- Choose your method for filing your claim. Virginia has two options for filing your unemployment claim.

- Complete your application. Regardless of the method you have chosen to file your claim, you will need to provide personal information and employment documentation.

- Calculate how much unemployment insurance you will collect. The more that you made at your previous job, the more you will collect in unemployment insurance.

- Select your method of payment. You will need to choose between a VA Debit Card or direct deposit. ...

Full Answer

How do you apply for unemployment benefits in Virginia?

How Do I Apply For Social Security In New Hampshire? At SSA.gov you can access your benefits online. Call SSA’s toll-free telephone service line (1-800-772-1213) for assistance. Find out where a local Social Security Office is located.

How do you collect unemployment in Virginia?

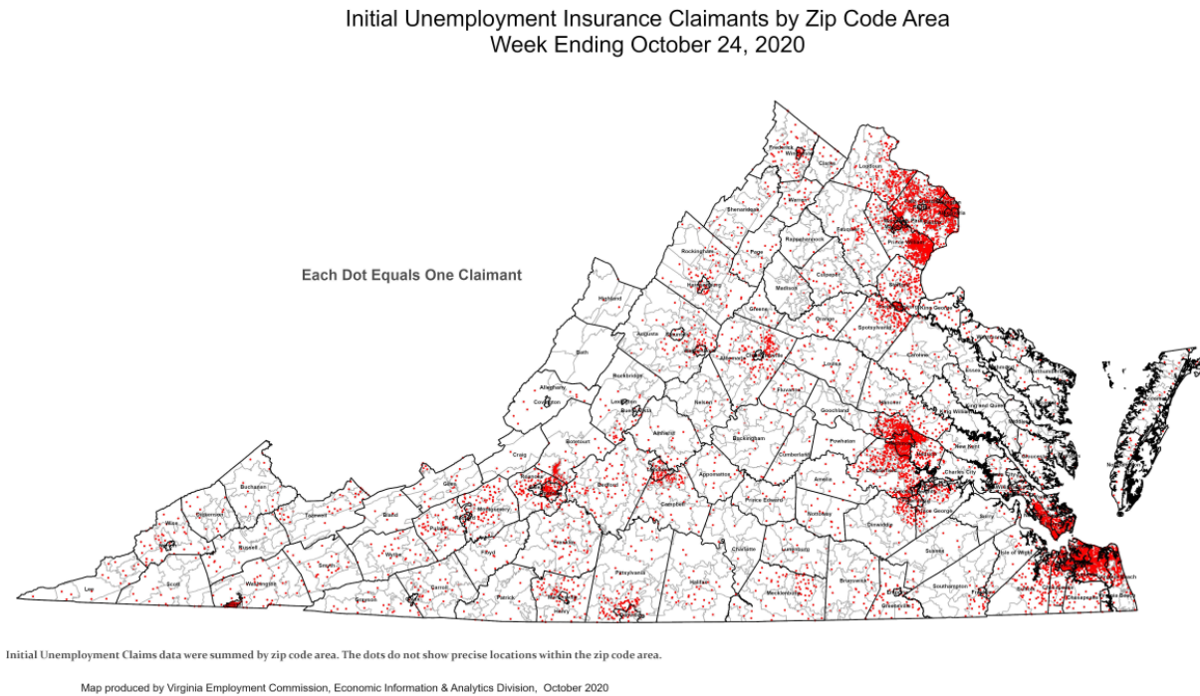

Unemployed workers who lost their jobs in October and November said they’re still waiting on approvals and payments, while the VEC undergoes a leadership change.

What is the maximum unemployment benefit in VA?

You will be required to submit the following information:

- Social Security or Alien Registration number

- Union hall contact details (if applicable)

- 18-month work history with your employers' contact information, start and end dates and why you no longer work for them

- Your bank account routing and account numbers (if you wish to be paid by direct transfer)

What are the requirements for unemployment in Virginia?

- You must be unemployed through no fault of your own, as defined by Virginia law.

