How to Perform a Cost Benefit Analysis

We’ll go through the five basic steps to performing a cost benefit analysis in the sections below, but first, here’s a high-level of overview:

- Establish a framework to outline the parameters of the analysis

- Identify costs and benefits so they can be categorized by type, and intent

- Calculate costs and benefits across the assumed life of a project or initiative

- Compare cost and benefits using aggregate information

- Analyze results and make an informed, final recommendation

- Step One: Brainstorm Costs and Benefits. ...

- Step Two: Assign a Monetary Value to the Costs. ...

- Step Three: Assign a Monetary Value to the Benefits. ...

- Step Four: Compare Costs and Benefits. ...

- Assumptions. ...

- Costs. ...

- Benefits. ...

- Flaws of Cost-Benefit Analysis.

How do you calculate cost benefit?

Benefit-Cost Ratio = ∑PV of all the Expected Benefits / ∑PV of all the Associated Costs Step 6: Now, the formula for net present value can be derived by deducting the sum of the present value of all the associated costs (step 4) from the sum of the present value of all the expected benefits (step 4) as shown below.

What are some examples of cost benefit analysis?

Examples of Cost-Benefit Analysis. An example of Cost-Benefit Analysis includes Cost-Benefit Ratio where suppose there are two projects where project one is incurring a total cost of $8,000 and earning total benefits of $ 12,000 whereas on the other hand project two is incurring costs of Rs. $11,000 and earning benefits of $ 20,000, therefore, by applying cost-benefit analysis the Cost-Benefit ...

How to calculate benefit cost?

- Up to 85% of your Social Security may be taxable.

- If your provisional income is above $25,000 as a single filer or $32,000 as a joint filer, you may owe federal income taxes.

- You can pay estimated taxes quarterly, through benefit withholdings, or in full with your federal tax return.

How to use pricing analytics to increase profits?

Iris Pricing Solutions Applies Analytics to:

- Optimize the Trade-Off Between Price, Volume and Profit

- Identify Quick Wins

- Develop High Impact Price Strategies

- Increase the Confidence of the Sales Force

What are the 5 steps of cost-benefit analysis?

The major steps in a cost-benefit analysisStep 1: Specify the set of options. ... Step 2: Decide whose costs and benefits count. ... Step 3: Identify the impacts and select measurement indicators. ... Step 4: Predict the impacts over the life of the proposed regulation. ... Step 5: Monetise (place dollar values on) impacts.More items...

How do you write a cost-benefit analysis report?

How to do a cost-benefit analysisStep 1: Understand the cost of maintaining the status quo. ... Step 2: Identify costs. ... Step 3: Identify benefits. ... Step 4: Assign a monetary value to the costs and benefits. ... Step 5: Create a timeline for expected costs and revenue. ... Step 6: Compare costs and benefits.

What does a cost-benefit analysis include?

A cost-benefit analysis (CBA) is the process used to measure the benefits of a decision or taking action minus the costs associated with taking that action. A CBA involves measurable financial metrics such as revenue earned or costs saved as a result of the decision to pursue a project.

How do you write a cost-benefit analysis template?

Cost Benefit Analysis Example, Template and its ComponentsStep 1: Analyze lists. ... Step 2: Put a financial value on the costs and benefits. ... Step 3: Equation and comparison. ... Basic project specification. ... Potential scenarios include the following. ... Determine the costs and benefits.

