When Oregon determines how much to give you per week, it uses a formula mandated by state law. It uses the average wage method and calculates the weekly benefit amount using the total wages in the base period. Average Wage Period: Several states calculate the weekly benefit as a percentage of annual wages in the base period.

What is the maximum weekly unemployment benefit in Oregon?

States That Pay The Lowest Unemployment Insurance Compensation

- Mississippi – $235

- Arizona – $240

- Louisiana – $247

How do you estimate unemployment benefits?

- You must have lost your job through no fault of your own. ...

- If you quit your job, you may still be eligible for benefits if you left under certain circumstances, such as being asked to perform illegal acts or work in hazardous ...

- You must have earned at least $2,500 in wages during your standard base period. ...

How much is the maximum unemployment benefit?

- A personal medical illness or injury prevented you from working

- You are caring for a minor child who has a medical illness

- You are caring for a terminally ill spouse

- You have documented cases of sexual assault, family violence or stalking

- You entered Commission-Approved Training and the job is not considered suitable under Section 20

What is Oregon's unemployment rate?

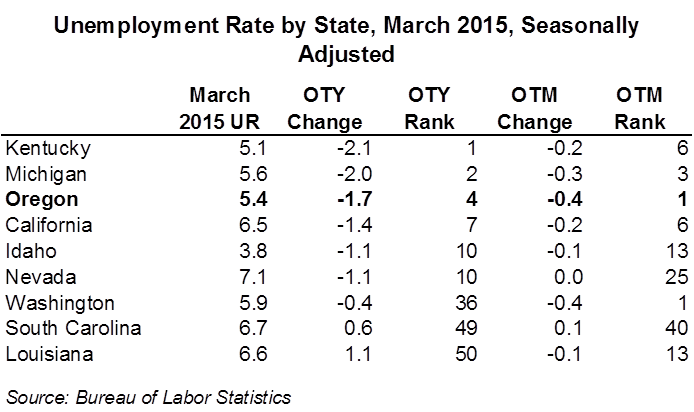

According to the BLS current population survey (CPS), the unemployment rate for Oregon fell 0.1 percentage points in March 2021 to 6.0%. The state unemployment rate was 0.0 percentage points lower than the national rate for the month. The unemployment rate in Oregon peaked in April 2020 at 13.2% and is now 7.2 percentage points lower.

How do you calculate how much unemployment you will receive in Oregon?

Your weekly benefit amount will be 1.25% of the total wages in your base period, subject to a weekly minimum of $151 and a maximum of $648. Benefits are generally available for up to 26 weeks. For an estimate of your weekly benefit, use the Oregon Unemployment Insurance Estimator.

How much money can you make and still collect unemployment in Oregon?

$300You can now earn up to $300 without seeing any change to your benefit. To qualify, you cannot: Earn an amount equal to or exceeding $300 (plus your weekly benefit amount), or. Work 40 hours or more in the week.

What is the base year for unemployment in Oregon?

Base year: Your base year is the first four of the last five completed calendar quarters before the week you file your initial claim. If you file your initial claim in January, February, or March 2021, your base year is Oct. 1, 2019 through Sept. 30, 2020.

How do you calculator unemployment?

The unemployment rate formula is unemployment rate = (Number of unemployed individuals /sums of employed and unemployed individuals) x 100%. Example-Assuming the number of unemployed people is 500 and those employed are 3000, the unemployment rate will be: 500/3500 x 100% =14.29%.

What can disqualify you from unemployment benefits?

Here are the top nine things that will disqualify you from unemployment in most states.Work-related misconduct. ... Misconduct outside work. ... Turning down a suitable job. ... Failing a drug test. ... Not looking for work. ... Being unable to work. ... Receiving severance pay. ... Getting freelance assignments.More items...•

Can you get partial unemployment in Oregon?

The law allows an unemployed worker to earn up to $300 a week without having their benefits reduced as long as they do not earn more than their weekly benefit amount or work more than 39 hours a week. An individual who works part time and earns an amount over $300 will get a partial unemployment benefit.

What you must do each week to be eligible for benefits Oregon?

What must I do to be eligible each week? You must be unemployed, physically and mentally able to work, available for work and actively seeking work each week that you claim. You must be willing and able to work all of the days and hours normal for type of work you are seeking.

How long can you draw unemployment in Oregon?

26 weeksOregon law sets a minimum and a maximum weekly benefit amount. As a general rule, you can collect up to 26 weeks of benefits in a one-year period. Sometimes there are state or federal programs that provide additional weeks of benefits after regular benefits are exhausted.

How long do you have to be employed to get unemployment in Oregon?

500 hoursYou will need to provide your complete work history for the past 18 months including em- ployer names, addresses, phone numbers, and dates of employment. How do I qualify? You've worked at least 500 hours and were paid some subject wages in employment during the base year.

How do you calculate employment?

Calculate the employment rate. Divide the number of employed people by the total labor force. Multiply this number by 100. The result of these calculations is the employment rate.

How is full employment calculated?

Suppose the natural unemployment rate equals 4 percent; another way of saying that is to say that when 96 percent of workers are employed, the economy is at full employment.

What are the 4 types of unemployment?

Unemployment—both voluntary and involuntary—can be broken down into four types if you dig a little deeper.Frictional Unemployment.Cyclical Unemployment.Structural Unemployment.Institutional Unemployment.

How much can you get on unemployment in Oregon?

In order to get this maximum, you must have earned as a minimum $$39,680 in covered wages during your base period.

What is covered wages in Oregon?

Covered wages are those that you get from employment covered under Oregon’s unemployment compensation laws. The state leaves out self-employment, independent contract work or work that that you paid only through commission under these laws.

