Write a letter to the plan administrator of your previous health insurance to advise him of your intent to discontinue your COBRA benefits. If applicable, you can contact the human resources manager at your previous job for the plan administrator's information.

How do I cancel my Cobra coverage?

- The employer must notify TASC that a qualifying event has taken place within 30 days.

- TASC has 14 days from the date of the notice from the employer to inform the employee of their rights under COBRA.

- The employee has 60 days from the postmarked date of the Election Notice to elect COBRA coverage.

Can I cancel my Cobra coverage?

When you sign up for COBRA insurance always make a note of any special requirements your policy may have for cancellation as many times, you will have to notify your previous employer in writing. After your policy is canceled, you will receive a letter of termination and a certificate of credible coverage.

Can my former employer Cancel my Cobra?

days of receiving written notice of your COBRA rights from your former employer. Under COBRA, you and your family have the right to remain on whatever health plan your former employer has for up to 18 months. You must continue paying the full premium, which includes both your former employer's share and your share plus a 2 percent administrative fee. STATE CONTINUATION: If you are not eligible for COBRA or if you have exhausted your COBRA coverage, Texas law provides you with coverage

How do I cancel COBRA health insurance?

- That my COBRA benefits be discontinued effective May 1, 2015,

- That the balance of $xxx already applied to my account for the month of May be refunded to me, and

- That the balance due for the remainder of May be canceled.

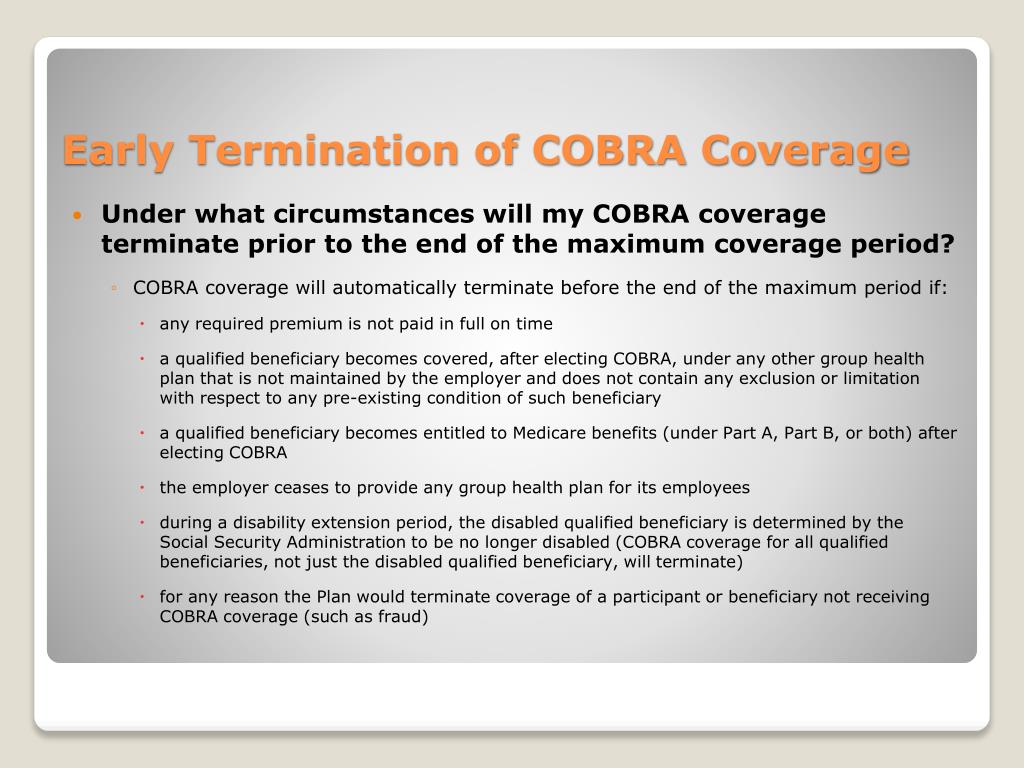

Does COBRA cancel automatically?

You will likely want to drop COBRA once you become eligible for a different health plan, such as if you get another job. If you stop paying premiums, COBRA coverage will end automatically. A health plan may also terminate a COBRA plan if your former employer drops group health insurance coverage.

Can I cancel COBRA during open enrollment?

A. Yes, you can buy insurance in the exchange during open enrollment and drop your COBRA insurance. Once you're enrolled in a plan for January, you can cancel your COBRA coverage. Whether you are eligible for a tax credit will depend on your household income.

Can COBRA be Cancelled without notice?

