- A widow, widower, or surviving divorced spouse cannot apply online for survivors benefits. You should contact Social Security at 1-800-772-1213 to request an appointment. ...

- If you wish to apply for disability benefits as a survivor, you can speed up the disability application process if you complete an Adult Disability Report and have it available ...

- We use the same definition of disability for widows and widowers as we do for workers.

What do you need to apply for Social Security survivor benefits?

You’ll need several documents to apply for Social Security survivor benefits. These might include: A death certificate for the deceased. The Social Security number of the deceased worker. Social Security numbers for yourself and dependent children. Birth and marriage certificates. Latest W-2 forms.

How to calculate widow's benefits for Social Security?

How to Calculate a Widow's Benefits for Social Security

- Qualification. The deceased worker must meet qualifications for the survivors to collect benefits on her work history.

- Considerations. ...

- Age. ...

- Calculations. ...

- Misconceptions. ...

How much does social security pay a surviving spouse?

- A widow or widower age 60 or older (age 50 if they are disabled) provided that they have not remarried

- A widow or widower at any age who is caring for the child (under age 16 or disabled) of the deceased

- A child of the deceased who is under 18 (19 if enrolled as a full-time student in elementary or secondary school)

How to get thousands more in Social Security survivor benefits?

Please select the benefit you will be applying for from the list below to see what information and documents you may need when you apply:

- Widows/Widowers or Surviving Divorced Spouse's Benefits.

- Child's Benefits.

- Mother's or Father's Benefits (You must have a child under age 16 or disabled in your care.)

- Lump-Sum Death Payment.

- Parent's Benefits (You must have been dependent on your child at the time of his or her death.)

Who is eligible for Social Security survivor benefits?

A widow or widower age 60 or older (age 50 or older if they have a disability). A surviving divorced spouse, under certain circumstances. A widow or widower at any age who is caring for the deceased's child who is under age 16 or has a disability and receiving child's benefits.

When can a widow collect her husband's Social Security?

age 60The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

What are the qualifications to receive survivor benefits?

Who Qualifies for Social Security Survivor Benefits?A widow(er) age 60 or older (age 50 or older if they are disabled) who has not remarried.A widow(er) of any age who is caring for the deceased's child (or children) under age 16 or disabled.More items...

How do I claim Social Security death benefit?

You can apply for benefits by calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or by visiting your local Social Security office. An appointment is not required, but if you call ahead and schedule one, it may reduce the time you spend waiting to apply.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

When a spouse dies does the survivor get their Social Security?

A surviving spouse can collect 100 percent of the late spouse's benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age.

Can you be denied survivor benefits?

If a person's application for Social Security Survivor Benefits is denied, the person can appeal the denial. A person has 60 days after they receive a notice of decision on their case from the SSA to ask for an appeal.

Who is not eligible for Social Security survivor benefits?

Widowed spouses and former spouses who remarry before age 60 (50 if they are disabled) cannot collect survivor benefits. Eligibility resumes if the later marriage ends. There is no effect on eligibility if you remarry at 60 or older (50 or older if disabled).

How long does it take to get approved for survivor benefits?

30 to 60 daysAbout 5 million widows and widowers currently qualify. It takes 30 to 60 days for survivors benefits payments to start after they are approved, according to the agency's website.

How do I collect my deceased husband's Social Security?

Form SSA-10 | Information You Need to Apply for Widow's, Widower's or Surviving Divorced Spouse's Benefits. You can apply for benefits by calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office.

Who qualifies for the $255 Social Security death benefit?

Only the widow, widower or child of a Social Security beneficiary can collect the $255 death benefit, also known as a lump-sum death payment. Priority goes to a surviving spouse if any of the following apply: The widow or widower was living with the deceased at the time of death.

When a parent dies who gets Social Security?

Within a family, a child can receive up to half of the parent's full retirement or disability benefit. If a child receives Survivors benefits, he or she can get up to 75 percent of the deceased parent's basic Social Security benefit.

How to report a death to Social Security?

