How to Perform a Cost Benefit Analysis

We’ll go through the five basic steps to performing a cost benefit analysis in the sections below, but first, here’s a high-level of overview:

- Establish a framework to outline the parameters of the analysis

- Identify costs and benefits so they can be categorized by type, and intent

- Calculate costs and benefits across the assumed life of a project or initiative

- Compare cost and benefits using aggregate information

- Analyze results and make an informed, final recommendation

- Step 1: Understand the cost of maintaining the status quo. ...

- Step 2: Identify costs. ...

- Step 3: Identify benefits. ...

- Step 4: Assign a monetary value to the costs and benefits. ...

- Step 5: Create a timeline for expected costs and revenue. ...

- Step 6: Compare costs and benefits.

What is the last step of the cost benefit analysis?

Steps to Conduct a Coast-benefit analysis

- Compile List In the first step, we have to collect all the list of cost and benefit which associated with the action or decision. ...

- Give cost and benefit a monetary value. After gathering the lists of all costs and benefits then we have to give them the monetary value. ...

- Make the equation and compare.

What is the importance of a cost benefit analysis?

- To evaluate whether a capital investment is worth it.

- To decide whether to hire new employees.

- To determine whether a project or operating change is feasible.

- To develop a benchmark for comparing projects.

- To weigh up one marketing initiative against another.

- To appraise the desirability of a proposed policy.

What are always calculations of cost and benefit?

Cost Benefit Analysis Formula. The following equation can be used to calculate a cost-benefit analysis. Cost-Benefit = Sum of Present Value of Expected Benefits/ Sum of the present value of associated costs. It’s important to make note that this calculator uses the present value of the benefits in costs. This is to take into account their ...

How do you calculate cost benefit?

Benefit-Cost Ratio = ∑PV of all the Expected Benefits / ∑PV of all the Associated Costs Step 6: Now, the formula for net present value can be derived by deducting the sum of the present value of all the associated costs (step 4) from the sum of the present value of all the expected benefits (step 4) as shown below.

How is cost-benefit analysis calculated?

Explanation of Cost-Benefit Analysis Formula It is computed by dividing the present value of the project's expected benefits from the present value of the project's cost.

What are the 5 steps of cost-benefit analysis?

The major steps in a cost-benefit analysisStep 1: Specify the set of options. ... Step 2: Decide whose costs and benefits count. ... Step 3: Identify the impacts and select measurement indicators. ... Step 4: Predict the impacts over the life of the proposed regulation. ... Step 5: Monetise (place dollar values on) impacts.More items...

How do you calculate cost analysis?

How to calculate cost analysisDetermine the reason you need a cost analysis. The way you use a cost analysis can vary depending on why you need a cost analysis done. ... Evaluate cost. ... Compare to previous projects. ... Define all stakeholders. ... List the potential benefits. ... Subtract the cost from the outcome. ... Interpret your results.

How do you calculate BCR?

The BCR is calculated by dividing the proposed total cash benefit of a project by the proposed total cash cost of the project.

What is a cost-benefit analysis example?

For example: Build a new product will cost 100,000 with expected sales of 100,000 per unit (unit price = 2). The sales of benefits therefore are 200,000. The simple calculation for CBA for this project is 200,000 monetary benefit minus 100,000 cost equals a net benefit of 100,000.

What are two main parts of a cost-benefit analysis?

the two parts of cost-benefit analysis is in the name. It is knowing the cost and measuring the benefit by that cost.

How do you calculate NPV in cost-benefit analysis?

NPV is calculated by subtracting the discounted costs from the discounted benefits. All projects with a positive NPV provide a net economic benefit. NPV should be used when comparing mutually exclusive project options.

