What is the maximum unemployment benefit in Texas?

You will need to provide documentation to substantiate:

- The date and nature of your illness, injury, disability, or pregnancy. ...

- You were unable to work for a period of seven weeks in one or more quarters during your regular base period.

- You had more work in your alternative base period than in your regular base period. This may require employment and wage history.

What are the requirements to get unemployment benefits in Texas?

- The unemployment must be for objective business reasons such as a company, project or department shutdown or a lack of work.

- The unemployment must not be a result of quitting or firing.

- The unemployed individual must not be criminally charged for misdemeanors within the company or outside of it.

How to tell if you are eligible for unemployment benefits?

You must be:

- Physically able to work.

- Available for work.

- Ready and willing to accept work immediately.

How do you calculate Texas unemployment tax?

How Taxes on Unemployment Benefits Work

- Effect on Other Tax Benefits. Not only is unemployment compensation taxable, but receiving it can affect some tax credits you might be eligible for and are counting on to defray ...

- Income Taxes vs. FICA Taxes. ...

- State vs. Federal Taxation. ...

How much is unemployment in Texas during Covid?

FPUC provided an additional $600 per week to claimants who lost work as a result of the COVID-19 pandemic. Texans will continue to receive state unemployment benefits for the remainder of their claim.

What percentage of your pay do you get on unemployment in Texas?

27%Your maximum, or total, benefit amount is the smaller of 26 times the weekly amount, or 27% of all your wages in the base period. Your weekly benefit amount will be between $59 and $406 depending upon the wages you earned.

How is UNEM calculated?

In general, the unemployment rate in the United States is obtained by dividing the number of unemployed persons by the number of persons in the labor force (employed or unemployed) and multiplying that figure by 100.

How much is unemployment in Texas per week?

Weekly Benefit Amount Your WBA will be between $71 and $549 (minimum and maximum weekly benefit amounts in Texas) depending on your past wages. To calculate your WBA , we divide your base period quarter with the highest wages by 25 and round to the nearest dollar.

How much unemployment will I get?

Weekly Benefit Rate (WBR) The weekly benefit rate is capped at a maximum amount based on the state minimum wage. For 2022, the maximum weekly benefit rate is $804. We will calculate your weekly benefit rate at 60% of the average weekly wage you earned during the base year, up to that maximum.

How is full employment calculated?

Suppose the natural unemployment rate equals 4 percent; another way of saying that is to say that when 96 percent of workers are employed, the economy is at full employment.

What are the 4 types of unemployment?

Unemployment—both voluntary and involuntary—can be broken down into four types if you dig a little deeper.Frictional Unemployment.Cyclical Unemployment.Structural Unemployment.Institutional Unemployment.

What is the unemployment rate?

The unemployment rate is the percentage of people in the labour force who are unemployed. Consequently, measuring the unemployment rate requires identifying who is in the labour force. The labour force includes people who are either employed or unemployed.

How to find your weekly benefit allowance?

You will use your base-payments to discover your weekly benefit allowance (WBA) and maximum benefit amount (MBA). Take the following steps to learn what your benefits might be: For your WBA, find your base period quarter with the highest wages. Divide those wages by 25 then round to the nearest dollar.

What is base period wages?

Your base-period wages include the first four out of five fully complete calendar quarters that you worked. This period starts at the date you are applying for benefits, not when you became unemployed. You may receive a “statement of wages and potential benefits amounts” from the state of Texas. This statement will include ...

What is the maximum amount you can receive in unemployment?

Your maximum benefit amount ( MBA) is the total amount you can receive during your benefit year. Your MBA is 26 times your weekly benefit amount or 27 percent of all your wages in the base period, whichever is less. To receive benefits, you must be totally or partially unemployed and meet the eligibility requirements.

How much is WBA in Texas?

Your WBA will be between $70 and $535 (minimum and maximum weekly benefit amounts in Texas) depending on your past wages. To calculate your WBA, we divide your base period quarter with the highest wages by 25 and round to the nearest dollar.

What is past wages?

Past Wages. Your past wages are one of the eligibility requirements and the basis of your potential unemployment benefit amounts. We use the taxable wages, earned in Texas, your employer (s) have reported paying you during your base period to calculate your benefits. If you worked in more than one state, see If You Earned Wages in More ...

What is the WBA in Texas?

Your weekly benefit amount ( WBA) is the amount you receive for weeks you are eligible for benefits. Your WBA will be between $70 and $535 (minimum and maximum weekly benefit amounts in Texas) depending on your past wages.

How long can you be out of work for APB?