To report a death or apply for survivors benefits, use one of these methods: Call our toll-free number, 1-800-772-1213 (TTY 1-800-325-0778 ). Visit or call your local Social Security office. More Information. If You Are The Survivor. Survivors Benefits.

How much is a death benefit for dependent parents?

Parents age 62 or older who received at least one-half support from the deceased can receive benefits. One-time lump sum death payment. A one-time payment of $255 can be made only to a spouse or child if they meet certain requirements.

How old do you have to be to get unemployment benefits?

Unmarried children can receive benefits if they are: Younger than age 18 (or up to age 19 if they are attending elementary or secondary school full time). Any age and were disabled before age 22 and remain disabled.

Can you get Social Security if you die?

When you die, members of your family could be eligible for benefits based on your earnings. You and your children also may be able to get benefits if your deceased spouse or former spouse worked long enough under Social Security.

Who can receive survivor benefits?

A stepchild, grandchild, step-grandchild or adopted child might also be eligible in certain circumstances. In some cases, others may be able to receive survivor benefits. Parents, step-parents or adoptive parents who are at least age 62 and dependent on the deceased could qualify for benefits .

How many people receive survivor benefits?

The Social Security Administration sends survivor benefits to about 6 million Americans every month. These payments are directed to family members of workers who have passed away. A widow, widower, child or other dependent might receive survivor benefits. The claim for survivor payments can be made if the deceased was eligible to receive Social Security benefits. Read on to learn if you might qualify for survivor benefits and how much can be claimed.

What happens to Social Security if your spouse dies?

If your spouse passes away, you would receive the higher amount of $2,000 each month. In cases where the surviving spouse has the higher of the two benefits for the couple, “You’d simply want to make sure the death has been reported to Social Security to stop benefits to the deceased spouse,” Adams says.

What is the survivor benefit based on?

The survivor benefit you receive each month will depend on several factors. “The benefit amount is based on the deceased's earnings ,” Slocum says. “The more that was paid into Social Security, the higher the benefits.”.

What happens after you share your forms and certificates?

After you share the forms and certificates, you’ll learn if you are eligible to receive benefits.

Can a lump sum be sent to a child?

In cases where there is no surviving spouse, this lump sum could be sent to a child. If sent to a child, the child must already be receiving benefits on the deceased’s record or be eligible for benefits at the time of death. [. See: 10 Ways to Increase Your Social Security Payments.

Who can get the same benefits as a widow?

Spouses who are 50 or older and disabled may also qualify. “An ex-spouse has the same benefits as a widow or widower if the marriage lasted at least 10 years,” says Kate Slocum, a certified financial planner and lead advisor at Exchange Capital Management in Ann Arbor, Michigan.

How do survivors benefit amounts work?

We base your survivors benefit amount on the earnings of the person who died. The more they paid into Social Security, the higher your benefits would be.

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

Who receives benefits?

Certain family members may be eligible to receive monthly benefits, including:

Are other family members eligible?

Under certain circumstances, the following family members may be eligible:

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

What happens if you die on reduced benefits?

If the person who died was receiving reduced benefits, we base your survivors benefit on that amount.

How to report a death to the funeral home?

You should give the funeral home the deceased person’s Social Security number if you want them to make the report. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778 ). You can speak to a Social Security representative between 8:00 am – 5:30 pm. Monday through Friday.

