How do I change my withholdings for Social Security?

If you are already receiving benefits or if you want to change or stop your withholding, you'll need a Form W-4V from the Internal Revenue Service (IRS). You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request.

How do I send W 4V to Social Security?

Complete lines 1 through 4; check one box on line 5, 6, or 7; sign Form W-4V; and give it to the payer, not to the IRS. Note. For withholding on social security benefits, give or send the completed Form W-4V to your local Social Security Administration office.

How much taxes should I have withheld from my Social Security check?

There are several ways to pay the taxes throughout the year and avoid an underpayment penalty or a big bill at tax time. You can file Form W-4V with the Social Security Administration requesting to have 7%, 10%, 12% or 22% of your monthly benefit withheld for taxes.

How long does it take to change Social Security withholding?

How long does it take to start having my premiums withheld from my Social Security payments? It could take up to 3 months from the time you request premium withhold before you start seeing premiums withheld from your Social Security payment.

Can I fill out a W 4V online?

How to fill out the Can you submit Irs form w 4v printable online 2018-2019 on the web: To start the document, use the Fill camp; Sign Online button or tick the preview image of the document. The advanced tools of the editor will lead you through the editable PDF template.

How do I change my withholding?

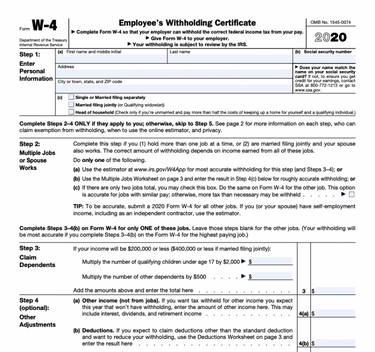

Change Your WithholdingComplete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer.Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.Make an additional or estimated tax payment to the IRS before the end of the year.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How can I avoid paying taxes on Social Security?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

Do seniors pay taxes on Social Security income?

Many seniors are surprised to learn Social security (SS) benefits are subject to taxes. For retirees who are still working, a part of their benefit is subject to taxation. The IRS adds these earnings to half of your social security benefits; if the amount exceeds the set income limit, then the benefits are taxed.

What happens if too much Social Security tax is withheld?

Unfortunately, you cannot stop the withholding. However, you will get a credit on your next tax return for any excess withheld. Each employer is obligated to withhold social security taxes from your wages. The total they both can withhold may exceed the maximum amount of tax that can be imposed for the year.

Why is Social Security taxed twice?

The rationalization for taxing Social Security benefits was based on how the program was funded. Employees paid in half of the payroll tax from after-tax dollars and employers paid in the other half (but could deduct that as a business expense).

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.