You may be able to use an alternate base period ( APB) if you were out of work for at least seven weeks in one base-period quarter because of a medically verifiable illness, injury, disability, or pregnancy. The ABP uses wages paid before the illness or injury. To be eligible, you must have filed your initial claim no later than 24 months after the date that the illness, injury, disability, or pregnancy began. Call a TWC Tele-Center at 800-939-6631 to ask if you qualify for an ABP.

What is the base period for TWC?

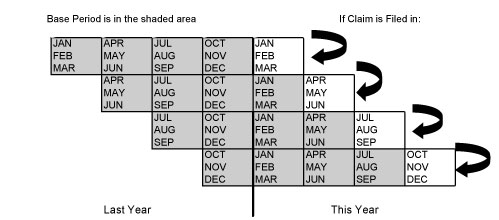

Your base period is the first four of the last five completed calendar quarters before the effective date of your initial claim. We do not use the quarter in which you file or the quarter before that; we use the one-year period before those two quarters. The effective date is the Sunday of the week in which you apply. The chart below can help you determine your base period. If you do not have enough wages from employment in the base period, TWC cannot pay you benefits.

Can you use the TWC unemployment estimate?

You may use the TWC Benefits Estimator to estimate your potential benefit amounts. The estimator cannot tell you whether you qualify for unemployment benefits. Your benefit amounts are based on your past wages. How we calculate benefits is explained below.

How long can you receive unemployment benefits?

The calculator indicates your total maximum benefit amount, which is the maximum you can receive for 52 weeks starting with the Sunday of the week that you filed your claim.

Who administers Texas unemployment?

The following link will let you start the online process to file a claim for benefits. Unemployment benefits are administered by the Texas Workforce Commission , the state government agency that helps Texan job seekers and workers.

When was the WBA updated in Texas?

Use the calculator to estimate your Texas weekly benefit rate amount (WBA) for unemployment benefits. The calculator was last updated in March 2020.

What is unemployment benefits?

Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed (working part-time) through no fault of their own. The benefits help unemployed workers who are looking for new jobs. Applicants must meet requirements concerning their past wages ...

What does TWC evaluate for unemployment?

TWC evaluates unemployment benefits claims based on the applicant's: An individual must meet all requirements in each of these three areas to qualify for unemployment benefits. Unemployment Benefits for job seekers and employees provides information for claimants on eligibility requirements.

What is severance pay in Texas?

Severance Pay. Severance pay is a sum of money an employee is eligible to receive upon job separation. You may have a company policy to pay severance pay. Texas law prohibits individuals from qualifying for unemployment benefits while receiving certain types of severance pay.

What is past wages?

Past Wages. We use the taxable wages each employer reported paying during the person's base period to calculate benefits. Each employer who paid wages during the base period may be charged for the claim. Employer Unemployment Benefit Chargebacks explains how employers are charged for unemployment benefits.

What is the base period for unemployment?

Base Period. The base period is the first four of the last five completed calendar quarters before the effective date of the initial claim. The effective date is the Sunday of the week in which the person applies for unemployment benefits.

How long can you be disqualified from military benefits?

The person may be eligible for benefits but will be disqualified for 6 to 25 weeks, depending on the situation.

Do you get unemployment if you quit your job?

If the individual chose to end their employment, then he or she quit. Most people who quit their jobs do not receive unemployment benefits. For example, if the person quit the job for personal reasons, such as to return to school full time or stay home with their children, we cannot pay benefits.

How does TWC calculate unemployment tax?

To calculate the amount of unemployment insurance tax payable, TWC multiplies their amount of taxable wages by the employer’s tax rate. The maximum amount of taxable wages per employee, per calendar year is set by statute and is currently $9,000.

What is the effective tax rate for experience rated employers?

The effective tax rate for experience-rated employers is the sum of five components. The amount of tax you pay is the sum of the five tax components multiplied by your taxable wages.

What does "chargeable" mean in unemployment?

Chargeable simply means that the employer could have been responsible for unemployment benefits paid to a former employee, it is not required that an unemployment claim be filed. In most cases an employer is not chargeable until their third quarter of paying wages.

How to get tax rate and chargeback information?

You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone, fax, email or postal mail, Online: Unemployment Tax Services. Phone: 512-463-2887.

What is the wages attributable to the acquired part of the organization?

The wages attributable to the acquired part of the organization, trade or business must be separate and distinct from other wages of the predecessor employer and must be solely attributable to services provided on behalf of the acquired part of the organization, trade, or business.

Is there a provision for voluntary transfer of experience in Texas?

Certain relationships exist between the predecessor and successor as prescribed in the Texas Unemployment Compensation Act. There is no provision in the law for voluntary total transfer of experience. A partial transfer of experience is possible when: