How do you calculate unemployment benefits in NY?

You will receive your unemployment benefits one week after filing the claim.

- Your Social Security Number

- The year you were born in

- Your home address and telephone number

- Whether you have filed an unemployment insurance claim in your state or any other state during the past 12 months

- Your last day of employment

- The names and addresses of all the employers you have worked for during the past 15 months before you file your claim. ...

How to check status of unemployment claim NY?

- Federal

- New York State

- Local

Why is my unemployment claim still pending NY?

- People who forget to action official unemployment agency requests or alerts. ...

- Waiting on identity verification approvals. ...

- End of Benefit Year (BYE date) With many folks getting unemployment for over 12 months, they would have passed their benefit year end mark and would normally need to file ...

- Missing documentation. ...

- Work Search Requirements. ...

How do you sign up for unemployment benefits in NY?

To apply for benefits, you'll need to provide your:

- Social Security number

- Driver's license or Motor Vehicle ID card number

- Complete mailing address

- Phone number

- Alien Registration card number if you're not a U.S. citizen

- Employment details from the past 18 months

- Copies of forms SF8 and SF50 if you were a federal employee

- Most recent separation form (DD 214) for military service

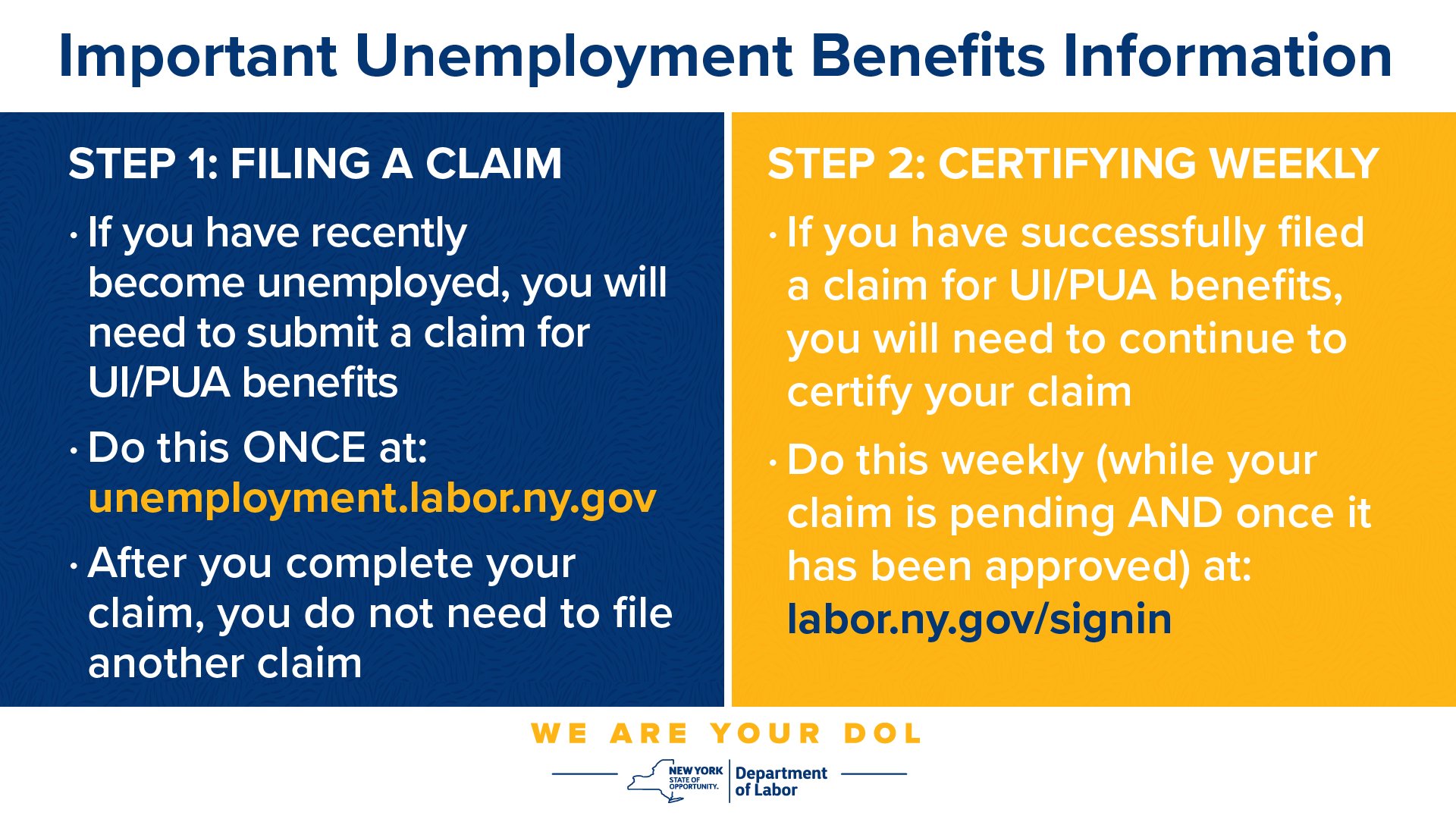

How do I claim my weekly unemployment benefits in NY?