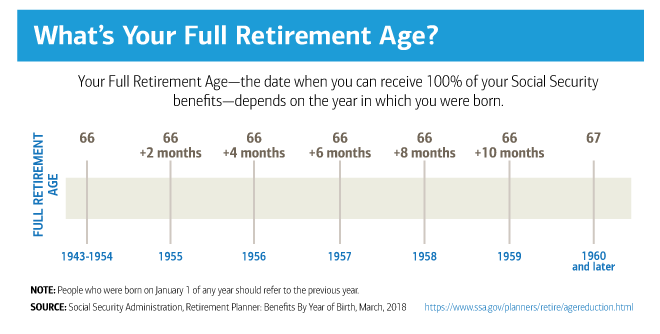

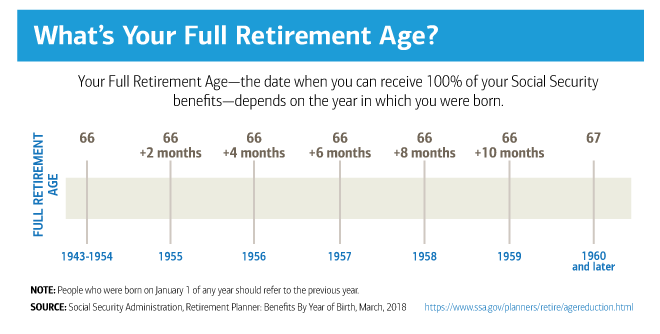

What age can you collect a $1000 survivor benefit?

Generally, if the person who died was receiving reduced benefits, we base the survivors benefit on that amount. Year of Birth 1. Full (survivors) Retirement Age 2. At age 62 a $1000 survivors benefit would be reduced to 3. Months between age 60 and full retirement age.

How much is the 62 survivors benefit?

It includes examples of the age 62 survivors benefit based on an estimated monthly benefit of $1000 at full retirement age . If the worker started receiving retirement benefits before their full retirement age, we cannot pay the full retirement age benefit amount on their record. Generally, if the person who died was receiving reduced benefits, ...

What are the pros and cons of taking survivors benefits before retirement age?

Pros And Cons. There are disadvantages and advantages to taking survivors benefits before full retirement age. The advantage is that the survivor collects benefits for a longer period of time. The disadvantage is that the survivors benefit may be reduced.

When can a widow receive Social Security?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor. If the benefits start at an earlier age, they are reduced a fraction of a percent for each month ...

Can you use the retirement estimate to determine the amount of a spouse's retirement benefits?

You cannot use the Retirement Estimator to determine benefit amounts for a surviving spouse. However, if you know what the worker's yearly lifetime earnings were, you can use our Online Calculator to get a rough estimate of what the benefits would be for the surviving spouse at full retirement age.

Who Is Eligible For Spouse Survivor Benefits?

Many surviving spouses are eligible for monthly benefits from Social Security, based upon their age, disability, children at home, or some combination thereof. In general, spouse survivor benefits are available to:

What happens if a deceased spouse files for Social Security?

If the Deceased DID File for Benefits. If the deceased spouse filed for benefit on or after their full retirement age, and the surviving spouse is at full retirement age, the benefit amount payable to the survivor will remain unchanged.

Why is knowing when you are full retirement important?

Why? Because if the survivor benefit is the highest benefit you’ll be entitled to, there is generally no benefit to delaying your filing beyond that age.

What is a surviving spouse?

A surviving spouse, who was residing with the deceased spouse, or. A surviving spouse, who was not residing with the deceased, but was receiving benefits based upon the work record of the deceased spouse, or who becomes eligible for benefits after the death of the spouse , or.

How long does it take to get a death benefit if you are not receiving it?

Even though $255 isn’t a lot, who wants to pass on money that’s rightfully theirs? If the eligible spouse or child is not receiving benefits at the time of death, they must apply for benefits within two years in order to receive the death payment.

What age can a spouse care for a deceased child?

Surviving spouses, of any age, caring for the deceased’s child aged 16 or younger or disabled.

What is proof of death?

Proof of death—either from a funeral home or death certificate; Your Social Security number, as well as the deceased worker’s; Your birth certificate; Your marriage certificate, if you are a widow or widower; Dependent children’s Social Security numbers, if available, and birth certificates;

Ways to Apply

You can complete an application for Retirement, Spouse's, Medicare or Disability Benefits online.

Retirement or Spouse's Benefits

You can apply online for Retirement or spouse's benefits or continue an application you already started.

Disability Benefits

You can apply online for disability benefits or continue an application you already started.

