For some reason,you are not able to register on LIC portal or not able submit your claim online, then you can go with email route too. One can submit maturity claims and survival benefits using this method. 1) The policyholder is required to send the claim requirement on email address – claims.bo<branch code>@licindia.com.

- Claim Form 'A' in Form No. 3783. ...

- Certified extract from death register.

- The original policy document with Deed/s of assignment/s, if any. (Additional requirement may be required under a policy according to the status of the policy.

How to submit maturity claims and survival benefits in LIC?

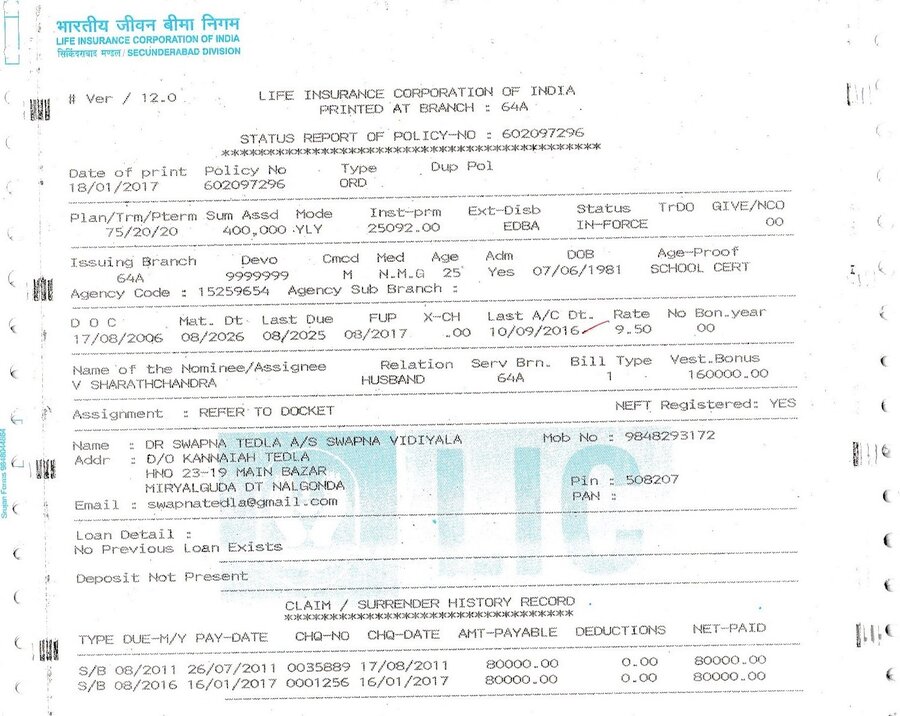

One can submit maturity claims and survival benefits using this method. 1) The policyholder is required to send the claim requirement on email address – claims.bo<branch code>@licindia.com. Here the branch code is the serving branch. One can get the details of the serving branch code from the policy document or premium receipt.

How do I claim my survival benefit?

Generally the Survival Benefit is directly credited to your registered Bank Account around your Due Date (If you had provided your bank details earlier), but in some cases ,when the amount of survival benefit is greater than a specific amount (say greater than 50000), you will need to fill a DISCHARGE VOUCHER, to claim your survival benefit.

Why do you need to make an online claim with LIC?

This enables you to avoid physical contact with the people while visiting the LIC Branch. The online procedure of making the claims also becomes handy in case the company has terminated the services of your LIC agent forcing you to make the claims on your own or visit the branch.

What are survival benefits in life insurance?

Survival benefits are benefits which are payable to the insured by the insurer on the insured surviving various stages of the policy. Maturity benefits payable under this type of insurance would be the balance of sum assured after deducting the survival benefits, but with all types of bonuses for full sum assured for full period of the policy.

How do I claim my LIC survival policy money back?

Survival Benefits: In case the policyholder makes it through the entire policy term, the beneficiary receives 20% of the basic sum assured at the termination of the 5th, 10th, and 15th year of the policy. Additionally, accrued bonuses coupled with 40% of the total sum assured are also provided to the nominee.

How can I check my LIC survival benefit?

Present loan position will be displayed such as total loan outstanding under the policy, due up to which loan interest paid etc. This option will display date of Survival Benefit (if any) or Maturity Benefit due under the policy during the policy term. Revival quotation will be provided in case of lapsed policies.

What is survival benefit amount?

Survival benefit is the amount a policyholder receives at the end of a policy term. In case, you survive till the end of your policy and the policy is active, it will take care of your financial needs by offering survival benefits. Survival benefits may include the followings: Your accrued bonuses.

What survival benefits claim?

Survival benefit is the amount that you will receive after you survive the policy's duration. Survival Benefit is mostly present in policies that offer to cover for your whole life (100 years) and money-back plans.

Are survival benefits taxable?

They both offer tax benefits under section 10(10D) of the Income Tax Act, 1961. As per this section, the amount you receive from your life insurance policy is exempt from tax. This includes both maturity benefits and survival benefits.

How to get LIC claim after death?

To start death claim filing process, the nominee is required to visit the home branch of LIC from where the policy was issued and inform them about the death of the policyholder. The branch official will give Form 3783, Form 3801, and NEFT forms for the transfer of funds into the nominee's bank account.