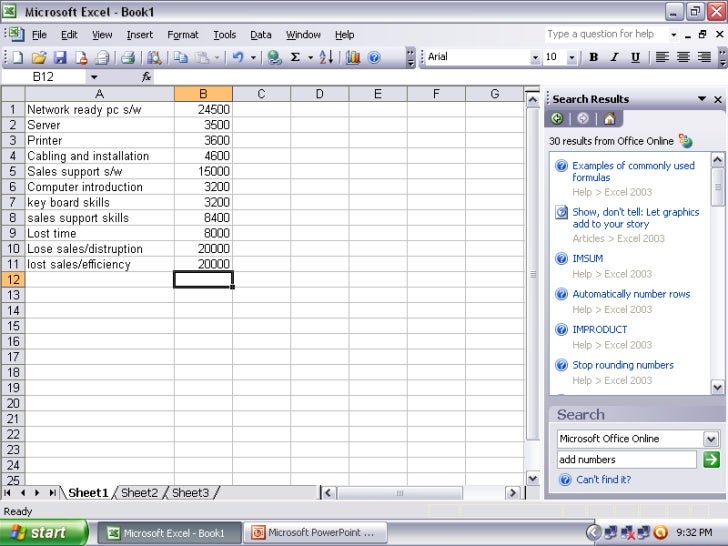

How do I do a cost-benefit analysis in Excel?

A typical cost benefit analysis involves these steps:Gather all the necessary data.Calculate costs. Fixed or one time costs. Variable costs.Calculate the benefits.Compare costs & benefits over a period of time.Decide which option is best for chosen time period.Optional: Provide what-if analysis.

Which is the first step of a cost-benefit analysis?

STEP 1: Determine whether or not the requirements in the rule are worth the cost it would take to enact those requirements. STEP 2: Make a list of one-time or ongoing costs (costs are based on market prices or research).

What are two main parts of a cost-benefit analysis?

the two parts of cost-benefit analysis is in the name. It is knowing the cost and measuring the benefit by that cost.

Which is the last step of a cost-benefit analysis?

Which is the last step of a cost-benefit analysis? Determine the costs of the decision.

What is CBA and CEA?

Cost-benefit analysis (CBA) and cost-effectiveness analysis (CEA) are formal analyt- ic techniques for comparing the positive and negative consequences of alternative uses of resources. Both CBA and CEA require the identification, quantification.

What is a cost analysis example?

What are cost benefit analysis examples? The output of cost benefit analysis will show the net benefit (benefits minus cost) of a project decision. For example: Build a new product will cost 100,000 with expected sales of 100,000 per unit (unit price = 2).

What is a real life example of cost-benefit analysis?

An example of Cost-Benefit Analysis includes Cost-Benefit Ratio where suppose there are two projects where project one is incurring a total cost of $8,000 and earning total benefits of $ 12,000 whereas on the other hand project two is incurring costs of Rs.

How is cost benefit ratio calculated?

The BCR is calculated by dividing the proposed total cash benefit of a project by the proposed total cash cost of the project.

What is cost benefit analysis?

A cost-benefit analysis is a procedure used by businesses to assess the value of undertaking a project or making an important decision. By looking at both what it costs to take a certain action, and the benefits that arise from it, a cost-benefit analysis empowers businesses to apply a data-driven approach to areas such as operations and growth, ...

What are the advantages and disadvantages of cost-benefit analysis?

The key advantages of a cost-benefit analysis are: Data-driven - It’s superior to “gut feel” decisions or “back of the envelope” calculations. Simplicity - It’s relatively simple to undertake. Adaptability - It can be adapted to a wide variety of business cases.

What is the benefit cost ratio?

Your benefit-cost ratio is then: Total monetary value of benefits / total monetary value of costs = Benefit-cost ratio. Any result greater than 1 indicates the benefits outweigh the costs, with a higher benefit-cost ratio indicating even greater benefits relative to the costs.

How to minimise risk of an inaccurate analysis?

To minimise your risk of an inaccurate analysis, conservatively increase the value of costs and decrease the value of benefits. Now, when you re-run the analysis, a resultant positive benefit-cost ratio (i.e. >1) indicates you can be confident this is a financially viable project or decision to undertake.

How to frame a decision?

Frame the decision to be made. Before considering the costs and benefits associated with a given project or decision, you need to appropriately frame the decision to be made (or the project to be undertaken).

Why is cost benefit analysis useful?