- You must have earned at least a minimum amount in wages before you were unemployed.

- You must be able and available to work, and you must be actively seeking employment.

What should I do if the Internet unemployment benefits claim filing system does not have my job title?

Search for a job title that most closely represents your job title. You will be mailed a job seeker registration form that will allow you to provide detailed information about your job title and duties and the positions you are seeking. Your job title does not affect your unemployment benefits.

Where do I file an unemployment benefits complaint that is not based on discrimination in Virginia?

If you have a complaint about the service you receive which cannot be resolved by your service point, you may contact the Customer Service Unit, Virginia Employment Commission, P.O. 1358, Richmond, VA 23261-6441, 1-866-832-2363 (Available 8:15am to 4:30pm, Monday - Friday. Closed state holidays.) Hearing impaired persons may call 1-(800) 828-1120.

When must an unemployment benefits appeal be filed?

All appeals must be filed within 30 days of the date the deputy's determination was mailed, unless the appeal period is extended. Each deputy's determination contains the final date on which an appeal can be filed.

What is the difference between a hearing for oral argument and for additional evidence for unemployment benefit hearing?

At an oral argument hearing, you can explain why, based on the information previously submitted, the appeals examiner's decision should be changed or remain the same. You will not be allowed to present new evidence.At a hearing for additional evidence, you will have the opportunity to present additional information that was not provided earlier. There may be limitations imposed by the special examiner who hears the case. If so, those limitations will usually be explained on the hearing notice or in a separate letter.

Who can be a representative for unemployment benefits appeal?

See full answerAny person of their choosing can represent a party. A representative does not have to be an attorney. If a claimant engages the services of an attorney, the Commission must approve the attorney's fee.If a claimant desires to be represented by an attorney but lacks the resources to hire one, free legal services may be available through one of the legal aid offices in the state. The Virginia State Bar or the local bar association can provide information concerning free legal services which may be available. If an attorney or other representative is engaged to represent a party, the attorney or representative should contact the clerk's office immediately to ensure proper notice of future proceedings in the case.

What is an affidavit in context of unemployment benefits appeal?

An affidavit is a statement, which is sworn to before a notary public, and not merely a notarized statement.

Can an unemployment benefits appeal hearing be reopened?

A party who was unable to appear at a hearing or who appeared but wishes to present additional evidence, may request a reopening of the hearing, which will be granted if good cause is shown. Requests for reopening must be made in writing to the chief appeals examiner and must contain the specific reason(s) for the request.

What is the importance of the unemployment benefits appeal hearing?

The hearing is one of the most important aspects of the appeals process. In most cases it is the only opportunity for evidence to be placed into the official record. Testimony and other evidence available but not offered at the hearing will usually not be allowed or considered at a higher level of appeal. When parties fail to participate in a hearing, the appeals examiner deciding the case will issue a decision based upon the available evidence.

Are parties allowed to tape record their own unemployment benefits appeal hearings?

No. The appeals examiner makes the official recording of the hearing. Parties desiring to engage the services of a court reporter may do so, at their own expense.

What should the parties consider concerning witnesses for unemployment benefits appeal hearing?

See full answerParties have the right to call witnesses on their behalf. Usually witnesses with first-hand knowledge should be called. This generally means eyewitnesses. Parties should be familiar with the substance of their witnesses' testimony before calling them to testify.This means that once a certain fact has been established, additional witnesses whose testimony is merely repetitive, will usually not be allowed to testify, except in rebuttal. Witnesses will be subject to the questioning of the opposing party and the appeals examiner. Parties should contact their witnesses as soon as possible. If a key witness cannot be present for a hearing the party should contact the clerk's office immediately at (804) 786-3020 and request the hearing be postponed, rescheduled or request permission to allow the witness to participate by telephone.

Can evidence obtained at unemployment benefits appeals examiner's hearing be used in other legal proceedings in Virgnia?

