How can I check the status of my unemployment benefits?

You can also check on the status of your unemployment claim through the EDD’s automated, self-service telephone system at 1-866-333-4606. This phone line is open 24 hours a day.

How do you check the status of your unemployment claim?

- You’re not able to work

- You’re not actively seeking work

- You quit

- You were fired

- You have certain kinds of income we need to factor in (list 1-3 examples)

How do I certify for unemployment?

How do I certify for unemployment benefits? We recommend that you certify for benefits with UI Online because it is a fast, convenient, and a secure way to certify. You can also certify by phone using EDD Tele-Cert SM at 1-866-333-4606 .

How do you file unemployment benefits?

- Name, address, and phone number

- First and last day of work

- Gross earnings (before taxes are taken out) during the listed dates

- The reason for separation

- FEIN (this is found on any W2 or 1099 tax forms you have received)

- If you don’t have the FEIN, you can use employer details off of a recent paystub

How do I check my PA unemployment balance online?

Page 1WHAT IS THE REMAINING BALANCE OF MY BENEFITS?Go to: https://www.paclaims.state.pa.us/uccc/WelcomeBenefitStatus.asp. ... You will be brought directly to the Benefit Payment Information screen.More items...

How do I know if my ga unemployment claim was approved?

You may check the status of your claim and payments in the MyUI portal.

How do I check my unemployment status in Texas?

You can check your claim status online at Unemployment Benefits Services or call Tele-Serv at 800-558-8321. We use information from you and your last employer to determine if you qualify. TWC sends your last employer a letter with the reason you gave for no longer working there.

How do I check the status of my EDD claim?

You can also check on the status of your unemployment claim through the EDD's automated, self-service telephone system at 1-866-333-4606. This phone line is open 24 hours a day.

How long does it take for unemployment benefits to be deposited Ga?

Expect at least 21 days or more to access your weekly benefit payment. Please expect at least 21 days or more to access your weekly benefit payment if you are eligible to receive benefits. Payments will be made to the most recent payment method on record: direct deposit or state issued debit card.

How long does unemployment take to get approved?

It takes at least three weeks to process a claim for unemployment benefits and issue payment to most eligible workers.

How long does it take to get your first unemployment check in Texas?

approximately four weeksIf you are eligible, we will issue your first payment approximately four weeks after you apply for benefits. Typically, your first payment is only for one week even though you submitted a payment request for two weeks. This is because the first payable week is your “waiting week.”

How long does it take for TWC to deposit money?

Your payment should be in your direct-deposit or debit-card account within three days of TWC processing your payment. If you request payment online after 6 p.m., allow two additional business days for processing.

How do I access my TWC account?

Create a TWC Internet User ID or logon with your existing TWC Internet User ID. Enter the employer's TWC tax account number for the account you wish to view. To request access to more than one account number, select the Request Employer Access link from the My Home page and enter the additional account number(s).

How long does it take for EDD to approve certification?

It takes at least three weeks to process a claim and issue payment to most eligible workers. With the large amount of claims we are processing, there may be delays.

How is a pending claim processed?

Claim pending: When a claim has been received but has not been approved or denied, finished or completed. It is waiting until the premium is paid or the plan is canceled due to nonpayment. It is simply in a waiting period.

Why is my EDD payment pending so long?

If you have a Pending status for any weeks on your UI OnlineSM Claim History, we may need to determine your eligibility or verify your identify. If we need to verify your identity, you'll receive a notice to provide additional documentation. For more information, visit Respond to Your Request for Identity Verification.

COVID-19 Unemployment Benefits

COVID-19 extended unemployment benefits from the federal government have ended. But you may still qualify for unemployment benefits from your state...

How to Apply for Unemployment Benefits

There are a variety of benefit and aid programs to help you if you lose your job. CareerOneStop.org is a good place to start. It can help with unem...

Continuation of Health Coverage: COBRA

Learn how you can continue your health care coverage through COBRA.What is COBRA?COBRA is the Consolidated Omnibus Budget Reconciliation Act. COBRA...

Short-Term and Long-Term Disability Insurance

If you can't work because you are sick or injured, disability insurance will pay part of your income. You may be able to get insurance through your...

Workers' Compensation for Illness or Injury on the Job

Workers' compensation laws protect employees who get hurt on the job or sick from it. The laws establish workers’ comp, a form of insurance that em...

Wrongful Discharge/Termination of Employment

If you feel that you have been wrongfully fired from a job or let go from an employment situation, you may wish to learn more about your state's wr...

Welfare or Temporary Assistance for Needy Families (TANF)

Temporary Assistance for Needy Families (TANF) is a federally funded, state-run benefits program. Also known as welfare, TANF helps families achiev...

How long does unemployment last?

Extended unemployment insurance benefits last for 13 weeks. You can apply for extended benefits only once you've run out of regular benefits. Check with your state; not everyone qualifies. You must report unemployment benefits as income on your tax return.

