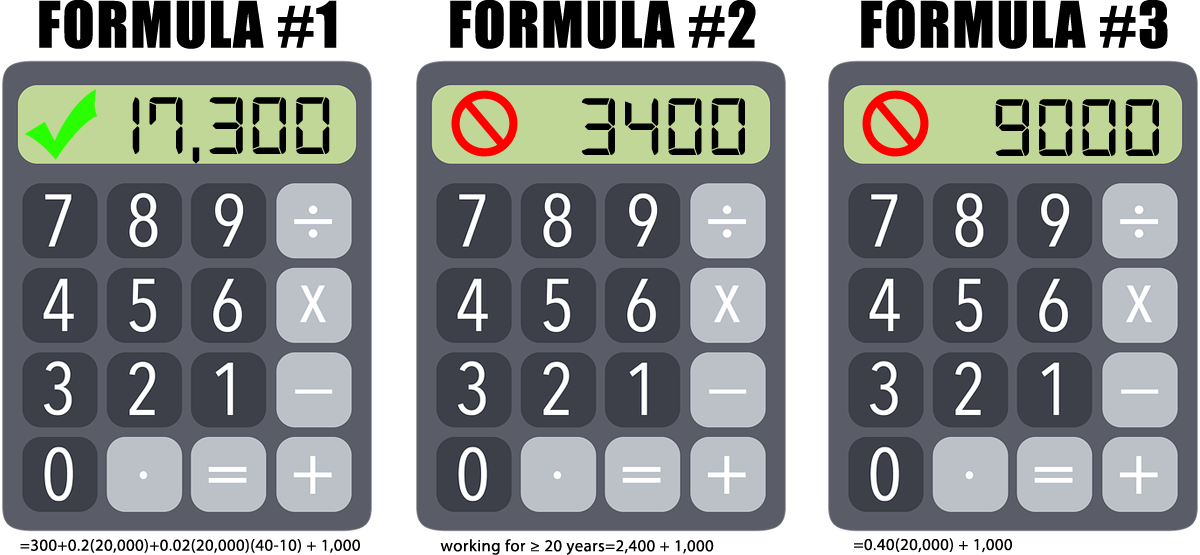

The formula breaks down your average monthly wage into three parts. In 2021, it is: 90 percent of the first $996 of your AIME; plus 32 percent of any amount over $996 up to $6,002; plus 15 percent of any amount over $6,002. The sum of those three figures is your PIA, also known as your full retirement benefit.

How many retirement estimates does Quick Calculator give?

If you do not give a retirement date and if you have not reached your normal (or full) retirement age, the Quick Calculator will give benefit estimates for three different retirement ages.

What is the benefit estimate?

Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough. Although the "Quick Calculator" makes an initial assumption ...

Why are retirement benefits unreliable?

Lack of a substantial earnings history will cause retirement benefit estimates to be unreliable.

What does "0" mean in retirement?

If you entered 0, we assume you are now retired. Enter the last year in which you had covered earnings and the amount of such earnings.

How old do you have to be to use Quick Calculator?

You must be at least age 22 to use the form at right.

Primary Insurance Amount

The basic Social Security benefit is called the primary insurance amount (PIA). Typically the PIA is a function of average indexed monthly earnings (AIME). We determine the PIA by applying a PIA formula to AIME. The formula we use depends on the year of first eligibility (the year a person attains age 62 in retirement cases).