Information provided to the Commission can be used only in proceedings arising from the Virginia Unemployment Compensation Act. Appeals hearings cannot be used for discovery or "fishing expeditions" for other legal proceedings.

How are parties advised if an unemployment benefits appeal has been filed?

If an appeal is filed, all parties to the case will be sent a Notice of Appeal. This notifies the appealing party that the appeal has been received and notifies other parties that an appeal has been filed. The Notice of Appeal indicates a hearing will be scheduled in the near future.

How to contact VEC for unemployment?

The Customer Contact Center telephone number is 1-866-832-2363 (Available 8:15am to 4:30pm, Monday - Friday and 9am to 1pm Saturday. Closed Sunday and state holidays.)

What to do if you can't call unemployment?

A: Call or report when you are scheduled to do so. If you do not, you may not be paid unemplo yment benefits for the week you are scheduled to call or report. If you cannot call or report for any reason, call ahead of the scheduled time to explain the circumstances. Unemployment Insurance Handbook for Claimants.

How to contact VEC for incorrect wages?

If you feel the wages shown for your base period are incorrect, you may call the VEC Customer Contact Center at 1-866-832-2363 (Available 8:15am to 4:30pm, Monday - Friday and 9am to 1pm Saturday. Closed Sunday and state holidays.) and provide information to correct the wages. You will be asked to fax or mail proof of correct wages (W-2s, ...

What happens if you disagree with the VEC?

If you disagree with the determination, you must file an appeal by the date shown on the notice.

How many weeks do you have to work to qualify for unemployment?

The amount of wages you earned will determine your weekly benefit amount and the maximum number of weeks (12 to 26 weeks) to which you will be entitled. Benefit computation tables are available on the VEC website.

What are the requirements for a VEC?

After you file your application for benefits, the VEC will decide whether you meet three separate requirements: 1) Monetary eligibility; 2) Separation qualification; and 3) Weekly eligibility.

What is it called when you file a claim against another state?

You file a claim against the other state if you have earned enough wages in that state to qualify for benefits. This is known as an Interstate Claim; or, You request that the wages earned in other states be transferred to Virginia and “combined” to qualify for benefits.

How are VA unemployment benefits paid?

Benefits are paid through taxes on employers covered under the Virginia Unemployment Compensation Act. No part of the cost of your unemployment benefits is deducted from your earnings.

What is the VA unemployment program?

The Virginia Employment Commission (VEC) administers the unemployment compensation program that provides temporary financial assistance to individuals who become unemployed through no fault of their own. Benefits are paid through taxes on employers covered under the Virginia Unemployment Compensation Act.

What is a B-14 form?

These forms are to be used only after being directed to do so by a VEC representative. VEC B-14 - Physician's Certificate of Health/Request for Medical Information. To be used when your medical condition was a factor in your separation from your employer. VEC B-14A - Medical Professional Certificate of Health.

How to file unemployment claim in Virginia?

Virginia has two options for filing your unemployment claim. You can file online or over the phone. Applying online is probably the easiest and fastest way to file your claim. To file your claim over the phone, contact the VEC call center toll free at 1-866-832-2363.

How to continue to receive unemployment benefits?

Be prepared to meet weekly eligibility qualifications. In order to continue to receive unemployment insurance, you will need to complete several tasks each week. If you are unable or unwilling to conduct an ongoing job search and file a weekly claim, you will not be able to collect your benefits.

How long does a VEC claim last?

Once your claim is established, the amount you qualify for will remain the same for one year. It is available to you until you have reached your maximum benefit amount or the benefit year comes to an end.

How long does it take to collect unemployment?

The more that you made at your previous job, the more you will collect in unemployment insurance. You will collect these benefits over a period of 12 and 26 weeks depending on your circumstances.

How long does it take to get VA debit card?

If you choose a VA Debit Card, it may take a few weeks after filing your claim before the card arrives in the mail. You can expect your first payment within 14 days of filing your initial claim. It takes 2 business days for your funds to be deposited into your account after your weekly claim is processed.

