How do I file for unemployment benefits in Kentucky?

- Collect your information

- Create an account. With an online Kentucky unemployment insurance account, you’ll be able to file your claim, submit weekly claims, and keep track of general benefit account information.

- File a claim. Once you’ve created your account, you’re ready to file your claim. ...

- Complete your eligibility review. Your Kentucky unemployment eligibility is based on a variety of factors. ...

- Set up your payment options. Through the online system, you’ll also decide how you want to receive your Kentucky unemployment compensation payments.

How much is KY unemployment benefits?

To meet Kentucky unemployment requirements, you must meet the following requirements:

- Have earned a minimum of $750 in at least one quarter of your base period

- Have earned a minimum of $750 total outside the base period quarter when you earned the most

- Have earned at least 1.5 times your wages in the highest paid quarter of your base period

Will KY extend unemployment benefits?

When it comes to receiving an unemployment compensation extension, the state of Kentucky often focuses more on the current job environment than on its unemployment applicants. In many situations, applicants who are eligible to receive an unemployment benefit extension will automatically roll over into that extension if one is available.

What are the qualifications for unemployment benefits in Kentucky?

- You must be able to work throughout the benefit period. ...

- You must be available to work at all times. ...

- You must be looking actively for employment opportunities throughout the benefit period

- You must not reject any job opportunities offered to you at any point during the benefit period

How do you file for unemployment benefits in Kentucky?

Unemployment Insurance Services

- File or access your unemployment insurance claim

- Request your bi-weekly benefits online

- Request your bi-weekly benefits by calling the voice response unit at 877-369-5984.

- Access your eligibility review

- Direct deposit - set up or make changes

How do I know if my ky unemployment claim was approved?

Claim your weeks or check your payment by telephone at 1-877-3my-kyui or 1-877-369-5984. By using Voice Response Unit (VRU) and a touchtone phone, you may claim your weeks or request the status of your last week claimed.

How do I request my unemployment payment in ky?

You may call our Unemployment Insurance Assistance Line at 502-875-0442 (for claim filing) and 502- 564-2900 (for general information and assistance). To request a payment through continued claims, you may call 1-877-369-5984 or go online. You may also file your initial claim at kcc.ky.gov.

How do I know if my unemployment claim was approved?

Once your application has been approved, the Department of Labor will send a “Monetary Determination” with information on your weekly benefit amount. After making your claim, it will take between two to three weeks to receive it. Delays may be caused if the state needs additional information before sending payment.

Will I get back pay for unemployment ky?

Eligible Claimants should continue to certify for benefits for weeks they are owed unemployment. Any weeks of unemployment that occurred before these programs expire can still be paid retroactively if a claimant is later determined to be eligible for those weeks of benefits.

How long does it take to get your first unemployment check in ky?

The waiting week will always be your first payable week on your initial claim. You will request benefits for two weeks. If you are otherwise eligible, the amount of your first benefit payment will be for one week. Your maximum benefit amount will not change.

Does Kentucky unemployment pay weekly or biweekly?

The KEWES Internet claims system is accessible 24 hours a day, 7 days a week for claims filing. To request your bi-weekly benefit check on-line, the system is available Monday through Friday from 7:00 a.m. until 7:00 p.m. and Sunday from 2:00 p.m. until 9:00 p.m. Eastern Time.

How long does unemployment take to get approved?

It takes at least three weeks to process a claim for unemployment benefits and issue payment to most eligible workers.

What do I do if I haven't received my unemployment?

6 things to do about the late paymentContact your state unemployment office. ... Submit any new forms of identification or documentation. ... Update your payment profile. ... Work with any lenders or companies you regularly pay a bill to. ... If you're denied, apply again. ... Be patient — and contact your state representatives.

How long does it take to get your unemployment debit card in the mail?

When will I receive my debit card? The debit card is mailed to you when your first benefit payment is authorized by the EDD. Allow 7 to 10 business days for delivery. Subsequent payments are issued to the debit card when you submit a certification and you are determined eligible for payment.

Are they extending unemployment?

About the PEUC Extension Pandemic Emergency Unemployment Compensation (PEUC) provided up to 53 additional weeks of payments if you've used all of your available unemployment benefits. The first 13 weeks were available from March 29, 2020 to September 4, 2021.

