How One Can Claim Life Insurance Death Benefits

- Contact Your Agent. The best person to approach in the beginning is to contact your insurance agent. He or she is fully...

- Fill Up the Claim Intimation Form. Life insurance companies have formatted ‘claim intimation forms’ that require details...

- Submission of Documents. The claim process will take further advances only...

What does death benefit mean in life insurance?

- The death benefit amount depends on your income and financial needs.

- There is generally no tax applied to the death benefit payout.

- Minor children cannot be direct recipients of the death benefit.

How does wrongful death affect my life insurance claim?

The claimed damages can include:

- Burial and funeral costs

- Medical expenses prior to the death

- Pre-death pain experienced by the deceased

- Lost love and companionship

How to make a life insurance claim?

When buying life insurance, it is important to name a contingent beneficiary. A contingent beneficiary allows the policyholder to determine who benefits from the life insurance policy in circumstances where the person who they originally wanted to protect has predeceased them. Life insurance pays a death benefit after the policyholder's death.

What happens to life insurance when the insured dies?

- Policy 1 for himself

- Policy 2 for his wife

- Policy 3 for his child Rahul

How long does it take to receive life insurance death benefits?

The average life insurance payout can take as little as two weeks, up to two months to receive the death benefit. However, the timeline depends on several factors. If you have an active life insurance policy, the company will pay your beneficiaries when you die.

How do I claim a death benefit from insurance?

Beneficiaries file a death claim with the insurance company by submitting a certified copy of the death certificate. Many states allow insurers 30 days to review the claim, after which they can pay it out, deny it, or ask for additional information.

How are life insurance death benefits paid?

Life insurance payouts are sent to the beneficiaries listed on your policy when you pass away. But your loved ones don't have to receive the money all at once. They can choose to get the proceeds through a series of payments or put the funds in an interest-earning account.

Who receives the death benefit from a life insurance policy?

A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured or annuitant dies. For life insurance policies, death benefits are not subject to income tax and named beneficiaries ordinarily receive the death benefit as a lump-sum payment.

How do you collect life insurance after death?

To claim life insurance benefits, the beneficiary should contact the insurance company's local agent or check the company's website. Some companies ask beneficiaries to start by sending in a form that merely reports the death; they then send the beneficiary a packet of forms and instructions explaining how to proceed.

What are the documents required for life insurance claim?

Life ClaimsOriginal policy documents.Original/attested copy of death certificate issued by local municipal authority.Death claim application form (Form A)NEFT mandate form attested by bank authorities along with a cancelled cheque or bank account passbook.More items...

Who claims the death benefit?

Who reports a death benefit that an employer pays? That depends on who received the death benefit. A death benefit is income of either the estate or the beneficiary who receives it.

How do I find out if I am a beneficiary on a life insurance policy?

Look through the deceased's papers and address books to find out if they had any life insurance policy in their name. Another way to find out if you're the beneficiary of a life insurance policy is by reviewing the income tax returns of the deceased for the past two years to check the interest income and expenses.

What's the average life insurance payout?

Statista reports that the average face value of life insurance policies sold in the United States ranges from $150,000 to $185,000, depending on the year. In the late 1990s, average face values were much lower, ranging from $100,000 to $140,000.

Can you cash out death benefit?

Cash Out Life Insurance Through A Life Settlement In fact, with a life settlement you may be able to get up to 60% of the death benefit amount in a lump cash sum that can be used to fund retirement, go on vacation, or spend however you want.

Who is eligible for lump-sum death benefit?

Only the widow, widower or child of a Social Security beneficiary can collect the $255 death benefit, also known as a lump-sum death payment. Priority goes to a surviving spouse if any of the following apply: The widow or widower was living with the deceased at the time of death.

What is the most common payout of death benefits?

lump-sum payoutThere are two common distributions. A lump-sum payout means that the entirety of the policy will be paid upfront. This is the most common and is used as the default for most policies. You can also choose for the money to be paid in installments, as an annuity.

