To file a PUA claim or check your claim status or correspondence, visit uinteract.labor.mo.gov. To upload proof of income, proof of employment, or file an appeal, visit uinteract.labor.mo.gov Benefits Section (PUA) Division of Employment Security PO Box 2313 Jefferson City, MO 65102-2313 Or fax to 573-751-5040

How do I file a claim for Pua?

You can file a claim for PUA only after you applied for regular unemployment insurance benefits and have been denied. If you have not, click " File for Regular Unemployment Benefits." If you have applied for regular unemployment insurance benefits and have been denied within twelve months of today’s date, you can now file for PUA.

Will Pua benefits be paid after September 4?

The CARES Act specifies that PUA benefits cannot be paid for weeks of unemployment ending after September 4, 2021.

Can I reopen my Pua claim if my benefits have lapsed?

For those with a lapse in benefits who were getting PUA in the past, a new claim or action to reopen your existing claim could be required. But state unemployment agencies are required to notify on actions required once they update their systems for the extended weeks.

Do I need to certify my Pua benefits?

Applicants need to certify (request payment) for all eligible weeks since the closing of their business due to COVID-19. A weekly determination amount is decided and the claimant receives a PUA Benefits Determination letter in the mail stating the weekly benefit amount.

When will Georgia stop receiving PUA?

What is the CAA requirement for 2020?

What is proof of employment?

What is the second determination letter for unemployment?

What proof is needed for self employment?

Is Georgia still in the PUA program?

See more

About this website

Can self-employed individuals qualify for PUA benefits?

States are permitted to provide Pandemic Unemployment Assistance (PUA) to individuals who are self-employed, seeking part-time employment, or who otherwise would not qualify for regular unemployment compensation.

What is the maximum Pandemic Emergency Unemployment Compensation benefits (PEUC) eligibility in weeks?

No PEUC is payable for any week of unemployment beginning after April 5, 2021. In addition, the length of time an eligible individual can receive PEUC has been extended from 13 weeks to 24 weeks.

Are individuals eligible for PUA if they quit their job because of the COVID-19 pandemic?

There are multiple qualifying circumstances related to COVID-19 that can make an individual eligible for PUA, including if the individual quits his or her job as a direct result of COVID-19. Quitting to access unemployment benefits is not one of them.

Are self-employed, independent contractor and gig workers eligible for the new COVID-19 unemployment benefits?

See full answerSelf-employed workers, independent contractors, gig economy workers, and people who have not worked long enough to qualify for the other types of unemployment assistance may still qualify for PUA if they are otherwise able to work and available for work within the meaning of the applicable state law and certify that they are unemployed, partially unemployed or unable or unavailable to work for one of the following COVID-19 reasons:You have been diagnosed with COVID-19, or have symptoms, and are seeking a medical diagnosis.A member of your household has been diagnosed with COVID-19.You are caring for a family member of a member of your household who has been diagnosed with COVID-19.A child or other person in your household for whom you have primary caregiving responsibility is unable to attend school or another facility that is closed as a direct result of COVID-19 and the school or facility care is required for you to work.