How much unemployment will I get in KY?

If you are eligible to receive unemployment, your weekly benefit rate in Kentucky will be 1.1923% of your total wages during the base period. You will receive a maximum of $522 each week; the minimum amount is $39 (in 2021). You may receive benefits for a maximum of 26 weeks.

How long does Pua take to be approved?

Usually, it will take about a week after you certify before you receive your first benefit payment. With the large amount of claims we are processing, there may be delays. If you are eligible, you may get your first PUA payment in about two days if you already have a Debit Card from the EDD.

What time do you call for unemployment in Kentucky?

Sunday from 10 a.m. - 9 p.m. EST. You may also call toll-free 800-648-6057 for telecommunications relay service. IMPORTANT NOTE: Please be aware of fake unemployment filing websites designed to steal your personal information or charge you a fee. Make sure you are on a “.ky.gov” website when filing a Kentucky unemployment insurance claim.

How to request biweekly unemployment benefits?

Request your bi-weekly benefits by calling the voice response unit at 877-369-5984. Only claimants who are exempt from the work search requirements (those who have a definite recall date within 12 weeks of the initial claim filing, are in an approved training program, Eclaims, etc.) may choose to request benefits by phone.

What time does the unemployment office open?

Website: Monday - Friday from 7 a.m. - 7 p.m., EST. Sunday from 10 a.m. - 9 p.m. EST. You may also call toll-free 800-648-6057 for telecommunications relay service. IMPORTANT NOTE: Please be aware of fake unemployment filing websites designed to steal your personal information or charge you a fee.

How many times do you have to answer the same questions on a claim?

It will talk you through the step-by-step process. In most cases, you will get three attempts to enter the correct information. If you are claiming two weeks, the system will take you through the same set of questions twice; once for the first week and again for the second week.

Can you call back a week on a claim?

One phone call certifies both weeks you are claiming. Do not call the system back to claim your weeks again, unless there was a system problem and you were advised by the computer to call back later.

What is the taxable wage base for Kentucky in 2021?

2021 Taxable Wage Base Base per worker will remain at $10,800 per worker. Kentucky employers are eligible to claim the full FUTA credit of 5.40% when filing your 2020 IRS 940 forms in January 2021. This will reduce your FUTA contribution rate to 0.60% (6.00% - 5.40%). The FUTA taxable wage base remains at $7,000 per worker.

When will Kentucky take the FUTA credit?

Kentucky employers are eligible to claim the full FUTA credit of 5.40% when filing your 2019 IRS 940 Forms in January 2020. This will reduce your FUTA contribution rate to 0.60% (6.00% - 5.40%).

What is SCUF in KRS?

Per KRS 341.243, all contribution rates beginning with the 3rd quarter of 2018 shall be reduced by 0.075%, in order to implement SCUF. There is no increase or decrease in the total amount of tax you will pay. This reduction will divert 0.075% of the contributions that would have been applied to your employer reserve account, and apply to SCUF. In addition, you will not be able to claim SCUF payments on your Federal Unemployment Tax filings. Below is an example of how your 2018 reporting periods will change:

When will nonprofits get 50% unemployment?

During the 2nd, 3rd, and 4th quarters of 2020, all eligible nonprofit reimbursing employers will only be billed for 50% of the unemployment benefits charged to their account, with the remaining 50% paid with federal funds from the Protecting Nonprofits Act signed by the President on August 3, 2020.

Is there a contribution to unemployment in 2020?

Contributory Employers - The Office of Unemployment Insurance has elected not to charge Contributory Employer Reserve Accounts for any unemployment benefits paid out during the 2nd, 3rd and 4th quarters of 2020. This determination was made after consulting state and federal guidance from this unprecedented time, in order to keep employer rates as low as possible for 2021.

How to get biweekly unemployment benefits?

Request your bi-weekly benefits online. Request your bi-weekly benefits by calling the Voice Response Unit at 877-369-5984. Complete your eligibility review. Direct deposit - setup or make changes.

How long does it take to appeal unemployment benefits?

If your benefits are denied and you wish to contest it you can file an appeal in writing. Your letter of appeal must be postmarked within 15 days of the mail date of your denial. Full details are available here .