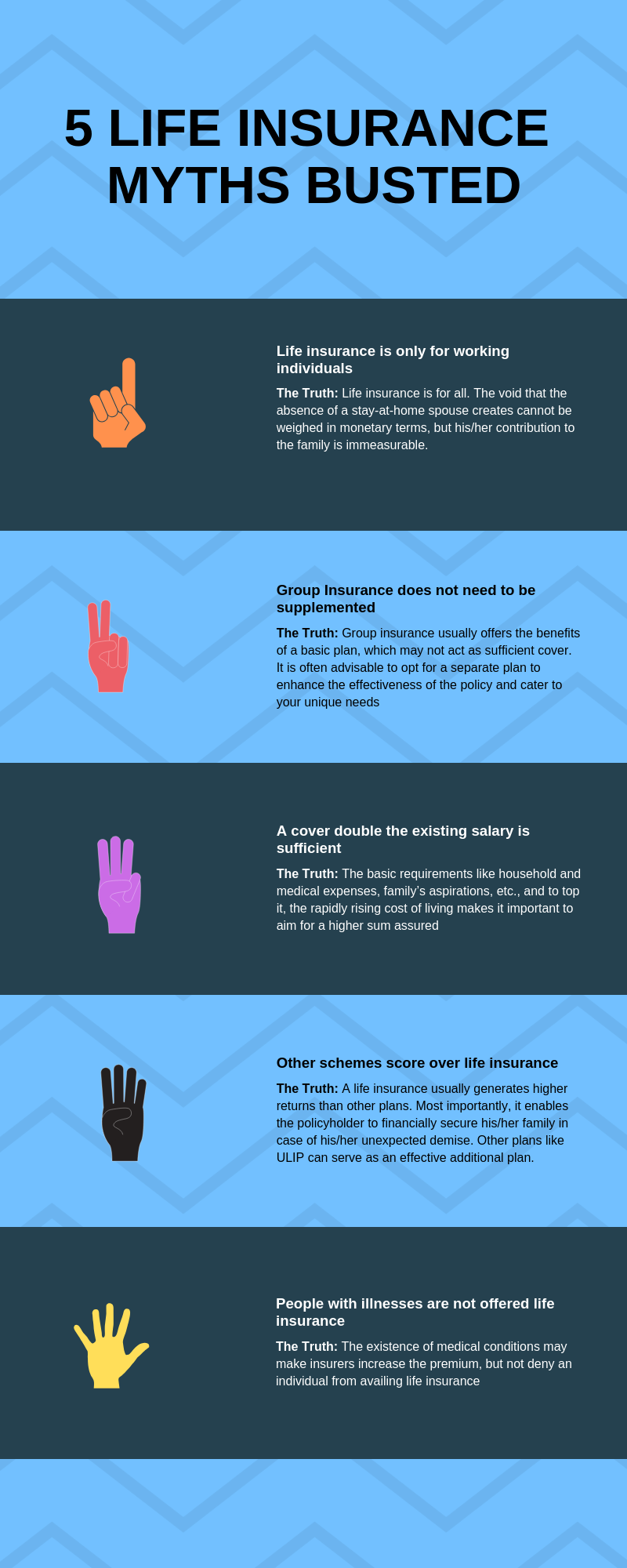

What kinds of things might cause a life insurance claim to be denied?

Lying on your application is one of the chief reasons claims are denied. If you misrepresent yourself and your situation – such as not disclosing a...

Can I get life insurance without taking a medical exam?

It’s possible to get life insurance without an exam. However, you might want to think twice before doing so. “You will be very limited in the amoun...

Can I have more than one life insurance policy?

Yes, you can hold more than one policy. Having multiple life insurance policies might sound wasteful. But that isn’t always the case. “Having multi...

How much life insurance do I need?

Determining how much life insurance you need can be difficult. Fortunately, Insure.com can help you zero in on the right amount of coverage for you...

How to make a claim on life insurance?

Get the policy details. With any luck, you're already aware of the deceased's life insurance policy and where it's located. Ideally, it will be stored safely, such as in a metal filing cabinet or fireproof lockbox.

