How to correct an overfunded defined benefit plan

- Enhance Existing Pension Benefits. The company may use the surplus funds to maximize the current plan benefits without...

- Match 401 (k) Contributions. A company can (in some situations) use overfunding to match employee contributions to a 401...

- Include Family Members as Participants. For small, closely held companies...

- Amend the plan to increase benefits. In some situations, the company can amend the plan so that current benefits can absorb the surplus funds. ...

- Consider a strategic sale. ...

- Employ family members. ...

- Acquire life insurance. ...

- Keep the plan open with no funding.

How do defined benefit plans become underfunded?

These include:

- PBGC Variable Rate Premiums are imposed on plans with unfunded Vested benefits (see article on PBGC).

- Minimum Funding Requirements (412) prescribe a sound long-term funding strategy.

- Additional Funding Requirement are placed on large plans (more than 100 participants) that are less than 90% funded.

educator:UnderfundedDefinedBenefitPlans More items...

How to freeze a defined benefit plan?

- Separate Business Units. In some larger, multi-industry companies, a pension benefit may be competitive in one part of the business, but not in another part. ...

- Satisfy Collective Bargaining Commitments. ...

- Continue Pay Growth. ...

- Offer Choice. ...

- Delay Announcement. ...

What companies offer defined benefit pension plans?

Who has the best pension plan?

- The Typical 401 (k) Match. When an employer decides to offer a 401 (k) plan for its workers, there are different types of plans on the market to choose from. ...

- Generous Employer 401 (k) Matches. …

- Amgen.

- Boeing. …

- BOK Financial. …

- Farmers Insurance. …

- Ultimate Software.

What are the advantages of a defined benefit plan?

What Are the Advantages of a Defined Benefit Plan?

- Guaranteed Benefits. Unlike most other retirement schemes, a defined benefit plan allows you to determine exactly how much you’ll receive at retirement.

- Reduce Your Tax Liability. Introducing a defined benefit plan to your business can significantly reduce your tax liabilities. ...

- Spouses Can be Employees. ...

Why is overfunding an issue?

What is defined benefit plan?

What is the discount on an underfunded pension?

How long does it take to get a refund from a company for an excess contribution?

What is asset balance?

How long do you have to keep an IRA open?

Is 25% of QRP pre-tax?

See more

Can defined contribution plans be overfunded with excess?

In some cases, defined benefit plans can become overfunded in the hundreds of thousands or even millions of dollars. Regrettably, overfunding is of no use while in the plan (beyond the sense of security it may provide beneficiaries).

How often does a defined benefit plan need to be restated?

every six yearsEvery retirement plan is required to have a formal written document that spells out how it operates. Your Defined Benefit plan is modeled on a pre-approved prototype or volume submitter document that's part of a cycle that must be restated every six years.

Can I terminate defined benefit plan?

When defined benefit (DB) plan assets are sufficient to terminate, all the benefits plan participants have earned must be provided in full—a process known as final risk transfer. These benefits represent the amount owed to participants upon retirement or termination.

What is a surplus in relation to a defined benefit plan?

Surplus is the excess of the value of the assets of a pension fund over the value of the plan's liabilities under the pension plan as calculated in accordance with the Pension Benefits Standards Regulations, 1985. Surplus can only arise in the context of a defined benefit plan.

What is Cycle 3 restatement deadline?

July 31, 2022The IRS has announced that the Cycle 3 restatement window will begin on August 1, 2020 and have a final deadline of July 31, 2022.

Why is it called Cycle 3 restatement?

This restatement is being referred to as the “Cycle 3 restatement” because it is the third time defined contribution plans had to be restated. What types of retirement plans must be restated? Cycle 3 Restatements are required for profit-sharing plans, 401(k) plans, and money purchase plans.

How long does it take to terminate a defined benefit plan?

(See this site for PBGC guidance on the steps for terminating a defined benefit plan.) The PBGC has 60 days after receipt of a Form 500 to review the plan termination for compliance with applicable law.

What is a distress termination of a pension plan?

What is a distress termination? A plan that does not have enough money to pay all benefits owed participants and beneficiaries may be terminated only if the employer and the members of the employer's "controlled group" of affiliated companies each meets one of the distress termination tests.

Can I be fired after announcing my retirement?

Can You Be Fired After Announcing Retirement? The short answer is yes, you can be fired after announcing your plans to retire. Most U.S. workers are considered "employed at will," which means they can be terminated at any time, with or without cause.

When an entity has a surplus in a defined benefit plan it shall measure the net defined benefit asset at?

64 When an entity has a surplus in a defined benefit plan, it shall measure the net defined benefit asset at the lower of: the surplus in the defined benefit plan; and. the asset ceiling, determined using the discount rate specified in paragraph 83.

