How do I check the status of a pending application for survivor benefits? Answer: If you applied for benefits, you can check the Status of Your Application online. If a decision has been made. Call us at 1-800-772-1213 (TTY 1-800-325-0778 ), Monday through Friday from 7 a.m. to 7 p.m.; or Contact your local Social Security office.

How do I report a death to survivor benefits?

Survivors Benefits. If you need to report a death, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ). You can speak to a Social Security representative between 7 AM and 7 PM Monday through Friday. In most cases, the funeral home will report the person’s death to Social Security.

How are Social Security survivor benefits calculated?

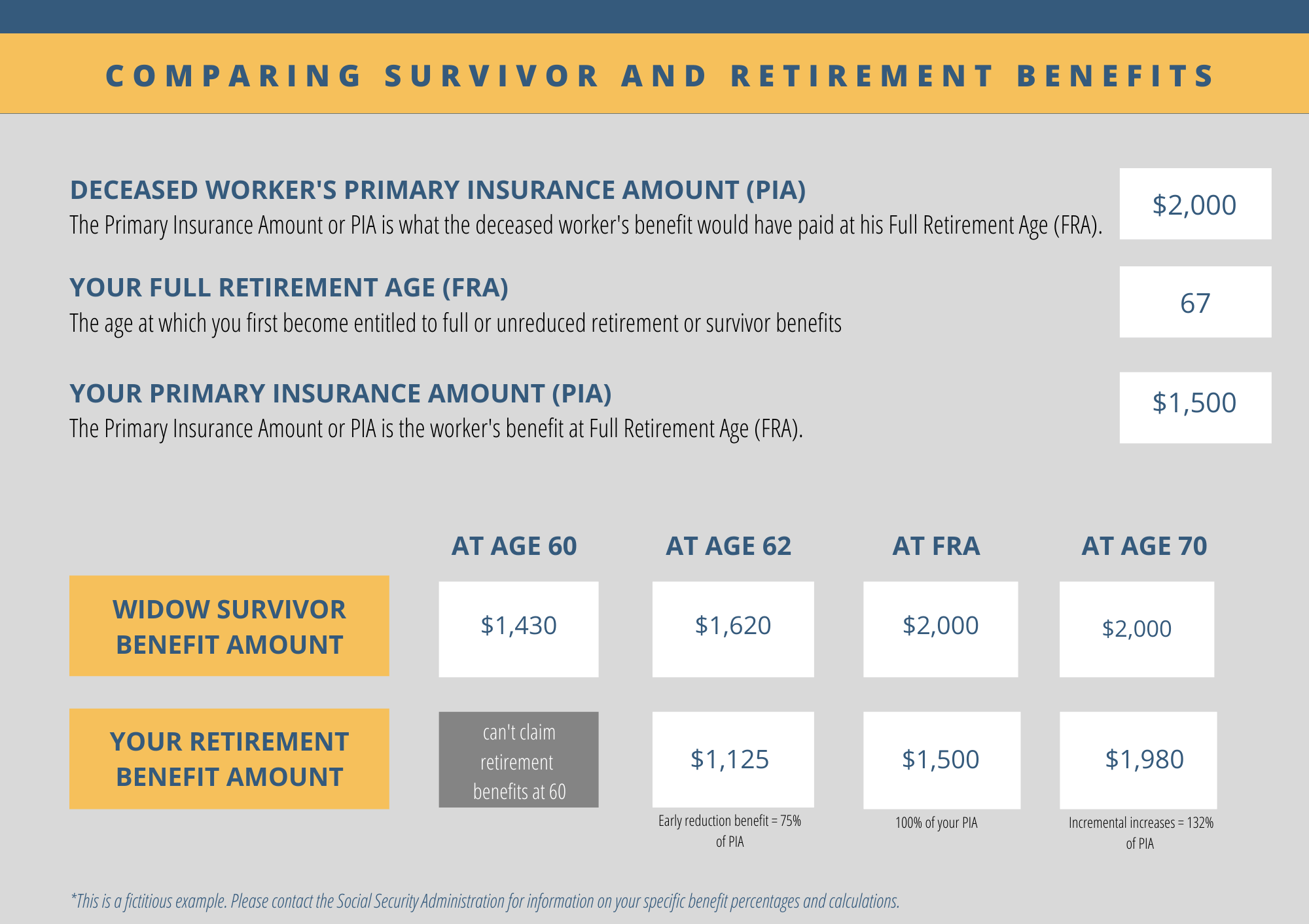

We base your survivors benefit amount on the earnings of the person who died. The more they paid into Social Security, the higher your benefits would be. The monthly amount you would get is a percentage of the deceased's basic Social Security benefit.