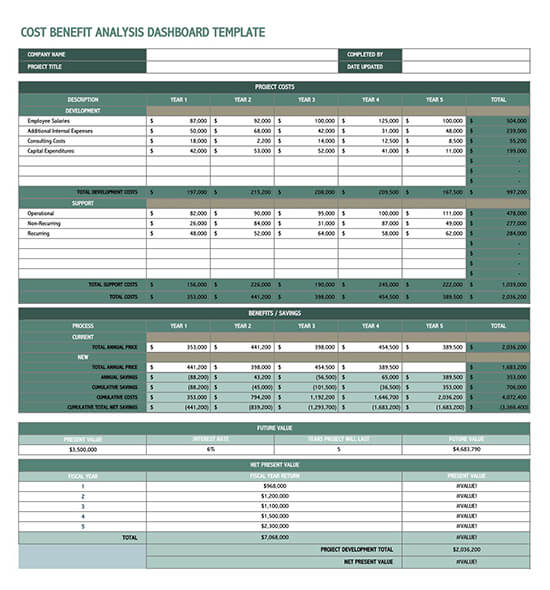

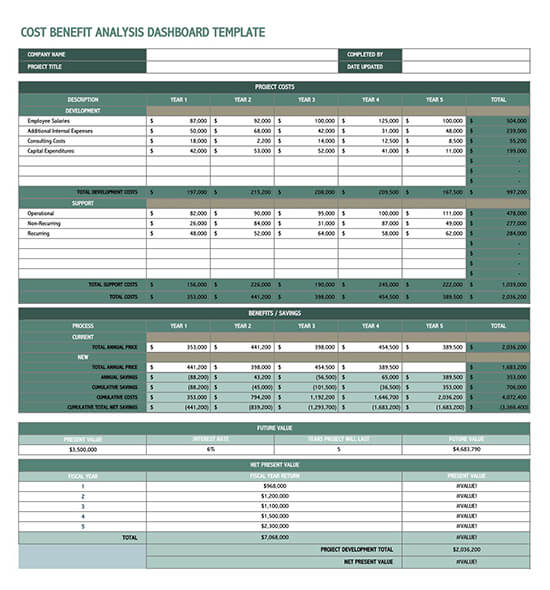

How do I do a cost-benefit analysis in Excel?

A typical cost benefit analysis involves these steps:Gather all the necessary data.Calculate costs. Fixed or one time costs. Variable costs.Calculate the benefits.Compare costs & benefits over a period of time.Decide which option is best for chosen time period.Optional: Provide what-if analysis.

How do you write a cost-benefit analysis template?

Cost Benefit Analysis Example, Template and its ComponentsStep 1: Analyze lists. ... Step 2: Put a financial value on the costs and benefits. ... Step 3: Equation and comparison. ... Basic project specification. ... Potential scenarios include the following. ... Determine the costs and benefits.

How do you calculate NPV and BCR?

There are two main criteria used for evaluating projects in Benefit: Cost Analysis (BCA): the Net Present Value (NPV = benefits minus costs) and the Benefit: Cost Ratio (BCR = benefits divided by costs).

What does a benefit-cost ratio of 2.1 mean?

This means: A. The costs are 2.1 times the benefits.

How do we calculate NPV?

If the project only has one cash flow, you can use the following net present value formula to calculate NPV:NPV = Cash flow / (1 + i)^t – initial investment.NPV = Today's value of the expected cash flows − Today's value of invested cash.ROI = (Total benefits – total costs) / total costs.

What is cost benefit analysis?

The cost-benefit analysis Cost-benefit Analysis Cost-benefit analysis is the technique used by the companies to arrive at a critical decision after working out the potential returns of a particular action and considering its overall costs. Some of these models include Net Present Value, Benefit-Cost Ratio etc. read more involves comparing the costs to the benefits of a project and then deciding whether to go ahead with the project. The costs and benefits of the project are quantified in monetary terms after adjusting for the time value of money, which gives a real picture of the costs and benefits.

Why is cost benefit analysis important?

Cost-benefit analysis is useful in making decisions on whether to carry out a project or not. Decisions like whether to shift to a new office, which sales strategy to implement are taken by carrying out a cost-benefit analysis.

How to calculate cost-benefit ratio?

For calculating the cost-benefit ratio, follow the given steps: Step 1: Calculate the future benefits. Step 2: Calculate the present and future costs. Step 3: Calculate the present value of future costs and benefits. Step 4: Calculate the benefit-cost ratio using the formula.