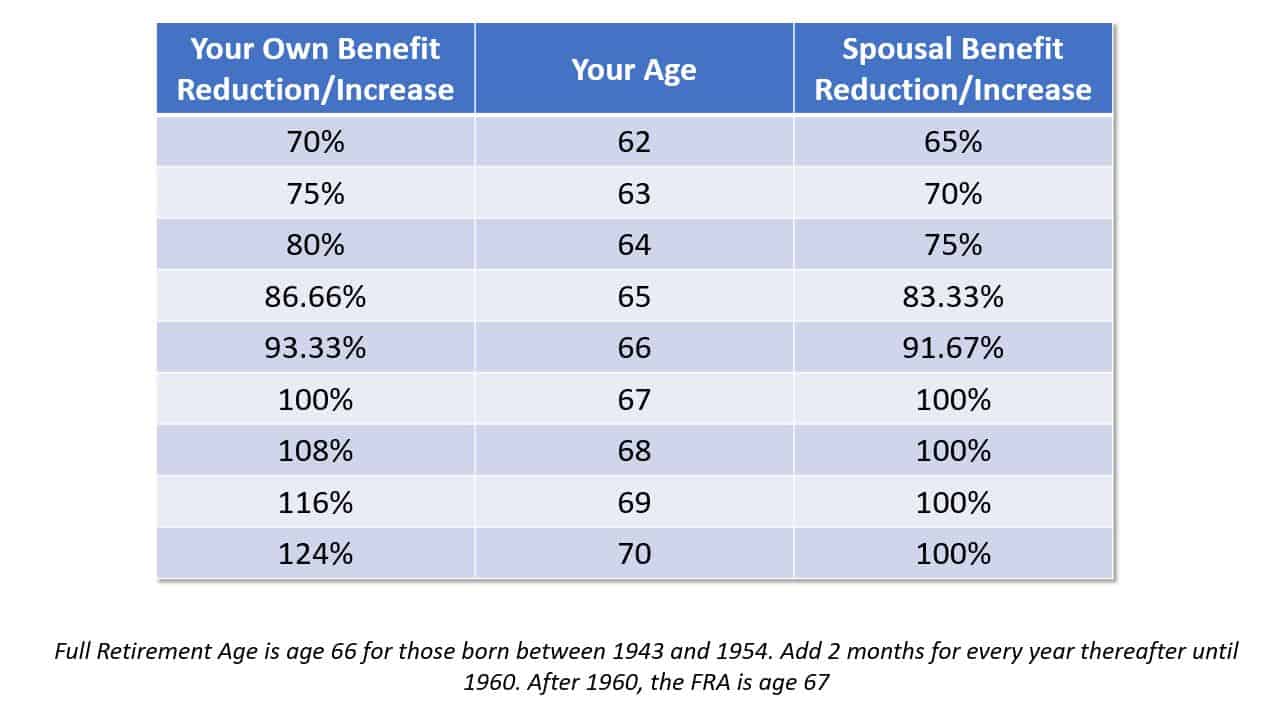

Benefit Based on PIA and Age

The amount of retirement benefits paid depends on a person's age when he or she begins receiving benefits. We reduce benefits taken before a person's normal (or full) retirement age and we increase benefits taken after normal retirement age.

Two Other Methods

Two other methods for computing a PIA have limited applicability. Relatively few new beneficiaries qualify for these two other methods.

Retirement Age Calculator

Find out your full retirement age, which is when you become eligible for unreduced Social Security retirement benefits. The year and month you reach full retirement age depends on the year you were born.

Why Did the Full Retirement Age Change?

Full retirement age, also called "normal retirement age," was 65 for many years. In 1983, Congress passed a law to gradually raise the age because people are living longer and are generally healthier in older age.

How to check my Social Security earnings?

You can view your covered earnings history by visiting www.ssa.gov/mystatement or you can check your Social Security statement which is sent every five years to those under the age of 60.

How long does a person have to be on SSDI to receive SSI?

In order to receive SSDI, the prospective recipient must be able to demonstrate they have a disability that is medically determinable, that will continue to last no less than twelve months, and that prevents the individual from engaging in substantial gainful activity.

What is back payment on SSDI?

Back payments are any disability benefits that are past due, or the benefits that you would have been paid if your initial application was approved right away. Retroactive payments are for the months that you were disabled and could not work. You are eligible for retroactive payments only with SSDI and not SSI.

What happens if you get 80% of your SSDI?

If your earnings from government run disability programs like worker’s comp combined with your SSDI earnings exceed 80% of your average income before you became disabled, your SSDI payments will be reduced.