What is the Kentucky Career Center?

The Kentucky Career Center can help. We offer a long list of services aimed at moving your career to the next level.

Is unemployment insurance taxable in Kentucky?

Unemployment insurance and your taxes. Unemployment insurance benefits are considered taxable income by the Internal Revenue Service and the Kentucky Department of Revenue. You may choose to have 10% of your benefits withheld for federal taxes and/or 4% for Kentucky state taxes. (Just remember, you can only change this withholding once ...

Can everyone get unemployment insurance?

Not everyone who applies for unemployment insurance is approved. Possible reasons for denial could include some common reasons below and require an investigation:

Who Is Eligible for Unemployment Insurance Benefits in Kentucky?

To receive Kentucky unemployment benefits, you'll need to meet various monetary and non-monetary eligibility criteria.

How Much Will I Receive in Kentucky Unemployment Benefits and for How Long?

Kentucky pays successful benefits claimants between $39 and $569 per week, and the exact amount awarded is calculated based on earnings during the base period. Your wages for the base period quarter when you earned the most will be divided by 26 and then rounded down to the nearest dollar to produce your weekly benefit rate.

What Can Disqualify You From Receiving Unemployment Benefits in Kentucky?

Your claim for Kentucky unemployment benefits may be denied if you don't meet the state's eligibility criteria. If you didn't earn enough during your base period, you wouldn't usually qualify for unemployment benefits apart from in exceptional circumstances.

How to stay eligible for unemployment in Kentucky?

To remain eligible and keep receiving your benefits, you must actively search for work and report this activity in your Kentucky unemployment weekly claim. The first step is registered for Focus Career on the Kentucky unemployment website .

How to find out if unemployment is changing in Kentucky?

However, you can also access the OETs claims system to view the status of your claim, including your pending payments and the balance of your claim. You can find out by Internet or phone system.

Why is the unemployment website closed in Kentucky?

FRANKFORT, Ky – Kentuckys unemployment website will close temporarily beginning Thursday night due to a massive, sophisticated cyberattack on the UI system.

How long does unemployment last in Kentucky?

Kentucky unemployment benefits are paid for a maximum of 26 weeks, though a Kentucky unemployment extension may be put in place to increase this limit during times of high unemployment.

What information do you need to file a claim?

When you file a claim, you will be asked for certain information, such as addresses and dates of your former employment. To make sure your claim is not delayed, be sure to give complete and correct information.

Where to register for unemployment in Kentucky?

Log on to uiclaimsportal.ky.gov or visit the unemployment homepage, kcc.ky.gov, to start the registration process.

Is unemployment based on need in Kentucky?

As in other states, eligibility for State of Kentucky unemployment insurance benefits is not based on need. That being said, there are many other eligibility requirements that must be met in order to receive benefits:

When does the Kentucky unemployment benefit expire?

ARP increases the maximum duration of PEUC benefits from 24 to 53 weeks, with an expiry date of September 4, 2021. For up-to-date information on Kentucky's rules on unemployment eligibility and amounts during the COVID-19 pandemic, visit the state's Unemployment Insurance page.

How much do you have to earn to qualify for unemployment in Kentucky?

To qualify for benefits in Kentucky, you must meet all four of the following requirements: You must have earned at least $750 in one quarter of the base period. You must have earned at least $750 outside of your highest paid quarter of the base period (that is, in the other three quarters).

What are the eligibility requirements for unemployment in Kentucky?

You must meet the following three eligibility requirements to collect unemployment benefits: You must have earned at least a minimum amount in wages before you were unemployed.

How to keep collecting unemployment benefits?

To keep collecting unemployment benefits, you must be able to work, available to work, and looking for employment. (For more information, see Nolo's article, Collecting Unemployment: Are You Able, Available, and Actively Seeking Work?) If you're offered a suitable position, you must accept it.