Who can help you fill out a life insurance claim?

A life insurance agent or the life insurance company can help you fill out the necessary forms. A life insurance company may deny a claim, including if the person lied on the life insurance application or the deceased person stopped paying premiums. Wondering how to file a life insurance claim?

What are the different types of life insurance?

There are three major types of policies available without a medical exam: 1 Simplified issue: This type of coverage requires you to answer questions about your medical history, ranging from your history of alcohol use to your personal and family medical history. 2 Guaranteed issue: People between the ages of 50 and 85 with serious health conditions often buy these policies -- usually because they can’t get other life insurance coverage. 3 Group coverage: Employers often offer group coverage as part of their benefits package. You may have to answer a series of questions to qualify for the coverage.

What to do if you don't know the agent name?

If you don't know the agent’s name, contact the life insurance company directly. If the deceased had group life insurance through an employer, contact the employer's human resources department about making a life insurance claim.

When will insurance companies deny a claim?

Insurance companies will likely deny a claim if the person fibbed during the “contestability period.”. This occurs during the first couple of years after you purchase the policy. An insurer may also deny a claim if the person died by suicide within the contestability period.

How to find out if a life insurance policy is sold?

Once you find the life insurance policy, look for a contact name and number. The life insurance agent who sold the policy can also help with the life insurance claim process and work as an intermediary with the insurance company. If you don't know the agent’s name, contact the life insurance company directly.

What to do if you never mentioned someone on your insurance?

Check for other policies. Even if the deceased never mentioned them, there may be other insurance policies in place. These can include accidental death and dismemberment policies, which employers sometimes offer as riders to their insurance policies. Check with the deceased's human resources representative.

What is the phone number to call for life insurance?

If an insurance company told you that you would not be eligible for any life insurance benefits, because of the time lapse between the insured’s death and your inquiry, please call our life insurance lawyers at 888-510-2212 for a free consultation.

What is a death certificate?

A death certificate is a necessary document that serves as proof of death.

What to do if someone is missing but has not been declared dead?

3. Contact the Life Insurance Company. Notifying the insurance company as soon as possible after a loved one’s death may expedite getting your life insurance claim paid.

How long does it take for a disability claim to be processed?

Once a claim is filed and all the necessary documents are submitted, the insurance company needs to make the final determination on the claim within 30 days. If more than two months have passed since you submitted all the documents and you haven’t collected the benefits, the claim is considered delayed.

What happens if a loved one dies in 2020?

October 23, 2020. If a loved one passed away untimely, you may be grieving and not be able to focus on your financial affairs. Many people who lost a family member go through a difficult time of readjustment and do not deal with life insurance issues immediately. In other cases, family members may not even know there was a life insurance policy in ...

What documents are needed for a death certificate?

You will need a certified copy of the death certificate, a police report, a toxicology report, an autopsy report, a coroner’s report, a medical examiner’s report and in some cases, medical records.

Can you file a claim if you don't have the original life insurance policy?

If you can find the original life insurance policy, you can see the details (payment amount, beneficiary, insurance company contact information, etc.) of the claim before filing it. You can still file a claim if you do not have the original policy. Completed Claim forms.

What Documents Do You Need to Claim Life Insurance?

There are only three documents you’ll need to file a life insurance claim: a death certificate, the life insurance policy, and a claim form required by life insurance companies. Let’s look at each and why they’re important.

How Long Do You Have to Claim Life Insurance After a Death?

Death benefits are not paid out automatically by the life insurance company. Instead, a claim must be filed either online or using a paper form; it depends on the life insurance company’s policies and procedures.

Steps for Claiming Life Insurance After a Death

Here are the four steps you’ll need to follow when you file a death claim.

Frequently Asked Questions: Claiming Life Insurance After a Death

Still a little bit hazy about what to do when someone dies as it pertains to filing a death claim? Looking at some frequently asked questions and the answers will help.