What is the AIME on SSDI?

This income is called your “covered earnings”. The average of your covered earnings over several years is called your average indexed monthly earnings (AIME).

How to find out what your maximum monthly disability payment is?

You can quickly find this out by contacting the Social Security Administration (SSA) to receive an estimate or you can visit our website for a quicker response and use the disability calculator.

What is SGA in Social Security?

Substantial Gainful Activity – SGA. is an important concept to understand when pursuing Social Security Disability Insurance or Supplemental Security Income. The Social Security Administration defines it as “the performance of significant mental and/or physical duties for profit”. SGA maximum amounts are set by the Social Security Administration ...

How Does the Social Security Administration Calculate Benefits?

The Social Security Administration takes your highest-earning 35 years of covered wages and averages them, indexing for inflation. They give you a big fat “zero” for each year you don’t have earnings, so people who worked for fewer than 35 years may see lower benefits.

How does Social Security affect retirement?

Social Security benefits in retirement are impacted by three main criteria: the year you were born, the age you plan on electing (begin taking) benefits and your annual income in your working years. First we take your annual income and we adjust it by the Average Wage Index (AWI), to get your indexed earnings.

Who Is Eligible for Social Security Benefits?

Anyone who pays into Social Security for at least 40 calendar quarters (10 years) is eligible for retirement benefits based on their earnings record. You are eligible for your full benefits once you reach full retirement age, which is either 66 and 67, depending on when you were born. But if you claim later than that - you can put it off as late as age 70 - you’ll get a credit for doing so, with larger monthly benefits. Conversely, you can claim as early as age 62, but taking benefits before your full retirement age will result in the Social Security Administration docking your monthly benefits.

How long do you have to be a Social Security employee to get full benefits?

Anyone who pays into Social Security for at least 40 calendar quarters (10 years) is eligible for retirement benefits based on their earnings record. You are eligible for your full benefits once you reach full retirement age, which is either 66 and 67, depending on when you were born.

What is the Social Security income test for 2021?

For 2021, the Retirement Earnings Test Exempt Amount is $18,960/year ($1,580/month). If you’re in this age group and claiming benefits, then every $2 you make above the Exempt Amount will reduce by $1 the Social Security benefits you'll receive. (Note that only income from work counts for the Earnings Test, so income from capital gains and pensions won’t count against you.)

What age do you have to be to claim Social Security?

If you claim Social Security benefits early and then continue working, you’ll be subject to what’s called the Retirement Earnings Test. If you’re between age 62 and your full retirement age, and you’re claiming benefits, you need to know about the Earnings Test Exempt Amount, a threshold that changes yearly.

How many states tax Social Security?

That covers federal income taxes. What about state income taxes? That depends. In 13 states, your Social Security benefits will be taxed as income, either in whole or in part; the remaining states do not tax Social Security income.

How much is spousal benefit?

The spousal benefit can be as much as half of the worker's " primary insurance amount ," depending on the spouse's age at retirement. If the spouse begins receiving benefits before " normal (or full) retirement age ," the spouse will receive a reduced benefit. However, if a spouse is caring for a qualifying child, the spousal benefit is not reduced.

What age do you have to be to file for retirement?

Another requirement is that the spouse must be at least age 62 or have a qualifying child in her/his care.

What is the reduction factor for spousal benefits?

For a spouse who is not entitled to benefits on his or her own earnings record, this reduction factor is applied to the base spousal benefit, which is 50 percent of the worker's primary insurance amount. For example, if the worker's primary insurance amount is $1,600 and the worker's spouse chooses to begin receiving benefits 36 months ...

Can a spouse reduce their spousal benefit?

However, if a spouse is caring for a qualifying child, the spousal benefit is not reduced. If a spouse is eligible for a retirement benefit based on his or her own earnings, and if that benefit is higher than the spousal benefit, then we pay the retirement benefit. Otherwise we pay the spousal benefit. Compute the effect of early retirement ...