If you miss claiming benefits for a week during which you were unemployed, you can request credit for this week by secure message, fax or regular mail. Do not call the Telephone Claims Center to request back credit for a week.

When can I file a new claim for unemployment NY?

When should I file a claim? File your claim during your first week of total or partial unemployment. If you wait, you may lose benefits. You may not file for a week when you work more than 30 hours or earn more than $504 gross pay between Monday and Sunday.

How long does it take to receive NY unemployment benefits?

It takes three to six weeks from the time you file your claim to when you receive your first payment, because we have to review and process your application for benefits. You will not receive benefits during this time period.

How do I get New York State unemployment Covid 19 benefits?

File online 7 days a week from 7:30 a.m. to 7:30 p.m. or call 888-209-8124 Monday-Friday, 8:00 a.m. to 7:30 p.m. Any claim you file will be backdated to the date you became unemployed. If you are eligible, you will be paid for all benefits due.

Will I get back pay for unemployment NY?

Missing Payments – If you are entitled to UI benefits, all benefits will be backdated to the day you were out of work. Pending Claims: If you recently filed a new claim and everything is in order, you should generally receive your first payment about 2-4 weeks after you apply for benefits.

What is the maximum unemployment benefit in NY for 2021?

The New York State Department of Labor (NYSDOL) determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 26, up to a maximum of $504 per week.

How do I know if my NY unemployment claim was approved?

Once your application has been approved, the Department of Labor will send a “Monetary Determination” with information on your weekly benefit amount. After making your claim, it will take between two to three weeks to receive it. Delays may be caused if the state needs additional information before sending payment.

How do you know if you are approved for unemployment?

You can check your claim status online at Unemployment Benefits Services or call Tele-Serv at 800-558-8321. We use information from you and your last employer to determine if you qualify. TWC sends your last employer a letter with the reason you gave for no longer working there.

What can disqualify you from unemployment benefits in NY?

For What Reasons Can You Be Denied Unemployment?Failing to Meet the Earnings Requirements. To qualify for benefits in New York (as in most states), you must have earned a minimum amount in wages during a 12-month stretch called the "base period."Getting Fired for Misconduct. ... Quitting Your Last Job.

Is pandemic unemployment still available?

The COVID-19 Pandemic Unemployment Payment (PUP) was a social welfare payment for employees and self-employed people who lost all their employment due to the COVID-19 public health emergency. The PUP scheme is closed.

Is NYS getting $300 unemployment?

Pandemic Unemployment Compensation: Additional payments of $600 per week for benefit weeks ending 4/5/2020 to 7/26/2020 and $300 per week for the benefit weeks ending 1/3/2021 to 9/5/2021 while unemployed.

Will pandemic unemployment be extended in NY?

Under the CARES Act, states can extend federal unemployment benefit programs, but that won't happen in New York State. BUFFALO, N.Y. — New York State will not extend federal pandemic unemployment programs that expired over Labor Day weekend. Gov.

How to certify for PUA benefits in New York?

Certify For Weekly Benefits by Phone. The Telephone Claim Center is available toll-free during business hours to certify: 1-888-581-5812 for New York State residents. PLEASE NOTE: If you are receiving PUA benefits and you want to certify by phone, you should call a different number.

How to prevent delays in unemployment payments?

Check your mail and email, and respond to any questionnaires, online forms, or phone calls from the Department of Labor right away to prevent delays in your payments.

What to expect after you certify in New York?

What to Do & Expect After You Certify. Following the expiration of New York State’s COVID-19 State of Emergency, the Unemployment Insurance unpaid waiting period rule is once again in effect. New Unemployment Insurance claims filed on and after June 28, 2021 will include an unpaid waiting week. Claimants will not receive payment for ...

What is asked each week when you are certifying benefits?

Each week you are certifying benefits you will be asked if you are ready, willing and able to work, and have been actively looking for work.

How long does it take to get a hearing on unemployment?

If you are found ineligible, you will receive a determination explaining the reason. If you disagree, you may request a hearing within 30 days from the date of the determination. For more information go to the Unemployment Insurance Appeal Board website. Next Section.

Do you have to claim weekly unemployment benefits?

Once you have filed a claim for benefits, you must also claim weekly benefits for each week you are unemployed and meet the eligibility requirements. This is also called “certifying for benefits.”.

When do you file a claim for the previous week?

You must file your claim for the previous week on the last day of that week (Sunday) through the following Saturday. This is called the claim window.

What is unemployment insurance?

Unemployment Insurance is temporary income for eligible workers who lose their jobs through no fault of their own. File your claim the first week that you lose your job.

When will the $600 unemployment be paid?

An additional $600/week until the week ending 7/26/2020. (The $600 would be paid the first week of your unemployment claim period but no earlier than 4/5/20). If you are not traditionally eligible for unemployment benefits (self-employed, independent contractors, farmers, workers with limited work history, and others) and are unable ...

How long will the $600 unemployment benefit last?