This makes it useful for higher-ups who want to evaluate their employees’ decision-making skills, or for organizations who seek to learn from their past decisions — right or wrong .

How is the cost and benefit tool used?

It’s made possible by placing a monetary value on both the costs and benefits of a decision. Some costs and benefits are easy to measure since they directly affect the business in a monetary way.

What is cost benefit ratio?

Cost benefit ratio is the ratio of the costs associated with a certain decision to the benefits associated with a certain decision. It’s more commonly known as benefit cost ratio, in which case the ratio is reversed (benefits to costs, instead of costs to benefits). Since both costs and benefits can be expressed in monetary terms, ...

Is cost benefit analysis a guiding tool?

In these cases, consider cost benefit analysis as a guiding tool, but look to other business analysis techniques to support your conclusion.

Can cost benefit ratios be numerically expressed?

Since both costs and benefits can be expressed in monetary terms, these ratios can also be expressed numerically. As a result, cost benefit or benefit cost ratios lend themselves well to comparison, which is why cost benefit analysis can be used to compare two or more definitions. The process is simple. For each decision or path in question, ...

What is cost benefit analysis?

A cost benefit analysis (also known as a benefit cost analysis) is a process by which organizations can analyze decisions, systems or projects, or determine a value for intangibles. The model is built by identifying the benefits of an action as well as the associated costs, and subtracting the costs from benefits.

Why do organizations use cost benefit analysis?

Organizations rely on cost benefit analysis to support decision making because it provides an agnostic, evidence-based view of the issue being evaluated—without the influences of opinion, politics, or bias. By providing an unclouded view of the consequences of a decision, cost benefit analysis is an invaluable tool in developing business strategy, ...

What are the risks and uncertainties of cost benefit analysis?

These risks and uncertainties can result from human agendas, inaccuracies around data utilized, and the use of heuristics to reach conclusions.

What is sensitivity analysis?

Kaplan recommends performing a sensitivity analysis (also known as a “what-if”) to predict outcomes and check accuracy in the face of a collection of variables. “Information on costs, benefits, and risks is rarely known with certainty, especially when one looks to the future,” Dr. Kaplan says. “This makes it essential that sensitivity analysis is carried out, testing the robustness of the CBA result to changes in some of the key numbers.”#N#EXAMPLE of Sensitivity Analysis#N#In trying to understand how customer traffic impacts sales in Bob’s Pie Shop, in which sales are a function of both price and volume of transactions, let’s look at some sales figures:

What is the difference between tangible and intangible costs?

Tangible costs are easy to measure and quantify, and are usually related to an identifiable source or asset, like payroll, rent, and purchasing tools. Intangible cost s are difficult to identify and measure, like shifts in customer satisfaction, and productivity levels.

What is direct cost?

Direct costs are often associated with production of a cost object (product, service, customer, project, or activity) Indirect costs are usually fixed in nature, and may come from overhead of a department or cost center.

Who developed the evaluation process?

Dupuit outlined the principles of his evaluation process in an article written in 1848, and the process was further refined and popularized in the late 1800s by British economist Alfred Marshall, author of the landmark text, Principles of Economics (1890).

Why do we need cost benefit analysis?

A cost-benefit analysis can help you determine where to efficiently spend your money for the best potential returns on your investment.

What is intangible cost?

Intangible costs. Ongoing or future costs. Any potential risks that may have a cost. Consider using a mind map to brainstorm the potential costs of each project and link them back to expected benefits.

How to calculate payback period?

To calculate the payback time, divide the projected total cost by the projected total revenues.

Do all costs and benefits need to be measured in the same unit?

All costs and benefits need to be measured in the same monetary unit. If you are doing a cost-benefit analysis for a global company, don’t try to separate the costs of a project into different denominations based on country or region.

How is cost benefit analysis used?