What is labor cost?

Labor costs. Labor Costs Cost of labor is the remuneration paid in the form of wages and salaries to the employees.

What are allowances in manufacturing?

The allowances are sub-divided broadly into two categories- direct labor involved in the manufacturing process and indirect labor pertaining to all other processes. read more. , other direct and indirect costs, social benefits, etc. are considered while carrying out a cost-benefit analysis.

Cost benefit analysis: What is it?

A cost benefit analysis (also known as a benefit cost analysis) is a process by which organizations can analyze decisions, systems or projects, or determine a value for intangibles. The model is built by identifying the benefits of an action as well as the associated costs, and subtracting the costs from benefits.

See how Smartsheet can help you be more effective

Watch the demo to see how you can more effectively manage your team, projects, and processes with real-time work management in Smartsheet.

Scenarios Utilizing Cost Benefit Analysis

As mentioned previously, cost benefit analysis is the foundation of the decision-making process across a wide variety of disciplines. In business, government, finance, and even the nonprofit world, cost benefit analysis offers unique and valuable insight when:

How to Do a Cost Benefit Analysis

While there is no “standard” format for performing a cost benefit analysis, there are certain core elements that will be present across almost all analyses. Use the structure that works best for your situation or industry, or try one of the resources and tools listed at the end of this article.

How to Establish a Framework

In establishing the framework of your cost benefit analysis, first outline the proposed program or policy change in detail. Look carefully at how you position what exactly is being evaluated in relationship to the problem being solved.

Identify and Categorize Costs and Benefits

Now that your framework is in place, it’s time to sort your costs and benefits into buckets by type. The primary categories that costs and benefits fall into are direct/indirect, tangible/intangible, and real:

How to Calculate Costs and Benefits

With the framework and categories in place, you can start outlining overall costs and benefits. As mentioned earlier, it’s important to take both the short and long term into consideration, so ensure that you make your projections based on the life of the program or initiative, and look at how both costs and benefits will evolve over time.

What Is Cost Benefit Analysis?

Cost benefit analysis, also known as benefit cost analysis, is a tool for comparing the costs of a decision with its benefits. The tool is often used in the business world, where the decision can be anything from developing a new product, to changing an existing process.

How is the cost and benefit tool used?

It’s made possible by placing a monetary value on both the costs and benefits of a decision. Some costs and benefits are easy to measure since they directly affect the business in a monetary way.

Is cost benefit analysis still useful?

Overall, we think cost benefit analysis is still a useful tool. However, in some circumstances, it might be too difficult to estimate costs or benefits so as to draw meaningful conclusions. In these cases, consider cost benefit analysis as a guiding tool, but look to other business analysis techniques to support your conclusion.

Can cost benefit ratios be numerically expressed?

Since both costs and benefits can be expressed in monetary terms, these ratios can also be expressed numerically. As a result, cost benefit or benefit cost ratios lend themselves well to comparison, which is why cost benefit analysis can be used to compare two or more definitions. The process is simple. For each decision or path in question, ...

What is a cost-benefit analysis?

Essentially, a cost-benefit analysis involves adding up the benefits of a business decision or policy and comparing the benefits with the associated costs. Use a cost-benefit analysis to:

How to calculate payback period?

To calculate the payback time, divide the projected total cost by the projected total revenues.

Why is monetizing benefits not easy?

Monetizing the benefits may not be as easy as putting a value on the costs because predicting accurate revenues can be tricky. Consult with other stakeholders to determine the value you will assign to intangible benefits, such as maintaining employee satisfaction, ensuring employees’ health and safety, or strengthening your company’s position with distributors.

How to determine if an investment is sound?

Determine if an investment is sound—verify that the benefits outweigh the costs and, if so, by how much.

What is intangible cost?

Intangible costs. Ongoing or future costs. Any potential risks that may have a cost. Consider using a mind map to brainstorm the potential costs of each project and link them back to expected benefits.