Do defined benefit pensions increase with inflation?

While many private sector defined benefit (DB) pensions increase in line with inflation, often this is subject to an annual cap, commonly set at 5%, XPS Pensions Group said. With inflation rising above the caps, pensions will lag behind.

What is the average defined benefit pension amount?

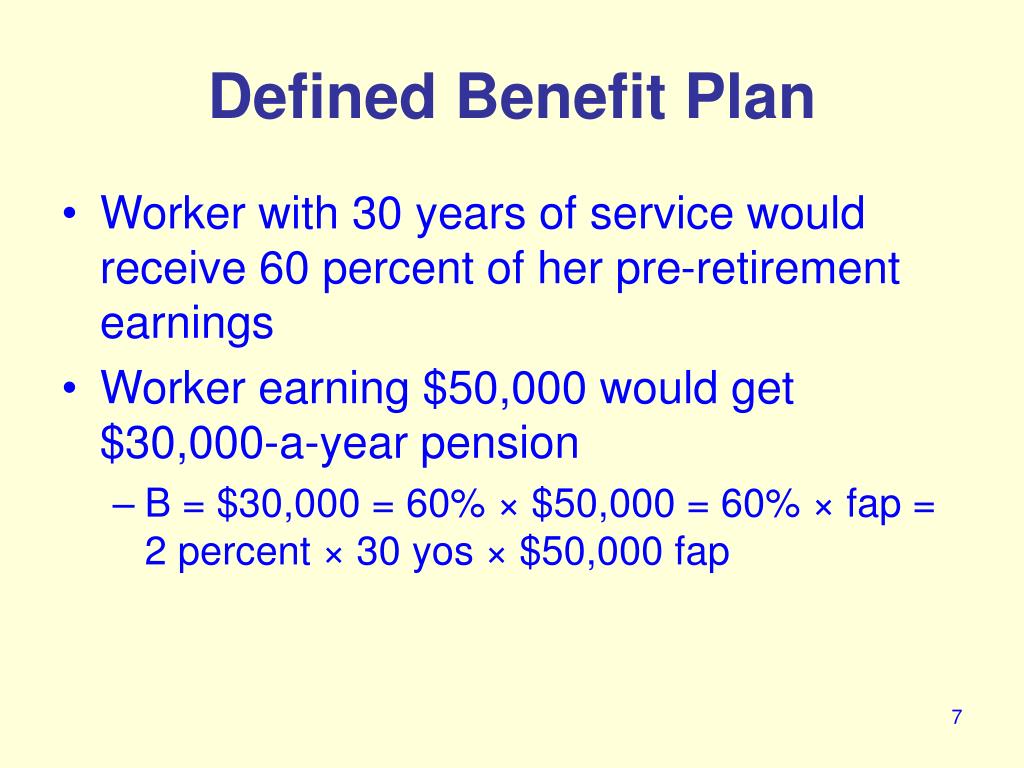

The average amount works out to $60,000. The defined benefit plan applies a pension factor of 1.5 percent. Multiply $60,000 times 1.5 percent and then multiply by the 30 years of service. The annual pension amount comes to $27,000.

Why is overfunding an issue?

The reason why overfunding can be an issue is mostly because at termination the overfunded amount is taxed to the company along with an excise tax. This issue is commonly called reversion.

What is defined benefit plan?

Funding for a defined benefit plan or cash balance is a constant juggling act. There are annual contributions that are mostly determined by the number of participants as well as compensation and age. The plan actuary will determine annual contribution levels.

What is the discount on an underfunded pension?

The company with the underfunded pension will usually pay a 20% to 25% discount on the overfunded amount. The transaction is structured as a stock purchase and the two plans are subsequently merged. The purchase price is generally taxes as long-term capital gains to the company with the overfunded plan.

How long does it take to get a refund from a company for an excess contribution?

The company can request this refund the trustee within one year after the date of the contribution.

What is asset balance?

The asset balance is driven mostly by contributions, but also reflects earnings on the investments, like dividends, interest, and capital gains. At the end of the day, fluctuations in investment performance and contributions can result in plan underfunding or overfunding.

How long do you have to keep an IRA open?

Many owners have their plan open for 5-10 years and then get to a point where they are looking to retire or maybe even work part-time. The thought process is that they can simply terminate the plan and just roll the assets over into an IRA.

Is 25% of QRP pre-tax?

The 25% asset transfer to the QRP remains a pre-tax allocation until distributed at retirement and taxed as ordinary income. The result of this approach is that 30% of the excess assets are returned to the company (after tax). If it is a small company, the business owner may get a large allocation in the QRP.

What happens when a defined benefit plan is overfunded?