When do my survivor benefits end?

When do survivor benefits end? Survivor annuity payments are payable through the end of the month prior to the date of the event which caused the loss of eligibility. For example, if a remarriage occurred in April, benefits would end on March 31.

How do I apply for survivor benefits online?

A widow, widower, or surviving divorced spouse cannot apply online for survivors benefits. You should contact Social Security at 1-800-772-1213 to request an appointment. (If you are deaf or hard of hearing, call our TTY number at 1-800-325-0778.)

How do I check my Social Security survivor benefits?

For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 (TTY 1-800-325-0778).

How long does it take to receive survivor benefits?

It takes 30 to 60 days for survivors benefits payments to start after they are approved, according to the agency's website.

How long does Social Security pay survivor benefits?

Widows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

How are survivor benefits paid out?

If the spouse or child was already receiving family benefits on the deceased's record, the death benefit will typically be paid to them automatically once the death is reported to Social Security.

Can you be denied survivor benefits?

If a person's application for Social Security Survivor Benefits is denied, the person can appeal the denial. A person has 60 days after they receive a notice of decision on their case from the SSA to ask for an appeal.

When a spouse dies does the survivor get their Social Security?

A surviving spouse can collect 100 percent of the late spouse's benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

Can you receive Social Security benefits and survivor benefits at the same time?

Social Security allows you to claim both a retirement and a survivor benefit at the same time, but the two won't be added together to produce a bigger payment; you will receive the higher of the two amounts. You would be, in effect, simply claiming the bigger benefit.

Do you report survivor benefits on taxes?

The IRS requires Social Security beneficiaries to report their survivors benefit income. The agency does not discriminate based on the type of benefit -- retirement, disability, survivors or spouse benefits are all considered taxable income.

How long do survivor benefits last for a child?

The benefits will usually continue until your child graduates or until two months after they reach age 19, whichever comes first. Childhood disability benefits are payable beyond age 18 if the disability began before age 22.

When a parent dies who gets Social Security?

Within a family, a child can receive up to half of the parent's full retirement or disability benefit. If a child receives Survivors benefits, he or she can get up to 75 percent of the deceased parent's basic Social Security benefit.

What are the qualifications to receive survivor benefits?

Your spouse, children, and parents could be eligible for benefits based on your earnings. You may receive survivors benefits when a family member dies. You and your family could be eligible for benefits based on the earnings of a worker who died. The deceased person must have worked long enough to qualify for benefits.

As a retiree, what kind of benefits are payable to my survivor?

The types of benefits payable are: Current spouse survivor annuity Former spouse annuity that is voluntarily elected or awarded by a court order in...

What is a full survivor benefit?

If you retire under the Civil Service Retirement System (CSRS), the maximum survivor benefit payable is 55 percent of your unreduced annual benefit...

What elections can I make when I retire to provide a survivor benefit for my spouse?

In the event of your death, you can make one of the following elections: No survivor benefit A partially reduced annuity A fully reduced annuity Th...

When will survivor benefits to my spouse end?

Monthly annuity payments to a surviving spouse generally continue for life unless your spouse remarries before age 55. If your spouse was married t...

How do I elect a survivor benefit for my former spouse?

You can only make your survivor benefit elections for current and/or former spouses when you retire, or based on a qualifying event after retiremen...

How do I provide a survivor benefit for my new spouse?

If you get married after retirement, you can elect a reduced annuity to provide a survivor annuity for your spouse. You must make this election wit...

What is an insurable interest survivor benefit election?

If you're in good health and you retire for reasons other than disability, you can elect to provide a survivor annuity to someone with an insurable...

Who is considered eligible to receive an insurable interest survivor benefit?

You can elect to provide an insurable interest annuity only for someone who has an insurable interest in you. "Insurable interest" is an insurance...