What is the extension for unemployment in 2021?

The American Rescue Plan Act of 2021 temporarily authorized: An extension for people already receiving unemployment benefits. Automatic, additional payments of $300 per week to everyone qualified for unemployment benefits. Extension of the Pandemic Unemployment Assistance (PUA) program for self-employed or gig workers.

What to do if you are terminated by an employer?

If you are an employer seeking information about legal termination of employees, you may wish to contact both the Equal Employment Opportunity Commission (EEOC) and your State Labor Office to ensure you do not violate any federal or state labor laws. You may wish to consult with a licensed attorney.

What to do if you lose your job?

Apply for Unemployment Benefits. There are a variety of benefit and aid programs to help you if you lose your job. CareerOneStop.org is a good place to start. It can help with unemployment insurance benefits, job training, and finding a job. Open All +.

How long does a disability policy last?

Types of Disability Policies. There are two types of disability policies. Short-term policies may pay for up to two years. Most last for a few months to a year. Long-term policies may pay benefits for a few years or until the disability ends.

What to do if you get hurt working for a private company?

Private Sector and State or Local Government Employees. If you get hurt working for a private company or state or local government, seek help through your state. Your state workers' compensation program can help you file a claim. If your claim is denied, you can appeal.

How to qualify for unemployment benefits each week?

To qualify for benefits, each week, you must be: Physically able to work. Available to work. Actively looking for work (3 work search attempts) You may also be required to register with a Career Center to complete mandatory seminars to remain eligible to receive unemployment benefits.

What is the eligibility for unemployment?

When you apply for Unemployment Insurance (UI), your initial eligibility for benefits is based on your earnings and your reason for leaving your job. Ongoing eligibility requirements include being able to work, available for work, and actively searching for work.

What affects weekly unemployment?

Your eligibility for weekly benefits may be affected if you: Aren’t able, available, or actively seeking work. Refuse, quit, or are fired from a job. Receive other income.

How much do you have to earn to collect unemployment?

To be eligible for Unemployment Insurance (UI) benefits, you must: Have earned at least: $5,400 during the last 4 completed calendar quarters, and. 26 times the weekly benefit amount you would be eligible to collect. Be legally authorized to work in the U.S.

Can I get unemployment if I am self employed?

You may not be eligible for Unemployment Insurance (UI) benefits if your only source of employment is from working as: If you’re self-employed, a contractor, or otherwise not traditionally eligible for Unemployment Insurance (UI) benefits, you may be eligible for Pandemic Unemployment Assistance (PUA). If you’re unemployed due to the COVID-19 ...

Can I get PUA if I am self employed?

If you’re self-employed, a contractor, or otherwise not traditionally eligible for Unemployment Insurance (UI) benefits, you may be eligible for Pandemic Unemployment Assistance (PU A). If you’re unemployed due to the COVID-19 public health emergency, and are able and available to work, learn more about PUA.

Is unemployment insurance covered in Massachusetts?

Learn about the requirements for staying eligible and discover what can affect your weekly benefits. Most Massachusetts workers are covered by the Unemployment Insurance (UI) program, although workers in some jobs may not be eligible for benefits.

How long can you collect unemployment?

State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits for a lower number of weeks, and maximum benefits also vary based on where you live. In times of high unemployment, additional weeks of unemployment compensation may be available. Regardless of how much you make, you never can collect more than ...

How long do you get unemployment if you are laid off?

The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker. In many states, you will be compensated for half of your earnings, up to a certain maximum. State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits ...