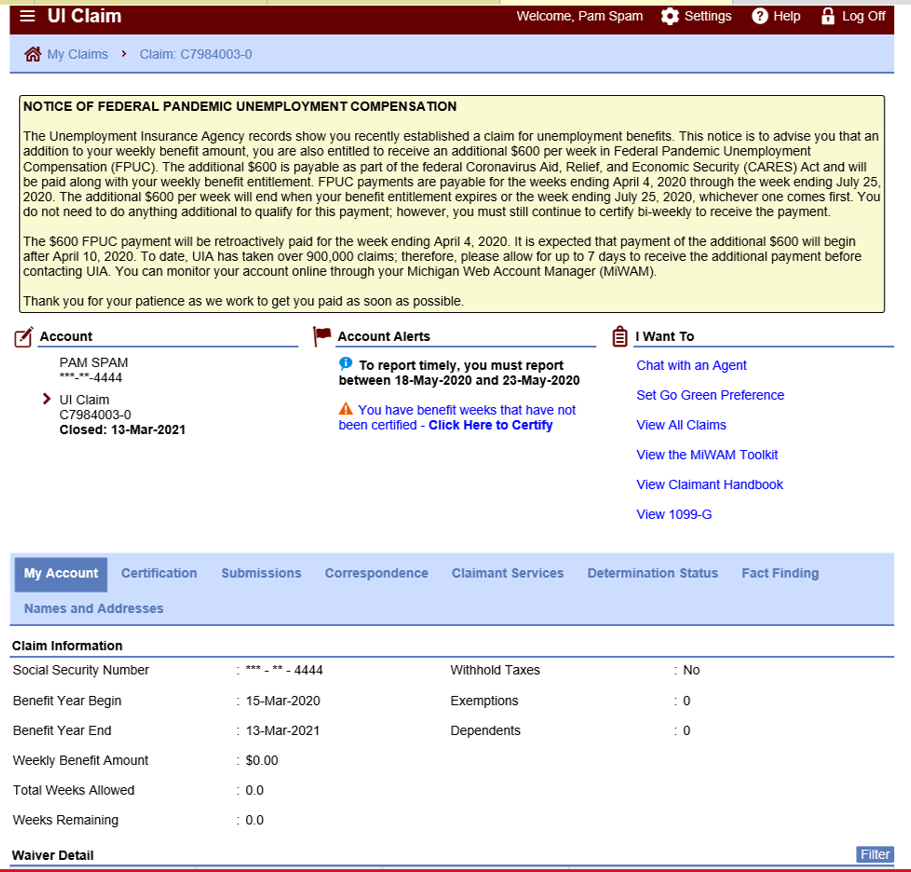

Is there additional relief available if my regular unemployment compensation benefits do not provide adequate support?

See full answerThe new law creates the Federal Pandemic Unemployment Compensation program (FPUC), which provides an additional $600 per week to individuals who are collecting regular UC (including Unemployment Compensation for Federal Employees (UCFE) and Unemployment Compensation for Ex-Servicemembers (UCX), PEUC, PUA, Extended Benefits (EB), Short Time Compensation (STC), Trade Readjustment Allowances (TRA), Disaster Unemployment Assistance (DUA), and payments under the Self Employment Assistance (SEA) program). This benefit is available for weeks of unemployment beginning after the date on which your state entered into an agreement with the U.S. Department of Labor and ending with weeks of unemployment ending on or before July 31, 2020.

Can I remain on unemployment if my employer has reopened?

No. As a general matter, individuals receiving regular unemployment compensation must act upon any referral to suitable employment and must accept any offer of suitable employment. Barring unusual circumstances, a request that a furloughed employee return to his or her job very likely constitutes an offer of suitable employment that the employee must accept.

What if an employee refuses to come to work for fear of infection?

Your policies, that have been clearly communicated, should address this.Educating your workforce is a critical part of your responsibility.Local and state regulations may address what you have to do and you should align with them.

What kinds of relief does the CARES Act provide for people who are about to exhaust regular unemployment benefits?

Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation (PEUC) program.

What does it mean to be unable to work, including telework for COVID-19 related reasons?

You are unable to work if your employer has work for you and one of the COVID-19 qualifying reasons set forth in the FFCRA prevents you from being able to perform that work, either under normal circumstances at your normal worksite or by means of telework.If you and your employer agree that you will work your normal number of hours, but outside of your normally scheduled hours (for instance early in the morning or late at night), then you are able to work and leave is not necessary unless a COVID-19 qualifying reason prevents you from working that schedule.

Who is considered to be essential worker during the COVID-19 pandemic?

Essential (critical infrastructure) workers include health care personnel and employees in other essential workplaces (e.g., first responders and grocery store workers).

Can I get unemployment assistance if I am partially employed under the CARES Act?

A gig economy worker, such as a driver for a ride-sharing service, is eligible for PUA provided that he or she is unemployed, partially employed, or unable or unavailable to work for one or more of the qualifying reasons provided for by the CARES Act.

Can COVID-19 be spread through sex?

The virus spreads by respiratory droplets released when someone with the virus coughs, sneezes or talks. These droplets can be inhaled or land in the mouth or nose of a person nearby. Coming into contact with a person's spit through kissing or other sexual activities could expose you to the virus.

Pandemic Unemployment Assistance Login

What is Pandemic Unemployment Assistance? Pandemic Unemployment Assistance (PUA) provides emergency unemployment assistance to individuals who are not eligible for regular state unemployment insurance (UI) benefits or benefits under any other state or federal program or who have exhausted all entitlement to regular UI benefits or any other state or federal benefits.

Check My UI Claim Status Info | Georgia Department of Labor

The .gov means it’s official. Local, state, and federal government websites often end in .gov. State of Georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the address.