The employer must notify the plan if the qualifying event is the covered employee's termination or reduction of hours of employment, death, entitlement to Medicare, or bankruptcy of a private-sector employer. The employer must notify the plan within 30 days of the event.

Can I cancel COBRA and get a refund?

Premium payments for your COBRA health insurance continuation coverage, will coverage for a full month. Major medical plans will most often start on the first of the month and end on the last day. Generally, there are no refunds.

Can I switch from COBRA?

If you're already enrolled in COBRA, you may have options in the Marketplace. Can you change from COBRA to a Marketplace plan? Yes, you can change. Yes, you can change.

Can you cancel health insurance at any time?

Although you can cancel your health insurance plan anytime, without having to serve a waiting period. The refund payable to you depends on when you've cancelled the policy. Read further to know in detail the cancellation policy of the health insurance plan.

What happens if you don't pay COBRA?

When a participant fails to make a timely payment of any required COBRA premium, the employer may terminate COBRA coverage. Employers must provide participants with at least a 30-day grace period for payment of any late premiums.

Is COBRA more expensive than regular insurance?

COBRA insurance is often more expensive than marketplace insurance, partly because there isn't any financial assistance from the government available to help you pay those COBRA premiums.

Can COBRA be reinstated once Cancelled?

Once COBRA coverage is canceled, there is no option for reinstatement. Note that waiting until the end of the grace period to make payment may not allow enough time within the grace period to reconcile payment if your check is lost in the mail or is rejected by your bank.

Can you prorate COBRA?

No, premiums cannot be prorated for a shorter period. You must pay the full premium amount for each month. Partial payments will be accepted, but cannot be reported to the carrier until the full amount has been paid.

Are COBRA payments taxable?

COBRA premiums. Amounts you pay to maintain medical coverage for a current or former employee under COBRA should not be reported as taxable wages, provided the plan covered by the COBRA premiums is a “qualified plan.” See IRC Section 4980B(g) for details.

Will COBRA reimburse me?

Yes. After you have enrolled, call the insurance carrier and ask for their procedure for reimbursement of claims that were paid out-of-pocket that will need to be submitted for review.

What Is Cobra Health Insurance?

COBRA or the Consolidated Omnibus Budget Reconciliation Act was passed in 1986 to provide provisions for certain health benefits. It was an amendme...

Are There Penalties For Canceling Cobra?

If you cancel your coverage before you become eligible for new insurance, they may not honor the certificate of coverage. They can write pre-existi...

Who Qualifies For Cobra Health Insurance?

Not all companies have to offer COBRA coverage. The law is designed to cover companies who maintain health insurance coverage on at least 20 employ...

How Does Cobra Health Insurance Work?

Your employer is required by law to notify you of your COBRA eligibility and notify their insurance provider. The provider will then send you infor...

What is Cobra insurance?

What is COBRA health insurance? COBRA or the Consolidated Omnibus Budget Reconciliation Act was passed in 1986 to provide provisions for certain health benefits.

How long do you have to pay Cobra insurance?

See below for a few things you need to know: If you chose COBRA coverage, you would have 45 days to make your first payment. You will be required to make any premium payments you missed during the 60-day enrollment period. Payments are due every 30 days after that.

How long do you have to wait to pay for Cobra?

You may also have to wait up to a year before they will pay for any treatments related to these conditions. This will apply to your spouse as well if they are covered under your plan. COBRA premiums are based on how your previous employer pays for their company health insurance plans.

Is Cobra a health insurance?

This is to help while you search for a new job and to cover any waiting period you may have for new health insurance. COBRA allows you to keep the health coverage your employer offered; it is not a health insurance provider. You will be required to follow the rules set forth by the insurance company for receiving services and filing claims.

Can you cancel Cobra insurance?

If you are using COBRA health insurance and no longer need it, you can cancel it. When you sign up for COBRA insurance always make a note of any special requirements your policy may have for cancellation as many times, you will have to notify your previous employer in writing. After your policy is canceled, you will receive a letter ...

Can my spouse apply for Cobra?

Your spouse can also apply for COBRA if you pass away or divorce. Any dependent children would also be covered. If you become eligible for Medicare, your spouse, and dependent children can apply for COBRA benefits. This would allow them to continue their benefits until they can find new ones.

Is Cobra more expensive than health insurance?

You will be required to follow the rules set forth by the insurance company for receiving services and filing claims. COBRA may cost more than your employer-sponsored health insurance. This is because employers usually pay a portion of your health care plan.

Billing mismatch was just the beginning

As I stated in my previous article, I needed COBRA only for the period between April 15 and May 1, when my insurance at my new employer was set to kick in.