When a defined benefit plan gets substantially overfunded, the best issue is to deal with it as soon as possible before it gets out of hand. So even though a strategic sale will reduce results in a discount on the over funding it can still be a home run in the right situation.

What happens when a plan is overfunded?

They typically involve one of the following: Increasing benefit accruals. The plan can possibly be amended to allow for more generous current benefits.

What is the excise tax on overfunded funds?

Any overfunded balance is subject to an excise tax of 50%. In addition, there will be income tax. This can run it as high as 90% in total. Not exactly a good thing! Besides the excise tax, time value of money needs to be considered.

Can you avoid overfunding a plan?

If substantial overfunding has occurred, there are huge penalties upon termination. But if you plan right, you can usually avoid them.

Can audit fees be paid out of a plan?

Paying operating expenses. Actuary fees and administrative costs like plan consulting, audit and advisory fees can normally be paid out of plan assets. This is often overlooked because in most situations these costs are paid by the company in order to get the tax deduction and to increase plan assets.

Can I set up a plan for 2020?

You can still set up a plan for 2020! Just set up and fund a plan for 2020 before you file your tax return. Overfunded cash balance plans and defined benefit plans happen more than you might think. In fact, we work extensively with clients to solve overfunding issues and avoid excise tax penalties.

What happens to an overfunded plan?

When an overfunded plan is ultimately terminated and liquidated, the company would pay an excise tax on the excess funds because the contributions were tax deductible. The overfunded balance is subject to the 50% excise tax. Unfortunately, this tax is non-deductible.

What is overfunded cash balance plan?

Overfunded cash balance plan. Also, funding levels are shown on the employer’s financial statements and plan financial statements. Loan covenants, certain types of insurance and other business relationships could be undermined in the event of a funding level that is too low. As a result, the plan sponsor may want to make contributions higher ...

Why use surplus funds?

The company may use the surplus funds to maximize the current plan benefits without significantly changing actuarial assumptions or benefit formulas. A certain amount or percentage of salary can be allocated to participants within the existing plan structure. This would enable the participants to receive larger benefits at retirement.

What happens if a plan sponsor contributes the minimum amount each year?

This can cause the minimum contribution to rise substantially each year. If the funding level falls below specified thresholds, the plan could be subject to benefit distribution restrictions.

Can you overfund life insurance?

Businesses can use overfunding to buy life insurance. There are certain limitations and specific rules when using life insurance in a plan. The first step is to amend the plan document to allow for the change.

Can a plan be overfunded?

As a result, changes in the market can cause a plan to be underfunded or overfunded. This is actually pretty common.

Can a closely held company add family members to a plan?

For small, closely held companies this can be a great option. The company can add family members as plan participants. Because the plan is overfunded, additional funds do not have to be contributed to the plan. The benefits will get allocated to family members and can avoid excise tax.

How to prevent overfunding?

The main method to prevent overfunding is by terminating the plan before it becomes overfunded and distributing benefits to plan participants. These distributions canbe rolled over into IRAs. Frequent comparison of the value of plan assets to plan benefits is advisable.

When did defined benefit retirement plans whose assets exceeded the present value of participant benefits terminated their plans?

History of the Problem. In the 1980s, several large companies with defined benefit retirement plans whose assets exceeded the present value of participant benefits terminated their plans and recaptured the excess amount as a plan reversion.

Some background

When most people set up a pension plan they don’t think much about overfunding issues. But when you consider volatility of the stock market and the flexibility of investment types, many people find that their plan is overfunded at some point down the road.

Paul Sundin, CPA

As a CPA, Paul has extensive experience with overfunded pension issues. Schedule a FREE call to discuss your overfunding issue and to review your options.

So how does the excise tax penalty work?

So let’s go back to the above example. The physician’s plan is overfunded by $400,000. What happens now?

What is reversion?

This issue is commonly referred to as reversion. But reversion aside, you need to also consider time value of money issues. If the plan continues to earn a return on investments, the reversion or overfunded portion will often become bigger.

So how does it work?

Upon the pension plan termination, any reversion of plan assets to the employer will be subject to an excise tax that is equal to 50 percent of the reversion amount, unless the employer either:

Paul Sundin, CPA

As a CPA, Paul has extensive experience with overfunded pension issues. Schedule a FREE call to discuss your overfunding issue and to review your options.

Excise penalty tax return

The tax is paid with Form 5330, Return of Excise Taxes Related to Employee Benefit Plans. At the rate determined under Code Section 6621, interest is charged on any tax not paid by the due date, even when an extension has been filed.

Possibilities to Consider if the Terminating Plan Document does not Permit a Reversion

A plan document may state that no part of the plan’s assets can be diverted for any purpose other than for the exclusive benefit of participants and beneficiaries. The plan may also indicate that the plan cannot be amended to designate any part of the assets to become the employer’s property.