How much is a dollar worth in one year?

For example, if the rate of inflation is three percent, in one year, one dollar will only be worth 97 cents. In 12 months, you’ll pay one dollar to buy an item that costs 97 cents today.

What happens if you spend money on a project now?

In spending money now to fund your project, you will lose potential income from interest if you were to invest the money instead.

What is cost benefit analysis?

The term “cost-benefit analysis” refers to the analytical technique that compares the benefits of a project with its associated costs. In other words, all the expected benefits out a project are placed on one side of the balance and the costs that have to be incurred are placed on the other side. The cost-benefit analysis can be executed ...

Why is cost benefit analysis important?

The importance of cost-benefit analysis lies in the fact that it is used for assessing the feasibility of an opportunity, comparing projects, appraising opportunity cost and building real-life scenario-based sensitivity testing. In this way, this technique helps in ascertaining the accuracy of an investment decision and provides a platform for its comparison with similar proposals.

How to calculate cash inflow from a project?

Step 1: Firstly, Calculate all the cash inflow from the subject project, which is either revenue generation or savings due to operational efficiency. Step 2: Next, Calculate all the cash outflow into the project, which are the costs incurred in order to maintain and keep the project up and running.

What is the benefit cost ratio?

Benefit-Cost Ratio = ∑PV of all the Expected Benefits / ∑PV of all the Associated Costs

How to calculate benefit cost ratio?

The formula for a benefit-cost ratio can be derived by dividing the aggregate of the present value of all the expected benefits by an aggregate of the present value of all the associated costs, which is represented as,

What is Net Present Value?

Net Present Value = ∑PV of all the Expected Benefits – ∑PV of all the Associated Costs

What should an analyst do when calculating cost-benefit analysis?

An analyst or project manager should apply a monetary measurement to all of the items on the cost-benefit list, taking special care not to underestimate costs or overestimate benefits. A conservative approach with a conscious effort to avoid any subjective tendencies when calculating estimates is best suited when assigning a value to both costs and benefits for a cost-benefit analysis.

What Are the Costs and Benefits of Doing a Cost-Benefit Analysis?

The costs involve the time needed to carefully understand and estimate all of the potential rewards and costs. This may also involve money paid to an analyst or consultant to carry out the work. One other potential downside is that various estimates and forecasts are required to build the CBA, and these assumptions may prove to be wrong or even biased.

What Is a Cost-Benefit Analysis (CBA)?

A cost-benefit analysis is a systematic process that businesses use to analyze which decisions to make and which to forgo. The cost-benefit analyst sums the potential rewards expected from a situation or action and then subtracts the total costs associated with taking that action. Some consultants or analysts also build models to assign a dollar value on intangible items, such as the benefits and costs associated with living in a certain town.

How Does one Weigh Costs vs. Benefits?

Cost-benefit analysis (CBA) is a systematic method for quantifying and then comparing the total costs to the total expected rewards of undertaking a project or making an investment. If the benefits greatly outweigh the costs, the decision should go ahead; otherwise, it should probably not. CBAs, importantly, will also include the opportunity costs of missed or skipped projects.

What are the costs of a CBA?

The costs involved in a CBA might include the following: 1 Direct costs would be direct labor involved in manufacturing, inventory, raw materials, manufacturing expenses. 2 Indirect costs might include electricity, overhead costs from management, rent, utilities. 3 Intangible costs of a decision, such as the impact on customers, employees, or delivery times. 4 Opportunity costs such as alternative investments, or buying a plant versus building one. 5 Cost of potential risks such as regulatory risks, competition, and environmental impacts.

What is CBA in finance?

A CBA involves measurable financial metrics such as revenue earned or costs saved as a result of the decision to pursue a project.

What are the forecasts used in a cost benefit analysis?

The forecasts used in any CBA might include future revenue or sales, alternative rates of return, expected costs, and expected future cash flows. If one or two of the forecasts are off, the CBA results would likely be thrown into question, thus highlighting the limitations in performing a cost-benefit analysis.

How to do Cost Benefit Analysis?