My COBRA cancellation letter

I am writing in regard to COBRA benefits for account #xxx. Since I had health coverage through my new employer as of May 1, 2015, I would like to request the following:

Other billing issues arose too

Since the COBRA plan I opted for was the exact same plan I had been on at my employer, I thought that my physical therapist had processed my claims without any issue during this time. However, in early May, I received a bill from them for over $350. Whoa!

Another lag: Waiting for verification of my cancellation

Time ticked by, and I received a bill for June. (For all the lags during the sign-up process, they were pretty prompt about sending my monthly invoice!) However, because of the timing, I knew the two items had crossed paths in the mail.

Is the check actually in the mail?

The confirmation included verification that I had a negative balance for the amount that had been applied to my account for May 1 through May 15. Unfortunately, there was no check included with the updated invoice. I assume the check is in the mail?

Who is best suited for COBRA? Other benefits and drawbacks

If you are leaving your job to pursue self-employment, you may be able to get health coverage that is as good as or better than COBRA for less money. The packet you receive in the mail with the sign-up materials articulates this pretty forcefully! You are definitely encouraged to pursue other options.

How to fill out and sign cobra termination form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Video instructions and help with filling out and completing cobra forms for terminated employees

Utilize our fast video guideline for completing Form on the web. Going paperless is the only method to save your time for more essential activities in the digital age.

Tips on how to complete the Benefits termination form online

To begin the blank, utilize the Fill & Sign Online button or tick the preview image of the document.

Video instructions and help with filling out and completing Cobra Benefits Termination Form

Find a suitable template on the Internet. Read all the field labels carefully. Start filling out the blanks according to the instructions:

Instructions and help about discovery benefits

Music the final stage in a discipline process may be called discharge firing dismissal termination among other terms regardless of the word used termination occurs when an employee is removed from a job at an organization both positive and progressive approaches to discipline clearly provide employees with warnings about the seriousness of their performance problems before dismissal occurs termination should not take place in the heat of the moment even in cases that involve very serious infractions such as an employee found drinking alcohol on the job the employee should be suspended without pay pending an investigation the time taken to thoroughly review the situation may save the organization time in litigation costs in the end terminating an individual's employment is a serious matter and one that should be taken only after conferring with HR and confirming the decision is free of bias managers must be careful not to move forward with these terminations too hastily and they should.

FAQs discoverybenefits

Here is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer.

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host).

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Automated. Compliant. Seamless

With decades of experience navigating the compliance and business of COBRA and direct bill, you can count on us to streamline your workflow and simplify the participant experience.

More than Software

We offer integrated services, such as payment processing and mail fulfillment, to reduce processing errors and keep you compliant.

Want More Information?

Download our COBRA + direct bill handout, subscribe to our blog, and listen to our podcast.

How long is Cobra coverage?

Federal COBRA is available for a minimum of 18 months following a qualifying event and may be available up to 36 months for certain circumstances (or under State COBRA rules). Make sure you understand when you have exhausted your COBRA coverage benefits and need to seek out alternative coverages.

What happens if you fail to pay Cobra premiums?

Late payments (or failure to pay COBRA premiums) may result in a loss of coverage. You are at the mercy of the plan sponsor.

What is Cobra insurance?

COBRA is commonly used to provide continuous group health coverage between employment. You got the new job! The benefits are awesome. The only problem, you have a waiting period before you are eligible to enroll. So you enroll in COBRA to avoid a gap in coverage. Your benefits finally kick-in and you no longer need COBRA. You will need to notify the plan sponsor (or designated COBRA administrator) to terminate your COBRA coverage. Be sure to specify the date your new group coverage begins and COBRA coverage ends. Any overpayment of premiums is returned to you.

When does Cobra end?

If you already have COBRA when you enroll in Medicare, your COBRA coverage usually ends on the date you enroll in Medicare. If you have COBRA and become Medicare-eligible, you should enroll in Part B immediately because you are not entitled to a Special Enrollment Period (SEP) when COBRA ends. Your spouse and dependents may keep COBRA for up to 36 months if certain conditions are met, regardless of whether you enroll in Medicare during that time.

What happens if a group plan no longer exists?

If a group plan no longer exists for any active employees, there is no longer an opportunity for you to maintain coverage through COBRA. This is where it gets a little dicey. Through no fault of your own, your COBRA coverage may be terminated early.

How to ensure continuous uninterrupted coverage?

To ensure continuous, uninterrupted coverage, always pay your premiums by the due date. When you enrolled in COBRA, you likely received a coupon book to easily track payment amounts and due dates. Note on starting alternative coverages.

Why does my employer stop providing insurance?

The decision to stop providing coverage may be the result of a company closure, bankruptcy filing or just an evaluation of benefits offered.