How is the insurable interest survivor benefit calculated?

The benefit is provided by reducing the retiree's annuity. This means the retiree's monthly annuity payment will be less than the full amount had t...

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

How to report a death to the funeral home?

You should give the funeral home the deceased person’s Social Security number if you want them to make the report. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778 ). You can speak to a Social Security representative between 8:00 am – 5:30 pm. Monday through Friday.

How much can a family member receive per month?

The limit varies, but it is generally equal to between 150 and 180 percent of the basic benefit rate.

Can I apply for survivors benefits now?

You can apply for retirement or survivors benefits now and switch to the other (higher) benefit later. For those already receiving retirement benefits, you can only apply for benefits as a widow or widower if the retirement benefit you receive is less than the benefits you would receive as a survivor.

When can I switch to my own Social Security?

If you qualify for retirement benefits on your own record, you can switch to your own retirement benefit as early as age 62 .

Can a widow get a divorce if she dies?

If you are the divorced spouse of a worker who dies, you could get benefits the same as a widow or widower, provided that your marriage lasted 10 years or more. Benefits paid to you as a surviving divorced spouse won't affect the benefit amount for other survivors getting benefits on the worker's record.

What is the maximum survivor benefit?

If you retire under the Civil Service Retirement System (CSRS), the maximum survivor benefit payable is 55 percent of your unreduced annual benefit. If you retire under the Federal Employees Retirement System (FERS), the maximum survivor benefit payable is 50 percent of your unreduced annual benefit .

When is a survivor annuity payable?

For both CSRS and FERS, a survivor annuity may still be payable if the employee's death occurred before 9 months if the death was accidental or there was a child born of your marriage to the employee. If a former spouse was awarded part of the total survivor CSRS or FERS annuity, you'll receive the remainder.

What are the types of benefits payable?

The types of benefits payable are: Current spouse survivor annuity. Former spouse annuity that is voluntarily elected or awarded by a court order in divorces granted on or after May 7, 1985. A one-time lump sum benefit.

What happens if you don't pay an annuity upon death?

If no survivor annuity is payable upon the retiree's death, any remaining portion, representing either the remaining annuity and/ or retirement contributions not paid to the retiree, is payable to the person (s) eligible under the order of precedence.

How long after annuity can you increase your spouse's health insurance?

Your spouse's need for continued coverage under the Federal Employees Health Benefit program. There's an opportunity to increase survivor benefits within 18 months after the annuity begins. However, this election may be more expensive than the one you make at retirement.

When does an insurable interest end?

The insurable interest automatically ends if the insurable interest dies, if you marry the insurable interest and elect to provide a spousal benefit, or if the named person is your spouse and you change your election to provide a spousal survivor benefit.

How long do you have to elect a reduced annuity?

If you get married after retirement, you can elect a reduced annuity to provide a survivor annuity for your spouse. You must make this election within 2 years of the date of your marriage. Under the Civil Service Retirement System (CSRS), you can elect any portion of your annuity (from 55 percent of $22.00, which results in a $1.00 per month ...

What types of claims and appeals can I track with this tool?

You can use this tool to check the status of a VA claim or appeal for compensation. Track your:

What kind of information will I learn about my VA claim or appeal?

You’ll see where your claim or appeal is in our review process, and when we think we’ll complete our review.

Will my personal information be protected if I use this tool?

Yes. This is a secure website. We follow strict security policies and practices to protect your personal health information.

What happens if a former employee dies and no survivor annuity is payable?

If a former employee dies and no survivor annuity is payable, the retirement contributions remaining to the deceased person’s credit in the Civil Service Retirement and Disability Fund, plus applicable interest, are payable. This lump sum is payable under the order of precedence.

How long can you keep an annuity?

Monthly survivor annuity payments for a child can continue after age 18, if the child is a full-time student attending a recognized school. Benefits can continue until age 22. Unmarried disabled dependent children may receive recurring monthly benefits, if the disability occurred before age 18.

What is lump sum benefit?

Lump Sum Benefits. If no survivor annuity is payable upon the employee/former employee’s death, a lump sum may be payable of the unpaid balance of retirement contributions made by the employee. This lump sum is payable under the order of precedence.