Appeal a Disability Decision

If your application for disability benefits was denied recently for medical reasons, you can request an appeal online or continue working on an appeal you already started.

Medicare Benefits

You can apply online for Medicare or continue an application you already started.

Extra Help with Medicare Prescription Drug Costs

You can apply online for Extra Help with Medicare prescription drug costs.

Supplemental Security Income (SSI) Benefits

If you want to apply for Supplemental Security Income (SSI), please read:

What happens when you start claiming survivor benefits?

When you start claiming your survivor benefit, you would get what their payment would have been at that later age. This will be a larger amount than if they had started sooner.

Who Can Get Survivor Benefits and at What Age?

After the death of a spouse, you can get a monthly Social Security survivor benefit. This is true as long as you have been married for at least nine months. 1

What happens if you collect a survivor benefit and have not reached FRA?

If you collect a survivor benefit and you have not yet reached FRA, the amount you get can go down if you are working. 7 This would happen if your income is higher than the earnings limit .

What age can you get a survivor benefit?

Survivor’s benefits include the effect of delayed retirement credits. If your spouse was already past age 66 or 67 and had not started taking Social Security, you may get a higher survivor benefit than if they had filed sooner.

What happens if you and your spouse start claiming?

If you and your spouse had both started claiming, the higher benefit amount becomes your monthly payment. The lower of the two payment amounts will be stopped.

How much does Social Security pay for a deceased spouse?

First, Social Security pays a death benefit of $255 if the surviving spouse lived with the deceased spouse. 3 This payment is made only once. More important is the monthly income. At a basic level, the monthly amount depends on the earnings of the deceased spouse over their whole life.

How old do you have to be to claim spousal support?

If you are caring for the child of your deceased spouse, and the child is under the age of 16 , you can claim your spousal payment after their death even if you were married much less time. 2

Documents you may need to provide

We may ask you to provide documents to show that you are eligible, such as:

What we will ask you

You also should bring along your checkbook or other papers that show your account number at a bank, credit union or other financial institution so you can sign up for Direct Deposit, and avoid worries about lost or stolen checks and mail delays.

What percentage of survivor benefits do you get when you retire?

If you claim survivor benefits between age 60 and your full retirement age, you will receive between 71.5 percent and 99 percent of the deceased’s benefit. The percentage gets higher the older you are when you claim.

How long do you have to be married to receive survivor benefits?

In most cases, a widow or widower qualifies for survivor benefits if he or she is at least 60 and had been married to the deceased for at least nine months at the time of death. But there are a few exceptions to those requirements: 1 If the late beneficiary’s death was accidental or occurred in the line of U.S. military duty, there’s no length-of-marriage requirement. 2 You can apply for survivor benefits as early as age 50 if you are disabled and the disability occurred within seven years of your spouse’s death. 3 If you are caring for children from the marriage who are under 16 or disabled, you can apply at any age.

What happens to Social Security when a spouse dies?

En español | When a Social Security beneficiary dies, his or her surviving spouse is eligible for survivor benefits. A surviving spouse can collect 100 percent of the late spouse’s benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age. (Full retirement age for survivor benefits differs from that for retirement and spousal benefits; it is currently 66 but will gradually increasing to 67 over the next several years.)

What percentage of late spouse's disability is survivor?

If you claim in your 50s as a disabled spouse, the survivor benefit is 71.5 percent of your late spouse's benefit.

Can a survivor get Social Security if they are still working?

If you are below full retirement age and still working, your survivor benefit could be affected by Social Security's earnings limit. It does not matter whether a surviving spouse worked long enough to qualify for Social Security on his or her own.

Do you get a survivor benefit if you are on Social Security?

You will not receive a survivor benefit in addition to your own retirement benefit; Social Security will pay the higher of the two amounts.

Can you get survivor benefits if you remarry?

If the remarriage took place before you turned 60 (50 if you are disabled), you cannot draw survivor benefits. You regain eligibility if that marriage ends. And there is no effect on eligibility for survivor benefits if you remarry at or past 60 (50 if disabled).