Cost-benefit analysis is useful in making decisions on whether to carry out a project or not. Decisions like whether to shift to a new office, which sales strategy to implement are taken by carrying out a cost-benefit analysis. Generally, it is used for carrying out long term decisions that have an impact over several years. This method can be used by organizations, government as well as individuals. Labor costs, other direct and indirect costs, social benefits, etc. are considered while carrying out a cost-benefit analysis. The costs and benefits need to be objectively defined to the extent possible.

Why is cost benefit analysis important?

Cost-benefit analysis is useful in making decisions on whether to carry out a project or not. Decisions like whether to shift to a new office, which sales strategy to implement are taken by carrying out a cost-benefit analysis.

How to calculate cost-benefit ratio?

For calculating the cost-benefit ratio, follow the given steps: Step 1: Calculate the future benefits. Step 2: Calculate the present and future costs. Step 3: Calculate the present value of future costs and benefits. Step 4: Calculate the benefit-cost ratio using the formula.

What is labor cost?

Labor costs. Labor Costs Cost of labor is the remuneration paid in the form of wages and salaries to the employees.

What are allowances in manufacturing?

The allowances are sub-divided broadly into two categories- direct labor involved in the manufacturing process and indirect labor pertaining to all other processes. read more. , other direct and indirect costs, social benefits, etc. are considered while carrying out a cost-benefit analysis.

Step One: Calculate All-Inclusive Cost

It is critical for managers to calculate an all-inclusive cost for project analysis. These costs include, but should not be limited to:

Step Two: Calculate Benefits

Similar to the cost calculation, it is critical to be all inclusive in your approach to project benefits. A solid cost benefit analysis with a positive material return provides a Return on Investment (ROI) period. Some types of benefits are harder to quantify than others.

Step Three: Incorporate Time to the Equation

Cash flow is king in today’s business world. The key is collecting the discrete cost and benefit numbers, then place it in a template, generally in a spreadsheet such as Microsoft Excel, and determine the net result on cash flow over time.

What is cost analysis?

Cost analysis is one of four types of economic evaluation (the other three being cost-benefit analysis, cost-effectiveness analysis, and cost-utility analysis). Conducting a cost analysis, as the name implies, focuses on the costs of implementing a program without regard to the ultimate outcome. A cost analysis is an important first step ...

How to keep cost analysis continuity?

If your organization has done cost analyses in the past, use the same or similar methods to categorize costs. Maintaining continuity in this way means the reports can be compared, making them more useful over time.

What is indirect cost?

Indirect costs include general administration or management salaries and benefits, facilities, equipment, and anything else shared across multiple programs or services. What you categorize as an indirect cost will depend on how you have separated the programs or services offered by your organization.

What is a narrower cost analysis?

On the other hand, a narrower or more specific purpose, such as determining whether to bill for a particular service (and how much), might require a narrower cost analysis that only addressed the costs of that particular service.

Is depreciation included in total costs?

If your organization's capital assets, including furniture, equipment, or fixtures, must be used to implement the program or provide the service you're evaluating, depreciation of those assets should be included in your total costs for the program or service. Calculating depreciation can be a complicated endeavor.

What Is A Cost-Benefit Analysis?

How to Conduct A Cost-Benefit Analysis

- 1. Establish a Framework for Your Analysis

For your analysis to be as accurate as possible, you must first establish the framework within which you’re conducting it. What, exactly, this framework looks like will depend on the specifics of your organization. Identify the goals and objectives you’re trying to address with the proposal. W… - 2. Identify Your Costs and Benefits

Your next step is to sit down and compile two separate lists: One of all of the projected costs, and the other of the expected benefits of the proposed project or action. When tallying costs, you’ll likely begin with direct costs, which include expenses directly related to the production or develo…

Pros and Cons of Cost-Benefit Analysis

- There are many positive reasons a business or organization might choose to leverage cost-benefit analysis as a part of their decision-making process. There are also several potential disadvantages and limitations that should be considered before relying entirely on a cost-benefit analysis.