Possibilities to Consider if the Terminating Plan Document Permits a Reversion

The overfunded pension plan may explicitly state that excess assets, once all of the plan’s obligations to participants and beneficiaries have been satisfied, may revert to the plan sponsor. On the other hand, the plan may not explicitly permit a reversion.

Why is overfunding an issue?

The reason why overfunding can be an issue is mostly because at termination the overfunded amount is taxed to the company along with an excise tax. This issue is commonly called reversion.

What is defined benefit plan?

Funding for a defined benefit plan or cash balance is a constant juggling act. There are annual contributions that are mostly determined by the number of participants as well as compensation and age. The plan actuary will determine annual contribution levels.

What is the discount on an underfunded pension?

The company with the underfunded pension will usually pay a 20% to 25% discount on the overfunded amount. The transaction is structured as a stock purchase and the two plans are subsequently merged. The purchase price is generally taxes as long-term capital gains to the company with the overfunded plan.

How long does it take to get a refund from a company for an excess contribution?

The company can request this refund the trustee within one year after the date of the contribution.

What is asset balance?

The asset balance is driven mostly by contributions, but also reflects earnings on the investments, like dividends, interest, and capital gains. At the end of the day, fluctuations in investment performance and contributions can result in plan underfunding or overfunding.

How long do you have to keep an IRA open?

Many owners have their plan open for 5-10 years and then get to a point where they are looking to retire or maybe even work part-time. The thought process is that they can simply terminate the plan and just roll the assets over into an IRA.

Is 25% of QRP pre-tax?

The 25% asset transfer to the QRP remains a pre-tax allocation until distributed at retirement and taxed as ordinary income. The result of this approach is that 30% of the excess assets are returned to the company (after tax). If it is a small company, the business owner may get a large allocation in the QRP.

Overview

Keep The Plan Open For Extended Time

- Many owners have their plan open for 5-10 years and then get to a point where they are looking to retire or maybe even work part-time. The thought process is that they can simply terminate the plan and just roll the assets over into an IRA. In theory this is correct. However, in some situations the plan is overfunded and they cannot close the planw...

Increase Plan Benefits

- Simply increasing the plan benefits can be an easy solution. A plan formula that was structured properly many years back to allow for a maximum benefit (415 limit) might no longer be applicable considering law changes, etc. You may be able to change the plan formula to increase benefits until the value of all benefits equals the value of assets. Another option is to increase th…

Increase Compensation For Current Employees

- There may be key employees that could receive a pay increase. If they are close to the social security cap it might not create a lot of overall added taxes. It might be possible to simply increase the compensation paid to the owner for a year or two. Even if the owner is already at the 415 limit, it is inflation adjusted each year. Just holding out another year could result in around …

Pay Plan Expenses from Assets

- Most business owners are so interested in the tax deductions that they pay plan expenses directly from the company. They don’t realize that the plan expenses can be paid out of plan assets. These expenses aren’t often much, but it still should be considered. Don’t forget the following costs: 1. financial audits 2. actuarial and TPA fees 3. bonding 4. consulting This may only be a s…

Proactive Review

- This is an easy one. Don’t let the issue get out of hand to start with. Actuaries, plan fiduciaries, financial advisors and many CPAs review plans and calculations on an annual basis. The actuary is certainly the first line of defense. But unfortunately, more often that not, the company and it’s actuaries fail to timely communicate. One simple solution is to have annual calls with all parties …

Review For Plan Errors and Non-Deductible Contributions

- Most plan documents will state that if a company makes an excessive contribution due to an error, the company can demand the excess be returned. The company can request this refund the trustee within one year after the date of the contribution. Another consideration is that plan documents typically provide that a contribution will be made on the condition that the company r…

Hire Additional Employees

- Another option is to ultimately bring more participants into the plan. The owner could consider hiring additional employees (including family members) who can accrue benefits. Many business owners have succession plans in place. If these family members can work in the business this could be a benefit to the owner. Make sure to also consider employing a spouse. Many spouses …

Roll The Plan Into A Qualified Retirement Plan

- If an employer establishes terminates a defined benefit plan and has another qualified plan, the excise tax is 20% compared to the standard 50% rate. The plan is called a qualified replacement plan(QRP). The QRP may be a 401(k) plan or a Profit Sharing Plan. The excess assets could be includes as matching or profit sharing allocations. The company can allocate 25% of the overfun…

Consider Life Insurance

- I know that life insurance does not work well for many business owners. In fact, some owners actually detest it. I understand. In most situations, I am not a big fan of insurance in a defined benefit plan or cash balance plan. But this is one situation where it can work well. When a new life insurance policy is funded, a large portion of the initial funding relates to the insurance compone…