Insurance Companies Want to Help

Established, reputable insurance companies want to pay out claims they legally have to and will assist you if you’re unsure of what to do concerning filing a death claim.

What happens when you file a death benefit claim?

Procession of the Claim. Once you have filed the claim for death benefits of life insurance, the claim assistance team will take over the case. They will verify your documents and let you know the requirements if any, as the process takes place.

What is life insurance death benefit?

Especially during the occasions of untimely accidental death, the life insurance death benefits have supported families in raising their children and helping them to cope with family situations in a very significant manner. When an applicant files for life insurance policy, he or she nominates a beneficiary who can receive ...

How long does it take to settle a life insurance claim?

If we can submit all the necessary documents at the right time, it takes around only 30 days for the whole process to get settled.

How long does it take to get a disability check?

The overall process takes not more than 30-45 days given to when you file the application. It doesn’t take much time once after the claim gets settled as the company does instant payout to the beneficiary. For the process to be faster and legitimate one must submit the valid and all necessary documents at once.

How much of life insurance death benefit can you get?

If you’re one of four beneficiaries, that doesn’t automatically mean you’ll get one quarter of the death benefits . The policyholder can allocate different percentages to different beneficiaries.

How does term life death benefit work?

Generally speaking, a term life death benefit works the same as, say, the payout in a whole life policy: virtually any person or entity can be a beneficiary, it can be allocated in the same way, and the claims process is similar if not identical.

Why do people buy life insurance?

The most common reason people buy life insurance is to help protect their family’s financial well-being. That’s why married people commonly designate their spouse as the only primary beneficiary, especially when their children are still at home. However, if you live in a state with common property laws, you must name your spouse as the only beneficiary unless you have his or her consent to name someone else. One more thing: underage children can’t ordinarily be named as beneficiaries; if you want to leave money to a minor, you may have to set up a trust to manage the financial payout until they become of age.

How long does it take for a death benefit to be paid?

Once the insurance company has your claim, they will verify the information and likely pay out death benefits within 30-60 days of the date the claim was filed. You’ll typically be given a choice of getting your payout in one of 3 different ways:

What is death benefit?

To start, let’s define death benefit: It’s the money – lump sum or otherwise – that gets paid to your beneficiaries if you die while your life insurance policy is in effect. Whether you’re buying life insurance, or you’re filing a claim on a life insurance policy, there are a few things you need to know about beneficiaries: ...

What does it mean when someone says they have $100,000 in life insurance?

It’s the primary reason to get life insurance, and how policies are almost always described: when someone says they have a $100,000 policy, it really means they have $100,000 worth of death benefit insurance.

What is the form to fill out for death certificate?

The insured’s death certificate. While every company’s process varies somewhat, you’ll basically have to fill out a claims form called a “Request for Benefits” and provide a copy of the death certificate. If you are in touch with the insured’s insurance agent, they can help you through the claims process.

How long does it take for life insurance to pay a death benefit?

My Survivor's Checklist can help with getting organized. Most insurance companies pay benefits within 30-60 days of the date of a claim. However, if an insured passed away within two years of taking out the policy, the insurance company may delay paying to investigate the claim. This is called the "contestability clause."

What is the purpose of life insurance death benefit?

A life insurance death benefit helps the family carry on, maintain the family standard of living and provide immediate — and sometimes essential — funds to pay bills or provide a source for future expenses like college. Either way the impact can be enormous.

What is life insurance?

Life insurance is commonly used to provide an immediate source of funds for a surviving spouse or family member. As a financial planner working with those who lost a loved one, I've seen first-hand the impact an insurance policy can have on the surviving family. A life insurance death benefit helps the family carry on, ...

Why do people pay installments on death benefits?

An installment payment is good for those who are undecided about how to take a death benefit and need time to evaluate options. The payments can help cover some of the immediate bills while you decide how to best take and use the larger amount of money.

Can a widow take lump sum?

It can also be some combination of the three. It's not unusual to see widowers take a lump sum with some of the death benefit and purchase an annuity with the balance to help meet day-to-day income needs. It really depends on your situation.