When doing the cost-benefit analysis, there are two main methods of arriving at the overall results. These are Net Present Value (NPV) and the Benefit-Cost Ratio (BCR).

Why is cost benefit analysis important?

To provide a basis for comparing projects: With so many investment choices around, there has to be a basis for choosing the best alternative. Cost-benefit analysis is one the aptest to tools to pick through the available options. When one out of the two options seems more beneficial, the choice is simple. However, a problem arises when there are more than two alternatives to evaluate. This model helps businesses to rank the projects according to their order of merit and go for the most viable one.

What is discounting the costs and benefits?

Discounting the costs and benefits – The benefits and costs of a project have to be expressed in terms of equivalent money of a particular time. It is not just due to the effect of inflation but because a dollar available now can be invested, and it earns interest for five years and would eventually be worth more than a dollar in five years.

How does Benefit Cost work?

On the other hand, the Benefit-Cost provides value by calculating the ratio of the sum of the present value of the benefits associated with a project against the sum of the present value of the costs associated with a project.

What is the purpose of identity and classify costs and benefits?

It is essential to costs and benefits are classified in the following manner to ensure that you understand the effects of each cost and benefit. – Direct Costs (Intended Costs/Benefits) – Indirect Costs.

Is double counting of cost and benefits a problem?

Double counting of cost and benefits must be avoided – Sometimes though each of the benefits or costs is seen as a distinct feature, they might be producing the same economic value, resulting in the dual counting of elements. Hence these need to be avoided.

Can cost benefit analysis be mistaken for budget?

Cost-Benefit analysis might be mistaken for a project budget – The elements involve estimation and deemed quantification; however, there are possibilities that, at some level, the Cost-Benefit Analysis model may be mistaken for a project budget. Forecasting budget is a more precise function, and this analysis can only be a precursor to it. Using it as a budget may lead to a potentially risky outcome for the project under consideration.

What Is A Cost-Benefit Analysis?

How to Conduct A Cost-Benefit Analysis

- 1. Establish a Framework for Your Analysis

For your analysis to be as accurate as possible, you must first establish the framework within which you’re conducting it. What, exactly, this framework looks like will depend on the specifics of your organization. Identify the goals and objectives you’re trying to address with the proposal. W… - 2. Identify Your Costs and Benefits

Your next step is to sit down and compile two separate lists: One of all of the projected costs, and the other of the expected benefits of the proposed project or action. When tallying costs, you’ll likely begin with direct costs, which include expenses directly related to the production or develo…

Pros and Cons of Cost-Benefit Analysis

- There are many positive reasons a business or organization might choose to leverage cost-benefit analysis as a part of their decision-making process. There are also several potential disadvantages and limitations that should be considered before relying entirely on a cost-benefit analysis.

Explanation of Cost-Benefit Analysis Formula

Examples of Cost-Benefit Analysis Formula

- Let’s see some simple to advanced practical examples of the cost-benefit analysis equation to understand it better.

Relevance and Uses

- Cost-benefit analysis is useful in making decisions on whether to carry out a project or not. Decisions like whether to shift to a new office, which sales strategy to implement are taken by carrying out a cost-benefit analysis. Generally, it is used for carrying out long term decisions that have an impact over several years. This method can be used by organizations, government as w…

Cost-Benefit Analysis Formula in Excel

- The CFO of Housing Star Inc. gives the following information related to a project. Costs of $1,80,000 are to be incurred upfront at the start of 2019, which is the date of evaluation of the project. Use a discounting rate of 4% to determine whether to go ahead with the project based on the Net Present Value (NPV) method. Solution: Step 1: Insert the formula =1/(1+0.04)^A9 in cell …

Recommended Articles

- This article has been a guide to the Cost-Benefit Analysis Formula. Here we provide a calculation of cost-benefit analysis along with practical examples and a downloadable excel template. You can learn more about accounting and budgeting from the following articles – 1. Cost-Benefit Principle Examples 2. Standard Error Formula 3. Formula to Calculate Gain 4. Examples of Cost-…