Follow these steps to apply online:

- To start your application, go to our Apply for Benefits page, read and agree to the Terms of Service. Click “Next.”

- On that page, review the “Getting Ready” section to make sure you have the information you need to apply.

- Select “Start A New Application.”

- We will ask a few questions about who is filling out the application.

- You will then sign into your my Social Security account or you will be prompted to create one.

- Complete the application.

Full Answer

How do you apply for Social Security benefits online?

Widows and Widowers A widow or widower can receive benefits:

- At age 60 or older.

- At age 50 or older if disabled.

- At any age if they take care of a child of the deceased who is younger than age 16 or disabled.

How do I check my social security status online?

Your application status shows:

- Date of filing.

- Current claim location.

- Servicing office location.

- Scheduled hearing date and time.

- Re-entry numbers for incomplete applications.

- Publications that may be of interest to you, depending on your claim and current step in the process.

Where do I go to apply for Social Security benefits?

Where do I go to apply for Social Security benefits?

- Local Office. There are over 1,200 social security offices located throughout the country, and there is at least one in each state.

- Applying Online. There are a few benefits to applying for disability benefits online. ...

- Attorney or Advocate Help. ...

- Additional Resources. ...

How do you apply for Social Security retirement online?

You can apply:

- Online; or

- By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office. Call ahead to make an appointment.

- If you do not live in the U.S. or one of its territories, you can also contact your nearest U.S. Social Security office, U.S. Embassy or consulate.

Can you claim your Social Security benefits online?

Today, you can apply for retirement, disability, and Medicare benefits online, check the status of an application or appeal, request a replacement Social Security card (in most areas), print a benefit verification letter, and more – from anywhere and from any of your devices!

How do I start claiming my Social Security benefits?

You can apply:Online; or.By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office. ... If you do not live in the U.S. or one of its territories, you can also contact your nearest U.S. Social Security office, U.S. Embassy or consulate.

How many months in advance should you apply for Social Security benefits?

four monthsYou can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December, and apply in August. Even if you are not ready to retire, you still should sign up for Medicare three months before your 65th birthday.

How long does it take to get first Social Security check after applying?

Once you have applied, it could take up to three months to receive your first benefit payment. Social Security benefits are paid monthly, starting in the month after the birthday at which you attain full retirement age (which is currently 66 and will gradually rise to 67 over the next several years).