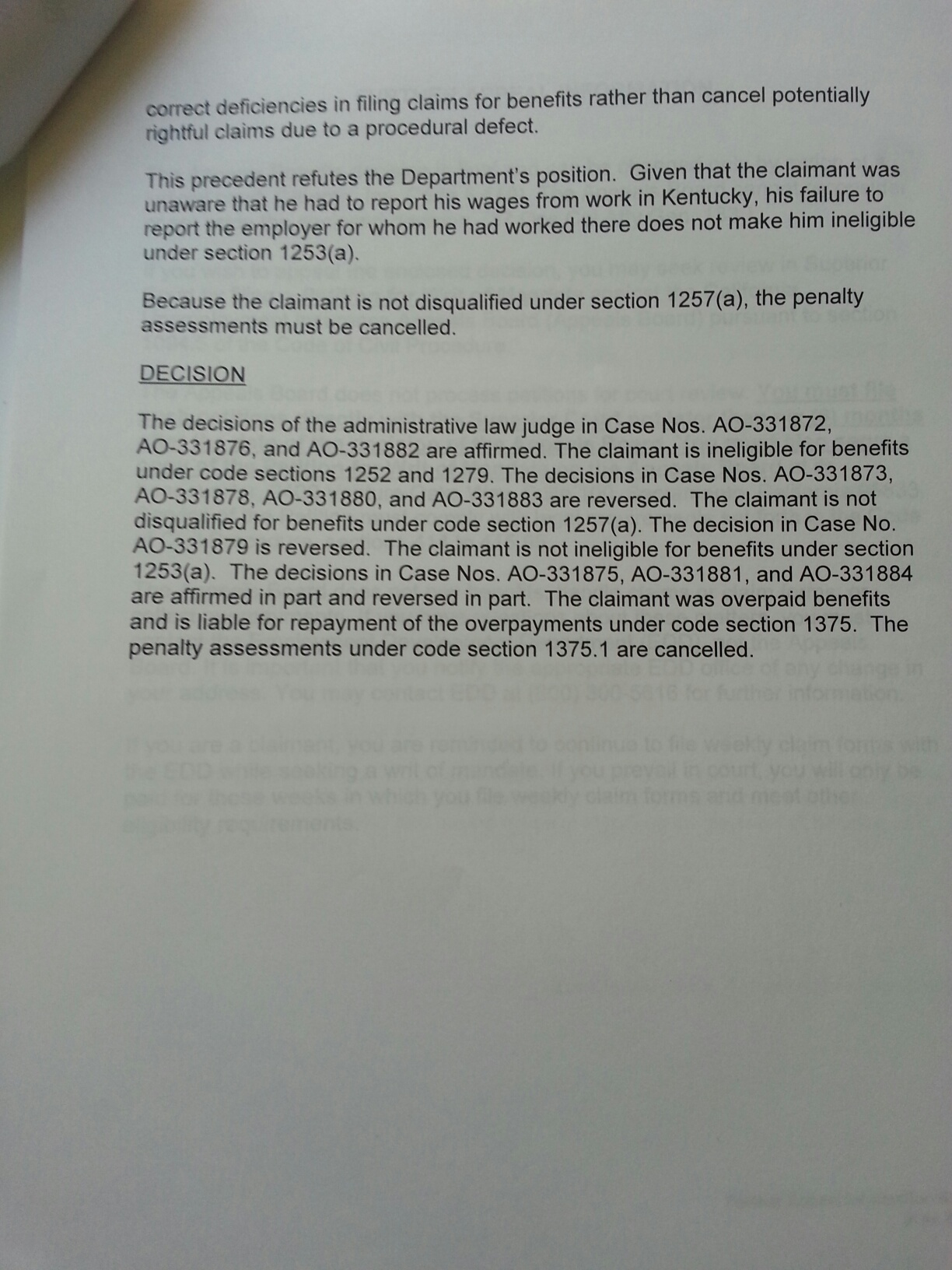

How long does it take to appeal unemployment?

If your unemployment claim is denied, you have 15 days to appeal the decision to a referee. A hearing will be held on your appeal, typically by phone. If you are unhappy with the referee's decision, you may file an appeal with the Unemployment Insurance Commission within 15 days. If you are still dissatisfied, you may file an appeal in court within 20 days.

How much do you have to earn to qualify for the base period?

In the entire base period, you must have earned at least 1.5 times your wages in the highest paid quarter of the base period.

Can you collect unemployment if you were fired?

If you were fired because you lacked the skills to perform the job or simply weren't a good fit, you won't necessarily be barred from receiving benefits. If, however, you were fired for good cause, you may be disqualified from receiving benefits.