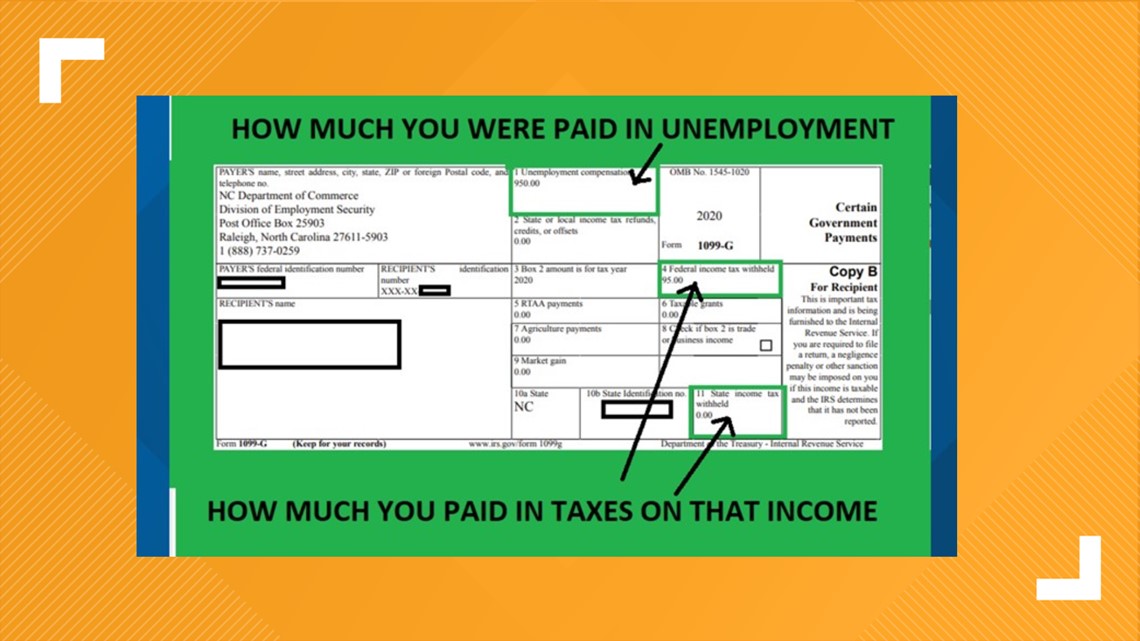

What percentage of unemployment is taxed?

Some states withhold a percentage of your unemployment benefits to cover taxes—typically 10%. If the option to have taxes withheld is available, you will be notified when you sign up for unemployment.

What does it mean to be ineligible for unemployment?

It typically means you are ineligible if you quit—although there are exceptions, like if you quit because of impossible work conditions. If you are fired for cause, you also are likely ineligible. You also have to have been employed for a minimum amount of time or have earned a minimum amount in compensation.

Is unemployment taxable income?

Taxes on Unemployment. Unemployment benefits are considered taxable income, and the unemployment compensation you receive must be reported when you file your federal and state tax returns. 2 . Both state unemployment benefits and federally funded extended benefits are considered income and must be reported when you file your federal ...

How long does it take to get a hearing on unemployment?

If you are found ineligible, you will receive a determination explaining the reason. If you disagree, you may request a hearing within 30 days from the date of the determination. For more information go to the Unemployment Insurance Appeal Board website. Next Section.

How to certify for PUA benefits in New York?

Certify For Weekly Benefits by Phone. The Telephone Claim Center is available toll-free during business hours to certify: 1-888-581-5812 for New York State residents. PLEASE NOTE: If you are receiving PUA benefits and you want to certify by phone, you should call a different number.

What to expect after you certify in New York?

What to Do & Expect After You Certify. Following the expiration of New York State’s COVID-19 State of Emergency, the Unemployment Insurance unpaid waiting period rule is once again in effect. New Unemployment Insurance claims filed on and after June 28, 2021 will include an unpaid waiting week. Claimants will not receive payment for ...

Do you have to claim weekly unemployment benefits?

Once you have filed a claim for benefits, you must also claim weekly benefits for each week you are unemployed and meet the eligibility requirements. This is also called “certifying for benefits.”.

Do you have to certify every week to get unemployment?

You must continue to certify every week you are unemployed in order to continue to receive benefits. During this process, you are confirming that you were unemployed for all or part of the past week and that you met all other conditions of receiving benefits. Each week you are certifying benefits you will be asked if you are ready, ...

How long can you draw unemployment benefits?

Applicants will be allowed to draw benefits for not more than 12 weeks, and the maximum benefit amount earned will not exceed $3,300.

How to receive weekly unemployment benefits in Florida?

To receive a weekly benefit amount in the state of Florida, the applicant must meet certain eligibility criteria. The criteria to be eligible includes monetary aspects, previous job-separation criteria, and various others throughout the course of the benefit period.

What is the base year for monetary benefits?

In the base year, the following conditions must be met by the applicants to gain eligibility for monetary benefits: Applicants must have earned a minimum of $3400 gross wages . The applicant must have a minimum of two-quarters of covered wages.

What is monetary eligibility?

Monetary Eligibility. Applicants must meet the criteria set for monetary requirements to be eligible to receive monetary benefits. The monetary requirements are based on the wages earned by the applicants in the base period.

What is Florida unemployment?

Florida Unemployment Benefits. The Unemployment Insurance provided in the state of Florida is intended to provide monetary assistance to those who lose their jobs for no fault of their own. It is also designed in such a way that it helps the applicants find other career opportunities at the earliest.

What is the Department of Economic Opportunity and Reemployment Assistance Program?

State of Florida’s Department of Economic Opportunity and Reemployment Assistance Program provides Job Assistance Resources to claimants to help them find employment. The department not only assists in career planning and job planning but also helps veterans, seniors and military spouses through various programs.

What is the purpose of unemployment in Florida?

The purpose of Unemployment Insurance in Florida is to support citizens monetarily when they lose a job until they find another one. It is, thus, important that the claimants keep up the pursuit of a job during the benefit period, or they may lose the eligibility to claim benefits.