Is an annuity a good idea?

The best option really depends on your needs and the type of person you are. If you are worried about running out of money, perhaps the annuity strategy will make you less anxious. If you want to pay off the mortgage and invest the difference for college or retirement, then a lump sum may be a good idea.

Can you keep life insurance money in an interest bearing account?

Another option involves keeping the life insurance death benefit at the insurance company and having installment payments paid to you. The insurance company holds the money for you in an interest-bearing account and can send you checks based on an installment schedule you decide.

How to report death of employee receiving compensation?

You can report the death in one of three ways: Phone: Call 1-888-767-6738 (1-88USOPMRET).

What is the number to call for a deceased overseas beneficiary?

Overseas beneficiaries should call 212-578-2975. Be sure you have the following information ready when you make the call: the name of the insured employee/retiree/compensationer. the insured's social security number. the name of the deceased (if different), and. the date of death of the deceased.

Where do you report a death to the employee?

Employee (Or Employee's Family Member) You must report the death to the human resources office of the employee's employing agency. Be sure to have the employee's full name and social security number. You'll also need the deceased's date of death.

Do you have to report an annuitant's death?

The Annuitant Receives Monthly Payments From Another Retirement System. You must report the death to that retirement system. Be sure to have the annuitant's full name, social security number and retirement claim number, if any. You'll also need the deceased annuitant 's date of death.

What happens to life insurance when you die?

If a person dies outside of the term of the policy, the policy won’t pay out. If the person passed within the insurance terms, and the policy premiums were paid regularly, ...

What happens if you die after opening an insurance policy?

If a person dies soon after opening an account, the death is deemed suspicious, or there were issues with the original application, delays can happen. First, if a person dies within 2 years of opening the policy, the insurance company will investigate.

Why do insurance companies review the original application?

Lastly, the insurance company is going to review the original application to make sure the insured didn’t lie.

What is universal life insurance?

Plans with universal life insurance or whole life insurance have terms that don’t end. This is called permanent life insurance, and it means these policies cover you through death, regardless. Some plans are called “term life insurance”. This means they last for a specific term (for example, a 30-year term life insurance policy bought ...

How does life insurance work?

Having an idea of how life insurance works, and how it pays out when someone passes can help ease the pressures during a personal moment . Plus, the money one receives from a life insurance policy can be used to offset funeral expenses. Of course, life insurance policies are often purchased to help pay the monthly bills that keep coming, ...

What happens when a loved one dies?

When a loved one dies, there are a lot of things that need to happen. And all of those tasks are piled on top of the grieving process. It can be exhausting—a lot of people find themselves unsure of what they need to do to prepare the arrangements, much less what financial needs are going to come up. Having an idea of how life insurance works, and ...

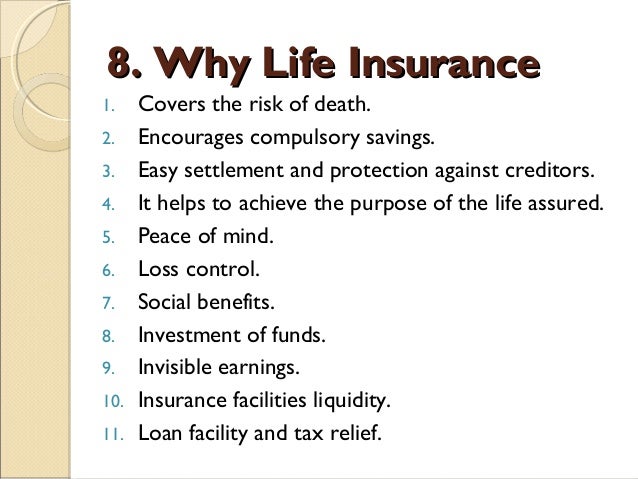

Why do people buy life insurance?

Of course, life insurance policies are often purchased to help pay the monthly bills that keep coming, or to pay off debts to avoid accumulating interest. Let’s take a look at how the process usually works, the different ways policies can be paid out, and the kinds of issues that might arise.