My UI Login

Welcome to My UI! MyUI allows you to view claim and payment information as well as some correspondence. You will need the following information:

Contact Us | Georgia Department of Labor

Thank you for using the Georgia Department of Labor (GDOL) web site. Every effort has been made to provide useful, accurate, and complete information and resources. Services Offered by the GDOL at no cost to businesses and individuals.

Employer Portal - Employer Portal Login

Welcome to the Georgia Department of Labor Employer Portal. All first time users are required to Establish Administrator Access.The first person establishing access is the administrator for the Employer's account and will be responsible for managing all other users on this portal.

ODJFS Login

WARNING. This system may contain U.S. Government information, which is restricted to authorized users ONLY. Unauthorized access, use, misuse, or modification of this computer system or of the data contained herein or in transit to/from this system constitutes a violation of Title 18, United States Code, Section 1030, and may subject the individual to Criminal and Civil penalties pursuant to ...

What is PUA?

The Pandemic Unemployment Assistance (PUA) provided up to 79 weeks of unemployment benefits to individuals not eligible for regular unemployment compensation or extended benefits due to COVID-19. PUA benefits ceased on September 4, 2021.

Understanding your Benefit Summary

Some claimants may still be seeing issue codes on their PUA claim. To better understand your benefit summary , please access the full alphabetical list of issue codes and their meanings . For your convenience, we have gathered the most common codes below:

Overview

In March of 2020, the federal government created Pandemic Unemployment Assistance (or PUA), a program that provided support for Americans who were unable to work due to the Coronavirus pandemic but did not qualify for traditional Unemployment Insurance (UI). The Continued Assistance Act (CAA) was signed into law on December 27, 2020.

Frequently Asked Questions

Q) When must I provide my proof of employment, self-employment, or proof of the planned beginning of employment or self-employment?

What is the PUA benefit for 2019?

Individuals who received at least $5,000 a year in self-employment income during 2019 now will receive an additional $100 weekly benefit, in addition to the benefit amounts they otherwise would be entitled to receive from regular state unemployment. Previously, such individuals were not eligible for PUA benefits if they received some regular state unemployment benefits for traditional employment, and regular state law benefits did not consider self-employment in calculating the benefit amounts. The new federally-funded “mixed earner” benefit is in addition to the $300 supplementary FPUC weekly benefit under FPUC.

What is PUA unemployment?

The Pandemic Unemployment Assistance (PUA) program was put in place primarily for those out-of-work Americans who are not eligible for regular state unemployment benefits and are unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic. This group of jobless workers are generally self-employed (e.g. independent contractors, freelancers or gig economy workers) who did not contribute taxes towards regular state unemployment (1099 wages). The PUA program has been extended several times over the last year and you can jump to the relevant extension section via the links below for further information on each extension, including FAQs around the evolution of the program.

How long will unemployment benefits last?

For those who don’t qualify for state unemployment they can get benefits for between 39 and 46 weeks until the end of 2020. At this stage unless Congress extends the PUA program via a new stimulus package, ...

What is the stimulus package for unemployment?

The $900 billion COVID relief stimulus package, under the Continued Assistance Act (CAA) included funding for extending pandemic unemployment programs (PUA, PEUC) and providing supplementary FPUC un employment benefits at $300 per week for millions of unemployed or underemployed Americans. The Department of Labor (DOL) has issued final guidelines for state unemployment agencies on payments and eligibility (as done with the original program) and any delayed payments will be retroactively reimbursed.

How long is the PUA program?

The PUA program, designed for freelancers, gig workers and independent contractors or those that generally don’t qualify for regular state unemployment has been extended by another 29 weeks (though only covers 25 actual weeks) under the Biden Stimulus Plan (ARP) that has been passed into law.

Why is my PUA denied?

Other reasons PUA claims are being denied are due to ongoing “ glitches” in unemployment filing systems/websites that have required a lot more updates to support the new PUA provisions.

When will PUA benefits end in 2021?

After March 14, 2021, new claimants will no longer be permitted to apply for PUA benefits, but eligible individuals who have a PUA claim balance (or remaining weeks) as of March 14th, 2021 will continue to receive benefits until the week beginning April 5, 2021 until their claim balance is exhausted.

What is PUA in unemployment?