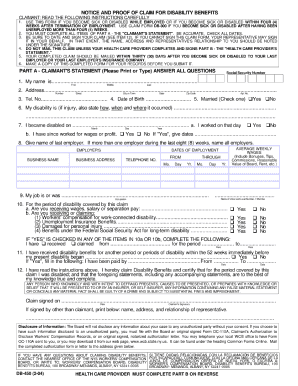

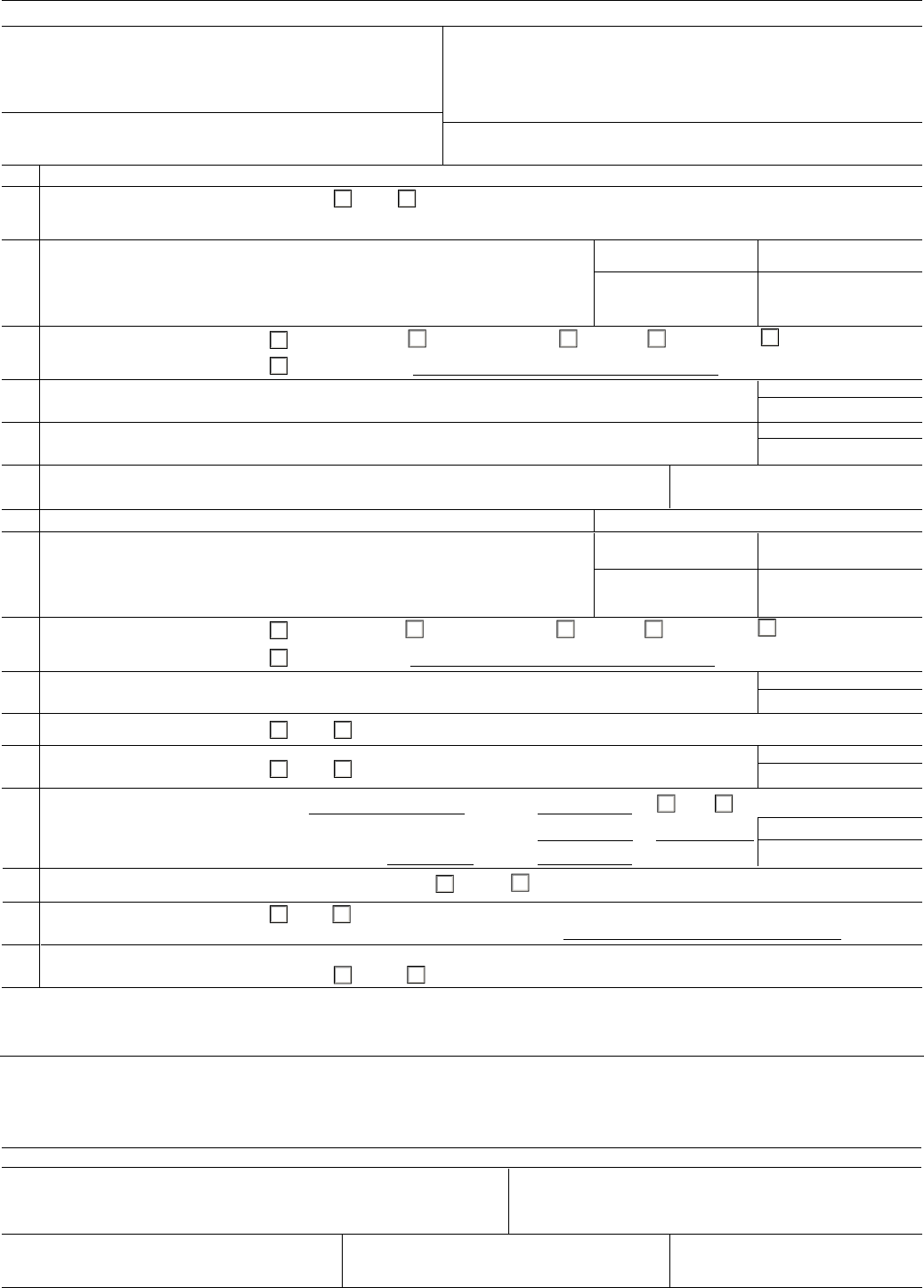

What form do I use to apply for Social Security benefits?

You can apply: Online; or. By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office.

Is it better to apply for Social Security in person or online?

While some may prefer to apply in person at their local Social Security office, an increasing number of retirees are finding it easier and more convenient to claim their benefits by retiring online at www.socialsecurity.gov.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Does it matter what month you start Social Security?

If you want your benefits to start in January, you can apply in September. Social Security benefits are paid in the month following the month they are due. If you are due benefits for the month of December, you will receive your first check in January for December.

Apply for Retirement Benefits

Starting your Social Security retirement benefits is a major step on your retirement journey. This page will guide you through the process of applying for retirement benefits when you’re ready to take that step. Our online application is a convenient way to apply on your own schedule, without an appointment.

Ready To Retire?

Before you apply, take time to review the basics, understand the process, and gather the documents you’ll need to complete an application.

How to maximize Social Security?

Or, you might consider the following rules of thumb: 1 Take Early: The only people who should consider taking their Social Security early are those who absolutely need the money immediately, or those who do not expect to live for very long, due to illness 2 Take at Full Retirement Age: Should you have reason to believe that you will not live past the age of 80, then generally speaking you will maximize your social security benefits if you take them when you reach your Full Retirement Age. 3 Wait as Long as Possible: On the other hand, if you are confident that you will live past the age of 80 or 85, then most experts recommend that you defer your social security for as long as you can (age 70), so as to maximize the benefits you receive from it. 4 Other: If you have dependent children, the additional benefits you receive for them might make filing when you are younger worthwhile.

What age do you need to be to get your spouse's Social Security number?

Spouse’s Social Security number and birth date and the beginning and ending dates of marriage (s) Names and birth dates of any children who became disabled prior to age 22 or who are under age 18 (and unmarried). You will also want names and birth dates for children who are aged 18-19 who are still attending secondary school full time.

How much is deducted from Social Security?

For every month prior to your full retirement age that you begin taking benefits, around 0.55% is deducted from your payout. And, for every year that you defer your benefits, you will receive a larger amount when you finally do begin drawing Social Security. The amount of the bonus is dependent, once more, on your birth date.

Online Services

We are constantly expanding our online services to give you freedom and control when conducting business with Social Security.

my Social Security

You can access many of our online services with a free my Social Security Account.

Online Services for Businesses, Governments, Organizational Payees and Third Parties

Use Business Services Online to report wages and use our other online services for businesses.

Supplemental Security Income

SSI is federal income that is funded by taxpayer dollars and helps people who have little or no income and who are age 65 or older, blind, or have disabilities. You can be under 65 for the benefit, but need to meet certain disability requirements. To see if you are eligible to apply and meet all requirements, click here.

Medicare

Medicare is a federal health insurance program that is mainly used by people aged 65 or older and used in retirement as health insurance. Certain people younger than 65 who have disabilities and those with end-stage renal disease can also be eligible for Medicare.