When will the state use your 2 highest earnings quarters?

For example, if you file your claim in September of 2018, the state will use your 2 highest earnings quarters from April 1, 2017 through March 31, 2018 to determine your eligibility. The amount of money you made while you were employed will affect how much unemployment insurance you can collect and for how long.

When does the weekly request for unemployment end?

You must meet the weekly eligibility requirements listed below. Your benefit week begins on Sunday and ends at midnight on Saturday. You cannot claim the week until it is completely over.

What is the regular base period for unemployment?

The regular base period consists of the first four of the last five completed calendar quarters prior to the effective date of your claim. If you feel the wages shown on the determination are incorrect, call 1-866-832-2363 (Available 8:15am to 4:30pm, Monday - Friday and 9am to 1pm Saturday.

What happens if you work less than your weekly income?

If you work and your gross income for the week is less than your weekly benefit amount, that gross amount less $50 will be deducted from your weekly benefit amount. If your gross earnings equal or exceed your weekly benefit amount, you will not receive benefits for that week.

How long do you have to file a weekly claim?

To avoid denial of benefits, you must file your first weekly claim within 28 days of the date you filed your initial/new claim. For example, if you filed your claim on January 2, your first weekly claim must be filed by January 30. Subsequent weekly claims for benefits must be filed within 28 days of the Saturday date of the week claimed. For example, if your last week claimed ended on Saturday, February 4, then your subsequent weekly claim must be filed no later than March 4. The Voice Response System and the Internet will not allow you to claim benefits for weeks that are more than 28 days old.

How long does unemployment last?

If you qualify monetarily, your claim remains in effect for one year. This period is called a benefit year.

Can you collect unemployment if you are separated?

Even though you may have enough earnings to qualify, there are circumstances that may prevent you from receiving unemployment benefits. If you are separated for any reason other than lack of work, it will be necessary to gather facts from you and your employer concerning your separation.

Can you be disqualified from a job without cause?

You will be disqualified if the deputy determines that you quit your job without good cause, or you were fired from your job for misconduct in connection with your work. You and your employer have the right to appeal the deputy’s determination if either of you disagrees with the results.

How is unemployment calculated in Virginia?

Decide how you want to be paid. In Virginia, you can receive benefits either by direct deposit or through a debit card .

How much is unemployment in Virginia?

Weekly unemployment benefits in Virginia range from $60 to $378 per week and are based on your wages. The more you made, the higher the payout. Benefits are paid between 12 and 26 weeks, depending on your situation.

How long does it take to file unemployment in Virginia?

Within 5 days of filing for unemployment insurance benefits, you must register for work through the Virginia Workforce Connection website or in person at any VEC workforce center. To avoid denial of benefits, you must file your first weekly claim within 28 days of the date you filed your initial/new claim.

How long does unemployment last?

Benefit payments last one year from the effective date of your claim, or until the benefits exhaust, whichever comes first.

What are the requirements to get unemployment in Virginia?

Before you apply, make sure you meet all benefit requirements. Virginia has three primary requirements: (1) Monetary eligibility, (2) Separation qualification, and (3) Weekly eligibility. If you meet all requirements, then you can apply for unemployment insurance.

How long does a claim stay in effect?

If you qualify monetarily, your claim remains in effect for one year.

When does the claim week end?

Remember that the claim week does not end until after midnight on Saturday of the week being claimed and will not be available to you to file until after that time.

How Do I Get Virginia Unemployment Benefits?

You can apply for Virginia unemployment benefits through the VEC's online portal or by calling 1-886-832-2363 on weekdays between 8:15 a.m. and 4:30 p.m. You will be required to submit the following information:

How Do the Virginia Unemployment Benefits Eligibility Criteria Work?

Applicants must satisfy the VEC's monetary and non-monetary eligibility criteria to receive Virginia unemployment benefits. You are also responsible for meeting the weekly criteria to continue receiving benefits once your claim is approved.

How Much Will I Get and for How Long?