Pandemic Unemployment Assistance (PUA) is a federal program that was included in the Coronavirus Aid, Relief and Economic Security (CARES) Act. The program provides support for Americans who are unable to work due to the Coronavirus pandemic, but do not qualify for traditional Unemployment Insurance (UI).

Why is my unemployment claim pending?

In some cases, additional information must be obtained before payment can be made and your payment may take longer. Any claim you file will be backdated to the date you became unemployed. If you are eligible, you will be paid for all benefits due.

Should I certify weekly while on PUA?

Instead, PUA claimants should continue to certify weekly while unemployed to continue receiving the benefits they are eligible for. Claimants who are receiving traditional Unemployment Insurance (UI), should reapply if they continue to be unemployed when their benefit year has ended.

How long does it take to get a biweekly unemployment claim in Pennsylvania?

It can take up to four to six weeks to receive the approval of your first biweekly claim.

How often do you have to file a claim for unemployment?

After you have filed your initial application for UC benefits or reopened an existing application, you must file a claim for each week in which you are totally or partially unemployed.

How long does it take to get your first unemployment payment?

Here’s how you can calculate your weekly benefit rate. If you are eligible for benefits, you should receive your first benefit payment within four weeks after the effective date of your application, provided you file your biweekly claims on time.

How long do you have to file a biweekly claim?

The compensable week ending (CWE) date is always a Saturday. In most cases, you will file claims for two weeks at one time. This is called a “biweekly claim”. Although you will file for two weeks at a time, you will certify your eligibility for each week separately.

How long does it take to receive a claim confirmation letter?

It will have your four-digit Personal Identification Number (PIN) that you will need to access your account AND file your biweekly claims.Claim confirmation letters are typically received within 7-10 business days via U.S. Postal Service.

When will Georgia stop receiving PUA?

Effective June 27, 2021, the state of Georgia is no longer participating in the PUA program. The last payable week ending date for PUA benefits was June 26, 2021. Step 1: Individual files a regular state unemployment claim. A claimant will receive 2 emails - one stating that the claim was received and another stating the claim was processed.

What is the CAA requirement for 2020?

CAA Federal Requirement for Proof of Employment/Self-employment and Wages. The Continued Assistance Act of 2020 requires individuals who received PUA benefits on or after 12/27/2020 to provide proof of employment/self-employment or a valid offer to begin employment along with proof of wages.

What is proof of employment?

Proof of employment with organizations such as Peace Corps, AmeriCorps, and educational or religious non-profit organizations includes, but is not limited to: documentation from the organizations or signed affidavit by an individual (with name and contact information) verifying your attachment to such organizations.

What is the second determination letter for unemployment?

If so, an individual receives a second determination letter (Claims Examiner's Determination) informing the claimant if state benefits are approved or denied.

What proof is needed for self employment?

For individuals who were starting self-employment but were not able to start the job, proof includes, but is not limited to, property titles or deeds for the place of employment, rental lease agreement, business registration documents, state or federal employer identification numbers, and an assumed name certificate.

Is Georgia still in the PUA program?

This includes individuals who are self-employed, gig workers, 1099 independent contractors, employees of churches, employees of non-profits, or those with limited work history who do not qualify for state unemployment benefits. Effective June 27, 2021, the state of Georgia is no longer participating in the PUA program.

Eligibility

Self-Employment and Employment Documentation

- Federal rules require that you provide documentation to prove you were, or planned to be, self-employed or employed at some point during the calendar year before and up to the start of your PUA claim. For example: 1. If your claim started in December 2020, you will need to provide documentation for some time between January 1, 2019, and the start date of your claim in 2020…

Pua Reassessment

- Recent federal guidance added three new reasons and updated the existing reasons unemployed Californians can use to explain why they were out of work during the COVID-19 public health emergency. If you were previously denied benefits for one or more weeks under the PUA program, you will receive a message in your UI Online account with instructions on how to complete the P…

Benefit Payments

- Certification

After your account is set up, you must “certify” for your benefit payments. Certifyingis answering basic questions every two weeks that tells us you were unemployed and eligible to receive payments. Note: With a PUA claim, you can only certify online or by mail for weeks of unemploy…

Your Claim Date

- Your claim start date was the Sunday of the week you applied for unemployment. For PUA applications received on or after December 27, 2020, the earliest start date for a claim was December 6, 2020.

Additional Resources

- America’s Job Center of CaliforniaSM– Provides employment assistance.

- COVID-19: Unemployment Claims– Learn what to expect after you file your claim