What is weekly unemployment?

The unemployment weekly benefit amount is the sum you are entitled to collect per week. State law restricts the WBA is limited to stop you from obtaining large unemployment payments. It also preserves the spirit of program by keeping claimants with prior high earnings from draining the fund. The maximum WBA may vary by year.

How long can you extend your EBP?

Extended Base Periods (EBP) Base period can be extended up to 4 quarters if the worker is disabled for the majority of a quarter. If the worker collected worker’s compensation, base year can be extended up to 4 quarters prior to the illness or injury.

Does Oregon require a work search?

The Oregon Department of Employment needs claimants to conduct a work search while collecting benefits. The state does not want claimants to make contact with a specific number of employers each week while obtaining compensation; however claimants must keep a record of employer contacts to provide proof of work search efforts.

Can you get unemployment benefits extended in Oregon?

Due to changing conditions unemployment benefits may be extended. During times of high unemployment in Oregon, individuals may become qualified for unemployment benefit extensions.

Do you have to work to collect UI?

All states need a worker to have earned a definite amount of wages or to have worked for a definite period of time (or both) within the base period to be financially eligible to collect any UI benefits. Most workers are entitled for benefits based on employment and wages in a single state.

How to file unemployment in Oregon?

How to File a Claim for Unemployment Benefits in Oregon. You may file your claim for unemployment benefits online, by phone, by fax, or by mail. You can find online filing information and contact information at the state of Oregon's Unemployment Insurance page. Once you file, you must continue to file weekly claims with ...

What is the employment department in Oregon?

In Oregon, the Employment Department handles unemployment benefits and determines eligibility on a case-by-case basis. Applicants must meet the following three eligibility requirements in order to collect unemployment benefits in Oregon:

How long is PUA unemployment in 2021?

ARP makes PUA benefits available through Labor Day 2021, and increases the maximum duration of these benefits from 50 to 79 weeks. The PEUC program provides for a federally-funded extension of benefits when state unemployment benefits expire. ARP increases the maximum duration of PEUC benefits from 24 to 53 weeks, ...

What are the factors that determine if a position is suitable for unemployment?

For the initial unemployment period, whether a position is suitable depends on several factors, including the level of skill and training required, the similarity between the work and your previous employment, how much the position pays, and the distance between the job site and your residence.

What is a reasonable search for work?

You must conduct a reasonable search for work, which includes contacting new employers each week. You should keep a record of your job search efforts, including the employers you have contacted, the dates you made contact, and the outcome. The ED may contact you or your employer contacts to verify your efforts.

What is misconduct in Oregon?

In Oregon, among other things, misconduct means an intentional violation of the employer's rules, the failure to conform to standards which an employer can reasonably expect from an employee, or careless behavior that is so frequent or severe that it shows a disregard for the employer's interests.

When is the base period for unemployment?

For example, if you filed your claim in October of 2020, the base period would be from June 1, 2019, through May 31, 2020. During the base period, you must meet at least one of the following requirements in order to be eligible for unemployment:

How long can you collect unemployment?

State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits for a lower number of weeks, and maximum benefits also vary based on where you live. In times of high unemployment, additional weeks of unemployment compensation may be available. Regardless of how much you make, you never can collect more than ...

What percentage of unemployment is taxed?

Some states withhold a percentage of your unemployment benefits to cover taxes—typically 10%. If the option to have taxes withheld is available, you will be notified when you sign up for unemployment.

How long do you get unemployment if you are laid off?

The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker. In many states, you will be compensated for half of your earnings, up to a certain maximum. State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits ...

What does it mean to be ineligible for unemployment?

It typically means you are ineligible if you quit—although there are exceptions, like if you quit because of impossible work conditions. If you are fired for cause, you also are likely ineligible. You also have to have been employed for a minimum amount of time or have earned a minimum amount in compensation.

Is unemployment taxable income?

Taxes on Unemployment. Unemployment benefits are considered taxable income, and the unemployment compensation you receive must be reported when you file your federal and state tax returns. 2 . Both state unemployment benefits and federally funded extended benefits are considered income and must be reported when you file your federal ...

How to calculate unemployment weekly?

To calculate your weekly benefits amount, you should: Work out your base period for calculating unemployment. Take a look at the base period where you received the highest pay. Calculate the highest quarter earnings with a calculator. Calculate what your weekly benefits would be if you have another job. Calculate your unemployment benefits ...

How long does it take to get unemployment?

If eligible for unemployment benefits, you can expect to receive your first payment within 3-4 weeks if there are no issues with your claim. In general, it takes approximately 3 weeks to process a claim; however, you will still need to claim benefits every week. The information you need before filing a claim:

What happens if you work while receiving unemployment?

In case you earn an income while receiving benefits, they would reduce the amount of benefits that you receive. If you work temporarily then you must report those earnings to the state unemployment agency and they will determine how much of the unemployment benefits would be reduced.

How long does unemployment last?

This is beneficial for those that are out of work for a long period. The maximum benefits duration has increased from 26 to 99 weeks in some states.

How to file a weekly claim?

You can file your weekly claim: Through the Internet – You can file your weekly claim online. You must have a User ID and PIN in order to file your weekly claim online. By phone – You must call the number given to you during the registration process.

Do higher wages get a larger benefit check?

In a way, this would be up to a cap that is tied to the average earnings in that state. So the employees with a higher wage would receive a larger benefits check but it is still a percentage of what they used to earn. The amount that an employee would receive differs from each state.

Can I file unemployment if I received severance pay?

Have your entire information ready before filing your claim. If you have received severance pay upon your separation from work, you may still be eligible for unemployment benefits. So it is still important to call and file your initial claim during your first week of total or partial unemployment.