You will not be paid during the first week following your initial claim, a period known as the waiting week. This week gives your previous employers time to object to your benefits application.

What If I'm Denied Virginia Unemployment Benefits?

The most likely reason for being denied Virginia unemployment benefits is not satisfying the eligibility criteria. However, you have the right to appeal if you believe the decision was incorrect.

How long can you get unemployment benefits?

The most you can receive per week is currently $378; the least you can receive is $60. You may receive benefits for a maximum of 26 weeks. (In times of very high unemployment, federal and state programs may make additional weeks of benefits available.)

How long do you have to appeal unemployment?

If your unemployment claim is denied, you have 30 days to appeal the decision to the VEC. A hearing will be held on your appeal, at which you may testify, present witnesses, and offer evidence before the Appeals Examiner makes a decision.

When will PUA benefits be available?

ARP makes PUA benefits available through Labor Day 2021, and increases the maximum duration of these benefits from 50 to 79 weeks.

Is unemployment the same in Virginia?

The basic structure of the unemployment system is the same from state to state. However, each state sets its own rules for eligibility, benefit amounts, filing procedures, and more. This article explains how unemployment benefits work in Virginia.

Can you collect unemployment if you were fired?

If you were fired because you lacked the skills to perform the job or simply weren't a good fit, you won't necessarily be barred from receiving benefits. If, however, you were fired for misconduct, you may be disqual ified from receiving benefits .

What is the VEC in Virginia?

Legal Aid groups and pro bono partners charge the Virginia Employment Commission (VEC) with violating the rights of Virginians who have been cut off benefits without process, or who face long delays in getting hearings to seek desperately needed benefits.

Who is entitled to a prompt response from the VEC?

But every Virginian who files a claim for benefits is entitled—by law —to a prompt response from the VEC. And everyone who has begun to receive benefits is entitled—by law—to continue receiving benefits until a VEC deputy decides otherwise. “Litigation was not our first choice.

What is the VEC lawsuit?

The litigation challenges two common VEC failures regarding processing and adjudication of applications (“Initial Claims”) and the abrupt cut-off of benefits the VEC initially approved (“Continued Claims”)—both of which violate federal and state unemployment laws, as well as the due process guarantees of the 14 th Amendment to the U.S. Constitution:

Is the VEC still withholding benefits?

The VEC was apparently unaware that it was illegal to cut off benefits in that way until last fall, when a group of legal aid advocates brought it to the agency’s attention. While many people who had faced continued claims cut-offs saw their benefits resume, the VEC is still withholding benefits due to many people.

Filing Your Initial Claim

- You can file either online or by telephone for your initial claim (to file online, please select below to get started) 1. English 2. Spanish To file by using the telephone, please call 1-866-832-2363. Call volume in our contact centers is exceedingly high. If you experience delays, please use the online portal to file your initial claim for UI bene...

Continuing/Weekly Claims

- It is your responsibility to file your weekly continued claim on time, each week, while you are receiving benefits. Please understand, filing your weekly claim is different than the initial claim. You will use the online portal to file the weekly claim or call the interactive voice response number. 1. File Your Weekly Continued Claim by Internet 1.1. English 1.2. Spanish 2. File Your W…

Contact Information Changes

- If your contact information changes at any time, it is your responsibility to notify us immediately at: 1-866-832-2363 or complete the name/address change form: Instructions | Form.

Text Telephone Relay/Tty Callers

- For TTY Callers: Virginia Relay, Call 711 Virginia Relay enables people who are deaf, hard of hearing, deaf/blind, or speech disabled to communicate by TTY (text telephone).

Important Information Regarding Your Claim

Special Circumstance Information and Forms

- These forms are to be used only after being directed to do so by a VEC representative. 1. VEC B-14 - Physician's Certificate of Health/Request for Medical Information To be used when your medical condition was a factor in your separation from your employer. 2. VEC B-14A - Medical Professional Certificate of Health To be used when your medical condition affects your weekly a…

Other Resources