On March 27, 2020, a law was signed that provides additional Unemployment Insurance assistance to workers impacted by COVID-19. This means that you may qualify to receive: Up to 39 weeks of UI benefits. An additional $600/week until the week ending 7/26/2020.

What does waiting week mean on unemployment?

If you’ve seen the term ‘waiting week’ on your payment history, it is a relic of our existing system and does NOT impact your benefits. To collect regular unemployment insurance benefits, you must be ready, willing, and able to work.

What is the FEIN number on a W-2?

Employer Registration number or Federal Employer Identification Number (FEIN) of your most recent employer (FEIN is on your W-2 forms)

How long does it take to get a disability payment?

If you are eligible, your first payment will generally be made in two to three weeks from the time your claim is completed and processed. In some cases, we must get additional information before payment can be made and your first payment may take longer. We use this time to review and process your application for benefits. You will not receive benefits during this period. This is why you may see your claim status as “pending.”

What to do if your wages are wrong?

If the wages are wrong, or if any employers are missing, fill out and send to us the Request for Reconsideration form.

Get Unemployment Assistance

File a claim online to receive temporary income while you search for a job.

Certify for Weekly Unemployment Insurance Benefits

Certify for benefits for each week you remain unemployed, as soon as you receive notification to do so.

How to apply for unemployment benefits in New York?

How to apply for unemployment in New York. To apply for benefits, you must log in to the New York Department of Labor website. You can also apply by calling the Telephone Claims Center at (888) 209-8124 . New York is currently offering extended telephone filing hours: Monday–Thursday, 8:00 a.m. to 7:30 p.m. Friday, 8:00 a.m. to 6:00 p.m.

How many weeks can you draw unemployment in New York?

Normally you can draw 26 weeks of benefits in any given Benefit Year. Know how and when you will be paid.

What is the phone number for KeyBank unemployment?

Have a question about unemployment debit cards? Call KeyBank Customer Service at (866) 295-2955.

How long does it take to appeal an unemployment decision?

If you disagree with the results of the hearing, you can appeal the decision to the Unemployment Insurance Appeal Board. You must file that appeal within 20 days after the ALJ’s decision was mailed to you.

How many work search activities do you need to do to get unemployment in New York?

To maintain your claim, you must do at least three work search activities each week. The exception to this is if you have a Work Search Plan that has been approved by the New York unemployment department (the Department of Labor). Work search activities include:

What time do you call unemployment in New York?

Friday, 8:00 a.m. to 6:00 p.m. Saturday, 7:30 a.m. to 8:00 p.m.. When you file a claim, you will be prompted to set up a Personal Identification Number or PIN. You will use this pin when you call the New York unemployment number (the Telephone Claims Center) to claim your weekly benefits or to certify your benefits.

What is the Department of Labor in New York?

The New York Department of Labor is the state agency that oversees administering unemployment insurance claims for citizens. It provides monetary benefits, job training, job search and other related services for those people who are actively seeking work in New York and who have lost their jobs ...

When is the 4th quarter unemployment in New York?

4th Quarter: October 1 – December 31. 5th Quarter: January 1 – March 31. I applicants must meet three earning requirements and the below qualifications for unemployment in New York: Former employees must have worked and been paid wages in at least two calendar quarters by companies who have unemployment insurance.

What is the basic base period for unemployment?

The basic base period is the last first four of the last five completed calendar quarters before filling out an unemployment insurance application. If you meet the minimum wage criteria in the first four quarters, then the basic base period will be the only one used to calculate your unemployment benefit payments.

How does EDD work in New York?

In New York, the amount of unemployment benefits a former employee can receive is based on how much they earn during what is referred to as a base period or an alternative base period. Unemployed weekly benefits are calculated by dividing residents’ earnings from their highest paid quarter by 26, with $425 being the maximum amount of benefits per week. The NYSDOL also provides residents who meet the qualifications for unemployment with job search tools for new employment opportunities while receiving unemployment coverage.

How many quarters are there in unemployment?

One year of work consists of four calendar quarters. Base period dates depend on when you file a claim to receive unemployment insurance. The following is an example of how the base period quarters are divided within a year: 1 1st Quarter: January 1 – March 31 2 2nd Quarter: April 1 – June 30 3 3rd Quarter: July 1 – September 30 4 4th Quarter: October 1 – December 31 5 5th Quarter: January 1 – March 31

How much do you have to be paid in one quarter to be a past employee?

Past workers must have been paid at least $1,900 in one calendar quarter.

Does NYSDOL provide unemployment?

The NYSDOL also provides residents who meet the qualifications for unemployment with job search tools for new employment opportunities while receiving unemployment coverage. To obtain more information on unemployment insurance eligibility in New York, and to learn how to qualify for unemployment benefits, review the sections below: ...

Can you get unemployment if you quit your job in New York?

Other qualifying circumstances include being laid off due to objective business conditions. Residents, who were let go by their employers due to misconduct or criminal charges, will not meet eligibility for unemployment insurance. Also, if you quit your job voluntarily, you may be ineligible to receive unemployment coverage.