Help With Prescription Drug Costs

Those who simply need some extra assistance with the cost of their prescription drugs and daily medications can apply for it through the SSA benefit website here. You must be enrolled in a Medicare Prescription Drug program to receive this benefit.

Check Out Our Free Newsletters!

Every day, get fresh ideas on how to save and make money and achieve your financial goals.

What to do if you are not getting survivors benefits?

If you are not getting benefits. If you are not getting benefits, you should apply for survivors benefits promptly because, in some cases, benefits may not be retroactive.

Can you get survivors benefits if you die?

The Basics About Survivors Benefits. Your family members may receive survivors benefits if you die. If you are working and paying into Social Security, some of those taxes you pay are for survivors benefits. Your spouse, children, and parents could be eligible for benefits based on your earnings.

Can you report a death online?

However, you cannot report a death or apply for survivors benefits online. In most cases, the funeral home will report the person’s death to us. You should give the funeral home the deceased person’s Social Security number if you want them to make the report. If you need to report a death or apply for benefits, ...

What happens to Social Security if your spouse dies?

If your spouse passes away, you would receive the higher amount of $2,000 each month. In cases where the surviving spouse has the higher of the two benefits for the couple, “You’d simply want to make sure the death has been reported to Social Security to stop benefits to the deceased spouse,” Adams says.

What is the survivor benefit based on?

The survivor benefit you receive each month will depend on several factors. “The benefit amount is based on the deceased's earnings ,” Slocum says. “The more that was paid into Social Security, the higher the benefits.”.

Can a widow receive Social Security if her spouse passes away?

Widows and widowers who are under age 60 and caring for a child who is younger than 16 or disabled may also be able to receive benefits. Spouses who are 50 or older and disabled may also qualify.

Can a widow receive survivor benefits?

A widow, widower, child or other dependent might receive survivor benefits. The claim for survivor payments can be made if the deceased was eligible to receive Social Security benefits. Read on to learn if you might qualify for survivor benefits and how much can be claimed.

Do you need to report a death to Social Security?

For survivor benefits to begin, the death will need to be reported. Funeral homes often report a person’s death as part of their services. If you choose to have the funeral home take care of the death report, remember to provide the Social Security number of the deceased person. You’ll need several documents to apply for Social Security survivor ...

Can a lump sum be sent to a child?

In cases where there is no surviving spouse, this lump sum could be sent to a child. If sent to a child, the child must already be receiving benefits on the deceased’s record or be eligible for benefits at the time of death. [. See: 10 Ways to Increase Your Social Security Payments.

Who can qualify for survivor benefits?

Sons and daughters who are unmarried and were disabled before age 22 might also qualify. A stepchild, grandchild, step-grandchild or adopted child might also be eligible in certain circumstances. In some cases, others may be able to receive survivor benefits.

Documents you may need to provide

We may ask you to provide documents to show that you are eligible, such as:

What we will ask you

You should also have your checkbook or other papers that show your account number at a bank, credit union or other financial institution so you can sign up for Direct Deposit, and avoid worries about lost or stolen checks and mail delays.

What does the SSA look for in spousal benefits?

The SSA looks at the amount of retirement benefits you're eligible for, then the amount of spousal benefits you're eligible for. If the spousal benefits are greater than your retirement benefits, you would be paid your retirement benefits first, then spousal benefits would be used to make up the difference. You always get the larger of the two ...

How much is my spouse's spousal benefit?

Decide when you want to start receiving benefits. Your full spousal benefit is 50% of your spouse's primary insurance amount. However, if you decide to start receiving those benefits before you reach your normal retirement age, your benefit amount will be permanently reduced.

What is the lowest percentage of your spouse's insurance?

The lowest percentage you could possibly get is 32.5% of your spouse's primary insurance amount. In some situations, it might make sense for you to claim your spousal benefits early. However, if you can afford to do so, you'll get more money if you wait until you reach your normal retirement age.

What is the phone number to call for Social Security?

If you can't apply online or don't want to use the online form, you can also call 1-800-772-1213 (TTY 1-800-325-0778).

Does Social Security pay out your own retirement?

The Social Security Administration (SSA) always pays out your own retirement benefits first. However, if your spouse worked for more years, or made more money than you did, it's possible that your spousal benefit will be greater than your retirement benefits. The SSA looks at the amount of retirement benefits you're eligible for, ...

How to check status of Social Security application?

1. Set up an online account if you haven't already. From your "My Social Security" account at https://www.ssa.gov/myaccount/ , you can check the status of your application and manage your benefits. If you didn't apply for your benefits online, you can still set up a free account to manage your benefits.

Is my spouse's retirement benefit based on my primary insurance?

The amount of your spousal benefit isn't affected by the age at which your spouse started receiving their retirement benefits. It is always based on your spouse's primary insurance amount, which is the amount they would receive if they started claiming benefits at their normal retirement age (NRA).