What is survival benefit in LIC money back policy?

Survival Benefit: On survival, 20% of the Sum Assured is paid to the policyholder as Survival Benefit, and the policy continues: Payable at the end of the 5th Policy Year. Payable at the end of the 10th Policy Year. Payable at the end of the 15th Policy Year.

What is a survival maturity benefit?

Survival benefit: Maturity of the policy in 40 years or the policyholder attaining the age of 80 years, whichever is later. The sums are paid in intervals to the policyholder. If the policyholder dies during the plan tenure, after receiving survival benefits, the full benefits are handed over to the nominees.

What is survival benefit life insurance?

Definition: Guaranteed survival benefits are benefit given to the policy holder during or upon completion of the policy tenure. Description: In the case of money back policies, a certain pre determined amount is paid to the insured after regular intervals. Survival benefit applies only in the case the insured is alive.

Who can apply for survivor benefits?

A widow or widower age 60 or older (age 50 or older if they have a disability). A surviving divorced spouse, under certain circumstances. A widow or widower at any age who is caring for the deceased's child who is under age 16 or has a disability and receiving child's benefits.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

How long do you have to be married to receive survivor benefits?

nine monthsIn most cases, a widow or widower qualifies for survivor benefits if he or she is at least 60 and had been married to the deceased for at least nine months at the time of death.

What kinds of things might cause a life insurance claim to be denied?

Lying on your application is one of the chief reasons claims are denied. If you misrepresent yourself and your situation – such as not disclosing a...

Can I get life insurance without taking a medical exam?

It’s possible to get life insurance without an exam. However, you might want to think twice before doing so. “You will be very limited in the amoun...

Can I have more than one life insurance policy?

Yes, you can hold more than one policy. Having multiple life insurance policies might sound wasteful. But that isn’t always the case. “Having multi...

How much life insurance do I need?

Determining how much life insurance you need can be difficult. Fortunately, Insure.com can help you zero in on the right amount of coverage for you...

How to make a claim on life insurance?

Get the policy details. With any luck, you're already aware of the deceased's life insurance policy and where it's located. Ideally, it will be stored safely, such as in a metal filing cabinet or fireproof lockbox.

Who can help you fill out a life insurance claim?

A life insurance agent or the life insurance company can help you fill out the necessary forms. A life insurance company may deny a claim, including if the person lied on the life insurance application or the deceased person stopped paying premiums. Wondering how to file a life insurance claim?

What are the different types of life insurance?

There are three major types of policies available without a medical exam: 1 Simplified issue: This type of coverage requires you to answer questions about your medical history, ranging from your history of alcohol use to your personal and family medical history. 2 Guaranteed issue: People between the ages of 50 and 85 with serious health conditions often buy these policies -- usually because they can’t get other life insurance coverage. 3 Group coverage: Employers often offer group coverage as part of their benefits package. You may have to answer a series of questions to qualify for the coverage.

When will insurance companies deny a claim?

Insurance companies will likely deny a claim if the person fibbed during the “contestability period.”. This occurs during the first couple of years after you purchase the policy. An insurer may also deny a claim if the person died by suicide within the contestability period.

How to find out if a life insurance policy is sold?

Once you find the life insurance policy, look for a contact name and number. The life insurance agent who sold the policy can also help with the life insurance claim process and work as an intermediary with the insurance company. If you don't know the agent’s name, contact the life insurance company directly.

What to do if you never mentioned someone on your insurance?

Check for other policies. Even if the deceased never mentioned them, there may be other insurance policies in place. These can include accidental death and dismemberment policies, which employers sometimes offer as riders to their insurance policies. Check with the deceased's human resources representative.

What is the purpose of life insurance?

It’s not greedy to think about life insurance after a person's death. The purpose of having life insurance is to help loved ones cope with the loss.

Who is the commission payable to when an agent dies?

In a case of the death of an agent, the commission payable to him shall be payable to the Nominee or Legal Heir of the Agent. 2. Gratuity. It is payable, for the Agent who dies while his agency is in force or he is physically or mentally incapacitated from carrying out his functions.

How long does an agent have to work to be terminated?

Agent should have worked continuously for 15 years or more and is not below 60 years. Worked for 15 years or more but agency is terminated. Confirmed but died while an agency is in force. Agency is terminated on Physical or Mental Grounds.

What percentage of pension is commuted?

Benefits payable: A pension will be payable depending on the age on vesting. 25% of the corpus can be commuted. Benefits on death: Accumulated value of the member’s contribution will be paid to the nominee (or) pension for the spouse.

How old do you have to be to get free term insurance?

Free term insurance under Lic Agent Benefits is payable in the event of death of a confirmed agent before 60 years of age provided among some other conditions: Agent was appointed before 50 years old. He must have completed at least three qualifying years. His agency was in force on the date of death.

How to make LIC claim online in India?

How to make LIC claims or requests online in India? Here is the process: 1) Login to LIC portal. 2) Select required services which you want to avail .

When was LIC established?

About LIC. Established in the year 1956 , Life Insurance Corporation of India is an Indian state-owned company. The company was established with the aim to spread the concept of insurance and bring more people to its regime.